Ethereum in May 2024: Will ETF Approvals Boost ETH Price?

In this report, we explore and analyze Ethereum’s ecosystem surge and the ETH price action in May 2024.

Key takeaways:

- ETH price remained volatile throughout May. The approval of spot Ethereum ETFs initially drove the price up, but it struggled to hold gains above $4,000.

- Research firm K33 estimates that these new Ethereum ETFs could trigger a substantial influx of investment capital, ranging from $3.1 billion to $4.8 billion within the first five months of trading.

- On-chain data shows a decrease in Ethereum network activity (daily transactions and addresses) in May. However, there was a notable influx of new users to the network, suggesting continued interest.

- The Petra upgrade, which aims to optimize transaction processing and reduce latency across the Ethereum network, is scheduled for release in Q1 2025.

- Ethereum Name Service (ENS) plans to migrate to Layer 2, a scaling solution that can significantly reduce gas fees and improve transaction speed.

- Ethereum’s NFT market saw a sales volume drop in May, falling from $1 billion in April to $624 million. Ethereum-based digital collectibles were hit particularly hard, with sales volume reaching $164.2 million (down 46% from April).

What You’ll Find in This May Ethereum Analysis:

What is Ethereum?

Founded in 2013 by Vitalik Buterin, Ethereum serves as a distributed blockchain computing platform designed for the execution of smart contracts and decentralized applications (dApps). The network enables users to create and innovate extensively with smart contracts, catalyzing the emergence of various assets and industries such as decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), Web3, and beyond. At its core, Ethereum features an execution engine tailored for smart contract processing, known as the Ethereum Virtual Machine (EVM). In addition, Ethereum employs a proof-of-stake (PoS) consensus mechanism, which enhances its scalability and sustainability.

Amid Approval of Ethereum ETFs, ETH Price Surges and Stumbles in May

Throughout May, Ethereum’s (ETH) price remained volatile, reflecting a combination of market optimism and underlying challenges. ETH began the month trading below $3,000. Despite several rallies, ETH struggled to sustain significant gains above this level through the middle of the month.

The approval and anticipation of spot Ethereum exchange-traded funds (ETFs) was key in driving market sentiment. On May 17, ETH began to rise above the $3,000 mark and nearly reached $4,000 on May 23, driven by investor optimism about the potential influx of institutional investment via these ETFs. The approval of the ETFs by the United States Securities and Exchange Commission (SEC) brought renewed hope for a bullish market, causing ETH to surge approximately 27% at one point.

However, despite these gains, ETH’s price faced resistance, and it was unable to sustain levels above $3,900 for a prolonged period. The announcement of the ETFs alone was not enough to break through the $4,000 resistance level, as evidenced by ETH’s repeated pullbacks below $3,800.

Green Light for Spot Ethereum ETFs

On May 23, the SEC approved spot Ethereum ETFs, a move that could significantly expand access to cryptocurrency investing. However, excitement was tempered by the reality that individual ETF applications (S-1 filings) still need approval, delaying actual trading for weeks or even months, as Bloomberg ETF analyst James Seyffart pointed out. This uncertainty may have contributed to Ethereum’s struggle to reach $4,000.

TO BE CLEAR: This does not mean they will begin trading tomorrow. This is just 19b-4 approval. Also needs to be an approval on the S-1 documents which is going to take time. We’re expecting it to take a couple weeks but could take longer. Should know more within a week or so!

— James Seyffart (@JSeyff) May 23, 2024

The approved applications come from industry heavyweights like VanEck, Grayscale, iShares, Fidelity, ARK 21Shares, Bitwise, Franklin Templeton, and Invesco. These ETFs will allow investors to buy shares that track the Ether price through their brokerage accounts, making it a more accessible investment than directly buying the cryptocurrency.

A New Gateway for Investors and Potential Market Impact

Similar to the launch of spot Bitcoin ETFs in January, these new Ethereum products could open the doors to a wider range of investors interested in the crypto asset class. While both Bitcoin and Ethereum utilize blockchain technology, they serve distinct purposes. Bitcoin is primarily seen as a store of value, similar to digital gold. Ethereum, on the other hand, functions as a decentralized computing platform hosting various applications akin to a decentralized app store.

