Bitcoin Mining Isn’t To Blame For Increasing Texas Power Demand

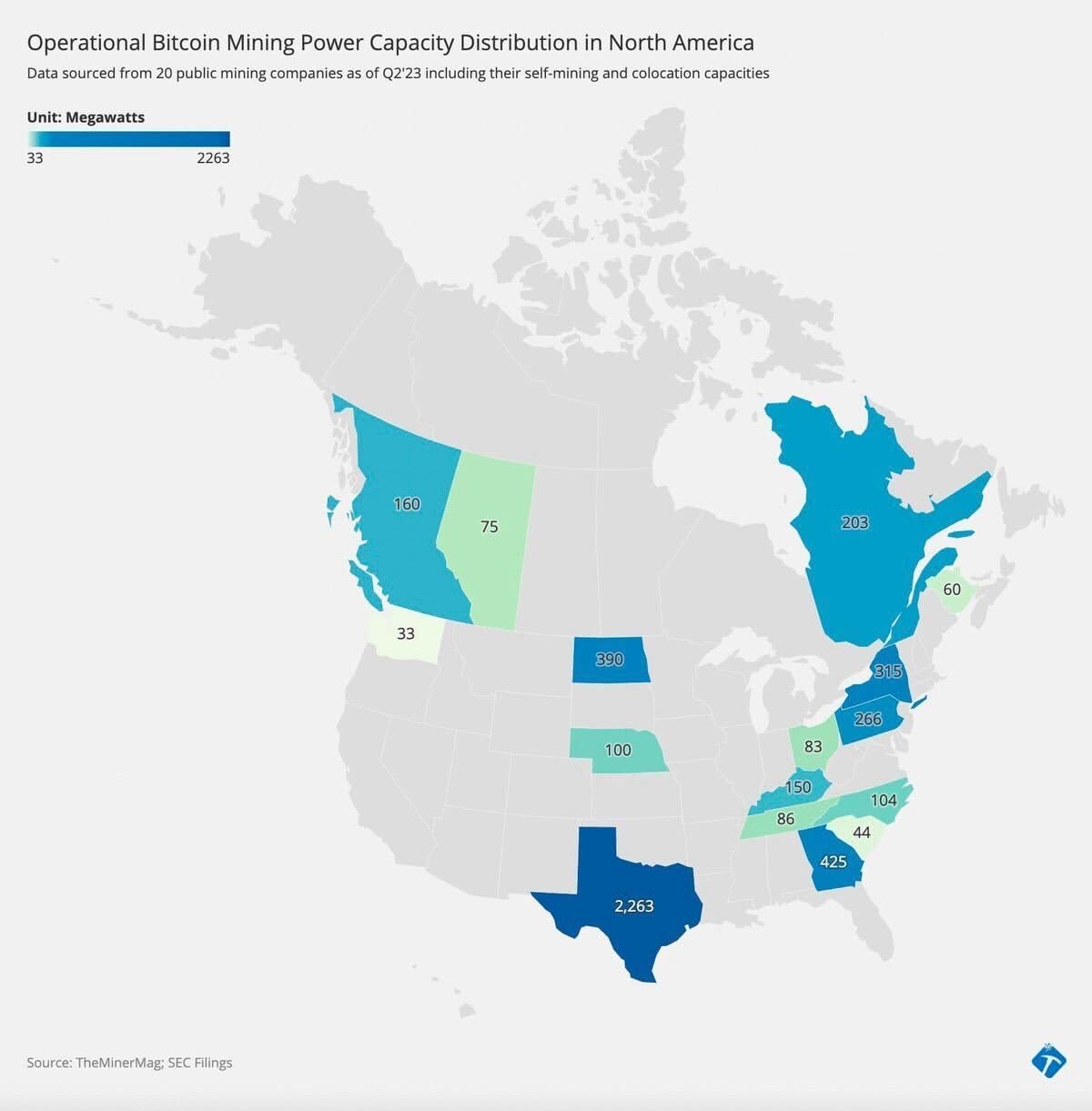

Everything is bigger in Texas, including the Bitcoin mining industry. The Lone Star State has grown to become one of the largest Bitcoin mining hubs in the world.

Miners started flocking to Texas following China’s mining exodus. A number of Bitcoin miners set up shop in Texas due to the region’s abundance of wind and solar power, along with its vast amounts of land.

