Bitcoin Price Prediction – BTC Consolidates at $19,000, Preparing for Lift Off?

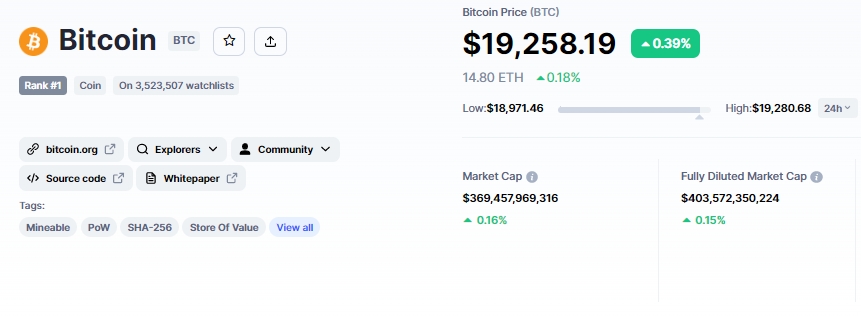

Bitcoin is trading bearish during the European session after being rejected below a major resistance level of $19,250. Following the bearish breakout of the symmetrical triangle, Bitcoin continues to trade with a bearish bias.

Whereas a slew of fundamentals weigh on BTC demand, can we expect the BTC/USD pair to rebound? Let’s find out.

Global Recession May Last Until 2024 Halving – Elon Musk

In a tweet he posted on October 21, Tesla CEO Elon Musk stated his opinion that the global recession wouldn’t end until the spring of 2024 in a tweet he posted on October 21. A technical slowdown was declared for the United States once the GDP report for the third quarter came in, and the extent to which things could worsen remains a matter of some contention.

Musk has long predicted that the United States economy would experience a recession, but he now believes that a worldwide downturn is more likely than ever.

Just guessing, but probably until spring of ‘24

— Elon Musk (@elonmusk) October 21, 2022

When asked on Twitter how long he thought a recession would continue, the world’s richest man was evasive but ultimately said it would be longer than a few months.

Elon said:

Just guessing, but probably until spring of ‘24

Moreover, he said further,

“it sure would be nice to have one year without a horrible global event.”

In response to Elon Musk’s tweets, the leading cryptocurrency, Bitcoin, fell below $19,000 on the day, indicating that it is still vulnerable to large-scale market fluctuations.

Responses to Musk considered the possibility that Bitcoin’s price performance wouldn’t experience a noticeable trend change until the cryptocurrency’s second halving. The date of May 1, 2024, has been set as the target date for the halving.

