Cautious Optimism in Crypto Market as Bitcoin Tests USD 43K, but Brace for Choppy Weeks

While optimism strengthened in the crypto market on Tuesday, after bitcoin (BTC) tested USD 43,000, and bullish sentiment remained in ethereum (ETH), some analysts warn that “choppy short-term movements may still continue.” In either case, the recent bullish moves came despite comments from US Federal Reserve (Fed) Chairman Jerome Powell that were seen as surprisingly hawkish.

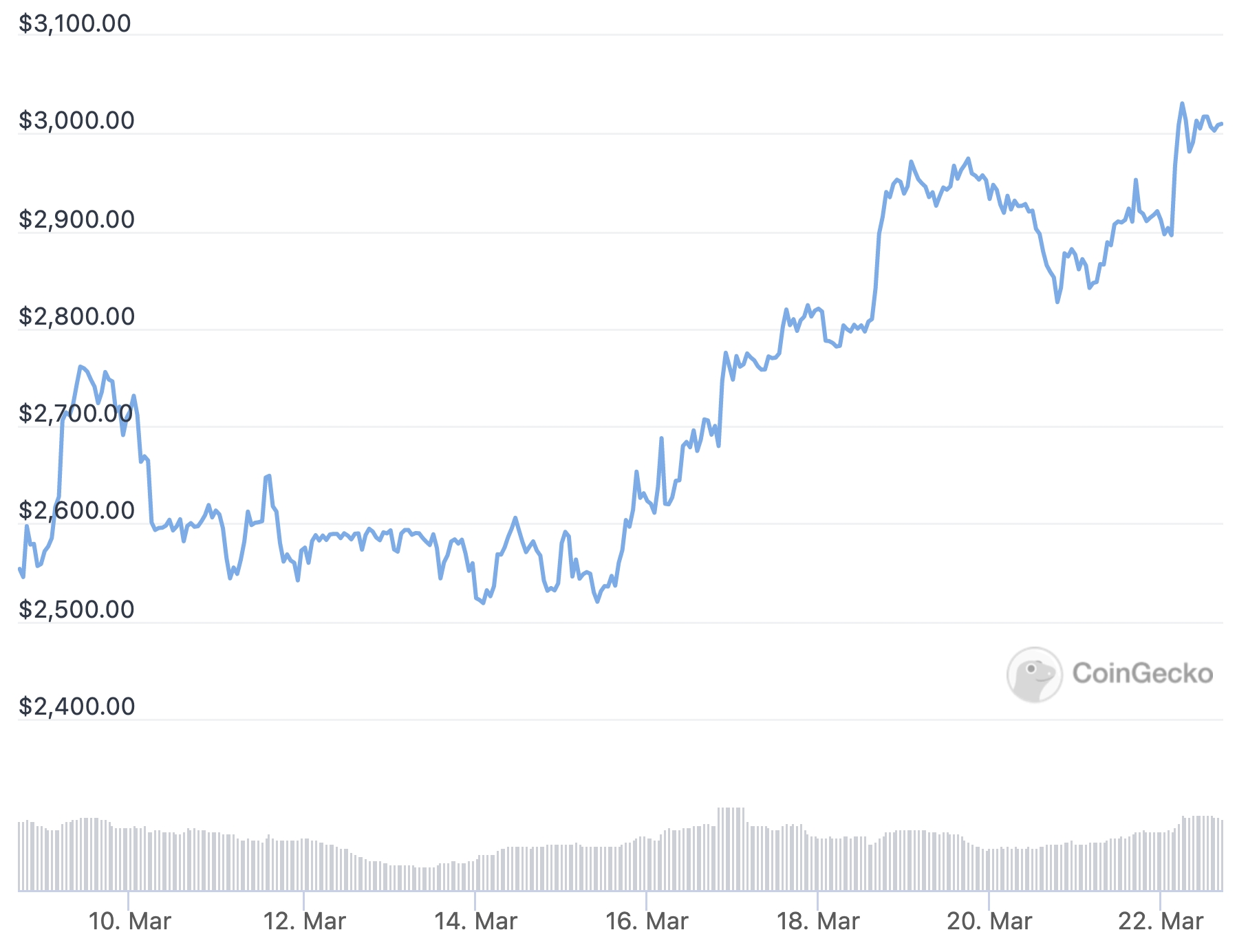

At 17:59 UTC, BTC was up almost 4% for the past 24 hours and 7% for the week to a price of USD 42,554.

