SegWit is Working and Might Do Wonders during the Next Bull Run

As Bitcoin blocks reached a new high with demand for more than just 1Mb of space, and average transaction fees jumped to almost 200% in April, the percentage of block space used by transactions utilizing the Segregated Witness (SegWit) technology are on the rise, reaching a usage high, but at the same time keeping the fees lower than all-time high.

This demonstrates that the technology behind SegWit is not only being thoroughly tested, but also that it is working. It is estimated that the technology might play a key role in keeping transaction fees affordable during a bull run, when they usually get notoriously high.

As a reminder, Bitcoin has activated the SegWit upgrade in August 2017, which has brought an increase in network transaction speeds, but also lower transaction fees.

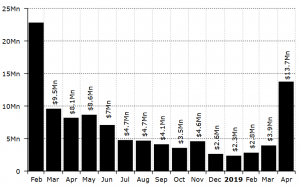

This is not the end of good news for all connected to Bitcoin because, as the price of the coin rises, many are reaping rewards. Bitcoin miners have earned USD 291 million in April, which is almost 30% higher than their profits in March, according to weekly crypto publication Diar. Also, rising fees helped miner to earn USD 13.7 million in April from transaction fees alone, or 250% more than in March, it added.

The reason for this seems to be on-chain volume, which is still very much utilized by traders to create sharp volume increases in exchanges, especially now that the price of Bitcoin increased almost 30% in April. But SegWit comes to rescue yet again, since it works to solve scalability issues. The percentage of blocks using SegWit has averaged 35%, compared to 26% in 2018 and just 11% at Bitcoin’s peak in December 2017, thus reducing the fee pressure, according to Diar.

Meanwhile, after dropping in February 2018, there has been a steady month-on-month rise in the number of transactions on-chain, nearing the December 2017 all-time-high.

Diar estimates that, looking at the current SegWit usage levels, fees could rise as high as 300%, presuming that on-chain movement of Bitcoins resemble those at the end of 2017. That being said, SegWit estimates that fees would still be more than 55% lower than they were in December 2018.