What is KYC in Crypto and Why Do Exchanges Require it?

KYC in crypto has a similar meaning and implementation to KYC in traditional finance. The abbreviation stands for Know Your Customer, and it encompasses various means of identity verification in addition to ongoing monitoring.

If you’ve ever opened a bank account, you likely completed KYC when you showed your driver’s license or ID card. Stock brokerages have similar identity verification requirements. Now, it’s the crypto market’s turn to become compliant with KYC regulations that have been implemented throughout the world.

What is KYC?

KYC’s meaning in a crypto context refers to identity verification, monitoring, and reporting obligations for financial service providers, including crypto exchanges. But what is KYC crypto exactly? Short for Know Your Customer, KYC has its roots in Anti-Money Laundering (AML) regulations. The process entails both identity verification and ongoing monitoring, making financial service providers responsible for the KYC process.

Through required identity verification and reporting, KYC helps authorities detect fraudulent activity or illegal transactions and identify the actors involved. However, KYC’s existence also acts as a deterrent, preventing fraudulent or illegal activity that may be possible in its absence.

To dig deeper, KYC has also become a tool for governments to Counter the Financing of Terrorism (CFT). In the US, for example, FinCEN coordinates AML/CFT priorities, which are the basis for KYC requirements.

Many of the guidelines for KYC implementations around the world utilize recommendations set by the Financial Action Task Force (FATF), a multinational body created in 1989 by G-7 countries with a shared interest in combating money laundering and terrorist financing.

Most centralized cryptocurrency exchanges now require identity verification before you can transact on the platform. Others may require KYC to perform transactions above a certain threshold. A much smaller group of centralized crypto exchanges, often in jurisdictions with lax regulation, do not require KYC identity verification.

