How to Accept Crypto Payments as a Business in 2024

Estimates vary on the number of businesses that accept Bitcoin or other cryptocurrencies for payments, but the number of crypto users keeps growing steadily. There are more than 575 million ID-verified crypto users worldwide, all of which shop and pay for services. Setting up crypto payments for your business to serve these crypto-savvy shoppers might be easier than you expect. In this guide, we’ll learn how to accept crypto payments as a business to reach more customers.

Accepting Bitcoin payments or other crypto payments can open new opportunities and build loyalty, but you may also see cost savings compared to credit card processing. Accepting crypto payments for business transactions also comes with some caveats, such as price volatility and accounting complexity, depending on which type of payment provider you choose.

Let’s explore the big picture, learning how to accept cryptocurrency payments, as well as the considerations to weigh before you get started.

Why Should Your Business Accept Crypto as Payment?

Accepting crypto payments for business transactions comes with several benefits. You’re reaching out to a new audience, one that tends to be a high-income consumer.

Crypto owners are also a growing segment of the population. According to Statista, nearly 600 million people worldwide now own cryptocurrencies. Statista’s data focuses on ID-verified users, meaning the number of crypto owners is likely much higher — and is expected to continue growing. According to Grand View Research, crypto payment app transactions are expected to grow at more than 16% compound annual growth rate (CAGR) through 2030.

Crypto consumers represent an expanding market and typically earn a high income. Finding a way to service this growing segment could make good business sense. Let’s look at some of the benefits of accepting crypto payments.

- Increase Average Order Value (AOV): According to ForumPay, a crypto payment provider, crypto consumers spend double the AOV compared to credit card consumers.

- Access a New Customer Base: A survey published by PYMNTS indicates that over a quarter of high-income consumers would switch to crypto-friendly retailers and service providers.

- Lower Transaction Fees: Credit card processing fees typically cost 1.5% up to 3.5% of the sale. By comparison, some crypto payment providers charge 1% to 1.5%. Using a non-custodial wallet can reduce costs further, and a “world bridge currency” like XRP could dramatically reduce costs in the future.

- Reduced Chargebacks: While your business may still need to make an occasional refund, crypto payments can’t be charged back to the business. The exception would be crypto-funded debit or credit cards, which follow the same guidelines as standard card payments.

- Competitive Advantage: Accepting crypto payments can give your business an edge. Crypto consumers seek out businesses that accept crypto and often purchase more per transaction, bolstering your bottom line.

How to Accept Crypto Payments as a Business in 5 Steps

Let’s look at how to accept cryptocurrency payments. The steps vary depending on how you decide to integrate crypto payments into your business. For example, some providers can instantly convert crypto to your local currency, eliminating the need for a crypto wallet. In other cases, you may want to keep some cryptocurrency rather than immediately convert to cash. In this case, you’ll need a crypto wallet to store your cryptocurrency payments.

1) Set up a Crypto Wallet

Consider which cryptocurrencies you want to accept and choose a compatible wallet. For example, if you plan on accepting Bitcoin payments, you’ll need a crypto wallet compatible with Bitcoin. Some crypto wallets, like Trust Wallet or Ledger hardware wallets, support multiple blockchains. Others support just one type of crypto or focus on select blockchains. For example, Electrum is a Bitcoin-only wallet, whereas Best Wallet supports Ethereum-compatible chains.

If you use a crypto payments provider that automatically converts crypto payments to cash, you won’t need a crypto wallet for transactions. However, transaction costs can be higher due to conversion costs.

2) Choose a Payments Provider

Crypto payments can take two routes. You can choose a custodial solution, where a payment provider does the heavy lifting, or non-custodial, which is more akin to DIY. In the latter case, you manage your own crypto wallet, including security for the wallet and conversions to fiat as needed.

Custodial Crypto Payments

With a custodial provider, the payment provider receives the payment and then sends the payment to your custodial crypto account (if you elect to settle in crypto) or your bank account (if you choose to convert to fiat currency). Downsides include higher fees in some cases, as well as any risks associated with the provider itself. Exchanges like Coinbase invest heavily in security but are also tempting targets for hacks.

Custodial payment providers typically require identity verification to comply with Know Your Customer (KYC) regulations.