A recent blog post from the Texas Blockchain Council stated that Texas was responsible for over 30% of the hashrate in the U.S. The post pointed out that Texas is home to 5 of the largest ten Bitcoin mines in America.

Additionally, Texas Blockchain Council noted that the U.S. is currently the world leader in terms of its share of the collective hashrate of the Bitcoin network. This means that Texas has essentially become the capital of Bitcoin mining globally.

Texas Media Outlets Blame Bitcoin Mining For Increasing Power Demand

While it’s notable that Texas has become a Bitcoin mining hub, Texas media outlets are blaming miners for increasing power demand.

An article published last week in The Austin Chronicle explained that current Texas power demand hovers around 85 gigawatts (GW). The article stated that this number is expected to double by 2030, reaching 150 GW.

According to the article, Bitcoin mining is to blame for the rising power demand.

“More than 50% of that new demand is expected to come from the increasing number of crypto mining operations and data centers in the Permian Basin,” the reporter wrote.

Another opinion article featured in The Houston Chronicle detailed why Bitcoin mining could crash the Texas power grid.

Bitcoin Mining Isn’t The Reason for Increasing Texas Power Demand

Although Bitcoin mining is a controversial topic in Texas, industry experts believe that mining isn’t to blame for increasing power demand.

Lee Bratcher, Founder and President of the Texas Blockchain Council, told Cryptonews that the Electric Reliability Council of Texas (ERCOT) estimation that Texas energy consumption will reach 150 GWs by 2030 is skewed.

Bratcher pointed out that Bitcoin mining in Texas currently accounts for 2902 Megawatts (MWs) of demand, according to ERCOT.

“We have seen a steady increase of about 90 MWs per month for the past two years,” he added. “Due to capacity constraints, competition with AI datacenters, falling profitability and the sheer expense of developing large scale bitcoin mining data centers, we expect the aggregate amount of bitcoin mining to level off around 5,000 MWs towards the end of the decade.”

Based on these numbers, Bratcher believes that Bitcoin mining will account for around 3% of the load growth between now and 2030.

He further remarked that ERCOT claims Bitcoin miners will account for 20% of the load growth in that time frame because many mining projects that never made it into development remain in the interconnection queue. As a result, this has skewed ERCOT’s projections.

ERCOT Says Crypto Mining Makes Up Largest Share of Flexible Loads

Trudi Webster, Head of ERCOT Communications, told Cryptonews that ERCOT does not comment on specific facilities’ power usage.

Webster pointed out that the crypto mining industry currently represents the largest share of large flexible loads (LFLs) in Texas, seeking to interconnect to the ERCOT system. This may be why Texas media outlets are blaming Bitcoin mining for increasing power demand.

Webster further explained that ERCOT established the Large Flexible Load Task Force (LFLTF) to identify the measures needed to address the operational, planning, and market impacts of interconnected large loads in the ERCOT region. For context, the LFLTF proposes for LFLs to be stand-alone loads greater than 75 MWs or co-located loads greater than 20 MWs.

Webster noted that the Large Load Interconnection Queue status update presented at the LFLTF meeting on June 3, 2024, is current at press time.

“ERCOT does not specifically break down crypto mining or data operations in this report,” Webster said. “But about 50% of ERCOT’s estimated new large load growth expected in Texas by 2030 is made up of combined crypto mining and AI data center load.”

Electricity Prices Double in Texas Despite Bitcoin Mining

While Texas media outlets continue to blame Bitcoin mining for increasing power demand, these findings are clearly not backed by ERCOT.

Jamie McAvity, Energy Expert and CEO at Cormint Data Systems—a Bitcoin mining company based in Ft. Stockton, Texas—told Cryptonews that electricity costs in Texas have already doubled in the last six years.

According to McAvity, rising electricity prices can be attributed to the fact that no new natural gas generation has been built in ERCOT since 2017.

“This has nothing to do with Bitcoin,” McAvity said. “Rather, it has to do with the fact that load and number of users on the grid is up by about 40%. The amount of power generation on the grid has gone up by that amount, but this new demand has been met entirely by wind and solar.”

McAvity pointed out that wind and solar are great sources of cheap energy, yet he remarked that when the sun does not shine, and the wind does not blow, a grid that relies on wind and solar can have serious shortages.

Texan media outlets reporting that power prices will double over the next 5 years because of Bitcoin mining.

