12 Crypto Coins That Pay Dividends in 2024

In the universe of cryptocurrencies, some assets stand out for their ability to generate passive income for holders. Dubbed ‘crypto dividends’, these rewards are similar to the dividends paid by stocks, providing a regular income stream for holders.

Crypto dividends are distributed through mechanisms such as staking, HODLing, or certain operational rewards provided by the blockchain platform. In this guide, we explore the top 12 crypto coins that pay dividends, reviewing what sets them apart from other cryptocurrencies in the market.

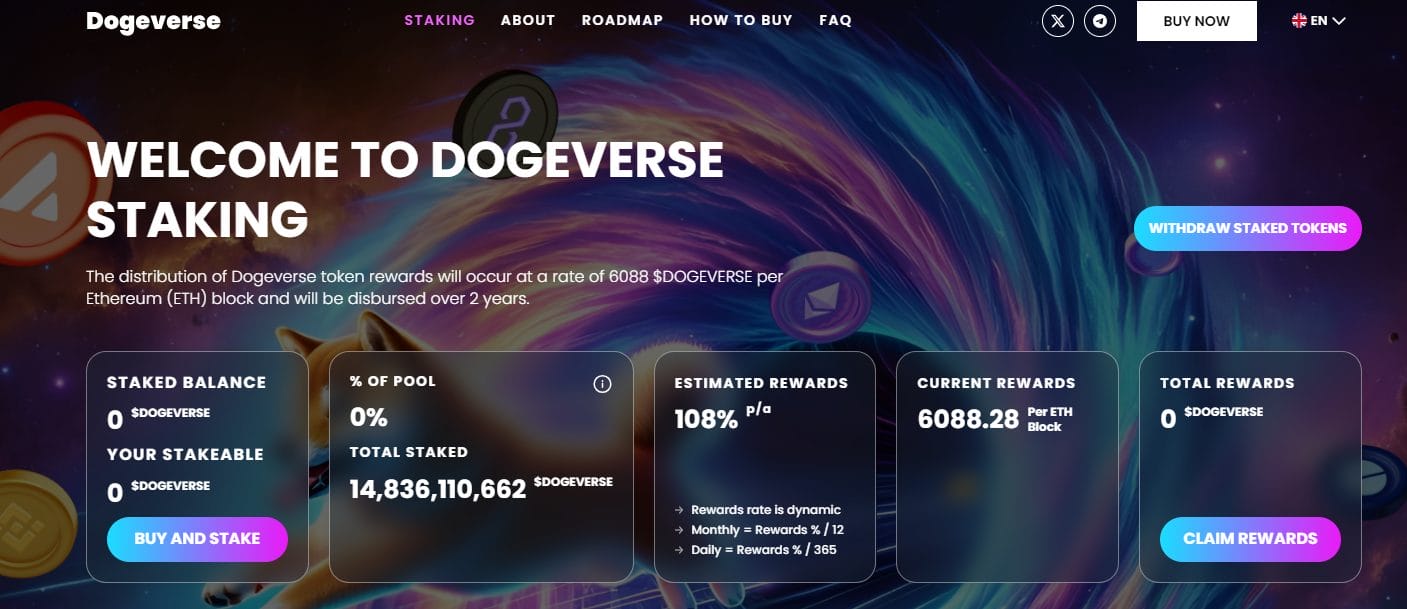

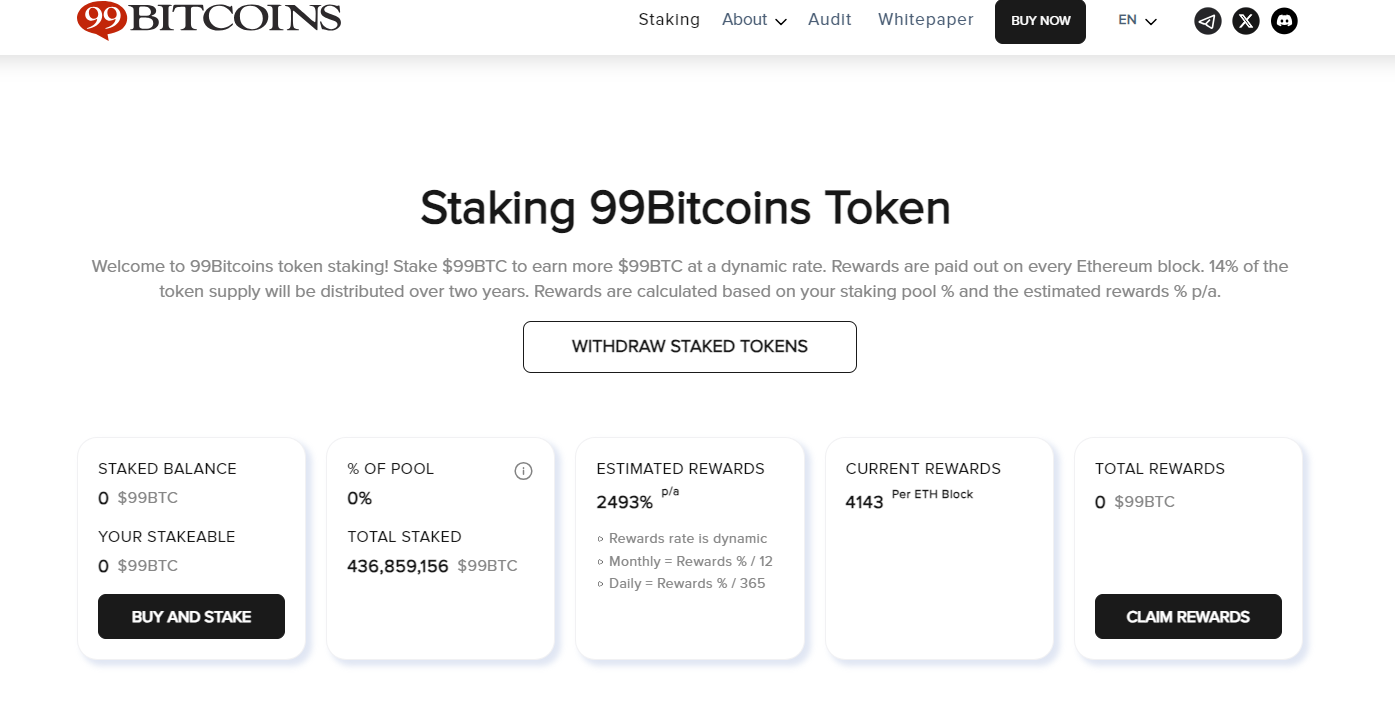

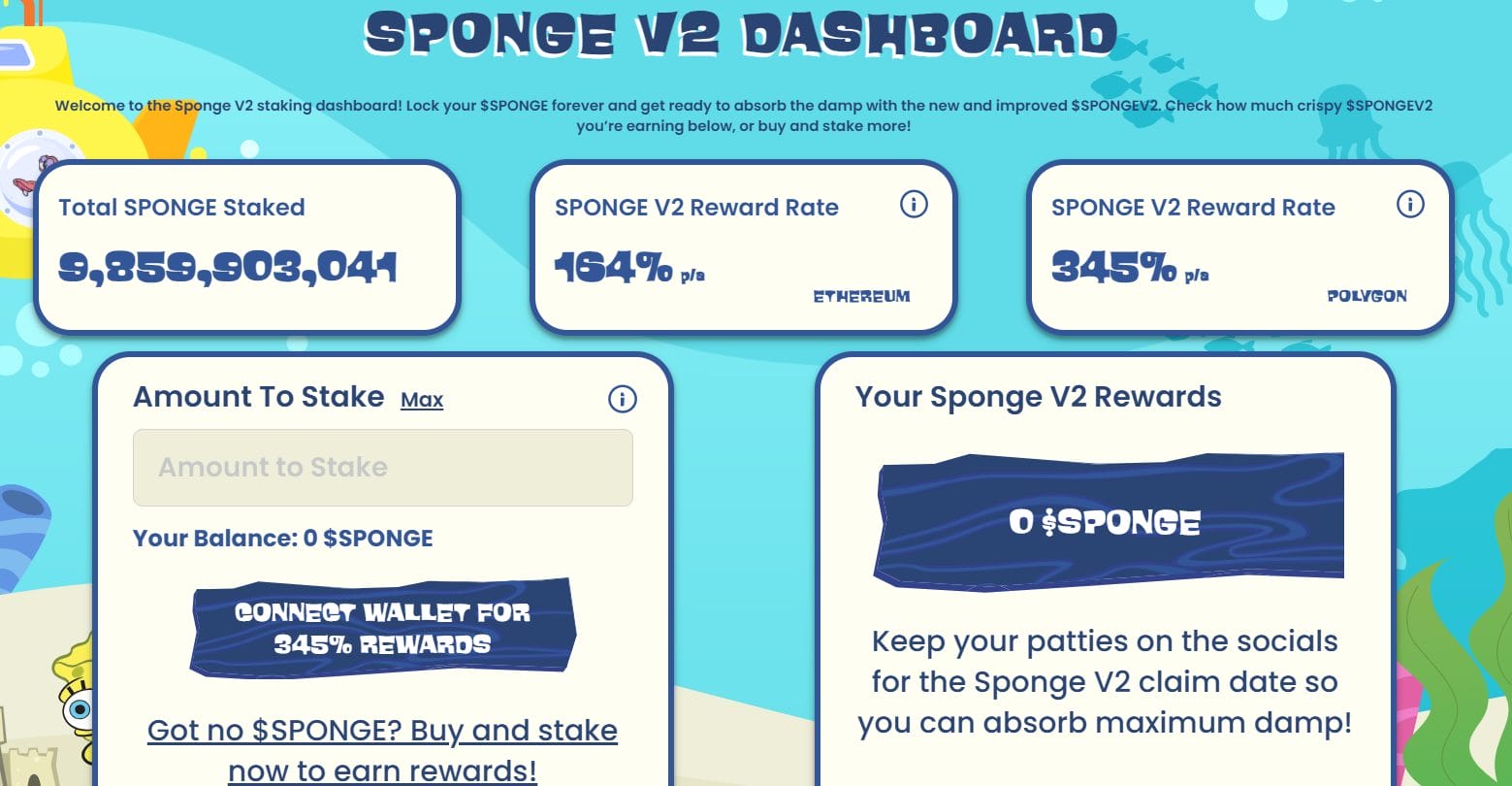

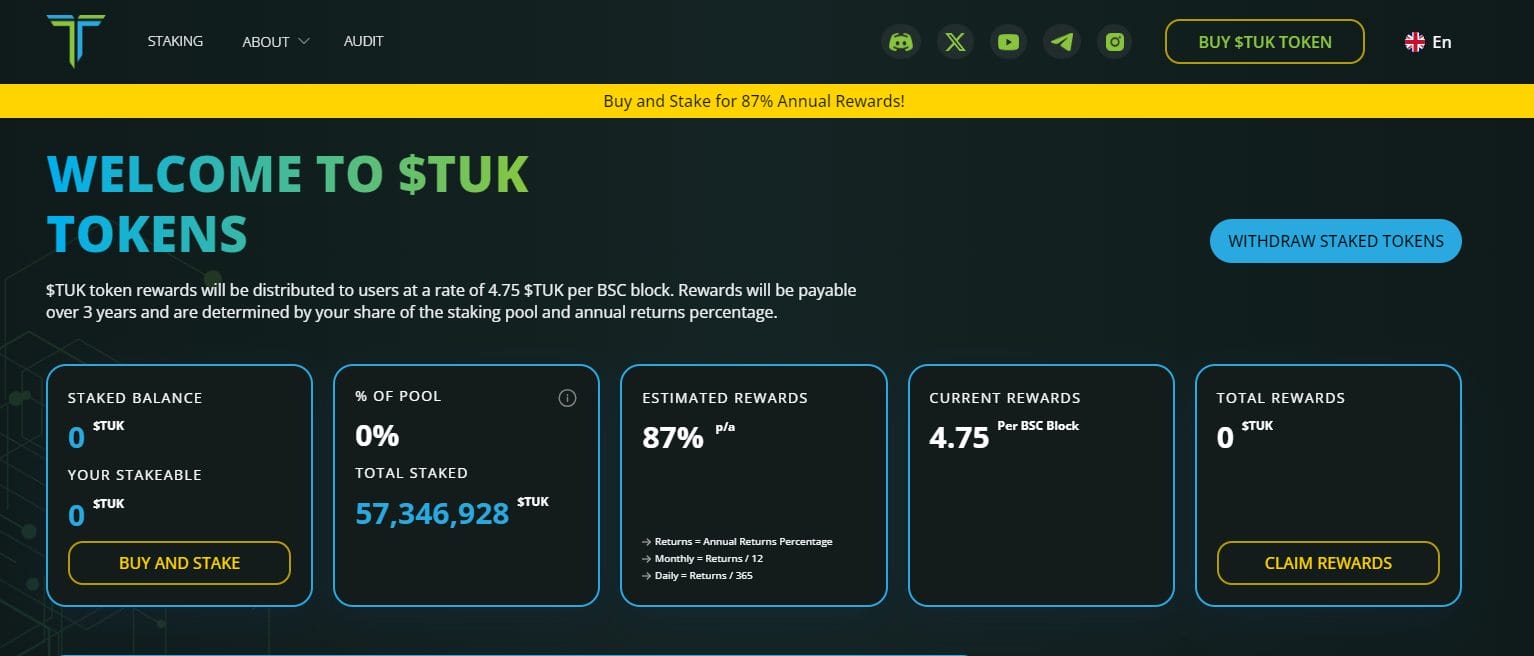

Whether through presale staking opportunities or established mechanisms like trading fee sharing and token generation, each of these coins has unique features that could make them valuable additions to a diversified investment portfolio. Let’s look at each crypto in more detail. Dogeverse is the best crypto coin on this list based on its unique approach to dividends by offering high-stakes APY. The meme coin is currently building its network of investors by adopting a dog theme, in hopes of gaining virality similar to Dogecoin and Shiba Inu. The token offers staking to investors so that they can benefit from significant annual percentage yields of over 108%. This is calculated based on how long they lock their holdings in the staking program. So the longer they commit to the project, the more they stand to gain in rewards. This can be an excellent way for investors to accumulate more tokens, enhancing the overall return on investment as the project grows, in addition to capturing staking rewards. Out of its total supply of 200,000,000,000 tokens, 14,836,110,662 have already been staked by holders looking to earn dividends. At the time of writing this, over $10 million has been raised in its presale. To learn more about Dogeverse, follow the project on both X and Telegram. 99Bitcoins is an educational platform venturing into the crypto space, its native $99BTC token rewards its early backers through a staking mechanism. The APY offered is 2493% as of writing, making it one of the highest dividends in the market. This is a promising incentive for those looking to support the project in its early stages while earning returns that are reflective of traditional dividend payments. Rewards are paid out on every Ethereum block. With roughly 