Dapps in 2019: What just happened?

The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

This article has been brought to you by DappRadar, a dapp data aggregator and analysis firm.

______

There are many ways to measure the success of the blockchain sector and the individual blockchains of which it consists. At DappRadar, our view is the best long term measure of success is the vibrancy of each blockchain’s dapp ecosystem.

Given the nascence of the industry, we don’t yet expect the dapp ecosystem to be the primary cause of such success, but — even in 2019 — we do expect to see the first green shoots that will eventually become great oaks.

One to rule them all

In terms of structure, the focus of our 2019 industry report sits squarely on the Ethereum dapp ecosystem.

As well as being the first smart contract blockchain, Ethereum remains the most significant in terms of the number of active dapps deployed, the depth of its development community, and growth in terms of users and value during 2019.

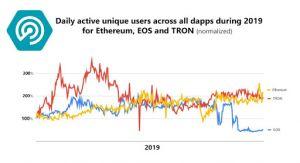

In terms of headline figures in 2019, daily active unique wallets across the Ethereum dapp ecosystem rose 118%, with daily value in terms of US dollars up 166%.

Ethereum also remains the only blockchain to-date that’s successfully nurtured dapps across the four main categories: DeFi, Exchanges, Games, and Gambling and High-Risk.

This isn’t to say Ethereum is the perfect blockchain for dapps. As demonstrated by a sharp rise in gas prices during September, dapps running on this Proof of Work blockchain remain vulnerable to systematic factors.

Yet, more generally, 2019 was a very successful year for the Ethereum dapp ecosystem, as highlighted by the many headlines covering the explosive growth of its DeFi sector.

Indeed, thanks to DappRadar’s new token tracking analysis, we estimate the daily value of its dapp ecosystem, in terms of accumulated daily token throughput, is now well over $10 billion.

Two rivals

Things weren’t so rosy for EOS and TRON, however.

Despite being labeled as ‘Ethereum Killers’ by many, both struggled to grow their user base, and the value captured by their dapps.

More significantly, their oft-mentioned technical advantages in terms of block time and transaction throughput, arising from their Delegated Proof of Stake consensus method, proved problematic.

This was particularly the case for EOS, which since 1st November has suffered from severe network congestion following what appeared to be a deliberate DDOS attack. Two months on from the launch of the EIDOS token, daily activity remains strongly down across most, although not all, EOS dapp categories.

Aside from the mysterious cancellation of founder Justin Sun’s much-anticipated charity dinner with Warren Buffett, TRON generated fewer headlines in 2019.

And yet while it experienced strong growth in terms of total daily active unique wallets from January to December, all key TRON dapps experienced decline in the second half of the year.

Another interesting trend was that while many TRON dapps — ranging from games to exchanges and gambling dapps — launched well, most failed to sustain their audiences.

The result is, much as at the start of the year, TRON ends 2019 as a blockchain predominantly used for gambling.

Explanation with numbers

Ethereum

- Total activity across all Ethereum dapps during 2019*, in terms of unique daily active wallets, grew 118% ending the year at over 19,000 daily active wallets

- Games and marketplaces made up 50% of the total daily active wallets. As a category, its user numbers rose 195%

- Gambling and High Risk was 22% overall, rising 78%

- Exchanges made up 20% of total user numbers, rising 26%

- DeFi was 6% of total users but rose 529%

- The total value of ETH cryptocurrency used in the Ethereum dapp ecosystem in 2019* was $1.8 billion, up 202% in terms of USD value

- However, the total value of ETH and ERC20 tokens used in the Ethereum dapp ecosystem was $7.2 billion, up 166%.

- This figure is for the period 1 June – 10 December; the period DappRadar was tracking ERC20 tokens.

Breakdown for that 6 months inc ERC20 tokens

- DeFi accounted for 45% of total volume, rising 20 times (almost 2,000%)

- Exchanges accounted for 50% of overall volume during 2019, declining 40% from 1 June to 10 Dec

- Gambling accounted for 3%, down 71%

- Games and marketplaces accounted for less than 1%, rising 87%

TRON

- Total activity in terms of accumulated unique daily active wallets across all TRON dapps grew 93% to over 16,000 daily active wallets.

- Total volume with respect to TRON token value in USD was down 63% (53% if we calculate in TRX)

- The total value of the TRON dapp ecosystem from 1 January to 8 December 2019 was $4.1 billion. (TRX token)

EOS

- Total activity in terms of accumulated unique daily active wallets across all EOS dapps declined by 48% down to 13,541 daily active wallets.

- Total volume with respect to EOS token value in USD was down 92% (% if we calculate )

- The total value of the EOS dapp ecosystem from 1 January to 8 December 2019 was 7.2 billion (EOS native and tokens)

You can read our full 5,000-word report (and download a PDF version) here.