The arrival of spot Ether ETFs could trigger a significant influx of investment capital, according to research firm K33. Their estimates suggest net inflows between $3.1 billion and $4.8 billion within the first five months of trading. This surge in investment could translate into a substantial absorption of Ethereum from the market. At current prices, analysts predict a range of 800,000 ETH to 1.26 million ETH being pulled out of circulation, representing a potential reduction in circulating supply by 0.7% to 1.05%.

Limited ETH Supply May Boost Price Volatility

Over half of Ethereum’s circulating supply might be considered relatively illiquid and unavailable for trading. 38% of ETH is locked in smart contracts, and about 11% of the supply resides in dormant accounts that haven’t shown any activity for at least five years.

About 52% of Ethereum's supply is relatively illiquid. This includes 38% locked in smart contracts, 11% in dormant accounts, and 3.3% held by Ethereum ETPs. pic.twitter.com/kl5hOP3LJH

— AMINA Bank (@AMINABankGlobal) May 31, 2024

Ethereum investment products (ETPs) hold 3.3%, while entities like the Ethereum Foundation and blockchain projects (Mantle, Golem) collectively hold another 0.7%. There might be some overlap here, for example, with ETH held by protocol treasuries that are staked (locked for rewards).

Recently, issuers of spot Ethereum ETF applications, including Grayscale, have removed references to staking from their public filings. This change indicates that the SEC may permit these products to trade in the United States without including staked ETH, which could further limit the supply accessible to ETFs. Additionally, ETH, which is used as gas for network transactions, accounts for $2.8 billion annually, representing an additional 0.6% of the supply at current prices. Altogether, these categories comprise around 52% of the ETH supply, despite some overlap, according to AMINA Bank.

In comparison, Bitcoin boasts a much higher illiquid supply (around 72%). This means that for new U.S.-listed spot Ethereum ETFs, their purchases of ETH will likely come from the remaining, more actively traded portion of the supply. “As existing uses limit the available supply for the new spot ETF products, any increase in demand could have a significant impact on price.”

Hong Kong’s Progressive Stance on Ethereum ETFs

The Hong Kong Securities and Futures Commission (SFC) is reportedly considering allowing ETH staking for ETF issuers. If approved, this move would allow ETFs to participate in Ethereum’s staking mechanism, potentially increasing returns for investors through staking rewards.

Ethereum ETPs Debut on London Stock Exchange

Ethereum and Bitcoin-based exchange-traded products (ETPs) debuted on the London Stock Exchange (LSE) following approval by the UK Financial Conduct Authority (FCA) on May 22.

The WisdomTree Physical Bitcoin ETP and the WisdomTree Physical Ethereum ETP were among the first crypto ETPs to be listed in the UK. These ETPs will be available exclusively to professional and institutional investors.

