Now That Bitcoin ‘is Digital Gold,’ Which Crypto is For Payments?

“Stablecoins are likely the ones that will emerge as the near term winners in commerce.” “The transition from store of value to currency is something that has happened before.”

Ever since the post-April cryptocurrency bull market, Bitcoin has been gradually consolidating its status as a store of value. This was confirmed most emphatically on July 11, when Federal Reserve chairman Jerome Powell told the U.S. Senate banking committee that investors use the cryptocurrency “as an alternative to gold.”

“It’s a store of value, a speculative store of value, like gold,” he added, providing further weight to the theory that Bitcoin’s relative lack of correlation with other assets makes it a safe haven. But assuming that this theory is largely true, it needs to be asked whether other cryptocurrencies are now superior as means of payment.

Well, while it is true that other cryptocurrencies can accommodate more transactions per second and are often cheaper to use, it’s also arguable that Bitcoin’s growing utility as a store of value makes it more suitable as a means of payment. Moreover, its decentralized network is still the biggest and safest. Still, new coins such as Facebook‘s Libra might pose a challenge to Bitcoin’s potential dominance.

The long-standing debate on scalability

Despite recent progress, Bitcoin still hasn’t witnessed a massive, step-change leap in its utility as an actual currency. Yes, SegWit adoption has steadily increased to around 35% over the past couple of years, but even with 100% uptake, Bitcoin’s capacity would remain only a fraction of Visa’s, for instance.

At the same time, the much-hyped Lightning Network is still a long way from being deployed as a fully workable scaling solution. And as Glen Goodman, the author of The Crypto Trader, tells Cryptonews.com, this could hurt Bitcoin’s usefulness as a means of payment.

“A crypto for everyday payments needs to be massively scalable, allowing thousands of payments per second,” he says. “It must be simple to use and allow fast, cheap, secure payments with protection against fraud.”

Arguably, Bitcoin doesn’t quite fit this bill at the moment, with other cryptocurrencies demonstrating greater scalability, speed and cost-effectiveness. For instance, XRP, Dash and Bitcoin Cash all currently provide faster throughput.

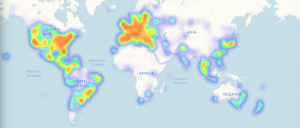

As Cryptonews.com wrote last year, other tokens such as Dash and Bitcoin Cash are witnessing a steady uptick in their merchant adoption rates. Dash announced in January that there was nearly 4,700 retailers throughout the globe which accepted the currency, while just over 4,500 merchants accept altcoins such as XRP, Ether and Bitcoin Cash through CoinGate alone. As Coingate told Cryptonews.com earlier this year, while the most popular payment option is still Bitcoin, other cryptocurrencies such as Litecoin, Ether and XRP are increasing their share.

And at the end of 2017, just over 500 merchants accepted Dash, indicating growth of around 840%. By contrast, Coinmap data reveals that a little over 14,000 merchants, registered on this website, accepted Bitcoin on January 1 of this year, representing 25% growth from the previous year’s figure of 11,200. As of August 13, it has 15,257 venues registered in its database:

Stablecoins and Libra

There’s also the growth of stablecoins to consider. As David Gold – the CEO of blockchain interoperability firm Dapix – explains, these have the obvious advantage of having a constant value, something which will attract mainstream users looking for a reliable way of paying for items online.

Bitcoin may be able to achieve faster transactions and lower fees with the help of layer-two solutions like Lightning Network, he tells Cryptonews.com, but creating a more widespread perception of its stability will be difficult. “So, stablecoins are likely the ones that will emerge as the near term winners in commerce.”

Glen Goodman agrees, suspecting that one new stablecoin in particular will emerge as the frontrunner in the race to become the most popular coin for everyday transactions.

“Cryptos are young and their prices have not yet settled down, so stablecoins are probably the best option for the near future,” he says. “Facebook already has an unparalleled global network to leverage with its Libra stablecoin.”

That said, Goodman admits there’s still a big question of whether “the regulators and central banks actually allow [Libra] to launch,” and assuming that they don’t, other alternatives could rise to the surface.

“Next-level infrastructure is being developed by fintech platforms such as COTI to allow companies to make their own stable coins with all the important features I’ve mentioned. So the future may consist of lots of different companies making their own cheaper, faster versions of PayPal based on stable-coin tech.”

Is Bitcoin still the king?

Of course, Libra hasn’t even launched yet. Similarly, while a number of non-stablecoin cryptocurrencies are superior in terms of scalability, none are more stable as a store of value than Bitcoin, which as a result is arguably still the best crypto for payments.

“The transition from store of value to currency is something that has happened before and could very well happen again with Bitcoin,” explains David Gold.

“And if volatility as a percentage of its value declines over time, the desire to hold it as an investment will not be as great, so people will be more open to using it in commerce.”

Bitcoin’s volatility is already lower relative to many other cryptos, given that it lost ‘only’ 80% of its USD 19,000 all-time high over the course of 2018, compared to 90% for Ethereum, for instance. Added to this, it’s still accepted by the highest number of merchants and used most frequently in transactions, while its scalability is gradually improving.