Bitcoin Futures ETF: Overview, Mechanism, and Investment Approach

After many years of rejections, the SEC approved 11 Bitcoin ETF applications in January 2024. Most are already trading on major US exchanges.

This means investors can now gain exposure to Bitcoin without owning or holding digital coins. Let alone worry about being hacked or scammed.

In this guide, we explore how Bitcoin ETFs work, their benefits and drawbacks, and which fund managers offer the best investment options.

The Best Bitcoin ETFs of 2024

Listed below are the best Bitcoin ETFs available in 2024:

| Bitcoin ETF | Ticker | Exchange | Assets Under Management |

| iShares Bitcoin ETF | IBIT | NASDAQ | $2.7 billion |

| Grayscale Bitcoin Trust [now an ETF] | GBTC | NYSE Arca | $20.7 billion |

| ARK 21Shares Bitcoin ETF | ARKB | CBOE | $10.3 million |

| Franklin Bitcoin ETF | EZBC | CBOE | $59.4 million |

| Fidelity Advantage Bitcoin ETF | FBTC | CBOE | $1.3 billion |

What Is a Bitcoin ETF?

Wondering how Bitcoin ETFs work? Let’s start with a quick overview of ETFs themselves.

Exchange-traded funds (ETFs) are popular investment vehicles. They enable investors to own an asset, or group of assets, without directly owning the underlying instruments. The most popular ETFs track index funds like the S&P 500 and Dow Jones. What’s more, ETFs trade on major stock exchanges just like shares. This makes it simple to enter and exit the market.

Bitcoin ETFs operate like any other ETF. They’re ideal for gaining exposure to Bitcoin without directly owning digital coins. This is expected to increase demand for Bitcoin significantly. After all, the ‘average’ investor doesn’t want to worry about Bitcoin wallets, private keys, public addresses, and ultimately – the risks of being hacked.

Bitcoin ETFs remove these concerns. This is because investors can buy Bitcoin ETFs from a traditional stock broker. The underlying Bitcoin is held by a regulated custodian with insurance and institutional-grade security. Investors only need to worry about the price of Bitcoin when investing in an ETF.

In theory, the value of Bitcoin ETFs will rise when the market value of Bitcoin increases. And conversely, when Bitcoin’s price drops, so will the ETF. However, there will always be a slight disparity between ETF and Bitcoin prices. This is because Bitcoin ETF prices are based on the net asset value (NAV).

The NAV is determined by the value of all assets owned by the ETF. It also takes into account internal fees, such as insurance, brokerage commissions, and custodianship. Nonetheless, when you invest in Bitcoin ETFs from financial powerhouses like BlackRock and Fidelity, the NAV should align with Bitcoin’s price movements very closely.

Why Don’t Bitcoin ETFs Own Bitcoin?

Previous to the SEC approving 11 Bitcoin ETFs in early 2024, there were no US-based ETFs directly backed by Bitcoin.

One of the workarounds was the Grayscale Bitcoin Trust. Similar to an ETF, Greyscale offered exposure to Bitcoin via traditional stock exchanges. However, the Grayscale Bitcoin Trust often traded at a huge discount or premium to Bitcoin’s market price. This is because, unlike ETFs, trusts can’t issue new daily shares to reflect shareholder ownership.

The Grayscale Bitcoin Trust has since converted to an ETF, as per the SEC’s green light. In addition, many Bitcoin ETFs were previously backed by futures contracts. This meant that investors were indirectly buying financial derivatives. Not only are futures more volatile but they’re not backed by Bitcoin itself.

Outside of the US, some fund managers launched Bitcoin exchange-traded notes (ETNs). While offering exposure to Bitcoin, ETNs are debt obligations. This means the ETN provider doesn’t directly own Bitcoin. That being said, Canadian investors have had access to Bitcoin ETFs for several years. The Purpose Bitcoin ETF, launching in 2021, is directly backed by Bitcoin.