14% of the total supply (99 billion) distributed over two years. In addition to dividends generated from staking, users are rewarded by expanding their knowledge base about the world of digital assets. There are over 70 hours of course material available, covering topics such as blockchain safety, exchange trading, and staking. At present, 436,859,156 tokens have been staked, with over 80 million 99BTC tokens rewarded thus far. Keep up to date with 99BTC on X and Telegram. SpongeV2 stands out as a next-generation meme coin with revolutionary features designed to captivate investors. Leveraging the success of $SPONGE, V2 aims to redefine the meme coin landscape, offering unique opportunities for community engagement and participation. With the use of its stake-to-bridge system currently offers staking rewards of nearly 165% APY, and hopes to replicate the success that saw its initial iteration climb from a $1 million to a $100 million market cap. In total, there are 150 billion SPONGEV2 tokens with 43.09% of them being distributed to staking. So far over $18 million has been staked and bridged for the earlier version of the token. Once the presale has been completed Sponge V2 will begin developing a play-to-earn game, and target a tier 1 centralized exchange (CEX) listing. Keep tabs on its progress on its X and Telegram channels. Smog is a fast-growing meme coin on the Solana blockchain offering dividends in the form of airdrops which are issued to holders of the token. After launching earlier this year its value already surged over by 4,000%. 35% of its 1.4 billion tokens will be given away as airdrops, with an additional 42% APY offered to stakers of $SMOG. The dragon-themed token is looking to replicate the success of recent meme coins on Solana like $WIF and $BONK. At present, 28,668,995 tokens have already been staked, with the cryptocurrency now available to buy on Jupiter, Raydium, and the Birdeye decentralized exchange (DEX). It is also using 50% of its total supply for its marketing efforts, in hopes of creating a loyal and engaging social media community. You can find a full list of the top decentralized exchanges in our guide. For more information on Smog check out its Telegram channel and X. eTukTuk is focused on transforming transportation in emerging markets and offers a dividend by allowing investors to stake their tokens during the presale period. The APY provided adds an additional layer of value, compensating stakeholders with a passive income while