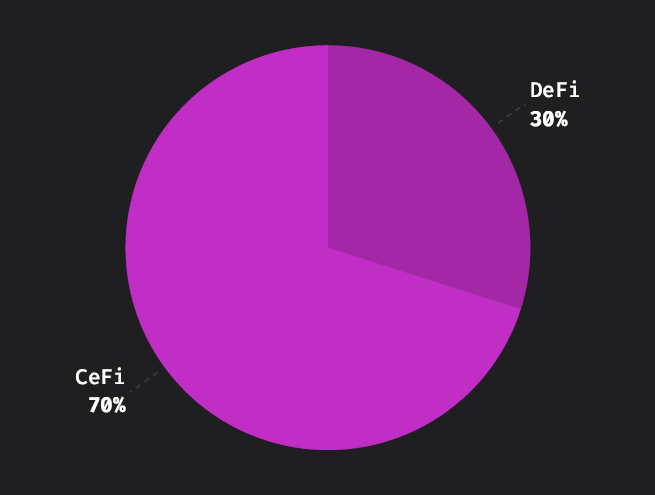

CeFi Overtakes DeFi and Surges to 70% of Total Crypto Losses in Q2, $572 Million Stolen Overall

The second quarter of this year saw quite a significant shift: centralized finance (CeFi) was the main target of successful exploits – with 70% of the total losses. This is according to the latest report by the major bug bounty and security services platform Immunefi.

Meanwhile, decentralized finance (DeFi) recorded 30% of the total losses.

This is a significant change, as a few earlier reports showed CeFi suffering no losses, with 100% of it recorded by DeFi.

In Q2 this year, CeFi suffered $401,400,000 in total losses across 5 incidents. This is a whopping 984% increase compared to $37,000,000 in Q2 2023.

On the other hand, DeFi saw $171,288,861 in total losses across 62 incidents. This is a 25% decrease compared to Q2 2023 when DeFi losses totaled $228,481,519, the report said.

According to Mitchell Amador, Founder and CEO at Immunefi, this quarter “highlights how infrastructure compromises can be the most devastating hacks in crypto, as a single compromise can lead to millions in damages.”

This was evident in Q2, he said. Losses surged primarily due to hacks targeting CeFi infrastructure, surpassing DeFi, despite fewer hacks in that sector.

“Robust measures to safeguard the entirety of the ecosystem are crucial,” he added.

Meanwhile, Ethereum and BNB Chain again accounted for the majority of the chain losses, totaling 71%.

Ethereum, with 34 incidents (46.6% of the total losses), once again surpassed BNB Chain with 18 incidents (24.7%), becoming the most targeted chain.

$572.7 Million Gone: 112% Increase

Immunefi said it looked at all instances where blackhat hackers had exploited crypto protocols, as well as alleged rug pulls in Q2 2024.

Overall, the team found 72 incidents, including successful and semi-successful hacking attempts and alleged fraud.

In total, the Web3 ecosystem lost $572,688,861 in this one quarter.

Hackers stole $564,238,811 across 53 incidents, and fraudsters took $8,450,050 across 19 specific incidents.

Two projects lost most of the sum, together representing 62.8% ($360 million) of the losses:

- DMM Bitcoin, a Japanese crypto exchange, lost $305,000,000 in an attack;

- BtcTurk, a Turkish crypto exchange, lost $55,000,000.

“The total loss of Q2 2024 represents a 112% increase compared to Q2 2023 when hackers and fraudsters stole $265,481,519,” the team stated.

Hacks were still the predominant cause of losses compared to fraud. Fraud accounts for 1.5% of the total losses ($8,450,050 across 19 incidents), while hacks account for 98.5% ($564,238,811 across 53 incidents).

Meanwhile, $28,736,000 was recovered in four situations: 5% of the total losses in Q2.

Nearly a Billion Lost YTD

Overall, the ecosystem saw $920,940,078 in losses year-to-date (YTD) across 135 incidents.

They were primarily driven by over $358 million lost in May, the report said.

Since the beginning of this year, the biggest loss to hacks occurred in June, with $138,139,000 taken.

When it comes to frauds, March was the record month this year so far, recording $6,541,000 in stolen funds.

Comparing Q2 2023 to Q2 2024, hack-related losses went up 155%, while fraud-related losses went down 81%.

In that same period, DeFi losses dropped 25%, and CeFi losses rose 984%.

Meanwhile, Immunefi says it offers over $163 million in available bounty rewards.

So far, it has paid out over $100 million in total bounties and saved over $25 billion in user funds, it stated.