Bitcoin ETF Fees

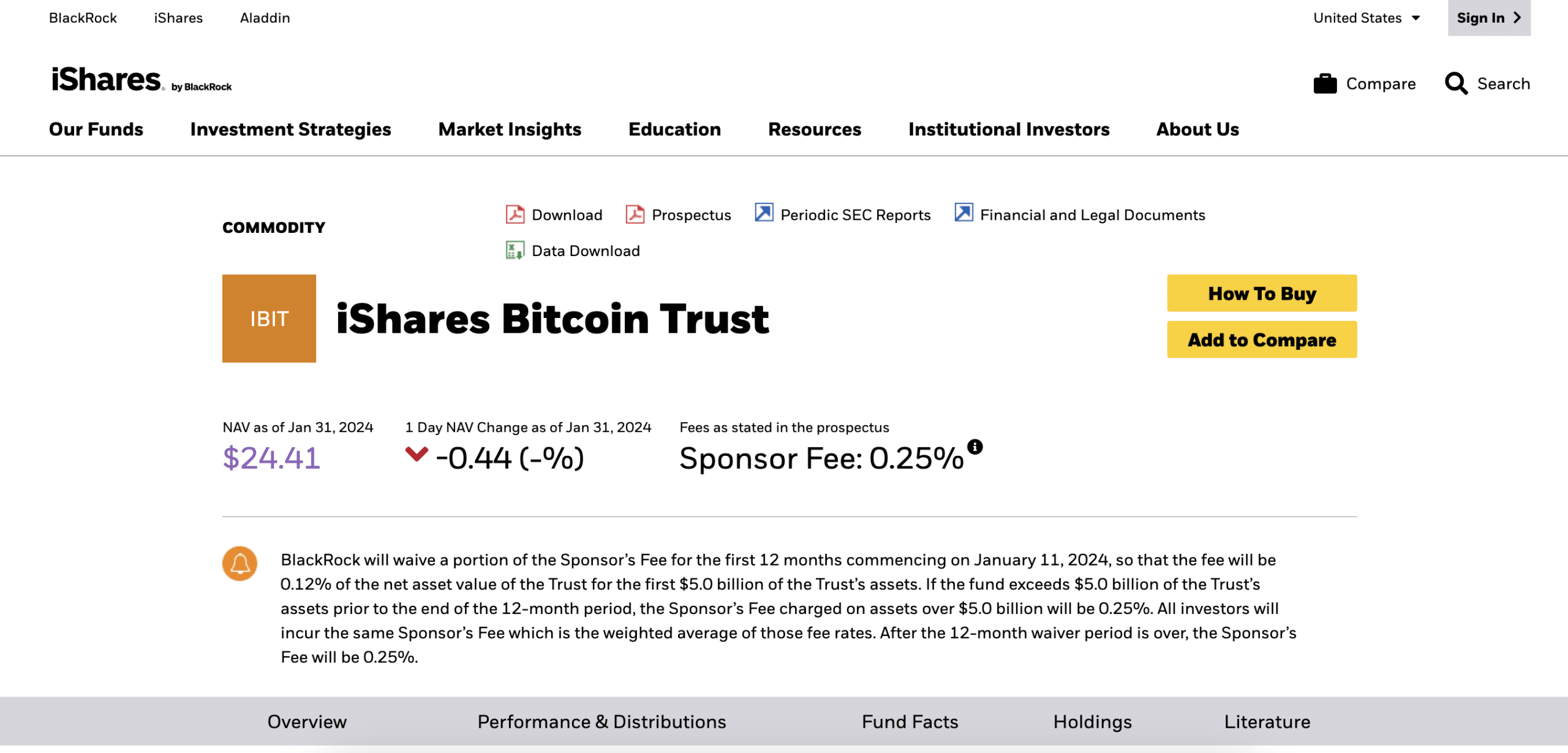

With the exception of select S&P 500 funds, most ETFs come with fees. Bitcoin ETFs are no different. After all, ETF managers are in the business of making money. The key fee to look for is the ‘expense ratio’. Put simply, the expense ratio includes all ETF fees, totaled as a percentage.

This includes the costs associated with exchange listings, compliance, regulation, payments, insurance, custodianship, and everything in between. For instance, suppose the expense ratio is 0.5%. If you invest $10,000, you’d pay $50 annually. If your average balance in the next year was $20,000, you’d pay $100.

So how do Bitcoin ETF fees compare to traditional investing? Well, let’s use the iShares Bitcoin ETF as an example. Currently, this Bitcoin ETF has an expense ratio of just 0.12%. This will increase to 0.25% once the ETF reaches a NAV of $5 billion. Even so, this represents excellent value. At 0.25%, investors will pay just $25 annually for every $10,000 held in the ETF.