they support the project’s growth and expansion. At its core eTukTuk is building the charging infrastructure of tomorrow in developing nations, using the blockchain to decentralize the process. The project has raised over $3 million in its presale, and has done this by offering rewards of 87% APY to investors. Currently, 57,346,928 TUK tokens have been staked, with holders receiving rewards of 4.75 TUK per BSC block. Over 30 million in rewards have already been unlocked. For more information on the TUK token, follow its X and Telegram. Bitcoin Minetrix merges the worlds of Bitcoin mining and market trading. Early investors can participate in the presale to unlock the benefits of staking rewards that serve as dividends. Over $13 million has so far been raised in its presale, and as a crypto that pays dividends, holders can earn up to 53% APY. This system rewards users based on the duration and quantity of their stake, providing a dynamic return that aligns with the project’s success and user commitment. BTCMTX aims to tokenize cloud mining to give more everyday people access to mining Bitcoin. This is down through the stake-to-mine mechanism. At present, 782,271,907 BTCMTX tokens have been staked, with rewards distributed to stakers at a rate of 158.5 BTCMTX per ETH block. Stay tuned with the latest progress of the project by following its X and Telegarm. Another one of the best crypto dividends is KCS. KuCoin Shares is the native token and an integral part of the KuCoin exchange, offering holders a share of the exchange’s daily transaction fees as dividends. Holders of KCS receive these dividends, which are distributed from 50% of the total trading fees collected by the platform, making it a lucrative option for those interested in gaining exposure to exchange revenues. KCS operates a deflationary model and plans to burn 100 million of its initial 200 million total token supply. Presently, the token has a market cap of over $990 million and a daily trading volume of $1.8 million NEO, often described as the “Ethereum of China,” implements a unique dual-token model where holding NEO generates GAS, another cryptocurrency used to pay for transaction fees and services on the network. This system rewards NEO holders just for holding the token, as they continuously receive GAS that can be used or sold on the market. There is a total supply of 100 million NEO, at its peak each cost $196.85, however, the value is now down by as much as 90%. 