The current price is down from a high of around USD 43,000 reached earlier in the day, but still marks the highest price in almost three weeks for the number one cryptocurrency.

BTC price past 14 days:

Meanwhile, at the same time, ETH traded at USD 3,002, up 3% for the past 24 hours and up by 16% for the past week. It topped near USD 3,040 earlier today.

The strong performance comes in the wake of a successful testnet merge of Ethereum’s highly anticipated new proof-of-stake (PoS) blockchain with the existing proof-of-work (PoW) chain last week.

ETH price past 14 days:

The gains in the two largest cryptoassets were also followed by higher prices across most of the altcoin market over the past 24 hours, led by double-digit percentage gains in cryptoassets like EOS, bitcoin cash (BCH), and ethereum classic (ETC).

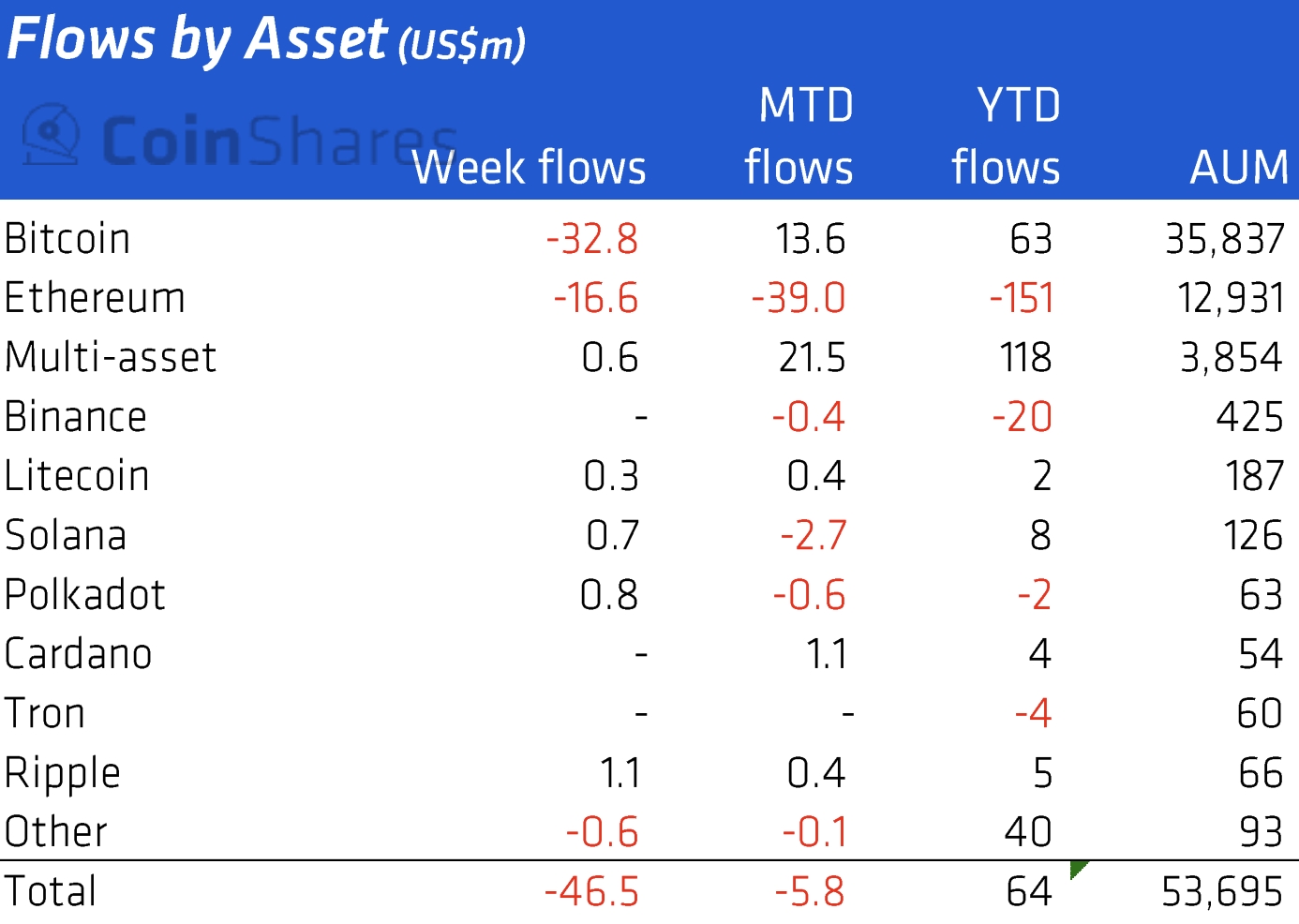

The strong performance over the past day came despite new data from the crypto investment firm CoinShares showing that outflows from crypto-backed investment products have continued.

Bitcoin saw the largest outflows for the past week, with USD 33m flowing out of investment products, CoinShares said, noting that this is half the amount seen last week. Meanwhile, ETH saw outflows of USD 17m, “much less” than the USD 50m seen the week before, according to the firm.

Inflation is ‘much too high’

The moves in the crypto market today also came after Fed Chairman Jerome Powell on Monday spoke publicly about inflation, calling it “much too high.” He added that the Fed must move “expeditiously” to raise rates and possibly “more aggressively” to keep prices from rising too high.

The comment was seen as a sign that the Fed could raise rates by 50 basis points (bps) at one or more meetings this year, something that would be far more aggressive than the 25 bps the market has previously anticipated.

“Our best guess is that the shift in wording from ‘steadily’ in January to ‘expeditiously’ today is a signal that a 50 bps rate hike is coming,” analysts at the major investment bank Goldman Sachs wrote in a note, cited by Reuters.

However, according to Marcus Sotiriou, an analyst at the digital asset broker GlobalBlock, traders should not be too concerned about Powell’s comments for now.

“In my opinion, they will not raise rates by more than 25 bps until September at the earliest, as the Federal Reserve will try their best to avoid a recession,” Sotiriou said in comments shared with Cryptonews.com.