Ugly truth: Power prices have already doubled in Texas over the last 5 years. Bitcoin miners had nothing to do with it. Relevant data in this tweet and thread below

— James McAvity (@jamesmcavity) June 19, 2024

“What we are seeing now is that the 70 most expensive hours of electricity delivery are driving 26% of the total annual cost,” he remarked. “In 2023, for 99.2% of the year, power prices were a reasonable $.037/KWh – which would be amongst the cheapest in the nation. Whereas during the most expensive .8% of the year, prices averaged a staggering $1.63/KWh, multiples higher than nationwide averages.”

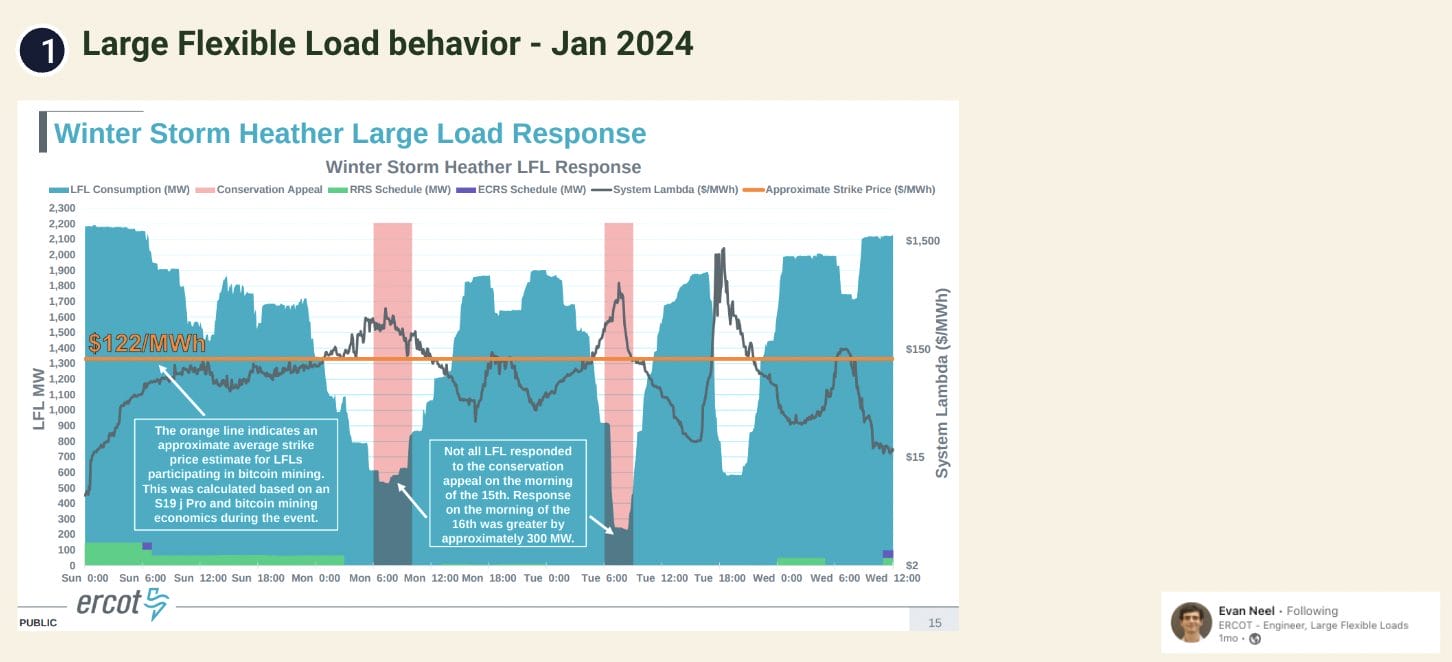

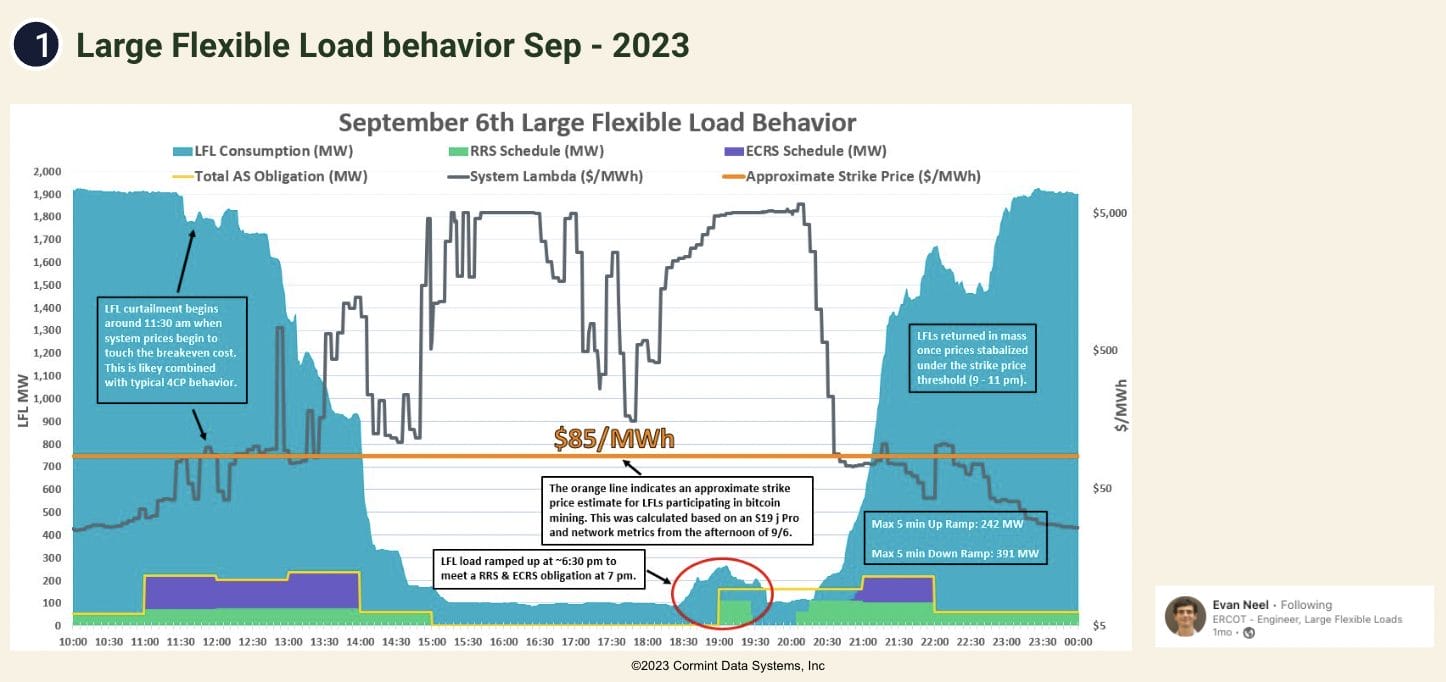

McAvity added that Bitcoin mining did not occur during those time periods of high prices and electricity scarcity.

“There were no Bitcoin mining loads online on September 6, 2023,” McAvity remarked. “There was a huge demand for power then. It was very hot, so no Bitcoin mining occurred.”

Highlighting the current state of affairs and proposing a solution to Texan government officials, McAvity believes that 7500 MW of natural gas peaker plants would be enough to solve this problem.

“It will take some time to build, but once it’s done, the pricing will go down. In the meantime, let’s please not make Bitcoin the boogie man,” he said.

Bitcoin Miners Help Stabilize Texas Power Grid

Additionally, Bitcoin miners actually help stabilize the Texas power grid by curtailing operations during peak performance times.

