Crypto ‘Is Now Finally Being Taken Seriously’ By Taxman – PwC

The major consulting company, PwC said that the increased interest in cryptoassets from tax authorities and other regulators shows that this asset class is now finally being taken seriously. (Updated at 14:59 UTC: the new last paragraph has been added).

“What our research shows is that the guidance issued by many tax authorities is already getting dated. Yes – it is important that people know how to account for tax on the trading of bitcoin and other cryptocurrencies but that is really crypto tax 101,” Peter Brewin, Tax Partner, PwC Hong Kong, was quoted as saying in a press release.

However, he stressed that in nearly all jurisdictions the crypto industry is still lacking principles-based guidance that is fit for the new decentralized economy.

Today, PwC released its first annual Global Crypto Tax Report that shows that few or none jurisdictions have issued guidance on crypto borrowing and lending, decentralized finance, non-fungible tokens, tokenized assets, and staking income.

“The PwC survey reveals that the most common treatment is to view cryptoassets as a type of property. Often this means that spending these for acquiring goods and services leads to a tax charge on disposal. This will continue to act as a major impediment to mass adoption of many crypto assets as a means of payment, unless technology solutions can be found to ease the administrative burden for users,” the company said.

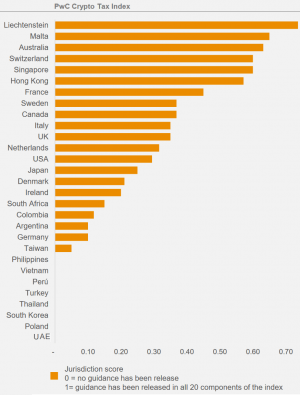

It also published the annual PwC Crypto Tax Index which ranks jurisdictions based on how comprehensive their crypto tax guidance is. Liechtenstein tops this year’s rankings.

“Having specific crypto tax guidance is an essential building block of the continuous institutionalization of the crypto ecosystem,” Henri Arslanian, PwC Global Crypto Leader, concluded.

Meanwhile, as recently reported by The Wall Street Journal, the US Internal Revenue Service is making it a lot harder to pretend you don’t have bitcoin or other cryptoassets hidden away somewhere. They plan to alter the standard 1040 form by putting this question on the front page: At any time during 2020, did you sell, receive, send, exchange or otherwise acquire any financial interest in any virtual currency? The taxpayer must check the box “Yes” or “No.”

At the same time, there was mixed news for the Japanese crypto industry as the regulatory Financial Services Agency (FCA), the body that polices the nation’s crypto companies, made no mention of the industry in its latest tax reform request submission. The FCA periodically passes tax reform requests on to the Ministry of Finance, which then has the power to recommend to parliament and the cabinet that these become enshrined in law. But per media outlet Coin Post, the FCA has made no mention of crypto tax reform – meaning that campaigners for more lenient crypto tax requirements could face frustration. However, on the plus side, the FCA’s silence on the matter could also indicate that crypto tax hikes are not on the horizon in the foreseeable future.

____

Learn more:

Declare Your Bitcoin or We’ll Take 30% of it – Draft Russian Law

Residents of Europe’s Crypto Valley Can Pay Tax Bills in Bitcoin, Ethereum

Crypto Earnings from Microtasks Still Taxable in the US – IRS

South Africa Might Impose Tighter Crypto Taxes Rules – Auditor