5 GAS tokens are generated every block of transactions on the network, with 10% given to NEO holders. VeChain token (VET) holders benefit from receiving VTHO, which is used to manage and create smart contract transactions on the VeChain platform. These tokens are also used to pay for GAS fees on the network. VET holders automatically generate VTHO over time, serving as a dividend that incentivizes long-term holding and participation in the ecosystem. There are over 85 billion VET tokens that total a market cap of just over $3 billion. Its daily trading volume sits just above $66 million. AscendEX, formerly BitMax, allows token holders to participate in staking programs that offer significant APYs. This CEX platform shares part of its operational profits with token holders, providing a direct benefit from the exchange’s success. The staking rewards act as dividends, enhancing the value held by its users. The platform was hacked in 2023, which raised security concerns and greatly impacted the token price. Additionally, AscendEX offers various investment products and services, such as margin trading and futures contracts, creating additional opportunities for users to grow their holdings. Komodo offers a blockchain platform where users can not only transact but also create their own blockchains. By staking KMD, holders can receive regular rewards, effectively earning a dividend. The Komodo network uses these incentives to ensure that the network remains secure and that holders are engaged. Moreover, Komodo’s technology, such as delayed Proof of Work (dPoW), provides enhanced security and protection against 51% attacks, further strengthening the value proposition for KMD holders. The KMD market capitalization sits at $63.1 million, with a daily trading volume of $4 million. LooksRare is an NFT marketplace that rewards its token holders with a share of the platform’s trading fees. By staking LOOKS tokens, holders can earn a portion of the fees generated from NFT sales, which acts as a continuous dividend stream. This incentivizes users to hold and stake the token while actively participating in the NFT economy. Furthermore, LooksRare’s user-friendly interface and comprehensive NFT curation tools make it an attractive platform for both creators and collectors, driving higher trading volumes and thus, higher dividends for token holders. LOOKS has a $117 million market cap at present, with daily trading volumes of $6 million. Over 8,000 prizes have been within games listed on the platform. Each plays a crucial