$15 Billion Palantir Firm Co-Founder Says ‘Most’ Crypto Companies Will Crash – Here’s Why

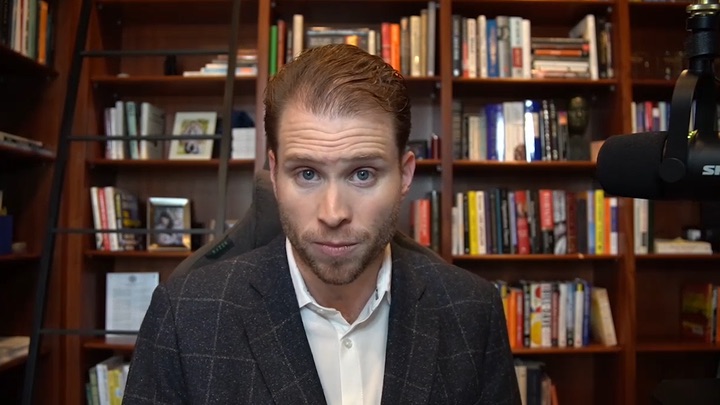

Palantir co-founder Joe Lonsdale has warned that the crypto meltdown could worsen in the future, saying that “most” crypto companies will go to zero.

In an interview with Fox News, Lonsdale said more crypto companies are going to crash as many crypto tokens were Ponzi schemes. However, the venture capitalist said blockchain technology would remain an important part of the future.

“Overall, I think you’re going to have most things crash,” he said. He added that various crypto lenders, crypto tokens, and other parts of the ecosystem are “a Ponzi scheme.”

Lonsdale claimed that crypto initiatives have been “valued not based on cash flows, not based on creating value in the economy, but based on what people would pay for it” over the past couple of years.

The recent comments come amid the collapse of FTX, once the third-largest cryptocurrency exchange in the world, which announced that it had filed for Chapter 11 bankruptcy in Delaware earlier last month.

Following the fall of FTX, cryptocurrency lending and borrowing platform BlockFi, formerly one of the biggest in the cryptocurrency space, also filed for Chapter 11 bankruptcy protection.

Lonsdale has claimed that some companies that have declared bankruptcy “have had a lot of corruption,” specifically talking about FTX. In fact, many experts have compared the sudden fall of cryptocurrency exchange FTX to Enron’s infamous collapse and even Lehman, which triggered the 2008 Global Financial Crisis.

“Long term, there’s a good part of crypto, but most of what we saw in crypto the last three, four, five years was a speculative bubble driven by cheap money and driven by a lot of these Ponzi schemes,” he added.

Nevertheless, crypto-based technologies will continue to be adopted despite the recent turmoil in crypto, Lonsdale said, adding that blockchain technology allows funds to be transferred online without using traditional government or bank infrastructure, enabling a new and important way to move money globally.

“It does make sense to have more decentralized power and for something like Bitcoin to exist. It’s helped people get money out of Russia, out of Venezuela, out of China. It allows more kind of liberty for the financial system from really bad-acting governments.”

However, not everyone is this optimistic. As reported, economist Paul Krugman claimed the entire crypto market has entered an “endless winter” and will never recover again.