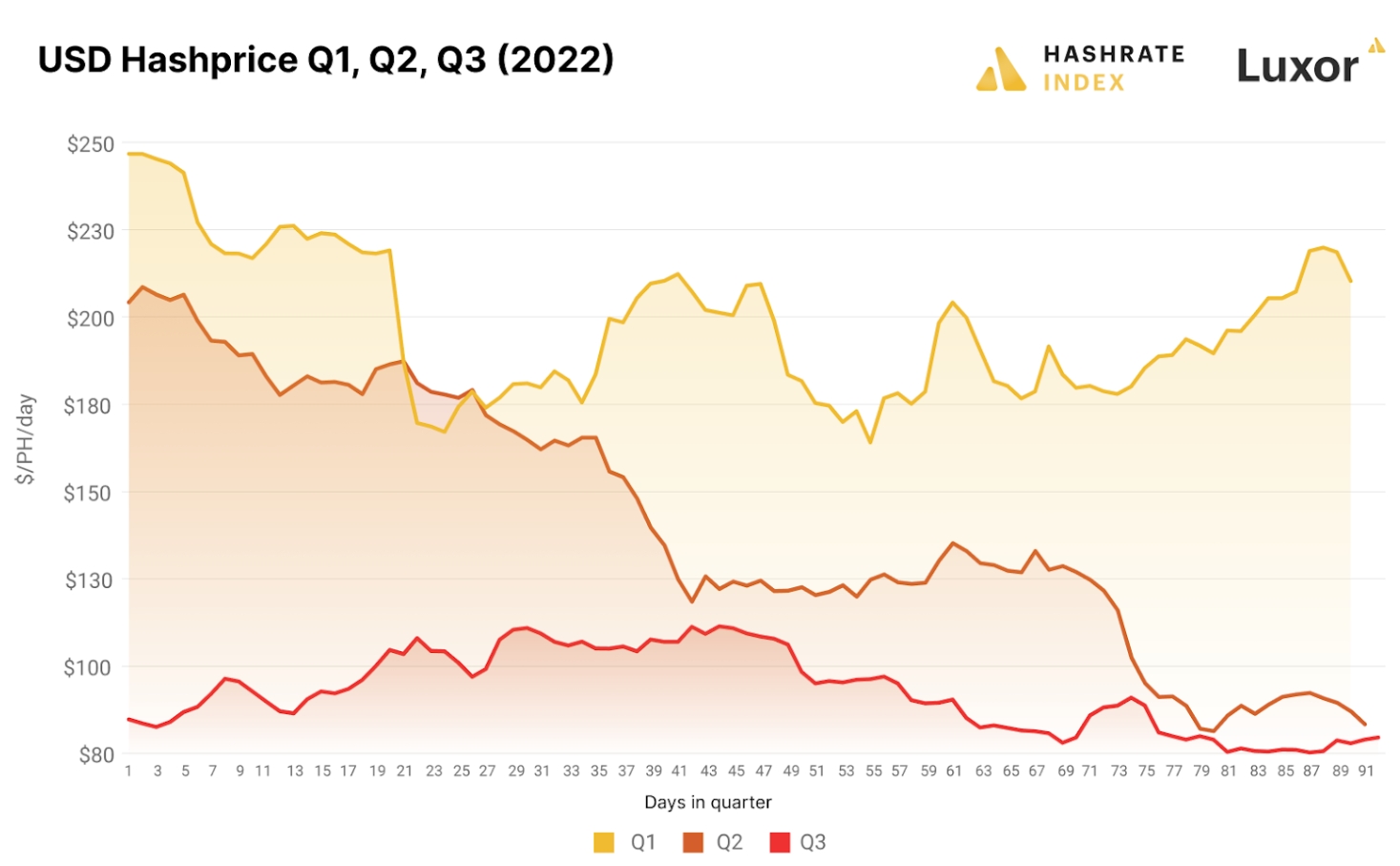

Low Hash Rate, Rising Energy Costs Make Q3 Unpleasant for Bitcoin Miners

The latest updates on Bitcoin mining difficulty are adding selling pressure to the BTC/USD pair. Due to energy issues and current market conditions, Bitcoin miners in North America and Europe have not had a good third quarter of 2022.

Hashrate Index’s latest quarterly mining report details the multiple causes of the dramatic decline in hash price and increases in the cost of mining a single bitcoin.

Hash price is the measurement used by the industry to assess the market value per unit of hashing power. This is measured by dividing the dollar per terahash per second each day and is influenced by variations in mining difficulty and the price of BTC.

‘Combination of mismanaged renewable energy policies, underinvestment in oil and gas, nuclear plant decommissioning, and Russia’s war with Ukraine‘ has caused energy prices to skyrocket, which has had a disproportionately negative impact on the latter.

Bitcoin’s price fell below $20,000 once more in September, while hash rates reached new highs, both of which contributed to a further drop in the hash price. Miner profit margins were jeopardized further by rising energy costs in North America and Europe. As a result, it is pressuring BTC and keeping it bearish.

Bitcoin Price Prediction – BTC Consolidates at $19,000, Preparing for Lift Off?

Bitcoin, the leading cryptocurrency, has lunged to the $$18,840 level, with a 24-hour trading volume of $28 billion. The value of Bitcoin has dropped by over 1.5% in the last 24 hours.

Recalling our Asian session’s Bitcoin price prediction, the leading coin is trading exactly as predicted and has breached the sideways trading range of $18,950 – $19,250. Following the bearish breakout, Bitcoin fell as low as $18,660 before reverting back to $18,900.

Leading technical indicators, such as the RSI and MACD, continue to be bearish, supporting investors’ bearish bias. Furthermore, the 50-day moving average is helping to support the downtrend by providing significant resistance at $19,250.

Alternative – Dash 2 Trade in the Highlights

Since BTC is on a downtrend, we can take this opportunity to invest in projects with good upside potential. For instance, Dash 2 Trade is an Ethereum-based platform that will provide cryptocurrency traders with actionable market data, insights, and analysis in real-time.

The Dash 2 Trade presale, which began yesterday, has quickly reached significant milestones, crossing $300,000 in just a few hours. It’s now up to more than $600,000, and it’s on track to surpass a few more significant milestones in the coming hours.

While forecasting the future is difficult, D2T appears to have a very bright future given its strong fundamentals.

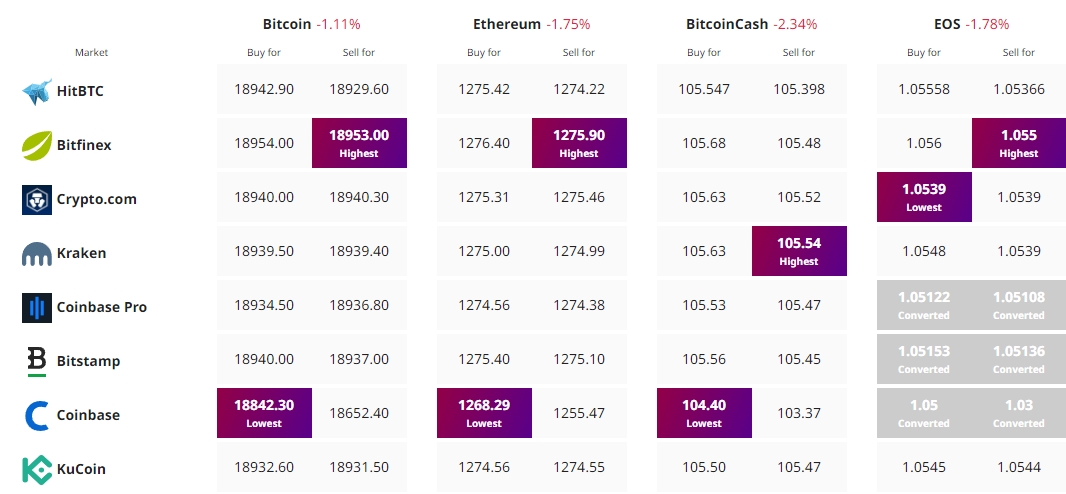

Find The Best Price to Buy/Sell Cryptocurrency