Bitcoin and Ethereum Price Prediction as BTC Drops Lower and ETH Takes a Hit – Time to Buy the Dip

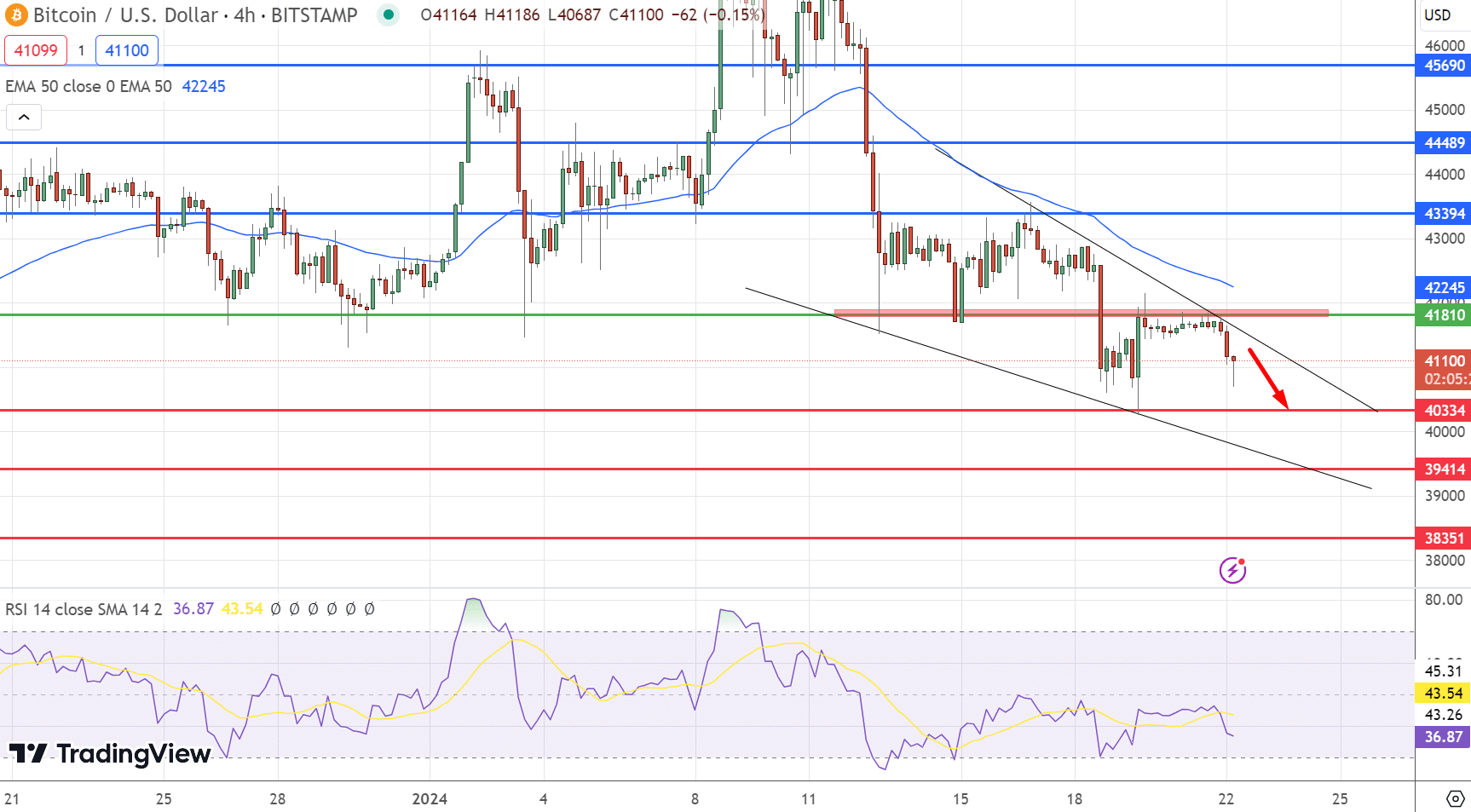

In the dynamic world of cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH) are facing pivotal moments. Bitcoin, the most prominent cryptocurrency, has witnessed a continual downward trajectory, plunging to the $41,000 threshold on Monday.

The entire global crypto market cap reflects this downturn, showing a 1.65% loss in the last 24 hours, settling at $1.62 trillion. Despite consolidating at $41,000 over the weekend, the market remains in a tug-of-war between bulls and bears, creating a state of uncertainty.

#Btc broke 41k important zone if broke 40,200 Btc will dump 39k – 38k then 34k 👀

pls be careful 👍#bitcoin #BitcoinETF #bitcoin #BTCETF pic.twitter.com/l0QVNQ0kb0

— CoinQTS (@CoinQTS) January 22, 2024

Ethereum, on the other hand, is hovering around $2,350, a precarious position given its recent inability to breach the $2,500 level. Amidst these fluctuations, the crypto market is also reacting to recent developments such as Grayscale’s substantial Bitcoin sell-off and the impact of Bitcoin and Ethereum ETF approvals.

These events are significantly influencing market dynamics, adding layers of complexity to the already intricate crypto trading environment.

ETF Approval: Impact on Bitcoin & Ethereum Flows

The recent approval of a Bitcoin spot ETF has notably triggered selling pressure, leading to modest outflows totaling $21 million in cryptocurrency products.

Specifically, Bitcoin and Ethereum experienced the largest outflows, amounting to $24.7 million and $13.6 million, respectively.

In contrast, the Bitcoin Short fund, which profits from BTC’s decline, saw an inflow of $12.7 million.

#BTC has actually gone down in price since spot bitcoin ETFs hit the US market. https://t.co/EE2w85bxju You won't believe the 21 million reasons bitcoin ETFs are dumb as heck and super-risky! Oh wait, of course you will

— Amy Castor (@ahcastor) January 21, 2024

In the meantime, the altcoins faced challenges, with Litecoin losing $1.5 million and Solana experiencing an $8.5 million outflow.

In terms of regional trends, Canada and Germany had significant outflows, while the USA and Brazil attracted inflows, with the USA leading at $263.2 million. Therefore, the news of outflows in Bitcoin and Ethereum, coupled with the surge in trading volumes, likely contributed to selling pressure.

However, the impact on BTC price depends on various factors, including market sentiment and external events.

Grayscale’s $2.14B Bitcoin Sale

The recent slowdown in cryptocurrency market momentum can partly be attributed to Grayscale, a prominent digital asset manager, offloading approximately $2.14 billion worth of Bitcoin, totaling about 52,227 BTC.

This significant sale occurred in the wake of the approval of a Bitcoin ETF, a pivotal development in the financial integration of cryptocurrencies. Other major players like BlackRock’s iShares, Fidelity, and Bitwise also hold substantial amounts of Bitcoin.

Grayscale has offloaded $2.14b in BTC since ETF approval – https://t.co/liCg4W8V9p #News #crypto #Twitter #elon pic.twitter.com/Yv9TJ7aQd7

— Kryptocoinz (@kryptocoinz0) January 22, 2024

Grayscale’s sell-off had a impact on Bitcoin prices, causing a temporary setback. However, the overall market context suggests that the fundamental drivers of the bull market, like growing crypto adoption and institutional interest, remain strong.

Bitcoin has a history of bouncing back from corrections, and the market is likely to recover once the immediate impact subsides.

Hence, Grayscale’s massive Bitcoin sell-off, totaling $2.14 billion, triggered a swift dip in BTC prices. Despite this setback, the market’s fundamentals, driven by increasing adoption and institutional interest, suggest a potential recovery.

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.