Non-Custodial Crypto Payments

With non-custodial payments, you’ll be accepting crypto payments directly from customers to the crypto wallet you’ve set up for the business. When it’s time to convert to dollars or your local currency, you’ll have to make the swap yourself. The upside is that this method is censorship-resistant. A payment provider can’t shut down your account, and you don’t need to agree to a service provider’s terms of service.

Top Crypto Payment Providers

| Provider | Supported Cryptocurrencies | Fees | Standout Features |

| BTCPay | BTC | 0% fees | No KYC, Lightning Network support, retail point of sale integration |

| BitPay | 100+ cryptocurrencies | 1% | Lightning Network support, instant conversions to fiat or other cryptocurrencies |

| Speed | BTC only | 1% of transactions after reaching a 0.5 BTC threshold | No KYC required |

| Coinbase Commerce | 10+ cryptocurrencies, including BTC and ETH | 1% of transaction | Convert to fiat option, WooCommerce, and Shopify support |

| DePay | ETH, BSC, SOL, USDC, and more | 1.5% of transaction value | Multi-chain support (no BTC support) |

| Blockonomics | BTC, BCH | 1% of transaction value | No KYC |

In the table above, the non-KYC options (BTCPay, Speed, and Blockonomics) send your payments directly to a crypto wallet you control. You’ll also want to consider the provider’s reliability. For example, several popular WooCommerce crypto plugins are no longer supported. Unsupported plugins could contain security flaws or bugs that may not ever be addressed.

3) Integrate Crypto Payments on Your Store

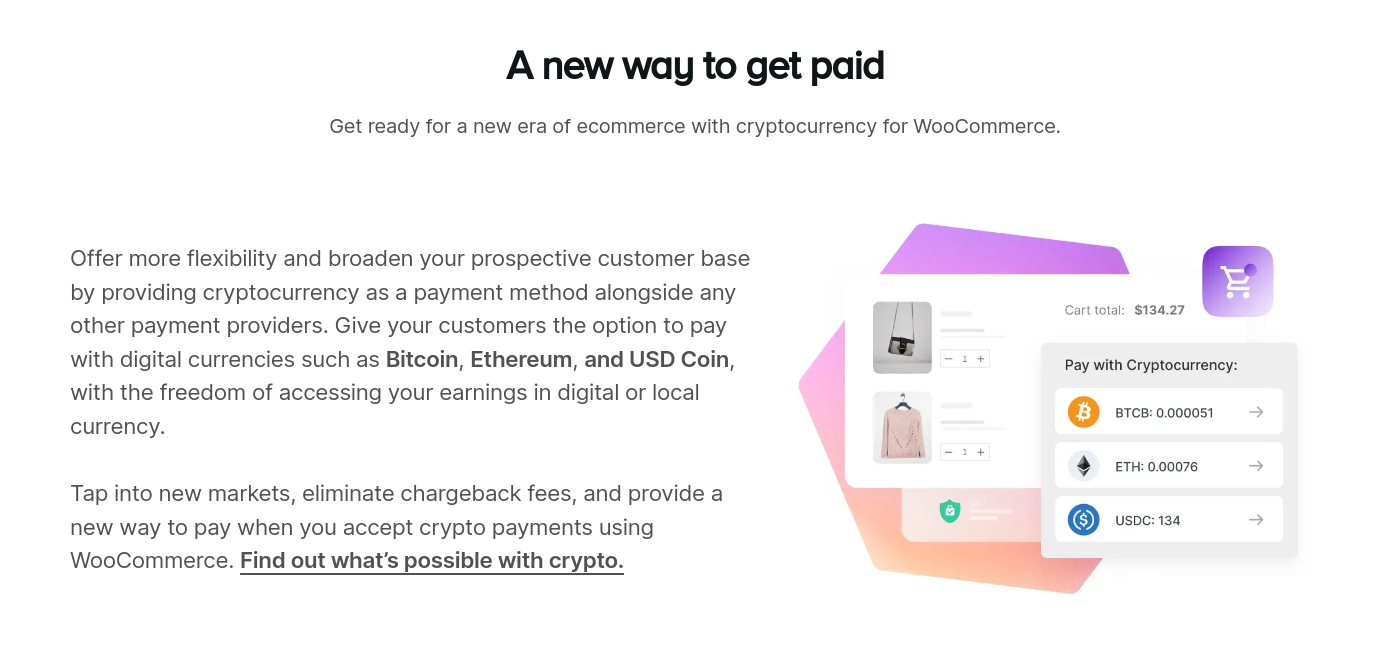

If you are accepting crypto payments on a website, a full-featured WordPress plugin like WooCommerce can help get integrate crypto as a payment option for customers. Shopify also offers ways to integrate crypto payments.

