Bitcoin Miner Reserves Drop to 1.90M BTC, Lowest Level in Over 14 Years

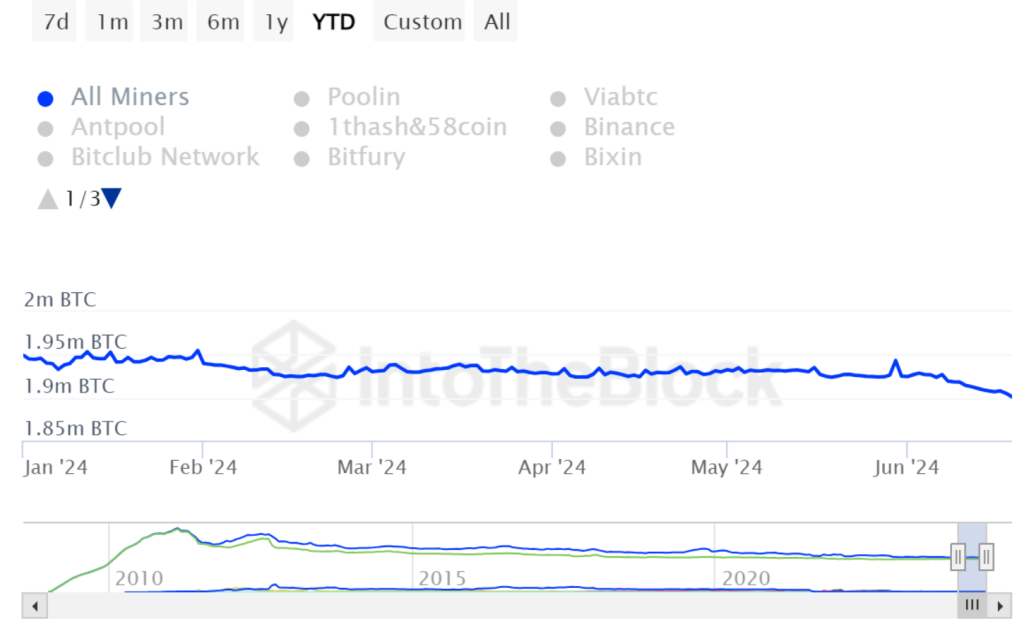

Bitcoin miner reserves have reached their lowest level in more than 14 years, falling to 1.90 million BTC as of June 19, 2024. This significant decline marks the lowest point since February 2010, reflecting a trend where miners hold less Bitcoin on their balance sheets.

Despite this reduction in Bitcoin reserves, the fiat value of these holdings remains near an all-time high, hovering around $135 billion.

Decline in Bitcoin Miner Reserves

Data from IntoTheBlock indicates that miner reserves fell from 1.95 million BTC at the start of the year to 1.90 million BTC by mid-June. This reduction is partly attributed to the Bitcoin halving event on April 20, 2024, which cut mining rewards from 6.25 BTC to 3.125 BTC.

Lucas Outumuro, head of research at IntoTheBlock, explained the trend:

“Miners are expected to hold less Bitcoin over time as the halving pressures their margins.”

The halving event occurs approximately every four years, significantly impacting miners’ operations by reducing their Bitcoin rewards.

However, Outumuro noted that the reserve reduction rate has historically been slow, minimizing major selling pressure on the market. He stated,

“Historically, this has been at a relatively slow rate, so it hasn’t been a major selling pressure.”

Despite the decrease in Bitcoin reserves, their dollar value has remained high due to the increase in Bitcoin’s price. Sascha Grumbach, CEO of Green Mining DAO, highlighted how miners have adapted to these changes:

“Today’s miners have learned from past cycles. Gone are the days of overleveraging and holding onto too much Bitcoin, a strategy that backfired in the past.”

While the amount of Bitcoin held by miners has decreased, the market capitalization of US-listed Bitcoin mining companies has surged. As of June 15, 2024, the market cap of these companies reached an all-time high of $22.8 billion.

Core Scientific, TeraWulf, and IREN led the surge in stock prices, with gains of 117%, 80%, and 70%, respectively. Despite the rising stock prices, miner revenue and reserves have declined, reflecting the broader impact of the halving and market dynamics.

Glassnode’s analysis revealed a steady decrease in Bitcoin miner balances over recent weeks, with reserves now at approximately 1.8 million BTC. This ongoing sell-off indicates a shift in miner strategy towards maintaining financial stability rather than the long-term accumulation of Bitcoin.

Bitcoin Miners Face Extended Sell-Off Period Not Seen Since 2017 Amid Current Bearish Trends

Bitcoin miners are experiencing an extended sell-off period not seen since 2017, according to on-chain data analyzed by CryptoSlate’s lead analyst, James Van Stratten. As of June 17, the Bitcoin market is 33 days into a miner capitulation, which historically lasts about 41 days on average.

Miner capitulation occurs when Bitcoin miners are forced to shut down their machines or sell their BTC to remain operational, indicating unprofitable business conditions. The primary challenge to miner profits is April’s Bitcoin halving, which cut the block subsidy from 6.25 BTC to 3.125 BTC per block. Since April 19, the average daily revenue for miners has dropped from approximately 900 BTC to 450 BTC. Network fees, though a source of revenue, remain minimal.

Mining has become highly competitive, with only the most efficient operations maintaining profitability. Despite expectations that large, publicly traded mining firms would endure post-halving, on-chain data indicates that even these industry leaders are selling their coins as profit margins narrow.

CryptoQuant reported last Wednesday that miners sold 1,200 BTC in over-the-counter (OTC) trades, primarily initiated by Marathon Digital, the largest publicly traded miner.

On June 18, Bitcoin’s price dropped by 2%, reaching approximately $65,152. But today, Bitcoin remains under pressure around $65,100, hitting an intraday low of $64,700 amid the lowest hedge fund Bitcoin holdings since October 2020, intensifying selling pressure.

Due to the price decline, the initial support level, marked by the short-moving average of around $66,000, has become a resistance level. As of this writing, Bitcoin is trading at around $65,660, but it has been unable to break through this new resistance.