Ethereum On-Chain Data Analysis

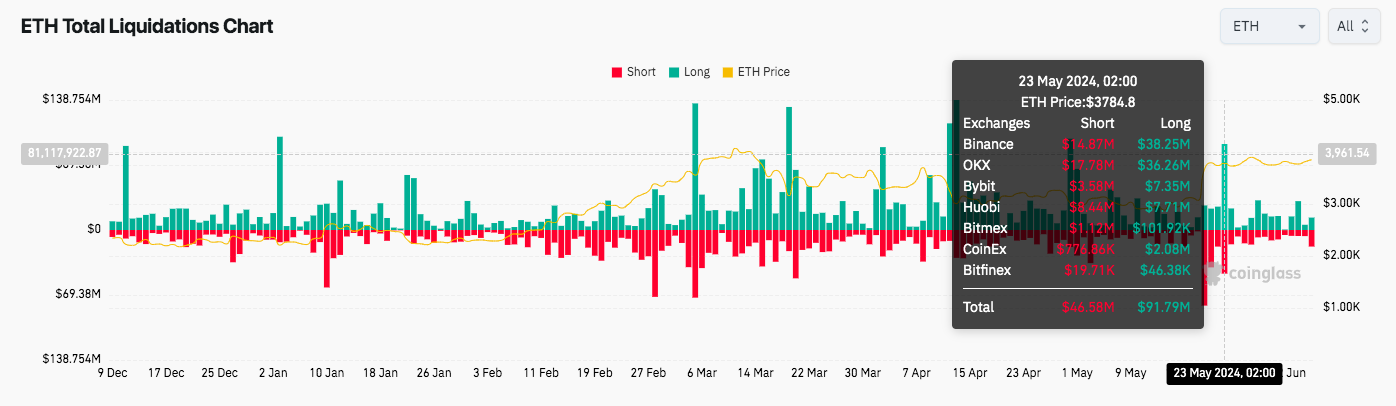

Following the approval of eight spot Ether ETF listings on May 23, Ether experienced $91.79 million in long liquidations, according to crypto data tracker Coinglass. A long position involves purchasing an asset with the expectation of selling it at a higher price in the future.

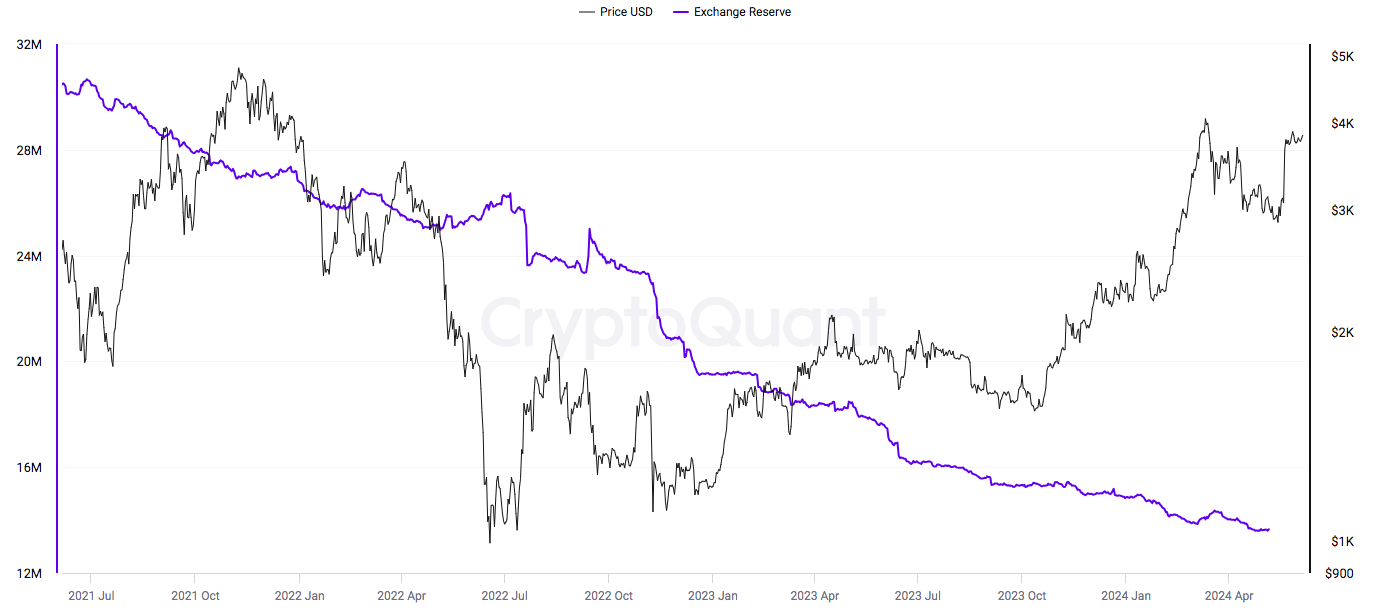

Meanwhile, data from on-chain metrics provider CryptoQuant shows ETH balance on exchanges has been decreasing over the last 12 months to reach a six-year low of 13.62 million ETH in May.

Additional data also reveals a decline in Ethereum’s network activity (in specific metrics) over the last month. Daily active addresses on Ethereum dropped from 474k addresses on May 1 to 384k addresses on May 31. Ethereum also witnessed a decline in daily transactions in May – from 1.3 million on May 1 to 1 million on May 19, but this number increased at the end of the month and reached 1.1k on May 31.

However, there was a notable influx of new users to the Ethereum network in May. According to data from The Block, the number of new wallet addresses created rose slightly – from 3.26 million to 3.83 million, indicating increased interest from both retail and institutional investors.