WooCommerce supports leading crypto payment providers, including Coinbase, Helio, and DePay. Coinbase supports crypto payments or direct conversions to fiat currencies. Helio and DePay support crypto payments to a crypto wallet, although DePay can convert payments to the token of your choice.

4) Integration with Accounting Software

Accounting is perhaps the most challenging aspect of accepting crypto payments for business transactions. If you’re using a custodial provider that converts crypto payments to your local currency, you’ll have an easier time with your accounting software.

However, if you accept crypto payments directly to a crypto wallet, you may need to take some additional steps for each transaction. For example, if a customer pays with BTC, the IRS needs to know the value of the transaction in US dollars rather than BTC.

Non-custodial payment solutions also lead to some additional calculations as the crypto asset’s price changes. The IRS views cryptocurrencies as property, so the accounting requires converting to the cryptocurrency’s USD value. For example, if you accept $100 worth of BTC without converting it to USD, you would need to log the transaction using its USD value.

When you convert to USD later (or spend the BTC), you also need to report the capital gain or loss based on the value of BTC at that time versus your cost basis (the value at the time you received it).

5) Converting Crypto to Cash

If you choose a custodial crypto payments provider, the provider may be able to settle in USD or your local currency. In other cases, you can either HODL or convert to cash. Many small businesses will need to convert to cash to maintain a healthy level of operating capital.

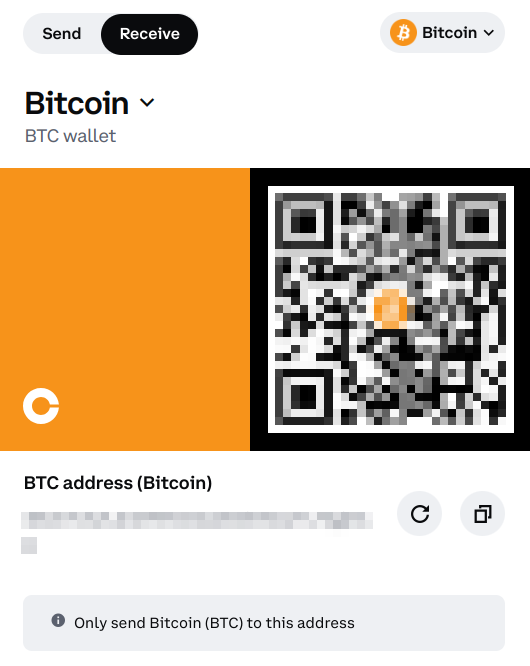

When you need to convert to traditional currencies, you’ll need to use a crypto exchange. A crypto exchange like Coinbase lets you sell your crypto for cash. To get started, open an account for your business and complete the KYC requirements. Then, use your crypto wallet to send the crypto to the exchange. Follow the exchange’s deposit instructions carefully. Sending crypto over the incorrect network or to an incorrect wallet address could result in a loss of funds.

Once the deposit has been credited to your exchange account, you can sell the crypto for USD and withdraw the funds to your bank account.

How Do Crypto Payment Transactions Work?

If you’re using a custodial payment provider that converts crypto to USD, crypto payment transactions work much like a merchant account for credit and debit card transactions. When the customer pays, the payment provider receives the payment and then settles the balance with the merchant, less fees. This likely happens in bulk, although currency conversions may happen in real time to avoid price volatility.

The transaction on the customer’s end involves either a webhook that allows the merchant website to connect to the buyer’s crypto wallet. The customer then approves or rejects the transaction using their wallet. Alternatively, retail point of sale (POS) transactions typically involve a QR code the customer can scan with their mobile device. Again, the customer uses their crypto wallet to approve or reject the transaction.

If you’re accepting cryptocurrency using a non-custodial payment provider, such as BTCPay, the funds from the transaction go directly to a crypto wallet you choose during setup. Instead of cash, you’ll have BTC in this example.

If you need to convert the BTC to cash, you’ll need to send the BTC to a crypto exchange like Coinbase to sell BTC for your local currency. The image above shows the dialog for sending BTC to Coinbase. A mobile Bitcoin wallet like Electrum can scan the QR code, or you can copy and paste the receiving wallet address.

What is The Cost of Accepting Crypto Payments?

