Bitcoin Price Prediction as Silicon Valley Bank Collapse Sends Shockwaves Through Global Markets – Can BTC Recover?

Bitcoin (BTC) and Ethereum (ETH) managed to halt their downward trend and experienced a rise in value above $20,000 and $1,400, respectively, on early Saturday morning. However, this surge can be attributed to the weaker US dollar, which turned negative after the February labor data showed slower wage growth, indicating a decrease in inflationary pressures.

The statement indicated that if the Federal Reserve reduces the pace of interest rate hikes, it could potentially make the US dollar less attractive, leading to increased demand and higher prices for cryptocurrencies.

https://www.twitter.com/DrProfitCrypto/status/1634235087104425984?s=20It is essential to highlight that the cryptocurrency market is known for its high volatility, with frequent price fluctuations. In the previous week, Bitcoin and Ethereum experienced considerable losses, with BTC dropping 10.88% and ETH losing 10.94% of its value.

The losses incurred by Bitcoin and Ethereum have resulted in the global cryptocurrency market cap falling below $900 billion, reaching $890 billion. However, there are signs that the decline may be slowing down, with BTC showing the potential to recover some of its lost ground.

This reversal may be attributed to the weakened US dollar and the recent weaker-than-expected US jobs data. It is important to note that the cryptocurrency market is highly volatile, and price fluctuations are expected.

Silicon Valley Bank’s Liquidity Crisis Sparks Concern for Cryptocurrencies

Recent reports indicate that Silicon Valley Bank, a significant financial institution for venture capital firms, is facing a liquidity crisis. This development has sparked concerns about the potential broader financial implications, leading to a decline in the value of cryptocurrencies.

Silicon Valley Bank's liquidity crisis is causing shockwaves in the financial industry. The bank, which serves many high-growth tech startups, is struggling to meet the demands of its clients, leading to concerns about the broader impact on the startup ecosystem $SIVB pic.twitter.com/H8Va5RQMKj

— MarketScope (@MarketSumm) March 10, 2023

It is important to note that Silicon Valley Bank is a major financial institution used by many venture capital firms, which could have an indirect impact on the crypto market. While this is not a direct hit to the cryptocurrency sector, it highlights how interconnected the financial world can be, with developments in one area potentially affecting another.

As a result, the crypto market has been negatively impacted by the news of Silicon Valley Bank’s liquidity issues.

Weaker Dollar Underpins Crypto Market

The US dollar, which had been on an upward rally, failed to sustain its momentum and weakened on the day. This was due to the latest labor data for February, which showed slower wage growth, suggesting a possible easing of inflation pressures.

This could lead to the Federal Reserve keeping the pace of interest rate hikes modest, thereby reducing the greenback’s appeal.

The U.S. economy added 311,000 jobs in February and the unemployment rate rose to 3.6 percent, according to data released Friday by the Labor Department. https://t.co/pf8J1uFbOW pic.twitter.com/YOhOdjh5Tz

— KELOLAND News (@keloland) March 11, 2023

Despite the US economy adding jobs rapidly in February, slower wage growth and a rise in the unemployment rate have tempered expectations of a 50-basis-point interest rate hike during the upcoming Federal Reserve meeting.

The crypto market had faced significant losses over the past week, with both Bitcoin and Ethereum losing almost 11% of their value. However, the decline began to fade as the US dollar weakened, causing BTC to recover some of its lost ground.

-Emergency Fed meeting on Monday

— Dunks ✨ (@Dunks077) March 10, 2023

-Biden saying CPI print will be good

Perhaps Fed knows CPI will come in low, and they want to release it early to prevent any meltdowns on Monday?

Then ugly inverted H+S for bitcoin?

🙏 pic.twitter.com/ww7kqET2Ms

In the coming weeks, the performance of the cryptocurrency market and the US dollar remains uncertain due to the ongoing pandemic and recent market volatility. The focus is now on the CPI print and overall financial conditions, given the recent events in the US banking sector.

Peter Schiff Advises Selling BTC for Gold amid Bleeding Market

Peter Schiff, a prominent critic of cryptocurrencies, has recently advised investors to sell their Bitcoin (BTC) holdings and invest in gold as the crypto market continues to suffer losses. Schiff, who has been a vocal skeptic of Bitcoin for a long time, has predicted that the industry will face more bankruptcy cases, which could further depress the market.

https://www.twitter.com/inuwarwer/status/1634434932658388992?s=20Schiff’s statement came in response to the recent fall in the stock market of Silvergate Bank, which has had a significant impact on Bitcoin and other cryptocurrencies. While some investors may disagree with Schiff’s viewpoints, some crypto enthusiasts remain optimistic about the future of the industry.

