USDC vs USDT: Which Stablecoin is Safer in 2024?

Any recent crypto market cap top-ten list includes both USD Tether (USDT) and USD Coin (USDC). These two giants lead the debate over stablecoins, specifically which one is safer. In this guide, we’ll do a deep dive into USDC vs USDT to find out what makes these tokens tick. More importantly, we’ll discuss how each is backed and how stable that backing is under scrutiny.

With over $135 billion in combined value and their deep connection to leverage and crypto money markets, these two tokens are key to the health of the crypto market. Both promise a safe way to store value without volatility. Let’s dig into the history and backing of each to find out which one could be safer to hold.

Summary: USDC vs USDT

Both USDC and USDT are fiat-backed stablecoins, meaning both token providers reportedly hold equivalent reserves in cash or cash equivalents, such as treasuries. We’ll explore backing in more detail later. USDT is issued by the company Tether, incorporated in the British Virgin Islands, while USDC is created by Circle, which is based in Boston, Massachusetts.

Differences between the two leading stablecoin options center on market capitalization and proliferation. Thus far, USDT wins on both counts.

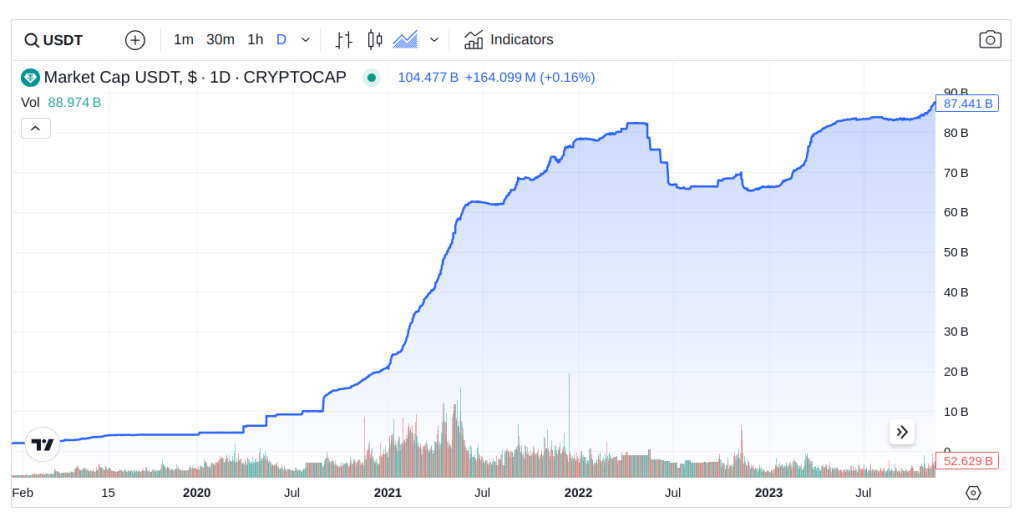

Currently. USDT’s market capitalization of $104 billion is more than triple USDC’s $32 billion market capitalization. Part of the delta can be attributed to the network effect. USDT launched in 2014, whereas USDC launched in 2018, long after USDT became a popular asset for trading pairs on crypto exchanges. The exchange role in USDT’s dominance is evident in daily trading volume in which USDT trading volume is 7.5 times as high as USDC trading volume.

Availability also plays an important role when comparing USDT vs USDC. While both stablecoins support a similar number of blockchains, ranging from 12 (USDT) to 15 (USDC), with support for Ethereum Layer 2 networks as well, they differ in support for specific blockchains. For example, Tether still supports USDT on the Tron network, which has the second-largest total value locked (TVL) behind Ethereum. However, Circle has announced it will discontinue support for USDC on Tron.

What are Stablecoins in Crypto?

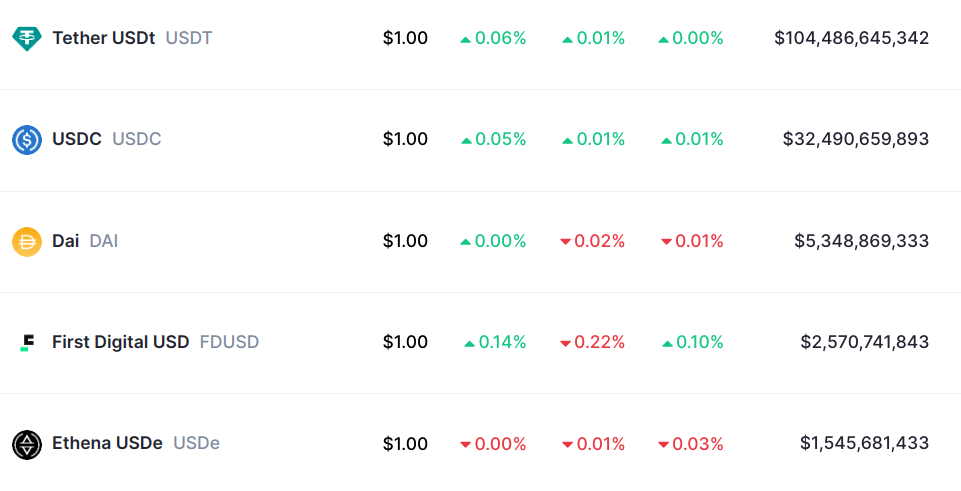

A stablecoin is a token designed to track the value of other assets, thereby providing a stable value relative to the asset. The most common stablecoins are pegged to the value of a fiat currency, such as the US dollar, EUR, or GBP. Currently, five stablecoins boast a market value of more than $1 billion, with each token holding a value of $1.

