Bitcoin Plays With USD 8k, Analysts Say Virus Fears Did Impact Price

While crypto may be an uncorrelated asset class, one analytics firm says that the virus fears had an “undeniable effect” on cryptocurrency prices, following the massive sell-off in both stocks and crypto on Monday. (The second paragraph was updated at 15:47 UTC).

However, on Tuesday, markets turned green as bitcoin (BTC) returned above USD 8,000 again, even reaching USD 8,160 before moving back below this threshold. At pixel time (15:44 UTC), it trades at c. USD 7,901 and is up by 2.6% in a day, trimming its weekly losses to 9.8%. Ethereum (ETH) is up 4%, while other coins from the top 10 advanced 3%-6%, except tezos (XTZ) that rallied 14%.

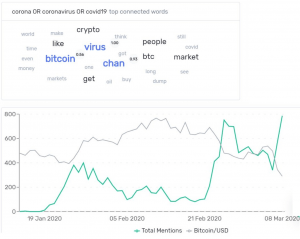

Meanwhile, according to crypto analytics firm Santiment, there is a relationship between the rates at which the coronavirus is being discussed on social media channels like Telegram, Reddit, Pro Traders Chat, and Discord, and the price of bitcoin.

“[…] whenever these discussions [about the virus] have skyrocketed, BTC has plummeted,” Santiment wrote on Monday while adding that we are currently “at or near all-time high levels of discourse about the coronavirus.”

What traders should do now, according to the firm, is to “look for the first bit of encouraging global news” about the virus, which should be taken as a sign that “FUD [fear, uncertainty, doubt] is easing up.”

“Cryptocurrency is driven by sentiment, and there’s no greater proof of this than what we are seeing now,” the firm added.

Contrary to what Santiment’s analysis would suggest, however, the latest sell-off in bitcoin appears to have caught even industry insiders by surprise, with for example Coinbase CEO Brian Armstrong saying he was “surprised” to see bitcoin fall.

The same sentiment was also shared by the technical analyst and YouTuber Alessio Rastani, who said in his latest bitcoin market update that the latest drop came unexpectedly and that his main expectation was that “the bullish uptrend could continue.” However, the analyst also noted a recently “high correlation” between stocks and bitcoin, saying that “bitcoin and the stock market peaked at about the same time” in February.

Addressing the question of why perceived “safe havens” would fall during a stock market panic, Bloomberg editor Joe Weisenthal wrote in a newsletter today that “In a panic, your first priority is maintaining cash flow and paying bills […] And since everyone has liabilities in fiat currencies something like gold eventually becomes a thing to sell for cash.”

He then added that like gold, bitcoin also becomes an asset to sell simply in order to raise cash for other more pressing needs: “virtually nobody has bills that are denominated in bitcoin […] So bitcoin becomes something to sell for cash.”

Lastly, Weisenthal went into further detail about how exactly he sees bitcoin as an investment:

“What bitcoin offers is a way to make payments that can’t be censored. If you’re worried about authoritarians, deciding who can buy what online, then it can be seen as a haven against that risk. […] In this environment though, where people fear not having enough dollars, bitcoin is just another thing that a distressed owner is forced to liquidate,” the editor concluded.