“Based on Bitcoin miners’ past performance and their interest in curtailing their power during peak demand times, it stands to reason that Bitcoin miners have a more muted or subdued impact on price increases than the average industrial or commercial load,” Bratcher said.

Bratcher added that Bitcoin miners raise prices overnight and during times of low demand, which helps lower prices during peak demand times when miners curtail.

Ross Gan, Chief Communications Officer of Bitdeer Technologies Group – one of the largest Bitcoin miners globally with operations in Texas – told Cryptonews that academic research demonstrates that voluntary curtailment can effectively manage the impact of load growth from Bitcoin mining.

“For instance, this recent 2023 research concludes that reliability concerns can be ‘fully avoided without major economic loss’ when Bitcoin miners curtail power usage for 200 hours annually,” Gan said.

Gan added that the researchers urged grid operators to leverage the demand flexibility of Bitcoin miners as a service to grid reliability while suggesting that new market structures might be necessary to achieve maximum mutual benefit.

“ERCOT’s active stakeholder participation via the Large Flexible Load Task Force is a constructive indicator of such efforts,” he said. “Unlike other large industrial electricity users with firm electrical demand, Bitdeer and other Bitcoin miners can curtail power demand accordingly to ease seasonal supply constraints at scale in a way that few, if any, industries can emulate.”