OKEx Led Market in Bitcoin Whale Trading in June – Study

In June, major crypto exchange OKEx positioned itself among the most popular exchanges for so-called whales, and a leading venue for bitcoin (BTC) price discovery, a study from crypto data provider Kaiko has found.

Originally launched as one of the early Chinese BTC exchanges, OKEx is now registered in Malta, and has according to the study become the leader in terms of “whale trades,” both on its spot and its derivatives market.

“It is clear that OKEx leads the market in terms of whale trades, outranking all other exchanges in terms of average whale trade size, count, and volume. OKEx is one of the highest volume exchanges in the industry and plays a significant role in price discovery,” the study said.

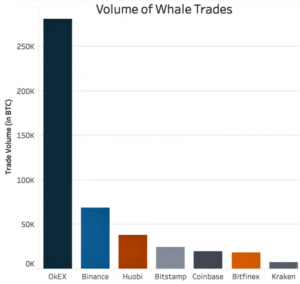

In particular, the study found that, in June, OKEx stood out from its competitors, mainly Binance and Huobi, in terms of the volume of the whale trades made on the exchange.

Kaiko defines a whale trade as any trade of BTC 10 (USD 93,700) or more.

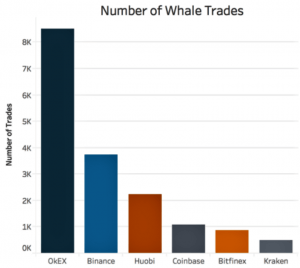

However, it is not the volume, but also the number of such trades that makes OKEx stand out last month, according to the study:

“It is clear that OKEx, by and large, leads the pack in terms of the raw number of whale trades, clocking 8,500 trades ≥ 10 BTC in the month of June,” the report said.

Further, it also pointed out that this was also supported by the findings of another Kaiko study from May this year, which said the derivatives markets on OKEx and BitMEX specifically “leads price discovery of Bitcoin.”

Lastly, the report also noted that high-volume trades are made on a regular basis on many of the leading exchanges, and that is “promising to see” exchange order books being able to absorb these large trades, which have often been thought to take place on over-the-counter (OTC) markets instead.

What the findings show, according to Kaiko, is that the distinction between institutional and retail-focused exchanges “is blurry at best,” given the large number of high-volume trades that are conducted on exchanges like OKEx.

“It is clear that retail exchanges have a significant user base of high-volume traders placing whale trades on a regular basis,” the report concluded.

Meanwhile, as reported, spot trading volumes on both top tier and lower tier crypto exchanges plummeted in June to USD 177bn (-36%) and USD 466bn (-53%) respectively. Among the top 15 top tier exchanges, Binance and OKEx represent approximately 3/4 of spot volume. Binance traded USD 42bn (-20%), OKEx USD 41bn (-29%), and Coinbase almost USD 7bn (-38.5%).

____

Learn more:

Bitcoin Whale Population Growth Might Be A Mirage

Number of Bitcoin Whales Rises, but Their Wealth ‘Declines’