The KYC Process for Crypto Exchanges Explained

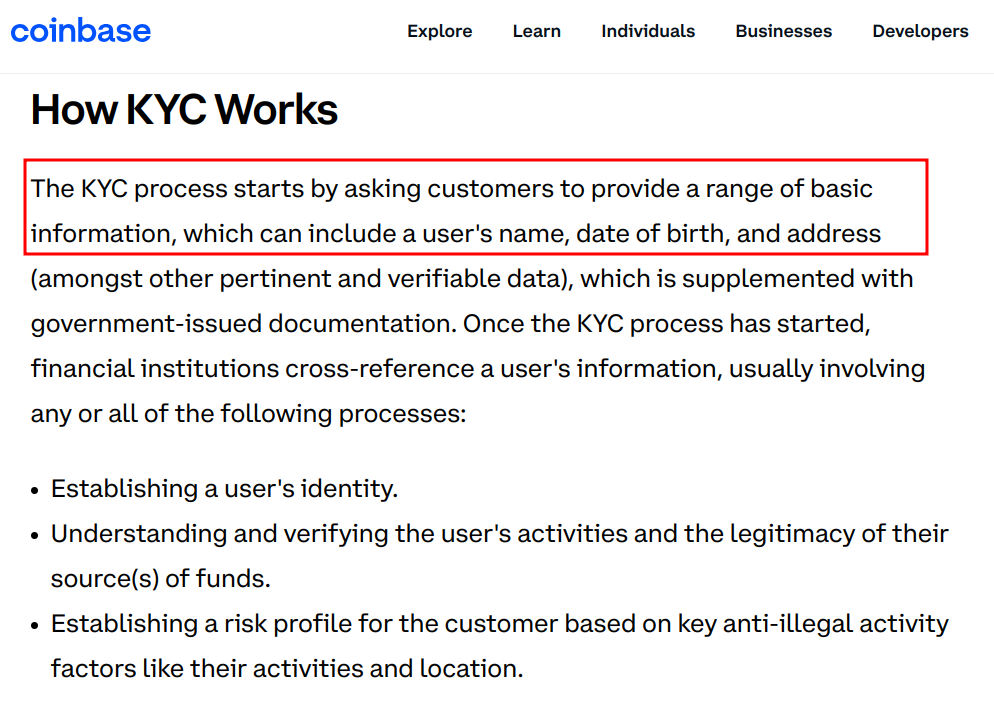

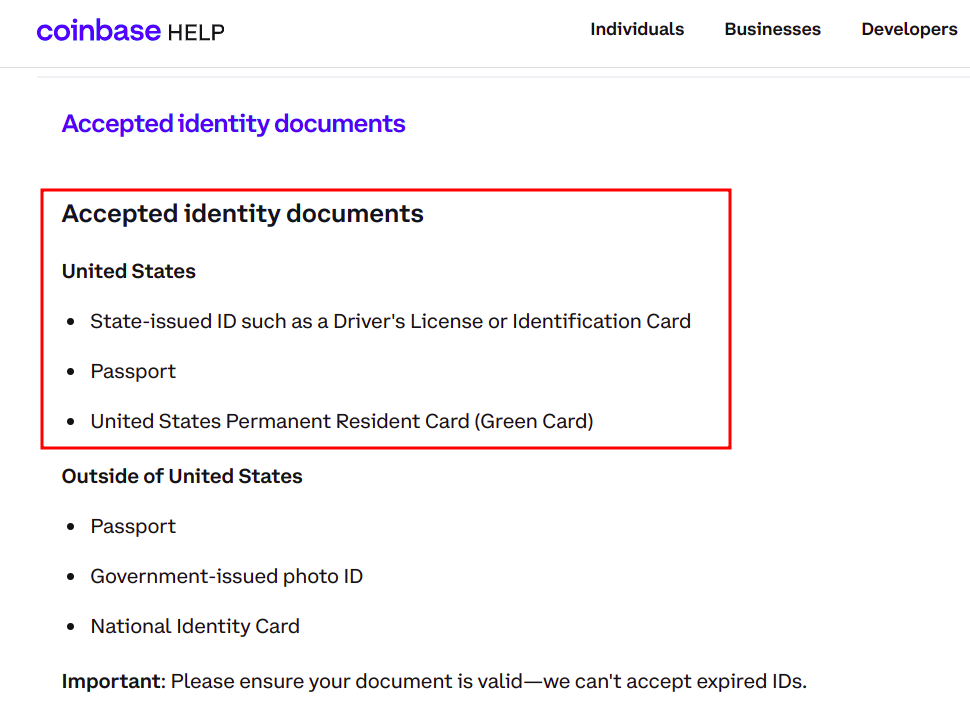

With cryptos designed in a decentralized ecosystem what does KYC mean in crypto? From a user standpoint, the KYC process typically involves providing basic information, such as your name, address, and phone number, and then providing proof of identity. Depending on your location, you may also be required to provide a tax identification number. For example, exchanges completing KYC for US residents typically require a social security number. In the background, the exchange verifies the information you provide, sometimes using third-party verification services to cross-reference information.

The process to complete KYC typically takes about 5 to 10 minutes. However, the verification process can take longer. You might be up and running in less than an hour, or you may have to wait a day or two before you can transact. Coinbase, for example, advises new customers that KYC ID verification can take between 10 minutes and 48 hours to complete.

1) Collecting Personal Details

Basic information needed for KYC usually includes your name and address, as well as your date of birth. Some platforms also require an email address and phone number, although these can also act as ways to secure your account.

2) Identity Verification

Identity verification usually requires a picture of your driver’s license, a government-issued ID card, or a passport. You may also need to provide a utility bill or other proof of address, depending on the platform and the form of ID you provide. For instance, a driver’s license lists an address, but some other forms of identification, such as a passport, may not.

Some crypto KYC platforms also use a “liveness” check, which is a way to compare a live image of you to the ID you’ve provided. If this step is required, you’ll use a phone camera or webcam and move your head within a marked area as directed by the verification app.

3) Ongoing Monitoring

Financial institutions must also assign a risk profile based on the information they’ve collected. The source of funds may also play a role in assigning a risk profile.

After you complete ID verification, the crypto exchange monitors the account to comply with regulations, updating the risk profile and taking additional actions where warranted. In effect, KYC in crypto isn’t only focused on your identity but also on knowing the customer financially.

Ongoing monitoring compliance includes the following:

- Identifying suspicious transactions

- Reporting suspicious activity

- Updating customer information

Advantages of KYC Compliance in Crypto

Although some in the crypto community prefer to trade without identity verification, KYC compliance can help make the crypto space safer in many ways. Identity verification and the ongoing risk assessments that are part of KYC help to reduce fraud and illicit activity but can also improve market stability.

Legal Compliance

Regulators can bring exchange activity to a virtual (or complete) halt if the exchange isn’t in compliance and is within the agency’s jurisdiction. For users, this can mean suspended bank-funded deposits and a flight of capital as traders leave the exchange.

For example, Binance.US suspended US dollar deposits following charges by the Securities and Exchange Commission (SEC). The result was a nearly 80% drop in market depth for Binance’s US-based exchange. In short, the exchange’s order book became a lot thinner, which can affect traders’ ability to enter or exit positions efficiently. While this incident wasn’t directly connected to KYC, it underscores the ability of regulators to take action against financial institutions within their jurisdictions.