role in evaluating the attractiveness and potential of dividend-paying cryptocurrencies. Let’s take a closer look at each one of these. To assess the dividend yield, we analyze the percentage return on investment generated by dividends relative to the token’s price. Coins with higher dividend yields offer greater potential for passive income, making them more attractive to investors seeking regular returns on their investments. These tokens were higher on our list, with the likes of DOGEVERSE offering yields of over 106% p/a. Reliability of payouts is essential for investors looking for consistent income streams. We evaluate the track record of each cryptocurrency in distributing dividends and assess factors such as payout frequency, consistency, and transparency to determine the reliability of dividend payments. One of the most transparent reward structures is $DOGEVERSE, which rewards 6088 tokens per Ethereum (ETH) block and is issued consistently over 2 years. Price stability is crucial for dividend-paying cryptocurrencies as it affects the overall return on investment and investor confidence. We consider factors such as historical price volatility, market liquidity, and external influences to gauge the stability of each token’s price. Long-term project viability is essential for sustainable dividend payments and overall project success. We assess factors such as the project’s roadmap, development team, community engagement, and adoption to evaluate the long-term prospects of dividend-paying cryptocurrencies. These dividends can take various forms, such as staking rewards, token burns, or direct distributions of additional tokens. Bitcoin does not pay traditional dividends like stocks. However, Bitcoin holders can earn rewards through a process called “Bitcoin mining,” where miners validate transactions on the Bitcoin network and are rewarded with newly minted bitcoins. While this is not considered a dividend in the traditional sense, it serves as a form of incentive for network participants. Recently, rewards have been reduced, which comes through a process called “Halving”, which occurs roughly every 4 years. However, tax laws regarding cryptocurrency can be complex and may require consultation with a tax professional to ensure compliance. Overall, it looks like Dogeverse is the best crypto dividends coin currently in the market. Having raised over $10 million USDT in its presale, plus 108% in APY given to holders, this could be a good way to earn passive income.