Slight fluctuations are common, but the relative stability of stablecoins compared to other cryptocurrencies makes them a popular choice for crypto payments or to hold between investments. Top choices for stablecoins include USDT and USDC, but also options like DAI, FDUSD, and USDe.

The largest of these, USDT and USDC, are asset-backed stablecoins, meaning that each token valued at $1 is backed by a $1 reserve held in cash or equivalents. DAI, the third-largest stablecoin by market cap, differs in that each DAI is backed by a basket of crypto assets, including ETH, stETH, WBTC, USDC, and other approved collateral. DAI is created through a loan and loan repayment process using smart contracts, whereas USDT and USDC are issued through the token providers themselves in exchange for fiat currencies.

Asset-backed stablecoins hold the top slots but some stablecoins instead use a balancing algorithm to keep the token value stable. In the most famous example, the UST (TerraUSD) stablecoin minted by an algorithm lost its peg in May of 2022, ultimately falling more than 98%. The fallout set off a domino chain that toppled several crypto institutions, including FTX.

Asset-backed stablecoins now lead in market share, with USDC vs USDT being the main contenders. Many countries have now issued regulations surrounding stablecoins, notably the MiCA (Markets in Crypto-Assets) legislation, which prohibits algorithmic stablecoins entirely. In the US, legislation has been introduced to prevent issuers of algorithmic stablecoins from labeling their products as “stablecoins.” Over time, this could see algorithmic stablecoins drop out of use entirely in favor of asset-backed stablecoins.

What is USDC?

USDC is an asset-backed stablecoin token pegged to the US dollar and issued through Circle. The USDC token is fully backed by cash and short-term treasuries. These assets are held in an SEC-registered money market fund held by BlackRock and other financial institutions.

USDC was jointly launched by Coinbase and Circle through the Centre Consortium in 2018. Since its launch, Circle has assumed issuance responsibility, with Coinbase taking a minority investment in Circle. USDC remains prominently featured on Coinbase, which the exchange treats as a USD equivalent for trading.

As tokens are redeemed for cash, they are burned (sent to an unrecoverable address). Cash deposits are used to mint new tokens. However, most users transact with USDC tokens already in circulation rather than minting or burning.

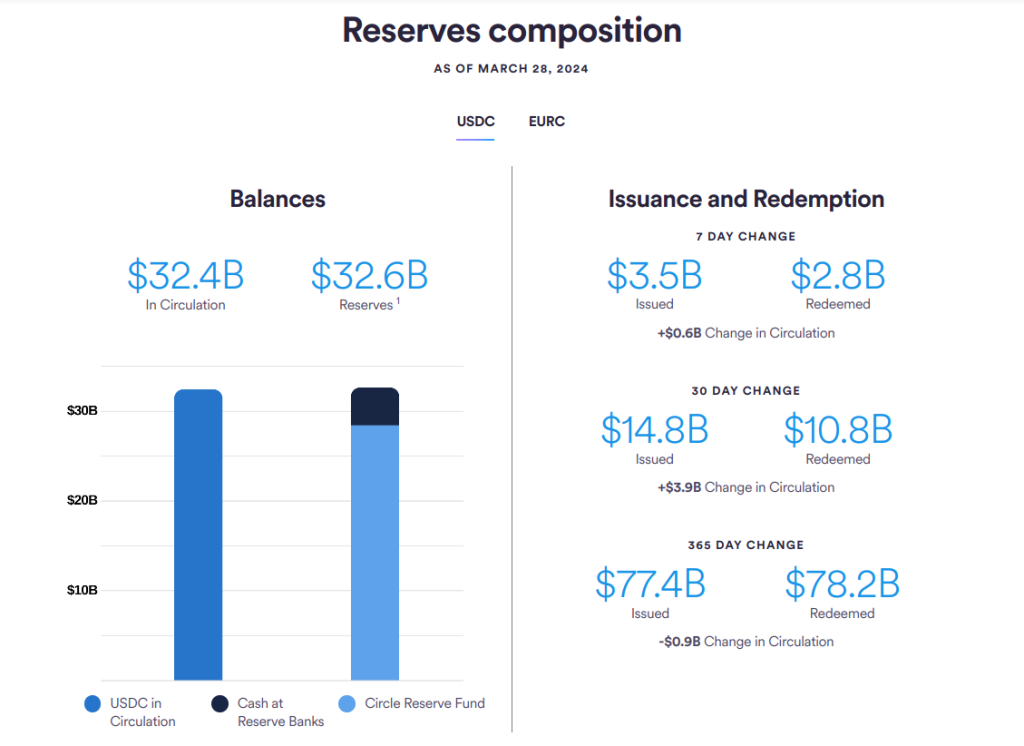

Circle provides transparency with weekly updates on reserve holdings and monthly reports dating back to USDC’s launch in October 2018.