Other Bitcoin ETF Fees

- Other than the expense ratio, the only other Bitcoin ETF fees to pay are brokerage commissions.

- That said, most online brokers now offer commission-free trading on US-listed ETFs.

- In contrast, even the best crypto exchanges charge more than the iShares ETF.

- For instance, Coinbase has a standard commission of 1.49%. Buying Bitcoin with a credit card will cost you 3.99%.

Why Should I Buy a Bitcoin ETF Instead of Bitcoin?

Let’s explore some of the benefits of investing in Bitcoin ETFs, rather than directly investing in Bitcoin itself.

Avoid Crypto Exchanges

The main appeal of ETFs is that you can invest in Bitcoin without using a crypto exchange. After all, billions of dollars have been stolen from crypto exchanges in the past decade. This is either because of internal malpractice (like FTX) or external hacks (like Cryptopia). In both instances, the likelihood is that crypto exchange clients lose money.

In contrast, Bitcoin ETFs trade on major US stock exchanges like the NYSE or NASDAQ. This means you can invest in Bitcoin ETFs through a traditional stock broker. Unlike crypto exchanges, stock brokers are heavily regulated. This offers a safe alternative to buying Bitcoin on an exchange.

Avoid Wallet Risks

When you buy Bitcoin directly, you can store the coins in two different ways.

First, you can leave them in your crypto exchange account. If the exchange is hacked, your Bitcoin could be stolen. Second, you can keep the Bitcoin in a self-custody wallet. This means you have full control of your private keys. However, if your wallet is hacked, your Bitcoin will be stolen.

These risks are too high for large-scale investors. This is where Bitcoin ETFs come in. The Bitcoin owned by the ETF is held by a regulated custodian. This will include institutional-grade security like 24/7 surveillance, not to mention insurance.

Stricter Regulatory Oversight

Unlike Bitcoin itself, ETFs are regulated as financial securities. This means that Bitcoin ETFs must follow US securities laws. This includes investor protection, adequate risk controls, and complete transparency. The likelihood of a Bitcoin ETF going out of business is minute.

As Bitcoin isn’t classed as a security, it largely operates in an unregulated environment. This is why most crypto exchanges function without licensing.

Can I Trade Bitcoin ETFs With Margin?

- Just like stocks, ETFs can be traded with margin.

- In the US, investors require margin maintenance of just 25%.

- This means that a $10,000 balance would allow you to invest $40,000 into a Bitcoin ETF. Put otherwise, you’re getting leverage 4x.

- However, while margin can amplify your Bitcoin ETF gains, it will also do the same to losses. Therefore, consider the risks before proceeding.

- You can read more about the best crypto leverage trading platforms here.

What are the Drawbacks of Bitcoin ETFs?

While Bitcoin ETFs do offer some benefits, they also come with drawbacks. Here are some of the reasons why Bitcoin ETFs might not be right for you.

You Won’t Directly Own Bitcoin

The main drawback of investing in a Bitcoin ETF is that you won’t directly own Bitcoin. Some would argue that this goes against Bitcoin’s core ethos. After all, Bitcoin was created as an alternative to the global banking ecosystem. Its decentralized nature ensures that Bitcoin holders own their wealth.

Directly owning Bitcoin in a self-custody wallet allows users to transfer funds without needing authorization from a third party. There’s no risk of the Bitcoins getting seized or transactions being frozen. Investing in a Bitcoin ETF doesn’t offer the same ownership structure. You’ll need to trust and rely on several intermediaries, including fund managers, brokers, and custodians.

Disparity Between ETF and Bitcoin Prices

Another drawback is that Bitcoin ETFs will never be 100% correlated to Bitcoin price movements. This is the same with all ETFs, including stock index funds. For a start, Bitcoin ETFs charge expense ratios, which are often factored into the ETF share price. Moreover, Bitcoin ETF prices can also be influenced by demand and supply.

If there isn’t enough demand, this can impact the ETF value. In addition, Bitcoin ETFs trade on stock exchanges during standard market hours. In contrast, Bitcoin trades 24/7 globally. While the stock exchange is closed, Bitcoin’s value could change rapidly.