Ethereum Supply No Longer Deflationary After Dencun Upgrade

The Dencun upgrade has made ETH inflationary, potentially undermining the “ultra sound” money narrative. This shift is due to a structurally lower amount of transaction fees being burned, which prevents the reduction of the overall supply of ETH needed to maintain its deflationary status.

Following the Dencun upgrade, Ethereum’s transaction fees have significantly decreased, with the median fee now up to four times lower for the same level of network activity, according to CryptoQuant data. Consequently, the amount of ETH being burned has dropped to one of the lowest levels since the Merge, causing the supply to grow at the fastest daily rate since then.

Ethereum Ecosystem Updates

The Ethereum ecosystem continues to evolve rapidly with several significant updates and proposals aimed at enhancing its functionality, reducing costs, and addressing governance issues.

Ethereum Name Service Layer 2 Migration

One of the notable developments is the Ethereum Name Service (ENS) planning a migration to Layer 2 to address the high gas fees and slow transaction speeds on the Ethereum mainnet. ENS, which allows users to register human-readable names for their Ethereum addresses, has seen substantial adoption but faces challenges due to the high costs associated with transactions.

The proposed migration to Layer 2 aims to significantly reduce these gas fees and improve transaction speeds, making the service more accessible and efficient for users.

Introducing ENSv2: The Next Generation of ENS 🎉🎉🎉

ENS Labs is excited to announce our proposal to extend the ENS protocol to a Layer 2 network. This move isn't just about migrating parts of the protocol; we're re-envisioning the architecture from the ground up! pic.twitter.com/3xM6owTpKk

— ens.eth (@ensdomains) May 28, 2024

Conflict of Interest Policy by Ethereum Foundation

The Ethereum Foundation introduced a conflict of interest policy on May 24, following concerns about a crossover with EigenLayer.

The Ethereum Foundation’s credible neutrality is critical for us to perform our role in the ecosystem. We are aware of the current conversation about potential conflicts of interest, and share the community’s concerns.

It is clear that relying on culture and individual judgment…

— Aya Miyaguchi (ayamiya.eth) (@AyaMiyagotchi) May 24, 2024

EigenLayer is a protocol that allows Ethereum validators to re-use their assets on other services. The announcement of the policy comes after Ethereum researcher Dankrad Feist joined EigenLayer, sparking community backlash over potential conflicts of interest.

The community raised concerns that Feist’s dual roles could lead to conflicting incentives, where decisions could favor EigenLayer at the expense of the broader Ethereum ecosystem. The new policy aims to mitigate such risks by establishing clear guidelines for managing and disclosing potential conflicts of interest, ensuring transparency and trust within the community.

Vitalik Buterin’s Proposals: Gas Model Overhaul and EIP-7702

Ethereum co-founder Vitalik Buterin has proposed a new Ethereum improvement protocol, EIP-7706, focused on a new gas model for transaction call data. The current gas system, while functional, has been criticized for its inefficiencies and high costs during peak usage times. Buterin’s proposal aims to introduce a more predictable and lower-cost gas model, potentially reducing transaction fees and making the network more accessible.

Upcoming Pectra Upgrade

Ethereum core developers target to release the Pectra upgrade by the first quarter of 2025. This upgrade will build on the improvements made by the Dencun, aiming to optimize transaction processing and reduce latency across the network.

The Dencun upgrade has already made significant strides in improving Ethereum’s transaction throughput and reducing gas fees. Pectra is anticipated to continue this trajectory, solidifying Ethereum’s position as the leading smart contract platform by addressing some of its most pressing performance bottlenecks.

Ethereum-Based Protocols and DEXs

Ethereum leads Layer 1 chains with 81% dominance and $66.7 billion TVL, while Arbitrum One tops Layer 2 chains with 29.5% dominance and $3.1 billion TVL.

May 2024 has been a pivotal month for the Ethereum decentralized exchange (DEX) ecosystem, with significant developments in various Layer 2 solutions, new incentive programs, regulatory challenges, and technological innovations.

Starknet’s Initiatives: Incentives and AI Integration

Starknet, a prominent Layer 2 scaling solution for Ethereum, announced several initiatives aimed at boosting its ecosystem. On May 28, the Starknet Foundation launched a $25 million worth Starknet token incentive program to reward 21 top-performing projects, aiming to drive innovation and adoption on its platform.

