The Next Level of Crypto Adoption: Bank Teaches Clients About Bitcoin

One German bank has an original way to teach its clients about the world’s most popular cryptocurrency, Bitcoin (BTC). It needs only two old-school things to accomplish this: a pen and a paper.

Recently, Cryptonews.com wrote about the Bitcoin-bullish report published by German bank Bayern LB. We’ve had a chance to talk with the author of the September 2019 report, Senior Economist and FX Analyst in the research team of Bayern LB, Manuel Andersch.

Andersch told us that “’crypto’ is a rather meaningless word” to the Economic Research Department (which is the part of the bank looking into BTC), as the Department is exclusively interested in Bitcoin as an alternative monetary system, but also in the products and additional layers that are built on top of BTC as the base layer, such as the Lightning Network.

“There is a constant interest on the client side to learn more about Bitcoin,” the economist told us. These are the bank’s corporate and institutional clients that want to learn the basics of Bitcoin. This interest prompted the research team to create “a very newbie-friendly workshop,” aimed both at newcomers and those who want to expand their theoretical knowledge with an intuitive and practical experience,” the analyst said. Interestingly, the format of the interactive workshop, aptly called ‘The Bitcoin Experience,’ allows for “a mixture of explanations and interactive simulation of the Bitcoin network” to be used in order to explain to the newcomers the basic functionality of Bitcoin – with pen and paper only.

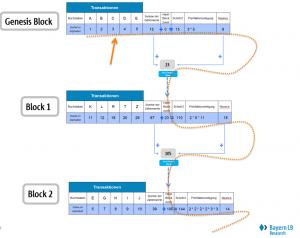

“It’s always fun and it has helped many to understand the basic underpinnings of Bitcoin,” says Andersch, further explaining how the workshop actually works. The participants perform proof of work mining, with prime factorization as the “work,” and they create a blockchain with pieces of paper that relate to each other. They are also faced with a challenge on how to find a consensus about the state of this database in a decentralized network of participants (where nodes are bar tables). “In order to illustrate the economic incentives of the Bitcoin system, there are also mining rewards,” says Andersch.

Pieces of papers with A-Z letters on it are used as transactions, and these circulate in the room for the nodes to validate them according to established rules based on colors. In order to make a calculation for the proof of work, the participants map from letters to numbers based on the number of the letter in the alphabet (e.g. A = 1, G = 7). After five transactions, a block is full and “every node can start with the proof of work puzzle, in order to be THE node that can present its block as the new valid block to rest of the network.”

Andersch explains that the proof of work task is simply to perform prime factorization to the sum of the transactions (if it is not the genesis block to the sum of the transactions plus some number from the previous block). Smartphones are not really allowed when calculating the prime factors.

“The nice thing is that you can explain a lot using prime factorization,” the economist says, such as:

- Difficulty adjustment (simply making the number a participant has to factorize larger)

- ASIC miners and their implications (smartphones are allowed at this point)

- It is “uncomfortable” enough to show the cost side

- As all calculations are linked to previous block’s calculations, participants quickly understand that changing something implies huge costs (a participant would have to do all the prime factorizations again).

“Since all the other nodes verify the calculations, everybody also gets that cheating is not paying off and that the only way to get the reward is to ‘to do the work’,” Andersch says.

In regards to the feedback, he says that it’s very positive and that most people like the workshop. If people are interested in the workshop, he’s the one to contact, he tells us, adding ‘We usually have a 30 minutes sessions after the ‘simulation’ to put everything into perspective of the ‘real Bitcoin world’.”

The team is connected with the vibrant Bitcoin scene in Munich, and they’ve hosted this year’s Value of Bitcoin Conference with Fidelity Digital Assets at the Bank, which was also well received by their clients, Andersch tells us.

Meanwhile, Bayern LB’s Research Department offers only educational BTC-related services for now, but more operational use cases such as Bitcoin custodial services are being explored (by the Department, not the bank as a whole), particularly as banks have three advantages when it comes to BTC custody: reputation and trust, IT security knowledge, and physical vaults for backups. “I think the race regarding Bitcoin custody services is on in Europe,” Andersch says. “The first business that can hire the best cryptographers and establish a good reputation will have a huge first mover advantage.”