For instance, Schiff’s son, Spencer Schiff, countered his father’s post, stating that while blockchain companies and other cryptocurrencies might crash, Bitcoin would remain afloat as a lifeboat.

Bitcoin Price

Bitcoin technical analysis suggests a significant bearish trend for the BTC/USD pair, as it has broken through the double-bottom support level of $20,350. The immediate support level for Bitcoin is at $18,430.

If this level is breached, it could escalate selling pressure, resulting in a further decline towards the $16,400 level.

On the other hand, the first hurdle for Bitcoin is at the $20,300 resistance level. If Bitcoin breaks above this level, it could trigger buying pressure and potentially push its price towards the $21,400 level.

If the bullish momentum continues, there is a chance that Bitcoin could even reach the $25,000 mark.

Top 15 Cryptocurrencies to Watch in 2023

Take a look at Industry Talk’s carefully selected roster of the top 15 altcoins to keep an eye on in 2023, curated by Cryptonews. The list is regularly updated with fresh ICO projects and altcoins, so be sure to check back frequently for the latest developments.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

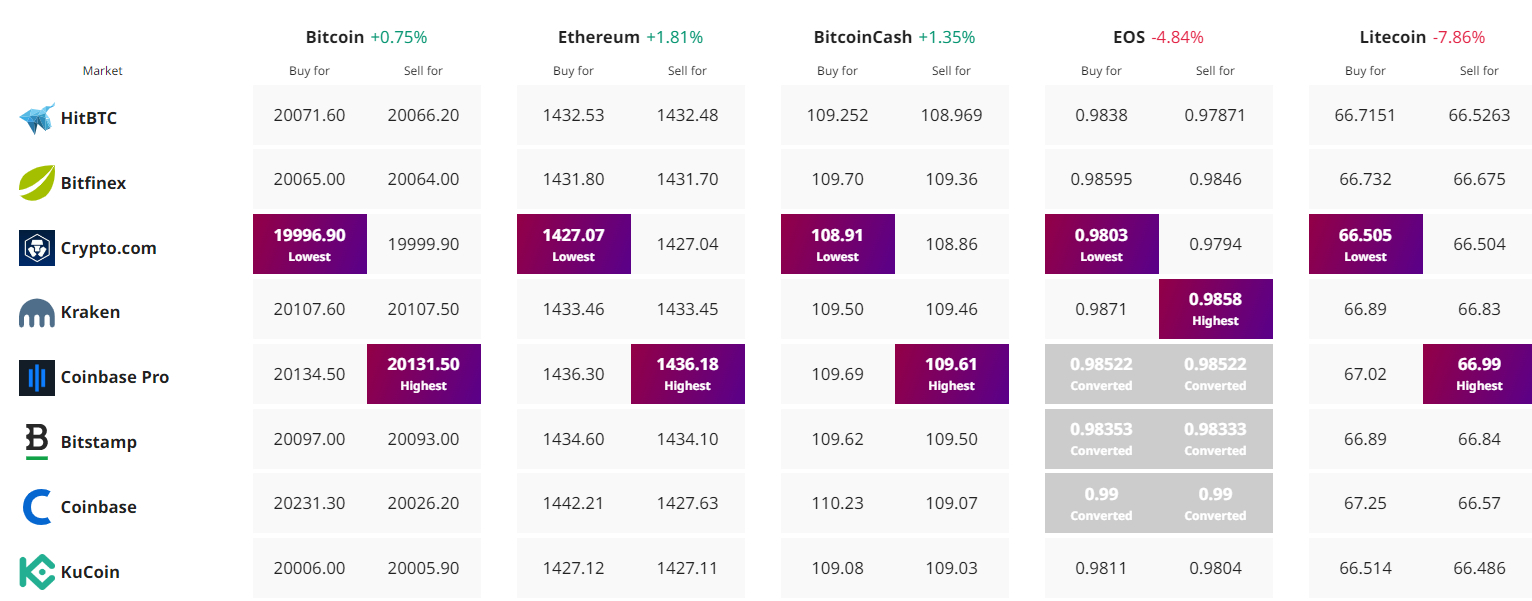

Find The Best Price to Buy/Sell Cryptocurrency