To further support ecosystem growth, the Starknet Foundation also unveiled a $5 million Seed Grants Program, targeting developers and projects that contribute to the platform’s growth.

Polygon’s ZK-Rollup and Taiko’s Mainnet Launch

Polygon’s ZK-rollup scaler, Miden, entered the alpha testnet phase on May 6. Miden aims to improve transaction throughput and reduce gas fees by leveraging zero-knowledge (ZK) proofs, which are critical for maintaining privacy and scalability on Ethereum. This advancement positions Polygon as a key player in the Layer 2 scaling arena, offering enhanced performance and security.

babe, wake up, it’s here: the Polygon Miden Alpha Testnet is live—a zk self-sovereign focused chain ready for pioneers who want to cook.

join the 👉🏽 brand new 👈🏽 alpha telegram to start the Miden journey rn: https://t.co/ZWOI7MQOWp

soo what can you do on this testnet anyway? 👀 pic.twitter.com/xwgg0pMTys

— Polygon | Aggregated (@0xPolygon) May 6, 2024

Similarly, Taiko, another Ethereum Layer 2 solution, went live on the Ethereum mainnet. Taiko’s launch was accompanied by a genesis airdrop to incentivize early adopters and developers. These developments signify a growing trend towards Layer 2 solutions, which are essential for addressing Ethereum’s scalability challenges.

Dear Taiko Community,

We are beyond excited to announce that after two years of hard work, the Taiko protocol has been deployed on Ethereum mainnet! 🥳

Let's look at how you can start exploring Taiko today:

— Taiko 🥁 (@taikoxyz) May 27, 2024

EigenLayer and the Controversies

EigenLayer, known for its liquid staking services, faced a mixed month. The platform launched its EIGEN token, which will remain non-transferable until September. However, the initial airdrop of the EIGEN token was met with backlash. (several jurisdictions were excluded from the airdrop, including the United States, Canada, and several African and Asian countries), prompting the Eigen Foundation to distribute additional tokens to holders. Despite these efforts, the platform witnessed over 12,000 queued withdrawals in one day, raising concerns about its TVL stability.

Uniswap’s Legal and Technical Developments

Uniswap, the leading Ethereum-based DEX, faced significant regulatory scrutiny in May. The SEC issued a Wells notice to Uniswap, prompting a strong response from Uniswap Labs, which vowed to defend DeFi and called the SEC’s case “weak” and wrong. This legal battle underscores the ongoing regulatory challenges faced by DeFi platforms.

On the technical front, Uniswap introduced ERC-7683, a new token standard developed in collaboration with Across Protocol. This standard aims to improve cross-chain interoperability, a crucial feature for the evolving multi-chain DeFi ecosystem.

Say hello to ERC-7683 ✨

In collaboration with @AcrossProtocol, this ERC proposes a new standard for cross-chain intents

Solving fragmentation through a universal filler network 👇 pic.twitter.com/2BB3BfawBd

— Uniswap Labs 🦄 (@Uniswap) May 20, 2024

Regulatory and Market Dynamics

The Ethereum DEX ecosystem’s regulatory landscape remains complex. The case of two brothers manipulating Ethereum protocols to steal $25 million highlights the vulnerabilities and the need for robust security measures in the DeFi space.

Meanwhile, Layer 3 network Degen Chain’s production issues (and the regulatory pressures on Uniswap) demonstrate the challenges of maintaining operational stability and legal compliance in a rapidly evolving market.

New Investments

Several new initiatives and funding rounds signal the ongoing innovation within the Ethereum DEX ecosystem. Plume Network, a Layer 2 solution focusing on real-world assets (RWA), raised $10 million in a seed round led by Haun Ventures. Kelp, a liquid restaking platform, also secured a $9 million valuation in its token round. These investments highlight the growing interest in specialized Layer 2 solutions and the diversification of the Ethereum ecosystem.

Ethereum Meme Coins

May witnessed a significant surge in the popularity and trading volume of Ethereum-based meme coins, led by the rise of Pepe (PEPE).