Pros and Cons of Bitcoin ETFs

Now let’s summarize the key benefits and drawbacks of Bitcoin ETFs:

Pros

- Invest in Bitcoin with a traditional stock broker

- Bitcoin ETFs trade as shares on major US stock exchanges

- No requirement to use crypto exchanges or wallets

- Bitcoin ETF fees are often very competitive

- ETFs are heavily regulated like other securities

- Many online brokers offer 0% commission on ETF trades

Cons

- You won’t directly own Bitcoin

- You’re relying on third-party custodians to keep your Bitcoin safe

- You can’t transfer Bitcoin to other people

- There can be a disparity between ETF and Bitcoin prices

- Unlike Bitcoin, ETFs don’t trade 24/7

How To Invest in Bitcoin ETFs

One of the best things about Bitcoin ETFs is that they’re easy to buy and sell. This is because you can invest through a traditional online stock broker.

Investing in a Bitcoin ETF requires the following steps:

- Step 1: Open a Brokerage Account: First, you’ll need to register an account with a regulated stock broker. Not only should the broker list your chosen Bitcoin ETF, but offer competitive fees and a user-friendly interface. Provide the broker with some personal information and if necessary, upload some ID verification documents.

- Step 2: Make a Deposit: Next, you’ll need to deposit some funds into your brokerage account. US brokers typically only accept domestic wires or ACH. That said, some brokers also support credit cards and e-wallets.

- Step 3: Search for Bitcoin ETF: Most online brokers support thousands of markets. Therefore, it’s best to search for the Bitcoin ETF that you want to buy. For instance, if you want to invest in the iShares Bitcoin ETF, you search for its ticker symbol – IBIT.

- Step 4: Create an Order and Buy Bitcoin ETF: The final step is to create an order with your broker. This simply means entering your investment stake. Many brokers support fractional ETF investments, meaning you can invest any dollar amount (e.g. $50). If fractional investments aren’t supported, you’ll need to buy full ETF shares. Either way, confirm the order to invest in your chosen Bitcoin ETF.

The Bitcoin ETF investment will remain in your brokerage account. You can sell your ETF shares at any time during standard market hours.