Yes, some cryptocurrencies pay dividends to their holders in the form of staking rewards, token burns, or direct distributions of additional tokens. Several cryptocurrencies pay dividends, including popular options like Dogeverse, 99Bitcoins Token, and Sponge V2. Crypto ETFs (Exchange-Traded Funds) may pay dividends if the underlying assets in the ETF generate income, but this varies depending on the structure of the ETF and the assets it holds. The highest-paying crypto dividends can vary over time and depend on factors such as staking rewards, tokenomics, and market conditions. Presently, Dogeverse is one of the highest-paying cryptos in 2024. Bitcoin does not pay traditional dividends like stocks. Instead, participants in the Bitcoin network can earn rewards through the process of mining.

List of Crypto Coins That Pay Dividends

After researching the best crypto dividends we have listed the most prominent ones below. They include a mixture of emerging projects and established cryptocurrencies that reward users with dividends or high APYs.

Reviewed: Best Crypto Coins That Pay Dividends

The cryptocurrencies listed here not only offer the potential for future price appreciation but also the added benefit of earning dividends.1. Dogeverse (DOGEVERSE) – Best Crypto Coin For High Dividends With $10 Million Raised via Presale

2. 99Bitcoins Token ($99BTC) – Educational Platform Rewarding Holders With 2,493% APY For Staking

3. Sponge V2 (SPONGE) – New Version of Viral Token That Soared 100X in 2023, Offering a 164% p/a Reward Rate

4. Smog (SMOG) – Solana Meme Coin Offering a Huge Airdrop Plus 42% APY via Staking

5. eTukTuk (TUK) – Innovative Transportation Focused Token Issuing Frequent Rewards