Enhanced Trust and Security

KYC can also work to the benefit of users. The enhanced trust that comes with a KYC-compliant exchange is helpful in onboarding new users, who then add to the trading liquidity on the platform.

Improved Market Stability

Market manipulation can be a problem in crypto trading, particularly on lesser-known exchanges that don’t focus on KYC/AML to enforce legal activity on the platform. Anonymous trading can lead to market manipulation tactics that separate honest traders from their money.

- Layering/spoofing: Layering, sometimes referred to as spoofing, refers to creating false demand by stacking fake buy orders in the order book. On the other side of the trade, layering can be used to create fake selling pressure to suppress the price of a crypto asset on the exchange.

- Wash trading: The term wash trading refers to selling to oneself or trading within a group, creating fake trading activity to manipulate prices for a crypto asset.

These types of trading activities are more easily identified on KYC exchanges, thereby reducing the risk of market manipulation.

Challenges and Drawbacks of KYC in Crypto

Not everyone is a fan of crypto KYC. Part of the initial allure of crypto was the promise of freedom in transactions. Many critics point to privacy concerns, but KYC also comes with additional costs, both in time and money.

Privacy Concerns

KYC in crypto requires collecting personal information. Who gets access to this information, and what might happen if it falls into the hands of the criminally inclined members of society it’s meant to protect against?

Data breaches have become so commonplace that we barely react when another headline hits the news. An email breach is one thing, as happened with seven million Robinhood users, but the KYC information collected may be enough to steal an identity — and it’s not unprecedented. In January 2024, an Iranian-based exchange reportedly suffered a breach of KYC documents, potentially putting 230,000 users at risk. The exchange denies the breach, but true or not, the report spotlights one of the potential risks associated with KYC.

KYC privacy concerns may also affect third parties. On September 1, 2023, the UK’s Financial Conduct Authority (FCA) enacted the “Travel Rule,” which requires reporting on crypto asset transfers.

Time-Consuming Procedures

KYC requirements cost more time than meets the eye. In an ideal scenario, a crypto exchange may have you up and running in under an hour, but countless hours of time go into the reporting and tracking requirements inherent to “know your customer” and “anti-money laundering” regulations.

Increased Cost and Overhead

Attempts to automate parts of the KYC process in crypto haven’t always been successful at streamlining the onboarding process. This delay can lead to lost business as frustrated traders go elsewhere, but it also increases the acquisition cost for new customers. In addition, KYC ongoing monitoring requirements create an expense that never goes away.

Who pays? The customers. Crypto exchanges survive on fees and spreads, with the latter being the markup commonly used with simple trading interfaces. When you see higher fees or wider spreads, KYC expenses represent at least part of the push for additional revenue.

Alternatives to KYC Crypto Exchanges

KYC is here to stay for the foreseeable future, but there remain a few ways to trade crypto without identity verification and the risks and inefficiencies it brings. However, some of these options come with their own caveats and potential costs.

Decentralized Exchanges (DEXs)

A decentralized crypto exchange facilitates trading by using liquidity pools powered by smart contracts. Entrepreneurial crypto holders deposit crypto into the pool, typically in a paired allocation with another cryptocurrency. Traders dip into the liquidity pool to trade this for that. Most decentralized exchanges, such as Uniswap or Curve Finance, do not require KYC or even ask for your name.

As a caveat, you need to already own compatible crypto assets to use a DEX. A DEX makes the swap for Crypto A to Crypto B directly from your crypto wallet.

No KYC Exchanges

Several crypto exchanges still don’t require KYC identity verification. In some cases, you may face account limitations, such as daily withdrawal limits. Non-KYC exchanges can also bring other challenges.

- Availability varies by location, with the IP addresses from some countries blocked from the exchange.

- Non-KYC exchanges may not have banking partners, making it more difficult or costlier to deposit to your trading account.

- A non-KYC exchange might also see less trading activity and lower liquidity, possibly leading to wider spreads or even price dislocations relative to the broad market.

However, for many traders, the potential tradeoffs are worthwhile. Some popular non-KYC crypto exchanges include the following:

- MEXC

- BingX

- Changelly

- Switchere

Crypto ATMs

Cryptocurrency ATMs don’t require KYC identity verification for most transactions. Instead, most crypto ATM machines simply require a mobile phone number with SMS support. However, larger transactions may require identification.

Privacy comes at a cost, however. Fees and spreads for crypto ATMs can reach as high as 25%, making them a costlier option.

Peer-to-Peer Exchanges

Platforms like Bisq offer a peer-to-peer marketplace to exchange US dollars or other currencies for Bitcoin and other supported cryptocurrencies. Several centralized exchanges also offer a peer-to-peer platform, including MEXC and Binance. However, Binance requires KYC for its P2P trading platform.