The Future of Bitcoin ETFs

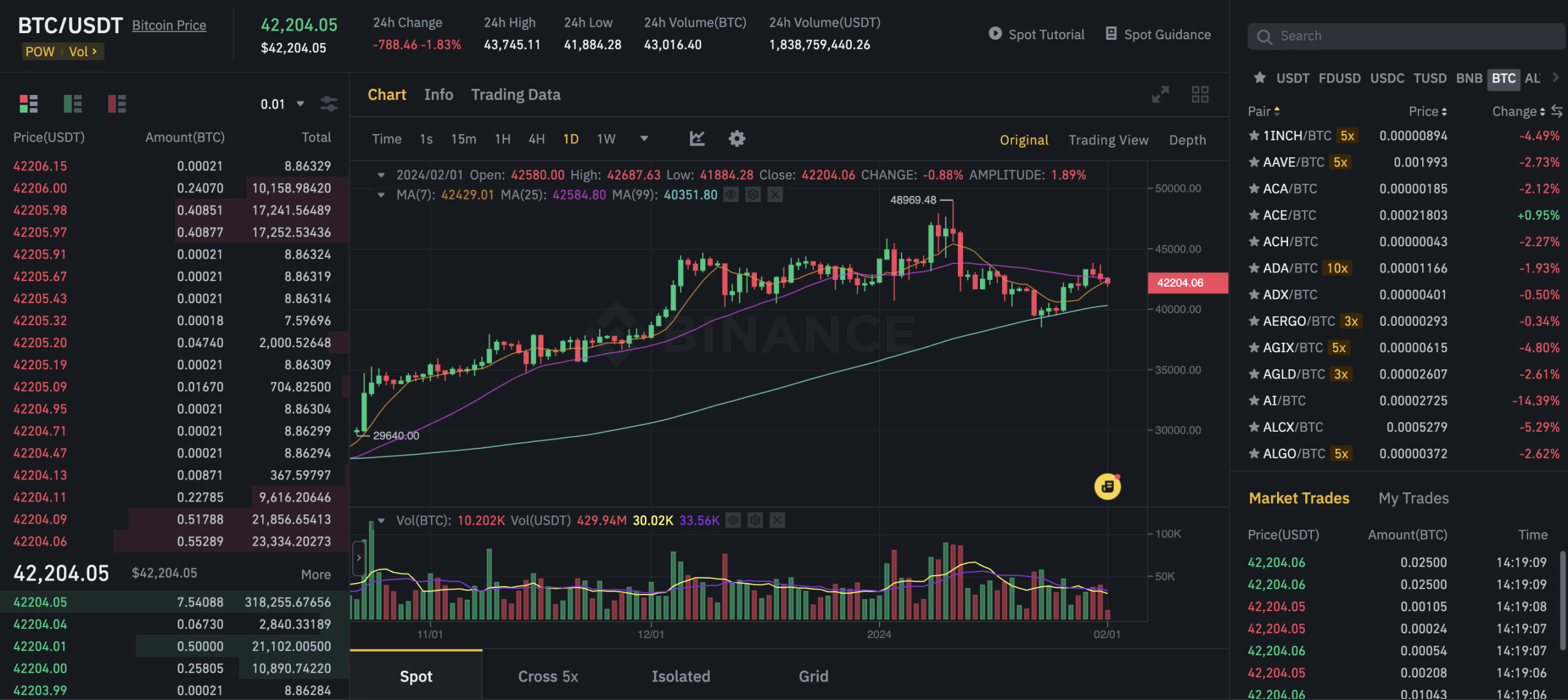

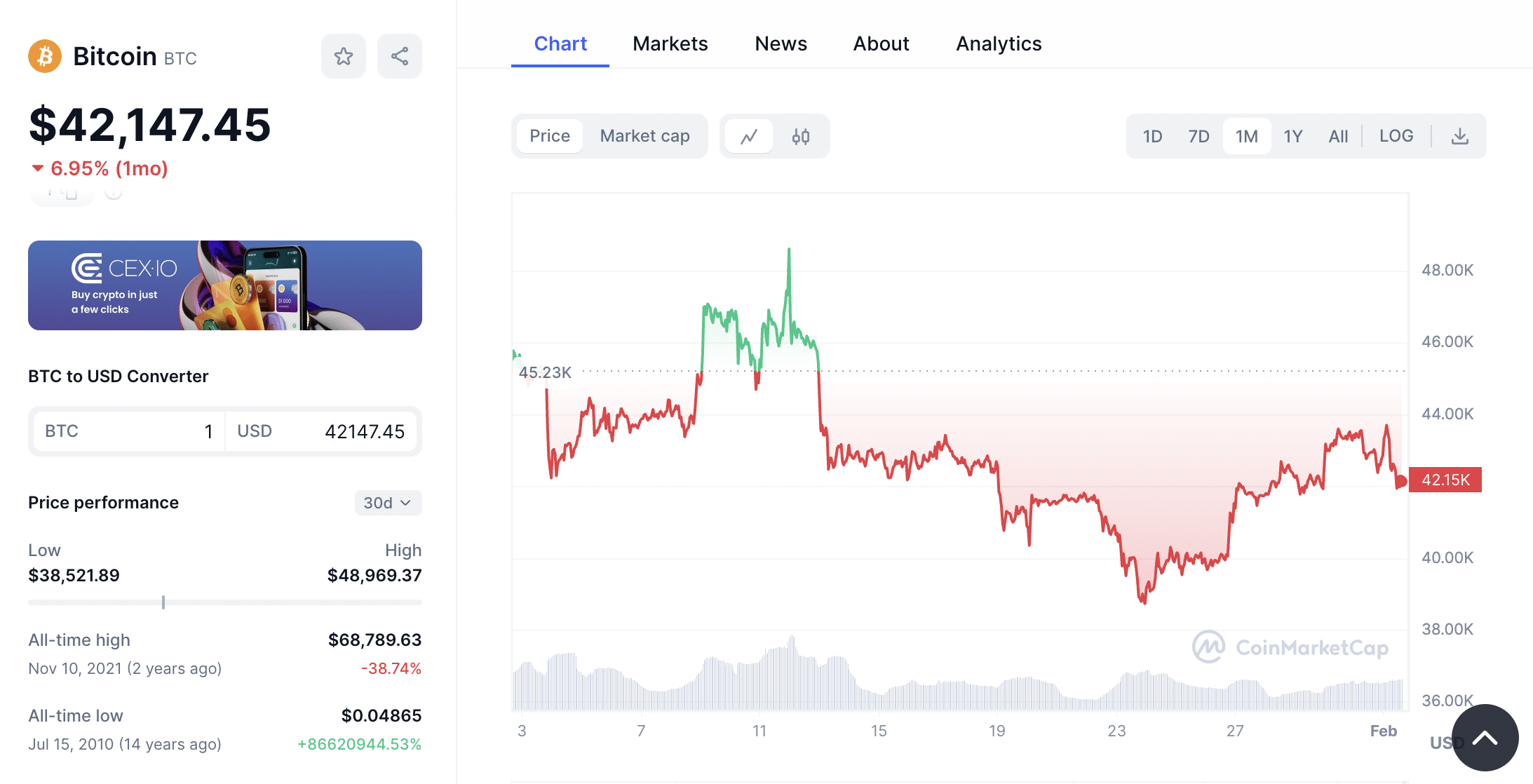

Bitcoin ETFs – at least in the US, are a very new marketplace. The consensus is that Bitcoin ETFs will open the doors to institutional money. This appears likely, with almost $2 billion invested in Bitcoin ETFs within the first three days of launching. However, this hasn’t been reflected in Bitcoin’s market price.

On January 10th, 2024 – which is when the SEC approved 11 Bitcoin ETFs, Bitcoin was trading at just over $46,000. Less than two weeks later, Bitcoin was trading at lows of $38,500. This represented a decline of over 16%. Although Bitcoin has since recovered to over $42,000, the Bitcoin ETF approvals didn’t spark a rally as many had hoped.

That said, this could be a classic example of “buy the rumor, sell the news”. This was also the case when Bitcoin futures were approved by US regulators in late 2017. In terms of what the future holds, it’s still too early to know how Bitcoin ETFs will impact the broader market.

So-called ‘purists’ won’t touch Bitcoin ETFs, as they won’t directly own the coins. Conversely, institutional investors, and those without any knowledge of Bitcoin, will likely prefer the ETF route. Nonetheless, Bitcoin ETFs can only help Bitcoin’s long-term trajectory, as it offers a solid alternative to crypto exchanges.

Conclusion

In summary, Bitcoin ETFs will likely spark continued interest from institutional investors. This will result in a new wave of capital inflows for the world’s largest cryptocurrency. Those concerned about security and unregulated exchanges will also find that Bitcoin ETFs offer a great alternative.

All that said, just remember that you won’t directly own the underlying coins when investing in a Bitcoin ETF. This means you’re relying on third-party custodians, which goes against Bitcoin’s decentralized framework.