Accepting cryptocurrencies can come with several types of costs. These range from payment provider fees to conversion fees to spread fees but vary based on the setup you choose.

- Payment provider fees: Most custodial payment providers charge 1% to 1.5% of the transaction amount.

- Network fees: If you use a non-custodial provider, you’ll need to send your cryptocurrency to an exchange to convert it to cash. Sending crypto requires a network fee that can range from under a penny to several dollars, depending on the type of crypto and network demand. Kraken supports Bitcoin Lightning Network payments, which reduces network fees dramatically when you need to transfer BTC.

- Conversion fees: If you need to convert your crypto to cash, you’ll need to sell it through an exchange. Fees to sell your crypto range from well under one percent on advanced trading platforms to as much as 10% for smaller transactions using a simple trade.

- Spread fees: Simple trades typically use a markup called a spread that locks in an exchange rate. Spread fees can add an additional 1% but can be avoided by using an advanced trading platform like Coinbase Advanced or Kraken Pro.

- Withdrawal fees: Bank withdrawals are usually free, but some other withdrawal methods may charge an additional fee.

- Price volatility costs: If the price of the cryptocurrency falls before you can convert it to cash, this represents another potential cost. However, it’s also possible to see a gain from volatility.

Which Cryptocurrencies Can You Accept?

If you’re considering accepting crypto, learning how to accept Bitcoin payments is a logical first step. Bitcoin is the most common cryptocurrency used as a payment method. However, you can also accept several other types of crypto depending on which payment provider you choose.

Below, we list the most common options.

- Bitcoin (BTC)

- Ether (ETH)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Bitcoin Cash (BCH)

- DAI (DAI)

- USD Coin (USDC)

- Tether USD (USDT)

- Shiba Inu (SHIB)

Coinbase Commerce supports all the cryptocurrencies listed above. Stablecoins like USDC and DAI hold their value at $1.00, making them a safer crypto option if you want to avoid price volatility risks.

Transaction fees can also play a role in which cryptocurrencies you choose. Sending crypto to another wallet address on Bitcoin and Ethereum Mainnet can be costly, whereas Dogecoin and Litecoin bring lower transaction fees in comparison.

Regulation for Crypto Payments for Businesses

As crypto transactions are legal in most countries, regulation largely centers around tax responsibilities. In the US, the IRS treats cryptocurrencies as property. Gains and losses attributable to crypto transactions must be reported on Schedule D (Capital Gains and Losses) and, in some cases, Form 8949 (Sales and Other Dispositions of Capital Assets).

However, as a business, you may also need to complete KYC verification with the exchange or payment provider you choose. This process is similar to the ID verification process required for bank accounts or merchant accounts. In all cases, the additional verification steps allow providers to comply with anti-money laundering (AML) regulations. AML/CFT (Combatting Financing of Terrorism) rules largely focus on financial institutions rather than retailers but require retailers to confirm their identity with financial service providers.

It’s also important to monitor broader regulation for the crypto industry itself. For example, Bitcoin is not a regulated security due to its decentralized nature and fair launch. However, the US Securities and Exchange Commission (SEC) has scrutinized other cryptocurrencies, including XRP, which the SEC took to court in a still-ongoing lawsuit. The case caused several leading exchanges to stop offering trading for XRP, impacting the price of the token and making it difficult for holders to convert XRP to cash.

Lastly, state enforcement may differ from federal laws regarding crypto assets. For example, the New Jersey Bureau of Securities issued a cease-and-desist order against Coinbase regarding its staking service for Ethereum and other assets. Although there is no current federal prohibition, this eliminates the opportunity for additional crypto passive income for NJ Coinbase customers. Research your local crypto laws in addition to federal regulations.

Cryptocurrency vs Credit Card Payments

Let’s look at how cryptocurrency payments compare to credit card payments. It’s likely you’ll need both in your business, but accepting crypto payments for business transactions does provide some benefits. In other areas, particularly price volatility, credit cards provide a better payment option. However, there may be ways to mitigate the risk with instant conversions to cash.

