Bitcoin Could ‘Insulate Portfolios’ From Financial Risks: Case Study

A new case study from the crypto-focused major asset management firm Grayscale offered some insights on how the firm sees bitcoin as a hedge against U.S.-China trade risks.

In the study, dubbed Hedging U.S.-China Trade Risk with Bitcoin, Grayscale pointed out just how significant a risk they consider the current trade war to be for the global economy, reminding that they are the two largest single-country economies in the world.

The authors further pointed to an earlier report from the International Monetary Fund, saying that the latest escalation between the U.S. and China “could significantly dent business and financial market sentiment, disrupt global supply chains, and jeopardize the projected recovery in global growth in 2019.”

Lastly, report explained what role bitcoin could play in this setting:

“There are significant shifts taking place in monetary, fiscal, and trade policies around the world that will likely impact global markets well into the future. […] it is clear that the challenges faced by politicians and policymakers will be difficult to manage given the complexity of our global financial system. Bitcoin could be a useful tool in helping investors insulate their portfolios from any failure to manage these problems effectively,” according to the firm that has direct interests in crypto investments and is known for its “Drop Gold” campaign.

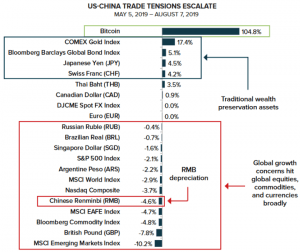

In either case, Grayscale stressed that “Since Trump first announced the tariff hike in May, Bitcoin has generated a cumulative return of 104.8% through August 7, versus an average of -0.5% for the twenty other asset classes, markets, and currencies below during the same period.”

Mixed opinions on Chinese demand

Following the narrative that bitcoin is increasingly seen as a safe-haven during the current financial turmoil, some observers have made the point that Chinese investors are buying up bitcoin in an effort to escape currency devaluations at home.

“If you’re in Asia and China and you’re in a closed currency system, or if you’re in Hong Kong and you can’t seem to get a big conversion of Hong Kong dollars to U.S. dollars what are you going to buy? You’re going to buy gold, you’re going to buy bitcoin, you’re going to do whatever you can to get your money out of your regime that’s falling,” Kyle Bass of Hayman Capital Management said earlier this week.

______________________

______________________

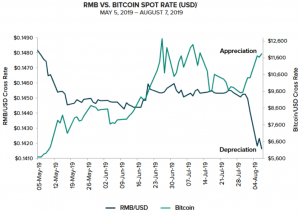

To illustrate this point, Grayscale also shared a graph in their report showing the concurrent depreciation in the Chinese yuan and appreciation of bitcoin against the U.S. dollar:

However, not everyone shares the view that it is Chinese investors that are predominantly driving up bitcoin prices.

Dovey Wan, founding partner of crypto investment firm Primitive Ventures, once again questioned the discussed rush from Chinese investors into bitcoin. Writing on Twitter Friday, she stressed that Tether, the most popular stablecoin, is trading at a “pretty wide negative premium” in mainland China and the “same” is with bitcoin.

As one might imagine, Tether trading at a discount on Chinese OTC (over-the-counter) markets compared to the Chinese Yuan/U.S. dollar market rate might possibly suggest a lack of demand for Tether – and in extension of that – a lack of Chinese demand for bitcoin.

However, according to crypto market data provider Coinlib.io, while USD, EUR, JPY, KRW and GBP flow into BTC decreased in the second half of the week, flows of CNY increased and surpassed USD 193 million in the past 24 hours (10:08 UTC). In comparison, at the same time on Monday it reached USD 137 million.

__

Read more: Mainstream Media Hails Bitcoin as Safe Haven Amidst Market Turmoil