‘Choppy short-term movements may still continue’

Meanwhile, commenting on the shorter-term outlook for bitcoin, Mikkel Morch, Executive Director at crypto hedge fund ARK36, said in a comment yesterday that USD 46,000 is becoming the next key level bulls need to overcome for the price to rise further.

“As long as BTC stays above USD 40,000, there is a good chance of continuation. However, we can only hope for a more sustained leg up if the bulls manage to reclaim the resistance at USD 46,000. Until then, the choppy short-term movements may still continue for some time,” Morch said.

Similarly, Ruud Feltkamp, CEO of crypto trading bot Cryptohopper, also identified the USD 42,000 level as an area of “strong resistance.” He added that it was not expected that price would move through this area “in one go,” and said “the coming weeks” will show whether the area can hold.

Cautious optimism for ETH

Commenting on the current action in the ETH market, CEO of crypto consultancy Eight, Michaël van de Poppe, hinted that the rally may not be sustainable, saying he “wouldn’t really long here.”

“Good move upwards, but is this going to be a fake-out, resulting in a bearish divergence and downwards correction towards USD 2,600, or are we going to continue showing strength,” the trader wrote on Twitter.

However, some observers were more bullish on ETH and the broader altcoin market over the coming weeks, with Delta Exchange CEO Pankaj Balani saying positions are being built on ETH and altcoins.

“Bitcoin continues to grind higher despite a weak macro backdrop. We are seeing traders turning bullish here and positioning them for a move up in the coming weeks. There is interest to long build positions in ETH and altcoins,” Balani said in emailed comments.

“Should BTC break higher here we can see a secular move up across the crypto market in April,” the exchange CEO added.

____

Learn more:

– Correlation Between Bitcoin and Traditional Markets Might Break This Spring – Pantera

– ‘Far More Bearish’ Survey Predicts Doubling of Ethereum Price This Year

– The Ukraine War: How Russia’s Aggression Affected Bitcoin & Crypto and What Might Happen Next

– Fed Can’t Stop Prices From Going Up Anytime Soon, But There’s Good News, Too

– Bitcoin to Hit USD 93K This Year, According to Less Optimistic Survey

– Goldman Sachs Claims Adoption Won’t Boost Crypto Prices, Talks Down Stablecoin Plans