The Future of KYC in Cryptocurrency

It’s tough to imagine a crypto world in which KYC isn’t part of transactions at some part of the chain, such as fiat onramps and offramps. However, innovators are already looking for ways to use tech to streamline the process, reducing the cost of compliance and the time required to complete KYC requirements.

AI can help monitor and search for patterns to flag for review. For example, C3 AI uses machine learning to detect suspicious activity. The company’s data shows an 85% reduction in false positives for AML alerts while tripling the detection of money laundering activity.

Blockchain-based identity verification could be in our future as well. One example is KYC-Chain, a Hong Kong-based KYC provider. The company already uses 10,000 data sources to help onboard new users, but it’s what’s on the roadmap that’s more interesting.

Future plans for KYC-Chain include blockchain-based identity credentials, which could allow much faster verifications. Automated electronic (eKYC) tools, such as biometric authentication and optical character recognition (OCR) data collection from documents, can bolster blockchain credentials and boost efficiency.

Blockchain and AI are the two technologies most likely to reduce the time and money expense of KYC compliance. These still-developing technologies could slash the cost of KYC compliance dramatically while onboarding users faster. Blockchain-based solutions, possibly including consortium chains for financial service providers, could also offer innovative ways to safeguard user privacy.

Conclusion

The role of KYC in crypto reaches far beyond identity verification, which is the most common way we first encounter KYC in the wild. In the background, KYC is an ongoing process that requires monitoring and reporting. While KYC brings additional costs and seems antithetical to the crypto ethos of financial self-sovereignty, the goal of KYC centers on preventing crypto markets from becoming a haven for illicit activity or terrorist funding.

The process remains cost and time-intensive, but the very technology upon which crypto exists may be part of the solution. Blockchain-based KYC, paired with AI, could make KYC faster and less expensive, while safeguarding the private information of users.

FAQs

What is KYC in crypto?

Know Your Customer (KYC) in crypto refers to a process that includes identity verification, risk assessment, and ongoing monitoring. The requirements stem from Anti-Money Laundering (AML) regulations in addition to measures designed to prevent the financing of terrorist activity.

Do all crypto exchanges require KYC?

No. Although most crypto exchanges require KYC to comply with local regulations, several exchanges, including MEXC, do not require KYC identity verification to transact. However, third-party providers for these platforms may require KYC to purchase crypto deposited into your trading account.

Do you need KYC to buy crypto?

Most crypto trading platforms require KYC for trading, and very few options remain for purchasing crypto with traditional fiat currencies like USD or GBP. Peer-to-peer platforms like Bisq and crypto ATMs are some of the few ways to buy crypto without KYC.

Why is KYC important in crypto exchanges?

KYC includes identity verification and risk assessment, as well as ongoing monitoring and reporting. All these aspects work together to reduce the risk of illegal activity on crypto exchanges. The result is a safer trading environment that attracts more trading activity, with increased liquidity and tighter spreads.

How do you avoid KYC in crypto?

Few options remain to avoid KYC entirely because it often occurs at the onramp when purchasing crypto with traditional fiat currencies. Peer-to-peer (P2P) transactions remain an option, including accepting crypto payments or buying crypto through a P2P exchange. Another option is to purchase crypto through crypto ATMs, which typically allow purchases below a certain threshold with only a mobile phone number.

References

- Anti-Money Laundering and Countering the Financing of Terrorism National Priorities (fincen.gov)

- The FATF Recommendations (fatf-gafi.org)

- Financial Action Task Force (treasury.gov)

- Verify your identity on Coinbase (coinbase.com)

- ASSESSING COMPLIANCE WITH BSA REGULATORY REQUIREMENTS (ffiec.gov)

- Binance.US – Our notice to customers (twitter.com)

- SEC Files 13 Charges Against Binance Entities and Founder Changpeng Zhao (sec.gov)

- Binance.US sees 78% decline in market depth following SEC lawsuit (theblock.co)

- Robinhood trading app hit by data breach affecting seven million (bbc.com)

- FCA sets out expectations for UK cryptoasset businesses complying with the Travel Rule (fca.org)

- Why Do Some P2P Merchants Require Users to Complete Additional Identity Verification? (binance.com)

- Improved Money Laundering Detection with Predictive Analytics (c3.ai)

- KYC-Chain – Blockchain & Banking KYC / AML Compliance Solution (kyc-chain.com)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Viraj Randev

Viraj Randev

Nick Pappas

Nick Pappas