Crypto Payments vs Credit Card Payments Compared

| Compare | Cryptocurrency | Credit Cards |

| Transaction Fees | 0% to 1.5% | 2% to 3.5% |

| Account Approval | Custodial providers require account approval; non-custodial accounts do not require approval | Account approval is required, and a minimum credit score applies |

| Price Risk | Crypto prices can move up or down before converting to cash; Custodial providers can make automatic cash conversions | None |

| Retail Integration | Limited selection of providers, largely focused on web integration | Vast number of choices for both brick-and-mortar and online businesses |

| Chargeback Policy | No chargeback risk; retailers issue refunds at their own discretion | Chargebacks are allowed within a minimum of 60 days by US law |

| Account Security | Non-custodial: merchants provide their own security; custodial providers may provide additional security | Security of funds provided by the merchant account provider until settlement |

| Cash Flow | Custodial accounts provide instant payments; non-custodial providers usually settle the following business day | Settlement typically occurs within 3-5 days |

| Customer Support | Limited or web-only in some cases | Extensive support, often including an account representative |

Challenges With Accepting Crypto Payments as a Business

While accepting crypto payments brings several advantages, including a wider reach and higher average order value, accepting Bitcoin payments and other crypto transactions also brings some challenges. Volatility tops the list, but there are ways to mitigate risks.

