How The Ethereum Merge Could Impact Staking Yields

Max Shannon, Digital Asset Analyst at major European digital asset investment firm CoinShares.

_____

The Merge aims to move Ethereum from Proof of Work (PoW) to Proof of Stake (PoS), and provide the foundation for increased scalability and reduced energy consumption. Detrimental trade-offs in terms of censorship resistance, trust minimization, and decentralization could occur as we have detailed here.

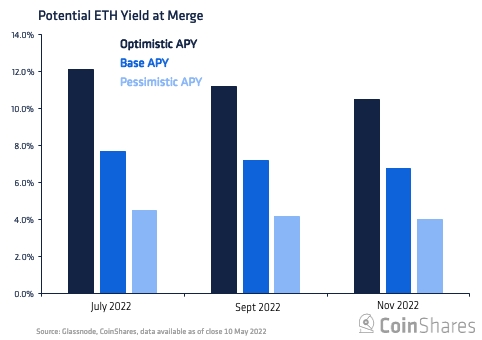

This article aims to investigate possible optimistic, base, and pessimistic scenarios across three different potential Merge dates for a validator with >=32ETH. Our research assumes The Merge could occur in H2 2022 with:

- base case yields sitting at around 8% APY [Annual Percentage Yield] – approximately double (x2) current yields of 4.3% (as of 23 May 2022)

- optimistic yields sitting at around 10-12% APY

- pessimistic yields sitting at 4% APY.

Please note that this article is intended for research only and is not intended to be taken as investment advice.

Model results

Outcome Explanation

Model methodology & critique

Ethereum’s changing monetary policy makes revenues hard to project over the long term in a granular fashion. However, assumptions need to be made that provide possible varying degrees of potential yield vs realized yield. This includes the date of The Merge which is not set, although [the] consensus seems to be around August 2022, and what could be optimistic or pessimistic scenarios for multiple Variable Inputs.

Risks and rewards of staking

Staking 32 ETH as soon as possible means a validator will likely receive a higher yield than staking later on. Becoming a validator allows the earning of maximum rewards directly from the protocol by proposing (batching transactions into a new block) and attesting (checking proposals from other validators) blocks, as well as tip fees from users. The key part is that in the future, it is very likely that there will be more ETH staked than presently. This is likely to reduce the yield because the block subsidies are distributed to a higher number of people, so each validator is likely to receive a smaller percentage of the rewards.

However, staking now does entail some risks. A validator is risking a lot of money which could be lost partially through penalties such as going offline or slashed severely by performing malicious actions (like double proposing or double voting). Or even being ejected from the network – but in reality, the penalties for imperfect behavior are quite low. If one stakes prior to the Merge, their staked funds and rewards are locked up and cannot be withdrawn and it is unclear as to precisely when withdrawals can be allowed post-Merge as well.

Summary

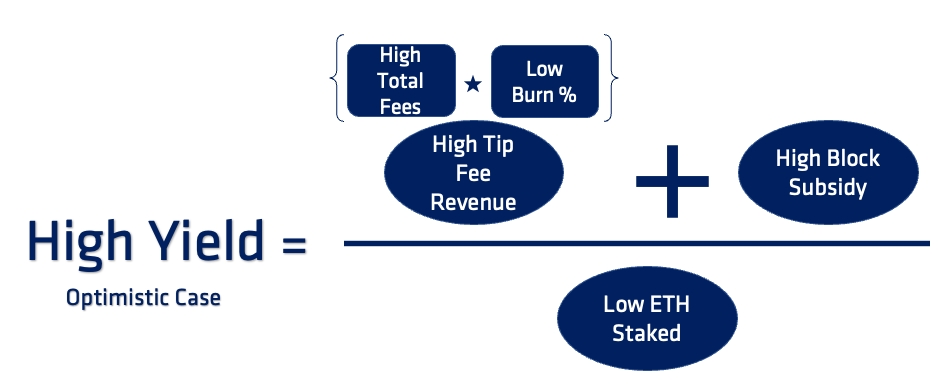

Once The Merge occurs, Ethereum will intrinsically produce cash flow as investors deposit ETH to become a validator (propose and attest blocks to secure the chain and keep the chain moving forward) and receive ETH as a reward. This creates a dynamic yield that depends on two main factors: a) how much revenue (tip fee and block subsidy) one earns; b) how much ETH is staked.

| Revenue | Network Stake | Yield |

| High | Low/Average | High |

| Low/Average | High | Low |

| High | High | Average |

| Low | Low | Average |

Appendix

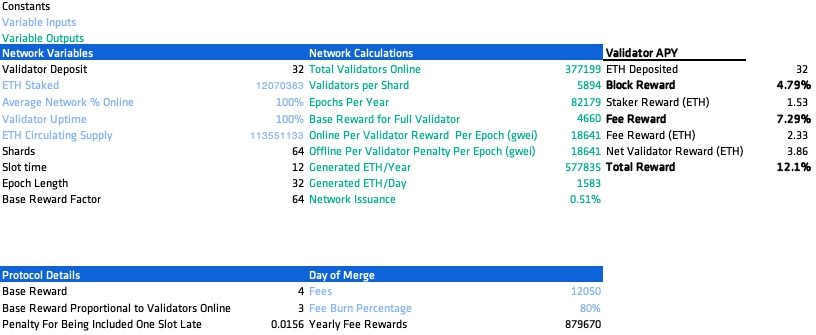

Below is CoinShares’ estimate calculation for the July 2022 optimistic case.

The Merge date was denounced once again

I chose July 2022, September 2022, and November 2022 as potential Merge dates because Vitalik Buterin, at the Ethereum Shanghai Summit, and other core Ethereum developers have mentioned it could occur in August if there are no issues. The Arrow Glacier fork rescheduled the Difficulty Bomb for June 2022 but it is likely to be pushed back again. These are noticeable exponential increases in block times, making it almost impossible for miners to create a block, and therefore reducing their ability to earn revenue for their operations. This practically leaves them redundant on a chain that doesn’t move forward. The community would not like to be forced onto a chain that is not fully complete with [minimal] or no issues. So it is likely that validators will accept a rescheduled Difficulty Bomb proposal to fork the chain and buy more time for the community to successfully Merge.

Multiple testnet and shadow fork merges have been deemed a success with Merge readiness almost seemingly complete. These practice merges reduce the execution risk of the Proof of Work chain (Mainnet) docking onto the Proof of Stake chain (The Beacon Chain). Issues such as integrating clients and facilitating effective block gossip and state synchronisation [are] imperative to how consensus is reached and transactions become finalised.

Hence, potential Merge dates align towards H2 2022.

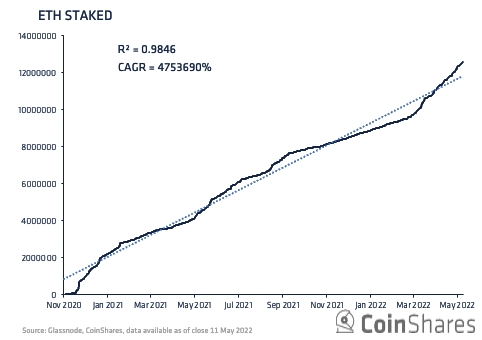

The amount of ETH Staked is critical to your yield

After the Beacon Chain’s Staking Deposit Contract [was] deployed on October 12th 2020[, the] first ETH staked was on November 3rd 2020. I took the trendline from the first date to [the] current with an r2(accuracy) of over 0.98 as the base case and chose an optimistic scenario (base case * 95%) and pessimistic scenario (base case * 110%). Less ETH staked likely means a higher yield because a validator’s own validator balance (stake) is a higher proportion of [the] overall network stake. Therefore, their revenue is a higher proportion of their overall network stake.

I think it’s highly likely that the amount of ETH staked will continue to increase which is proportionately bad for network and validator yields. This extrapolation works because these dates are not far in the future.

ETH staked is one of the models’ Variable Inputs to show the total ETH issuance on a daily and annual basis given the current state of the network (determined by the calculator user). It is important to note that this is imperfect due to the dynamic nature of [the] ETH 2 issuance rate.

The more ETH staked directly increases the Number of Validators Online and Per Shard because validators can only deposit in 32 ETH batches and there is likely a fixed limit of 64 shards. And, indirectly, more ETH staked likely means higher block subsidy from increased block proposals and attestation and, therefore, a higher network issuance rate.

However, more ETH staked decreases the Base Reward for Full Validators. Even though the total block subsidy increases to fund those validators, the return rate per validator decreases because they individually receive less rewards proportionately to the growing network as the number of validators increases.

Validator revenue is composed of Tip Fee and Block Subsidy.

Tip Fees are what is paid to the validator by the user to prioritize their transaction in the next block. Without tips, validators would find it economically viable to create empty blocks, as they would receive the same block reward. A fee market for transactions is created for users to outbid competing transactions. Users that need their transaction to get stuffed into a block, gossiped across the network according to the blockchain’s rules, and accepted by other nodes ahead of other transactions in the same block, are likely to pay a higher tip.

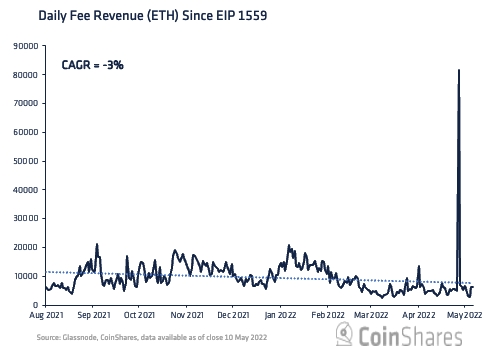

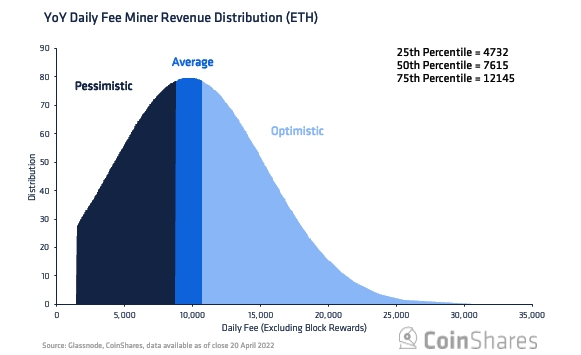

I took the daily total miner fee revenue distribution for optimistic (75th percentile), base (50th percentile), and pessimistic (25th percentile) scenarios and projected each scenario out to the three different Merge dates using the Compound Annual Growth Rate (CAGR) of -3% since Ethereum’s most recent monetary policy change, EIP-1559.

This method shows [how] much revenue a validator could receive depending on their network-weighted stake as a full peer.

Having calculated what the daily fee miner revenue distribution is, I extracted only the tip (removed base fee).

The average fee burn percentage is 85% since The London Hard Fork (EIP-1559) on December 1st 2020. Therefore, it is reasonable to assume in an optimistic case, less fees (80%) would be burned so miners would likely receive more revenue; and, in a pessimistic case, more fees (90%) would be burned and they would likely receive less revenue.

Annualized validator revenue = average daily fee revenue * (1 – fee burn percentage) * 365

The higher the annualized tip fee revenue and the lower the fee burn percentage, the higher the yield.

The other side of the equation

Block subsidy (newly minted supply) is issued by validators proposing blocks. This is a complicated calculation and involves a few components. Essentially, the block reward is the outcome of subtracting the total number of offline validator penalties – taking into account network uptime and validator uptime – from online validator rewards. If there are less validators online, there are less validators to reward because less blocks have been proposed and attested. Therefore, the total block subsidy per year decreases.

Uptime affects the amount [of] total network rewards

To sustain perfect market conditions with full validator and network uptime is very unlikely because of issues such as electricity outages. Slashing validators for being offline and punishing them for incorrect proposals and attestations incentivises them to act honestly and be online for as long as possible.

Post MainNet Shadow Fork 2 (a recent practice Merge), only around 95% of all validators were live and correct. Therefore, an optimistic case would be 100% and a pessimistic case would be 90%.

__

This article was first published on coinshares.com.

____

Learn more:

– Ethereum’s Ropsten Test is ‘Almost’ Bug-Free, Two More Testnets to Go Before the Merge

– Ethereum Beacon Chain Experienced a 7-block Reorg, More Work Needed Ahead of The Merge

– Ethereum Developers Move Merge Hopes to August

– Ethereum Needs to Pass These Three Tests Before Migrating to PoS

– The Compromises and Benefits of Ethereum Switching to a Proof-of-Stake Network

– Top Narratives About Ethereum and Its Merge with Its Proof-of-Stake Beacon Chain

– Major Bitcoin & Crypto Companies Warn of ‘Extreme’ Risk in Proof-of-Stake Systems

– Ethereum’s Merge Could Lower Demand for Bitcoin but Regulatory & Technical Challenges Persist