PEPE price reached a new all-time high on May 27, a surge driven by the approval of Ethereum ETF filings in the United States, which prompted traders to view Ethereum-based meme coins as a high-risk but high-reward opportunity. The return of the famous GameStop stock trader, known for their role in the 2021 retail trading frenzy, was also a major catalyst, leading to a sharp increase in meme coin prices, including PEPE.

A major highlight was the remarkable profit made by a PEPE whale, who saw their investment grow by nearly $5 million within a month. The whale has deposited all their PEPE holdings into a Binance wallet.

The price of $PEPE has fallen nearly 20% from its peak.

In the past 10 minutes, a whale deposited all 660.7B $PEPE($9.52M) bought a month ago into #Binance, making ~$4.95M, with an ROI of 52%.https://t.co/XTaeBlTNMLhttps://t.co/57yCOHJvpe pic.twitter.com/F6IV3qhrlq

— Lookonchain (@lookonchain) May 30, 2024

Ethereum NFTs

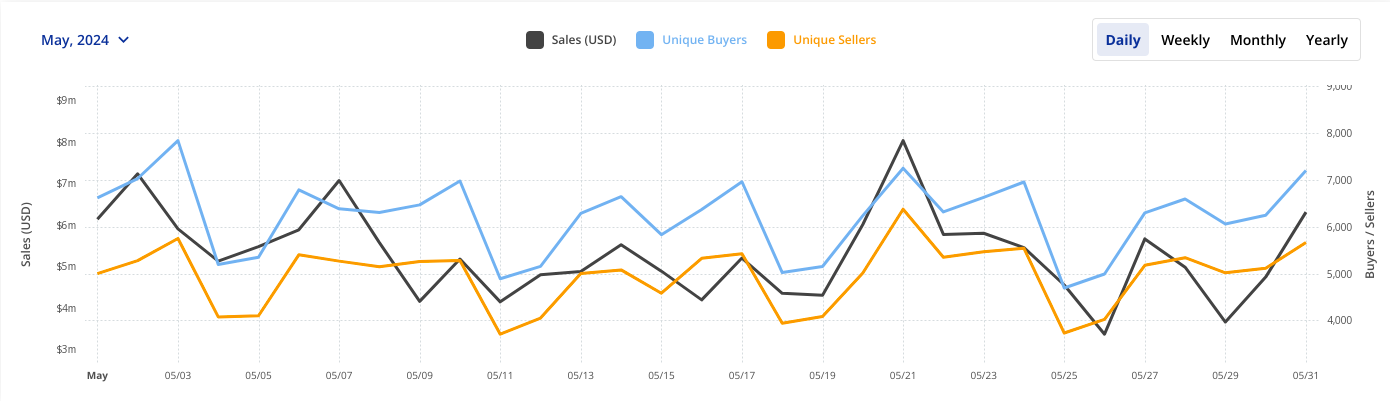

NFT sales dropped from $1 billion in April to $624 million in May, with Ethereum-based digital collectibles significantly declining.

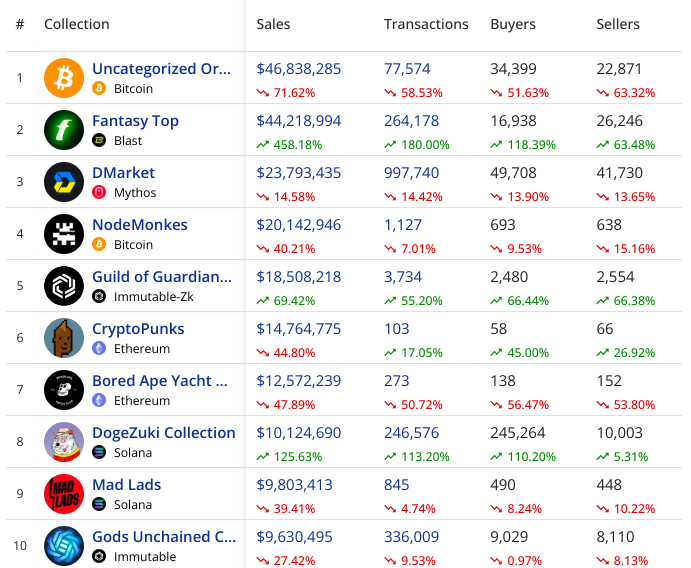

According to CryptoSlam data, the sales volume of Ethereum-based NFTs reached $164,2 million in May, 46% less than in April ($240,6 million). The data further revealed that the Ethereum network has attracted around 56k buyers and 52k sellers of NFTs during the last month. The number of NFT transactions on Solana reached more than 447k in May, 13,8% less than the previous month (509k).

The most traded NFTs last month were Bitcoin-based “Uncategorized Ordinals”, followed by Fantasy Top (Blast), DMarket (Mythos), NodeMonkes (Bitcoin). Ethereum-based NFTs CryptoPunks and Bored Ape Yacht Club are not in the top 5 and are ranked 6 and 7, respectively.

While overall NFT sales volume decreased in May, some collections saw growth. The SocialFi project Fantasy Top boosted Blast into the top blockchains for NFTs (more than 450%). Additionally, the Immutable-based game Guild of Guardians saw a 69% increase in sales volume, contributing to Immutable’s 23% growth, according to CryptoSlam.

Phishing Scams and Security Concerns

Once heralded for its explosive growth and innovative potential, the Ethereum NFT ecosystem is facing significant challenges.

One of the most pressing issues affecting the Ethereum NFT market is the rise of phishing scams. One notable incident on May 8 involved the popular Bored Ape Yacht Club (BAYC), where a phishing scam resulted in the loss of three high-value NFTs (#2100, #6736, #7531) totaling approximately 56 ETH. Influencers have become targets, with fraudsters creating fake trading cards to trick unsuspecting users.

Notable NFT Launches in May:

- Fuzzies (May 12 – May 19): Fuzzies is a charming collection of 999 distinctive NFTs, each portraying an adorable, plush character with a unique set of attributes, bringing a touch of whimsy to the Ethereum blockchain. These NFTs showcase a spectrum of vibrant designs, with each Fuzzy featuring distinct color schemes, patterns, and accessories that make them stand out.

- Mercedes-Benz “The Era of Technology” (May 21 – May 28): Mercedes-Benz NXT Icons brings the brand’s legendary design legacy to the digital age. This collection features 3D reinterpretations of Mercedes-Benz’s most iconic vehicles, overseen by design chief Gorden Wagener himself. The story unfolds across seven eras (from 2000 to 2017), with the “Era of Technology” kicking things off.

- The Boobls (May 22 – May 29): The Bloobs, a collection of 555 unique PFPs (profile pictures) by artist Buchara, offers a glimpse into the emotional rollercoaster of an NFT enthusiast named Bloobsy. Each Bloob, while visually similar, captures a distinct moment in Bloobsy’s life, showcasing the highs and lows, the anxieties and triumphs that come with navigating the ever-changing world of NFT flipping.

Ethereum’s Future: Opportunities and Challenges Ahead in 2024

As Ethereum progresses through May 2024, it faces promising opportunities and significant challenges that could shape its future.

The recent approval of spot Ethereum ETFs is a major development, potentially making Ethereum more accessible to investors. Although these ETFs initially sparked a rise in Ethereum’s price, their long-term impact will depend on how they are rolled out and how investors respond. There is expected to be a substantial influx of institutional money, projected to be between $3.1 billion and $4.8 billion, which might help stabilize and boost Ethereum’s price. However, possible delays in trading and regulatory obstacles require a careful approach. If these ETFs perform as hoped, they could steadily push Ethereum’s price higher, but their actual influence on market liquidity and price swings will become clear over time.

Moreover, the recent Dencun upgrade has made Ethereum’s supply dynamics more complex by reducing transaction fees and the rate at which Ethereum is burned, potentially leading to more price fluctuations.

Technological improvements and new developments within the Ethereum ecosystem will be key to its future. Vitalik Buterin’s suggestion for a new gas model and the upcoming Pectra upgrade aim to make the network more efficient, which could lower costs and enhance scalability. These improvements will likely make Ethereum more attractive to developers and users, encouraging wider use of decentralized applications (dApps) and Layer 2 solutions.

The next few months will be crucial for Ethereum as it navigates these changes, aiming to sustain its position at the forefront of the cryptocurrency market while tackling new challenges and seizing emerging opportunities.