Uncertainty with Price Volatility

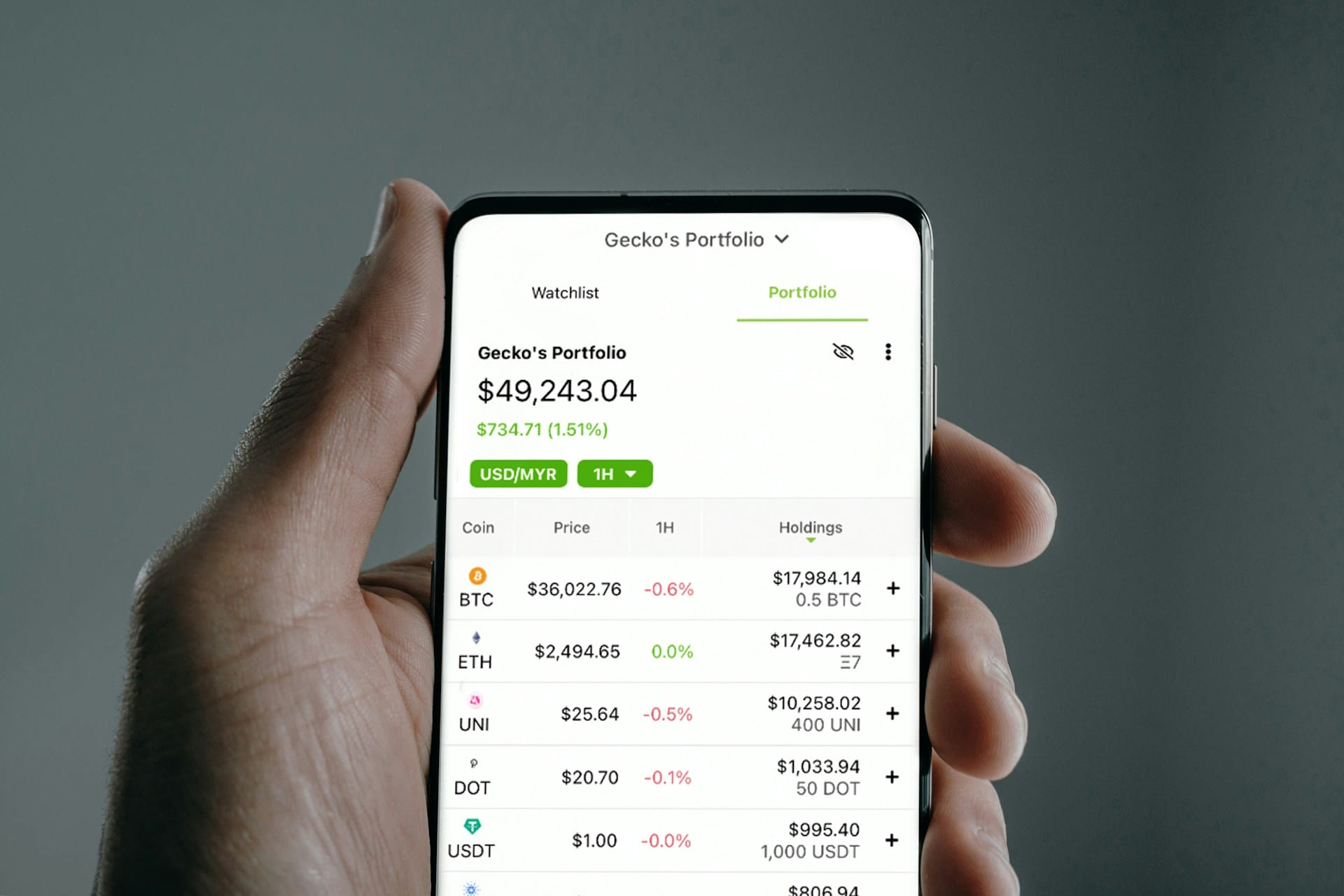

Crypto prices are notoriously volatile. Prices can move significantly in the course of a week, a day, or even minutes. In the chart shown below, the price of Bitcoin fell by nearly $1,000 in a 24-hour period. At some points, the price difference was even greater. In perspective, Bitcoin is one of the more stable cryptocurrencies due to its larger market capitalization.

However, viewed from an optimistic perspective, the price of Bitcoin or whichever cryptocurrency your business accepts could also increase.

The ups and downs of the market can affect profits and cash flow, but using a custodial crypto payments provider can help mitigate price risk. Depending on the provider, you can convert to cash immediately, convert to a more stable cryptocurrency, or convert to a stablecoin pegged to the US dollar.

Security Risks

Credit card merchant accounts come with security risks both at the merchant and provider levels, but accepting crypto payments brings some additional security concerns. Many methods for accepting crypto payments center on WooCommerce extensions or Shopify apps. Often, these apps are created by third-party developers and may even be abandonware (although still installable). Research your choices carefully and, if possible, research the developers behind the project.

Non-custodial crypto payments also come with crypto wallet security considerations. You’ll need to learn how to create a wallet securely and devise a strategy to protect your wallet’s recovery phrase. You may also need to provide access to someone else when you’re unavailable, adding another potential security risk.

Technical Complexity

Competition amongst crypto payment providers has made setup easier. However, the setup process is still better suited to someone who understands computers (and crypto) or has access to a trustworthy helper.

Converting your crypto to cash also adds some complexity. Advanced trading platforms offer the least expensive way to convert crypto to cash but also come with a learning curve. Many leading crypto exchanges offer advanced trading tools that can reduce conversion costs considerably.

Conclusion

Learning how to accept crypto payments first requires a fair amount of research. You’ll want to consider which cryptocurrencies you want to accept and how accepting crypto payments fits into your business workflow. Many solutions center on websites, which narrows the selection for brick-and-mortar businesses. However, today’s market offers more proven crypto payment options than ever before. With a bit of research, most businesses can find a crypto payments solution that works for them.

FAQs

How can merchants accept crypto?

A number of services, including BitPay and Coinbase Commerce, offer plug-in solutions for businesses that want to accept payments in cryptocurrency.

Is it worth accepting crypto payments for my business?

Accepting crypto payments for business transactions can open more opportunities and is often more cost-effective than credit card payments. However, you’ll also want to consider solutions to address price volatility, security concerns, and accounting integration. If you can overcome these challenges, then accepting crypto payments can be a net positive for your business.

Is it legal to accept crypto as a business?

Cryptocurrencies are legal in most jurisdictions, so accepting crypto as a business is allowed. Research the tax implications of accepting crypto payments as well as ways to account for the income in your P&L reporting properly.

How do retailers accept Bitcoin?

Retailers that accept crypto typically partner with a custodial payment provider like BitPay or Coinbase Commerce. Non-custodial options like BTCPay offer another alternative but don’t offer the same level of convenience in automatically converting crypto to traditional fiat currencies.

How many businesses accept crypto?

By some estimates, as many as 15,000 businesses worldwide accept cryptocurrencies. However, it’s likely that this estimate is quite low. Businesses can accept digital payments without using a payment provider, which makes tracking the number of businesses more difficult.

References

- Number of identity-verified cryptoasset users from 2016 to November 2023 (statista.com)

- Cryptocurrency Payment Apps Market Size, Share & Trend Analysis Report (grandviewresearch.com)

- Notice 2014-21 (irs.gov)

- Capital Gains and Losses (irs.gov)

- Sales and Other Dispositions of Capital Assets (irs.gov)

- Anti-Money Laundering (AML) (finra.org)

- Explainer: What makes a crypto asset a security in the US? (reuters.com)

- SEC Charges Ripple and Two Executives with Conducting $1.3 Billion Unregistered Securities Offering (sec.gov)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell