Terra Luna Price Chart Prediction – How High Can LUNC Pump in 2023?

The Terra Luna Classic price has fallen by 0.5% in the past 24 hours, dropping to $0.00026412. This also represents an 8% dive in a week and a 15% correction in a month, with LUNC’s depreciation over these timeframes outpacing falls witnessed by other major coins and the market as a whole.

Such above-average declines suggest that terra luna classic’s rallies over the past few weeks may have come to an end, with the release of Binance’s latest data for its ongoing LUNC burns doing little to prevent today’s dip, even though the market’s total cap is up today. And with the collapsed altcoin still having a supply of around 6.9 trillion, it will take many, many more burns before it can begin to enjoy consistent gains.

Terra Luna Price Chart Prediction – How High Can LUNC Pump in 2023?

LUNC’s technical indicators suggest a lack of momentum at this moment in time. Its relative strength index (purple) has dipped again below 50 after a momentary jump above this level yesterday, while its 30-day moving average (red) is sinking further below its 200-day (blue)

This signals that LUNC is currently experiencing a lull, having had a very good September (and a good start to October). Depending on your perspective, this could mean that it can now be had at a discount relative to its ‘true’ value or that it’s part of a longer-term stagnation.

To be fair, LUNC has had some good news in recent weeks. Not only did the Terra protocol introduce a 1.2% tax burn on all LUNC and USTC transactions in early September, but more recently Binance has launched its own additional burn of all the trading fees it collects in LUNC.

The announcement of the tax burn was responsible for LUNC’s rally in early September, while Binance’s announcement of its trading fee burn (on September 26) has been responsible for the coin’s more recent surge.

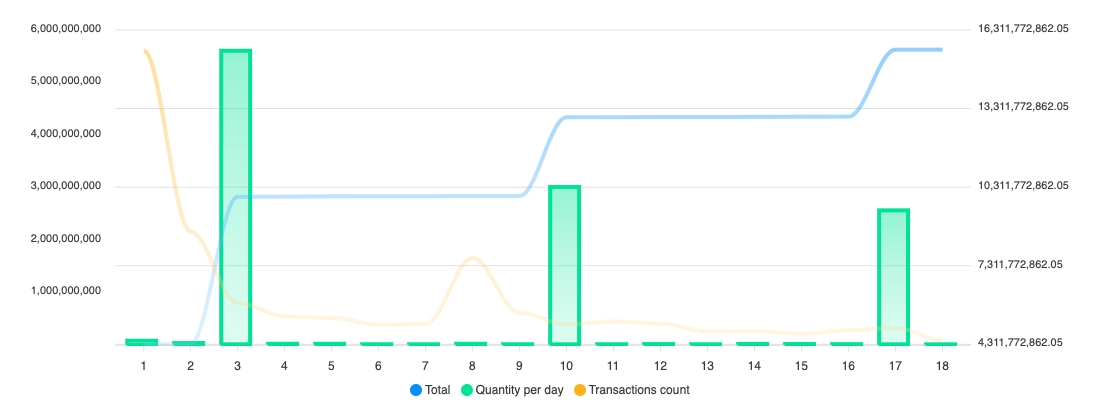

According to Binance’s latest data, it has now burned just under 8.6 billion LUNC to date, making for an average so far of 2.86 billion burned per week. Also, LUNC Burner Online puts the grand total of all terra luna classic burned to date at 22.2 billion.

What’s interesting to note about this latter figure is that its rate of increase has accelerated this month, most likely because of Binance’s additional burn. While September brought a total burn of 4.2 billion LUNC, October has already seen a further 18 billion destroyed, representing an increase of over 300% from one month to the next.

The point of this is that the rate at which the market is burning LUNC is increasing and may very well continue increasing over time. So while the current burn total has barely made a dent in the coin’s total supply of 6.9 trillion, this could change over the coming months (and years).

Indeed, recent weeks have brought news of other players introducing their own dedicated LUNC burns. On October 10, Seattle-based developer KaJ Labs announced it would be earmarking $450 million in order to support the burning of 2.5 trillion LUNC.

This burn will be achieved via its play-to-earn RPG Finesse Shadow Warriors, with in-game fees (i.e. for purchases) in LUNC being destroyed. Obviously, burning such a large amount of the altcoin will take some time, with KaJ stating that it will increase its monthly burn quotas by 20% from Q1 2023 and throughout 2023.

Taken together with the tax burn and exchange burns, such announcements have created the expectation among the Terra community that LUNC’s price (as well as USTC’s) will see significant gains in the near future.

I have a dream! $LUNC will reach $0.1 🔥

— Edy Play Games (@EdyPlayGames) October 17, 2022

Even a rise to the fairly modest price of $0.10 entails an increase of 37,000% from its current level. This is likely the best-case scenario, if only because LUNC has already enjoyed a 26,000% gain since reaching rock bottom in mid-May.

Still, in theory, a dramatic reduction in supply does imply a proportionate increase in demand and, by extension, an increase in price. In this respect, it’s interesting to note that LUNC’s gains over the past weeks and months have come without a substantial reduction in supply, suggesting that when such reductions do arrive, the altcoin will witness even bigger gains.

Real Demand?

However, you could flip such an argument entirely on its head. That is, LUNC’s recent increases have all been about expectations and hope on the part of its community rather than about actual wider demand, which would be increased in the event of supply reductions.

In other words, there is no genuine market demand for LUNC, and no amount of token burning may change that. At best, dramatic reductions in supply may result in a few more short-term price gains for LUNC, but given the lack of fundamentals for the coin, once the burning has stopped, its price may fall once again.

This argument is supported by the fact that the major dynamic supporting LUNC’s price growth in the past was broken in May when USTC (then known as UST) fatally lost its peg with the US dollar.

In the past, the latter was one of the biggest stablecoins in the cryptocurrency market, with investors trusting that its algorithmic support mechanism would ensure its stability. However, this trust has been permanently undermined by the de-peg, so there’s going to be no real demand for USTC as a stablecoin going forward.

This hurts LUNC because it would always be burned whenever demand for USTC grew and more USTC was issued. Investors bought LUNC under the assumption that this demand for USTC as a stablecoin would continue growing, reducing LUNC’s supply as a result.

But now, there’s no such demand for USTC, so what’s supporting LUNC’s price in the long term? Endless token burns until its supply reduces to zero?

This is the big contradiction that LUNC now faces, and with Terra co-founder Do Kwon wanted by Interpol and South Korean police, the altcoin’s long-term prospects look shakey.

While there remains a very good chance that LUNC (and USTC) will continue enjoying rallies in the short- and medium-term, its fundamentals have very much been removed, undermining its long-term bull case. As such, investors wanting above-average gains and the hope for sustainable appreciation over time would be better off looking elsewhere.

IMPT Presale Catches Attention of Crypto Experts

Given that the market is currently going through a bearish phase, the major cryptocurrencies aren’t really providing real profits right now, which explains the current fad for LUNC.

That said, there are a handful of coins that do have the potential to rise strongly while also promising an actual future of utility.

For example, 2022 has brought a number of successful presales, with new coins then going on to rise significantly following their first listings. The most notable of these is arguably Tamadoge (TAMA), which raised $19 million in September before going on to rise by 1,800% relative to its presale price at one point after it was listed on OKX.

While TAMA’s presale has ended, other promising sales are still ongoing, with the Impact Project (IMPT) offering being one of the best of the current crop. Running on Ethereum, the latter is a carbon credit marketplace and green retail platform that provides consumers with the ability to earn (and sell) NFT-based carbon credits for shopping with environmentally friendly retailers.

📣 LET’S GOOO #IMPT CREW!! 📣

— IMPT.io (@IMPT_token) October 17, 2022

♻️HUGE MILESTONE ACCOMPLISHED!! ♻️

🔥🔥$5 MILLION USD RAISED SO FAR🔥🔥

Hurry! Presale Stage 1 Will Run Out Soon! ⏰

BUY $IMPT NOW! 👉 https://t.co/oD1IG3PF0S pic.twitter.com/qoz8jZVc9x

Its sale began in October and has already raised more than $5 million, with its first stage having a cap of $10.8 million. Once this stage ends, its sale price will rise from $0.018 to $0.023 (and later to $0.028).

While there’s obviously no guarantee that IMPT will witness the kind of gains seen by other tokens this year, its fundamentals and ESG credentials give it a good shot. And while LUNC’s rally may fizzle out by next year, IMPT potentially has the utility to keep on growing.