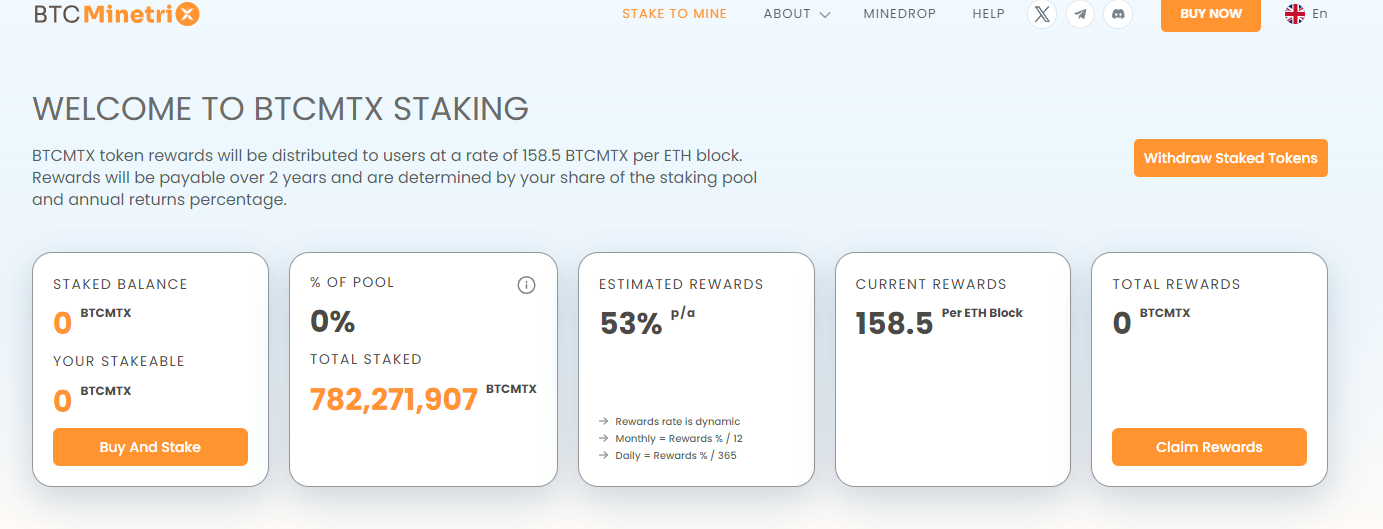

6. Bitcoin Minetrix (BTCMTX) – Dynamic Crypto With Stake-to-Mine Mechanisms Offering 53% APY

7. Kucoin (KCS) – Rewarding Exchange Coin Paying Dividends Through Fees

8. NEO (NEO) – Dual-Token System with Regular GAS Dividends

9. VeChain – Blockchain Platform for Supply Chain with VTHO Rewards

10. AscendEX – Crypto Exchange Offering Attractive Staking Rewards

11. Komodo – Blockchain Platform with Active User Rewards

12. LooksRare (LOOKS) – Exciting NFT Marketplace with Dividends From Fees

How We Ranked the Best Dividend-Paying Crypto Coins

Investors seeking cryptos with dividends need to consider various factors to determine the best options for their investment strategy. Our ranking methodology focuses on four key criteria: dividend yield, reliability of payouts, price stability, and long-term project viability.Highest Dividend Yield – 40%

Most Reliable Payouts – 25%

Price Stability – 20%

Long-Term Project Viability – 15%

What are Crypto Dividends?

Cryptocurrency dividends are a form of passive income earned by holders of certain cryptocurrencies. Unlike traditional dividends, which are typically paid out of a company’s earnings, crypto dividends are distributed by blockchain networks to token holders as a reward for participating in the network’s ecosystem.Does Bitcoin Pay Dividends?

How are Crypto Dividends Taxed?

The taxation of crypto dividends varies depending on the jurisdiction and the specific nature of the dividends. In many countries, crypto dividends are treated similarly to capital gains or other forms of investment income and are subject to taxation at the applicable capital gains tax rate. Recently, U.S. President Joe Biden proposed new changes to capital gains tax for high-net-worth investors. Could this have an impact on crypto dividends in 2024?Conclusion

So, does crypto pay dividends? We have seen that crypto dividends offer an opportunity for investors to earn passive income from their cryptocurrency holdings. Whether through staking rewards, token burns, or other mechanisms, dividends can provide additional incentives for investors to participate in blockchain networks.FAQs

Does crypto pay dividends?

Which crypto pays dividends?

Do crypto ETFs pay dividends?

What are the highest-paying crypto dividends?

What are Bitcoin dividends?

References

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Eric Huffman

Eric Huffman