Bitcoin Bulls and Bears List Reasons Why Price Will Rise or Drop by 2030

The majority of the respondents surveyed by hashpower provider Genesis Mining remain bullish on bitcoin (BTC)‘s long-term future, listing their reasons for believing so, including bitcoin adoption potential, security, and previous price rise. Also, nearly 20% of the participants said they’re bearish on BTC’s value, and these bears have their reasons too, the largest of which is, you guessed it, regulation.

The provider surveyed 1,000 bitcoin investors on the coin’s future.

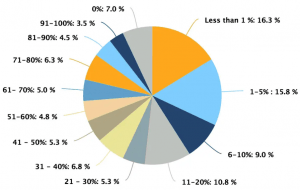

Percentage of savings invested in BTC or other cryptoasset

While 17% of these answered ‘I don’t know’ when asked about bitcoin’s future price-wise, 66% of bitcoin investors remained bullish, stating that the price will continue to rise on a long-term trajectory. There are several reasons why they think this is the case, said the report:

- bitcoin adoption has much room for growth (43.2% of the respondents);

- declining trust in alternative currencies, including but not limited to the USD (29.9%);

- a rise in bitcoin investment sparked by major economic depression (25.8%);

- as well as the security benefits of blockchain technology;

- the economy’s general trend towards digital currency;

- a growing slate of decentralized finance;

- and bitcoin’s history: in 2013, BTC 1 was worth some USD 13.50, while at the time of writing the report, it was USD 17,000. Furthermore, at the time of writing this article (9:42 UTC), it’s USD 19,186. It’s unchanged in a day and up 1.18% in a week.

“Only 17.3% of respondents described themselves as “bearish” on bitcoin’s value as a long-term investment,” said the report, and these respondents believe that the price will either drop or remain stagnant in the next ten years. Their reasons include:

- the threat of regulation (32.4%);

- government-issued bans on the use of bitcoin and maybe other cryptos too (20.6%) (Learn more: Response to Ray Dalio: Banning Bitcoin Is a ‘Game of Whack-a-Mole’);

- BTC being replaced by another cryptocurrency, perhaps a government-issued one (17.6%) (Learn more: This Is How G20 Might Keep Crypto And Stablecoins at Bay);

- waning hype (16.2%);

- lack of practicality (9.6%);

- as well as significant value fluctuations, which may result in the belief “that legacy financial investments will always reign supreme.”

This bullish vs bearish stance on BTC’s price is also seen in the survey’s question on where the respondents see the world’s No1 coin in a decade from now.

“No question produced greater, more evenly-split division than that of where Bitcoin’s price will be by 2030,” said Genesis Mining.

11.3% said that bitcoin’s value will drop below USD 1,000 in the next decade, another 10% see it between USD 1,000 and USD 5,000, while 12.3% think it won’t go above USD 10,000 – still lower than its current price.

While 16% think it may reach USD 20,000 – but will generally stay in the range where it currently lies – 31.6% think it might rise between USD 20,000 and USD 50,000. A combined 13.8% believe bitcoin will be worth between USD 50,000 and USD 500,000 by 2030, on top of which only 4.8% believe it might surpass half a million.

Among other findings, Genesis Mining’s survey highlighted that:

- 66% of respondents stated that they believe bitcoin to be a better long-term investment than those tied to the US dollar;

- 52% of them said they believe bitcoin to be a better investment than real estate in the next 5-10 years;

- 57% said bitcoin is the better long-term investment than gold for the next 5-10 years;

- 54.5% said the same but in comparison with stocks.

The conclusion the survey reached about bitcoin’s future is simply “we don’t know.” As history has shown, these things are impossible to predict, but most of this survey’s respondents, who are already crypto investors, are unsurprisingly betting on bitcoin.

__

Learn more:

Bitcoin, Ethereum, XRP, Bitcoin Cash, Litecoin, Chainlink Price Predictions for 2021

Crypto in 2021: Bitcoin To Ride The Same Wave Of Macroeconomic Problems

Crypto in 2021: Institutions Prefer Bitcoin, Retail Open to Altcoins

In 2021, Bitcoin To Hit USD 25K, Ether – USD 900 – Median Estimates Of Pre-rally Survey

‘Bitcoin on Track for USD 100,000 in 2025’ – Bloomberg Intelligence