References

- https://www.reuters.com/technology/bitcoin-etf-hopefuls-still-expect-sec-approval-despite-social-media-hack-2024-01-10

- https://www.theguardian.com/technology/2024/jan/11/bitcoin-etf-approved-sec-explained-meaning-securities-regulator-tweet

- https://www.reuters.com/world/americas/canadian-regulator-clears-launch-worlds-first-bitcoin-etf-investment-manager-2021-02-12/

- https://www.cnbc.com/2023/02/04/crypto-investors-lost-nearly-4-billion-dollars-to-hackers-in-2022.html

- https://www.sec.gov/investor/alerts/etfs.pdf

- https://www.finra.org/rules-guidance/rulebooks/finra-rules/4210

- https://www.reuters.com/technology/spot-bitcoin-etfs-draw-nearly-2-billion-first-three-days-trading-2024-01-18/

FAQs

Are Bitcoin ETFs a good investment?

Bitcoin ETFs can be a good investment if you want exposure to Bitcoin without dealing with crypto exchanges and wallets. However, just like owning Bitcoin directly, the value of Bitcoin ETFs will rise and fall.

What is the best Bitcoin ETF?

The iShares Bitcoin ETF (IBIT) is the best Bitcoin ETF to buy. Expense ratios cost just 0.12% and IBIT shares trade on the NASDAQ.

What to look for in a Bitcoin ETF?

When choosing a Bitcoin ETF to invest in, make sure the ETF is backed like-for-like by Bitcoin. Investors should also consider the exchange it’s listed on, total assets under management, and expense ratio fees.

Are Bitcoin ETFs safe to use?

Yes, Bitcoin ETFs now trade on US exchanges like the NASDAQ and CBOE. This means most Bitcoin ETFs operate in a heavily regulated environment.

What are Bitcoin futures ETFs?

Bitcoin futures ETFs offer exposure to Bitcoin without owning the underlying coins. However, the ETF is backed by futures rather than actual Bitcoin.

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman