Decentralized Finance, DeFi, Explained

The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

This article has been brought to you by DappRadar, a dapp data aggregator and analysis firm.

_____

Well, we are living in a digital age. Better systems, better rates, better everything. However, there are individuals who are yearning for more. The oligopoly of centralized behemoths in the financial sector, they reckon, is a threat to the global economy.

With the current financial architecture, global banks are a systemic risk. Some are too large to fail yet when push comes to shove, they are propped by taxpayers’ monies. Despite the safety net, financial services remain limited. There ought to be a simple, participative fix that will level and democratize the financial industry.

Enter blockchain. Supporters are adamant that this cutting edge, 21st century technology solves the financial inclusion and inequality problems. Arguing that its distribution levels the field, the best way forward, in their judgment, is open finance or decentralized finance, or simply, DeFi.

What is Decentralized Finance (DeFi)?

Simply put, DeFi can be defined as financial smart contracts, protocols, dapps executed on Ethereum, a distributed digital ledger, with the objective of changing how banking, lending and trading is done.

DeFi is part of Fintech in they incorporate emerging technology with the purpose of improving services to clients, bettering the financial industry as a whole.

Development around decentralized finance is broad and divided into two main categories. The first are solutions that are actively empowering individuals by building products that allow them to better engage with decentralized systems as payment, trading, or lending.

The other arm is trying to rope in traditional systems, building enticing products or services that change narratives by incorporating through effective and efficient blockchain-based options in their operations. Overly, DeFi as an emerging sub sector spans across development in stablecoins, wallets, decentralized cryptocurrency exchanges and marketplaces, infrastructure, lending, insurance and payments.

Presently, DeFi is at a nascent stage. Even so, there are many projects that raised millions of dollars in the name of DeFi promising heaven but have nothing to show.

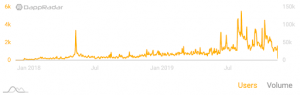

Bancor managed to raise $157 million in 2017 but while their goal was grand, it got hacked and at the moment, their liquidity is wanting. MakerDAO, critics say, is too complex. Many others exist. But most are struggling as the market see-saws.

MakerDAO has seen a steady rise in users since launching in November 2018.

Benefits of Launching DeFi products from a Public Blockchain

As a blockchain drive, the overarching goal is to eliminate the middleman making way for cheap and free flow of services without intermediaries.

Most DeFi products are active in Ethereum, the pioneer and open source global smart contracting platform. You may wonder why? Well, there are distinct advantages when DeFi applications are launched on a public blockchain.

Some of them include the benefits of:

- The network being open source, and therefore anyone can join without permission. With a smartphone, the unbanked, anywhere in the world can get access to financial service off a reliable and secure public blockchain.

- Decentralized-Ethereum is satisfactorily decentralized with no entity controlling any part of the network.

- Disintermediation and therefore the elimination of expensive third party.

Analyzed, DeFi is a by-product of customer demands. Bank clients are increasingly aware, demanding prompt services and convenient ways of accessing loans, depositing or withdrawing funds.

Meanwhile, banks are expected to satisfactorily meet the needs of their clients while remaining compliant with regulators’ demands and simultaneously mitigating against fraud-part of the baggage associated with centralized systems.

DeFi, by leveraging Blockchain in their operations, solves a major pain point allowing users to not only access funds but do so cheaply in a transparent manner thereby serving individuals that are under-banked, de-banked or completely unbanked. The decentralization tagged by blockchain adds more efficiency as a direct route between the service and the client is built in a secure, global, cheap, and transparent platform.

All the same, there could be shortcomings not from the financial service being rolled out but more from the anchor platform. Slow networks, shaky economics and the fact that developers don’t exactly know how to draw maximum benefits from DeFi solutions.

But we can cut them some slack given the many advantages they bear when stacked up against centralized systems. DeFi services could end up being the best alternative to a digital economy stemming from a reliable blockchain.

In the UK, for example, the advent of Open Banking, a raft of rules took effect in early 2018 and mandated by the Competition and Markets Authority (CMA), encourages innovation and development of competitive markets in the UK’s financial landscape. That means despite banks posting profits, future growth is limited as innovative and customer-facing DeFi products are launched. Customers can not only compare between products but gain access to financial services offered by a multitude of licensed providers. That is a source of concern for banks according to a survey conducted by Bain & Company, Salesforce and MaritzCX.

DeFi Is a Good Place to Hang Out

That is why supporters are overwhelmingly bullish of what the future holds. Painting a picture-perfect world of negligible fees and frictionless environment where funds can be sent like mail or loans approved in mere seconds, it is no wonder development around DeFi has been ramped up.

So confident are proponents that Fred Wilson of Union Square Ventures said “DeFi is a good place to hang out” because “It uses all of the same technologies, architectures, and value systems that we have come to know and love in crypto.”

Going forward, the expectation is even higher because of Ethereum’s scaling initiative. Being the first with the most support from developers, a scalable Ethereum that can handle millions of transactions a second without clogging means more DeFi products and therefore efficiency, wider reach and ultimately financial inclusion via a censorship resistant, intermediation free platform as envisioned by product founders.

At this pace, by 2023 once the network will be ideally scalable without sacrificing decentralization and security, Ethereum would cement its position as a go-to public blockchain with verifiable ecosystem that is fully interoperable and with global network effects.

Here are some noteworthy DeFi projects:

- OmiseGo for payments across the Ethereum network.

- Raiden for low-cost payments across Ethereum.

- Dai, a stablecoin governed by MakerDAO-and other stablecoins including Tether, USDC, Gemini Dollar etc.

- Ox, a Decentralized Exchange (DEX) for digital assets-and other DEXs including UniSwap, Kyber Network or Bancor.

- Polymath which is a Security Token Offering investment platform.

- Civic, Bloom and other DeFi products serving KYC and identity.

- Augur dominant in the prediction market.

- Dharma, ETHLend and other products in Lending.

The list is endless. There are thousands of blockchain-based products from different public blockchains rolling out services for the financial sector. Some have seen success, setting the pace for global adoption and the spread of shaping crypto-based financial services.

Ultimately, despite all the hurdles and political resistance, the success of DeFi would translate to a world of secure transactions, diversity, low transaction costs and financial inclusion since anyone with a smartphone and an internet connection can access complex financial services or products previously meant for the affluent regardless of geographic location. That is success, and it is being registered.