Grayscale Selling Bitcoin But This Meme Crypto Explodes 20%

Bitcoin (BTC) hit fresh lows for the year on Friday in the $40,200s, as concerns mount about Grayscale’s ongoing Bitcoin selling, but a meme crypto called Sponge ($SPONGE) has exploded another 20% higher.

Grayscale is selling Bitcoin as traders dump is Grayscale Bitcoin Trust (GBTC), which just converted into a spot Bitcoin ETF.

As per Arkham Intelligence, Grayscale held 621.85K BTC on the 1st of January 2024.

As of the 19th of January, it now holds just over 582K coins, nearly 40,000 less.

Traders are dumping GBTC for a few reasons.

Firstly, prior to becoming a spot Bitcoin ETF which can be redeemed 1:1 for physical Bitcoin or its cash equivalent, GBTC had at times been trading with a discount to net asset value of as much as 50%.

As per YCharts, this discount was nearly as big as 50% in early 2023.

Many traders thus bought GBTC over the last year to express a view that this discount would close.

Now that GBTC is a spot Bitcoin ETF, the discount has effectively closed to zero.

These traders have subsequently been taking profit.

Secondly, GBTC charges a management fee of 1.5% annually, way above most of its spot Bitcoin ETF competitors.

Investors are thus dumping GBTC in order to shift their funds into a Bitcoin ETF product with lower fees.

Grayscale Selling Bitcoin Weighs on the BTC Price

Spot Bitcoin ETF approval euphoria saw the Bitcoin price reach as high as $49,000 last Thursday.

But with Bitcoin dropping back to around $41,500, those warning of a “sell-the-fact” reaction appear to have been vindicated.

Grayscale’s selling of Bitcoin has certainly contributed to the dampening Bitcoin market sentiment over the course of the last week.

And Grayscale may continue selling Bitcoin as traders dump GBTC.

JP Morgan estimated in a research note on Friday that profit-taking flows of $1.5 billion had already exited GBTC.

But the US bank reckons that there could be another $1.5 billion in GBTC profit-taking.

Grayscale’s Bitcoin selling and general post-ETF approval profit-taking aren’t the only factors weighing on the market.

US bond yields and the US dollar have generally been strengthening this year.

That’s because US economic data this month has largely been stronger than expected, dampening hopes that the Fed will start cutting interest rates as soon as March.

Bitcoin historically has a negative relationship to both US bond yields and the US dollar.

As Bitcoin Struggles, This Meme Coin is Pumping

As bitcoin bears eye a possible break to the south of the $40,000 level, crypto investors with a high risk tolerance who are looking for a better chance of near-term gains should look no further than Sponge V2 ($SPONGEV2).

Sponge V2 is the reincarnation of the legendary Spongebob Squarepants-themed $SPONGE token, which reached a market cap of nearly $100 million earlier in 2023 and delivered gains to its earlier investors in the region of 100x.

🌟📈 Ready for explosive growth?

Stake your $SPONGE and be part of the bright future with #SpongeV2!

With added utility and more exchanges on the horizon, we're here to take over! 🔥$SPONGE #Crypto #Web3 #Altcoins pic.twitter.com/iFrZxFShr9

— $SPONGE (@spongeoneth) January 19, 2024

$SPONGE token holders will be able to stake their tokens to receive an equivalent amount of $SPONGEV2 tokens, as well as to start earning staking rewards (paid out in $SPONGEV2) with a minimum APY of 40%.

Over $5 million worth of $SPONGE tokens have already been staked and are gaining an APY of over 300%.

📢 $SPONGE Update!

We've hit a new milestone with 5,390,882,888 tokens staked, valued at $5,233,589.24! 🌟

With a current APY of +300% and a price of $0.0009663 (+18% increase), $SPONGE is stronger than ever. 🧽

Don't miss out, join the takeover! 🚀💰#SpongeV2 #Web3 #Alts pic.twitter.com/GMhqAnTehI

— $SPONGE (@spongeoneth) January 19, 2024

$SPONGEV2’s main advantage over $SPONGE is that it will power a new play-to-earn game racing game.

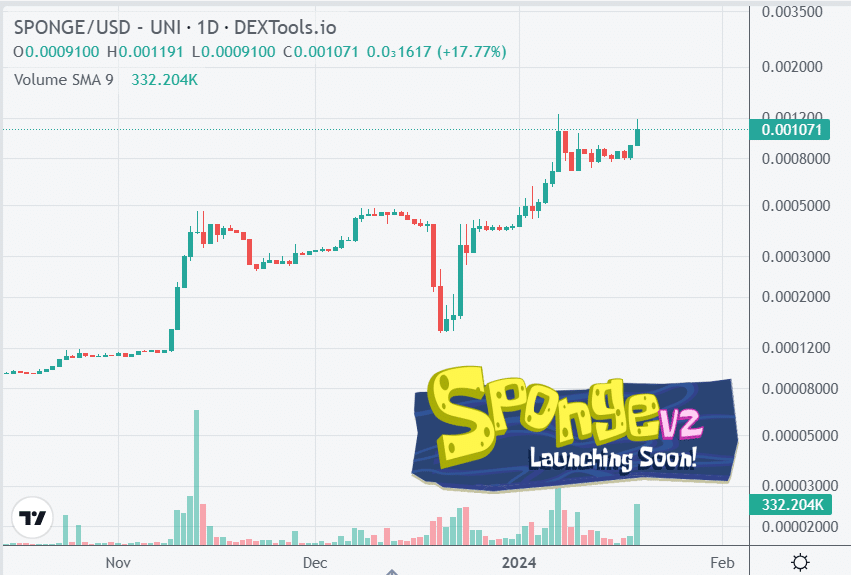

Hype surrounding Sponge V2 has driven significant gains in the price of the original Sponge token in recent weeks.

$SPONGE gained another 20% on Friday to near its all-time highs just above $0.0012.

The meme coin is up an impressive near 10x since the start of November.

At a still tiny market cap of $26.5 million, the meme coin has a lot of potential upside as traders keep flocking to Sponge V2.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.