USDC History

Since its launch in 2018, USDC has grown in market capitalization, reaching a peak of $55 billion in 2022, later falling to its current range above $30 billion.

The USDC token was first launched on the Ethereum blockchain as an ERC-20 token. Since then, USDC has launched on several other blockchain networks, including Solana, Polkadot, Stellar, and Hedera.

Much of USDC’s success since its 2018 launch can be attributed to its popularity in decentralized finance (DeFi) applications, where it has become the favored choice for users in many high-value applications. For example, on the Aave lending and borrowing platform, USDC deposits outpace USDT by nearly 20% on Ethereum Mainnet.

2022 marks the short-term peak for USDC in circulation, topping $50 billion, tying into continued interest in DeFi applications and later providing a safe haven in the fallout surrounding the UST algorithmic stablecoin collapse.

USDC Price Stability

Generally, USDC has maintained its peg to the dollar, with one notable exception. Following the collapse of Silicon Valley Bank in March 2023, Circle was unable to access $3.3 billion in reserves for USDC held with the bank. The figure represented 8% of USDC reserves, causing USDC to depeg from $1 for four days. At the lowest point, USDC fell to $0.87. USDC recovered following an announcement that assured markets the Silicon Valley Bank customers would be made whole.

The isolated incident demonstrated USDC’s resilience but also highlighted the market’s ability to closely match its value to the available assets backing the token.

What is USDT?

USDT is the world’s first fiat-backed stablecoin. Tether launched USDT in 2014, using a different strategy compared to two stablecoins (BitUSD and NuBits) that preceded USDT, both of which used crypto assets to back the stablecoins.

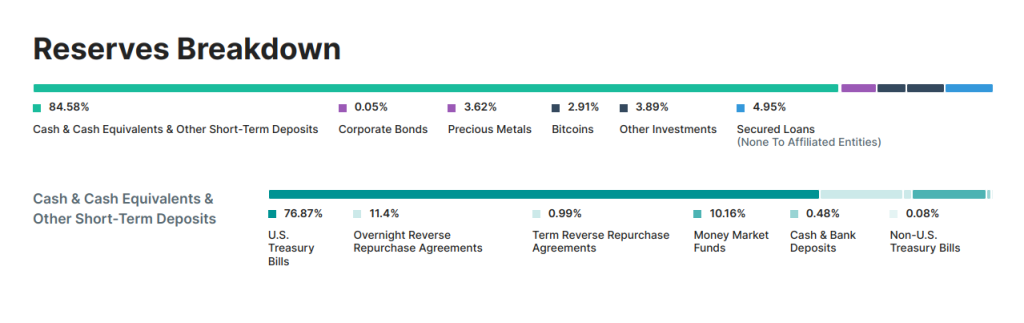

Similar to USDC, Tether’s USDT uses asset backing to secure the token value. However, in its earlier days, much of Tether’s backing came in the form of unsecured short-term corporate debt, a less liquid asset class compared to cash and treasuries. Today, Tether has changed the mix, instead holding nearly 85% of its reserves in cash and short-term deposits, with the balance held in a variety of other assets, including bitcoins.

Tether is owned by Hong Kong-based iFinex, which also owns the BitFinex exchange. The company provides daily balance updates and quarterly audits of assets.

Similar to USDC, USDT tokens are either minted or burned according to deposits or redemptions. However, the supply seen by everyday users represents the circulation of already minted tokens.

USDT History

The first iteration of Tether — called Realcoin at the time — used the Omni Layer, a protocol for creating and transacting digital assets on top of the Bitcoin blockchain. By 2023, Tether had eliminated support for Omni but was already well-entrenched in the crypto market, having launched an ERC-20 token for the Ethereum blockchain in 2017.

The supply of Tether reached $1 billion for the first time in 2017 following its launch on Ethereum, later growing to its $104 billion market cap as it became the de facto stablecoin for many in the community. Currently, USDT enjoys a top-three market capitalization, following Bitcoin and Ethereum.

However, Tether’s rise to dominance wasn’t without controversy. In 2021, the CFTC fined Tether $41 million, citing discrepancies in USDT’s 1:1 USD backing.

USDT Price Stability

Like USDC, USDT has lost its peg. In 2022, following the market panic stemming from the UST collapse, USDT fell to $0.95. $3 billion in withdrawals led to liquidity challenges that caused USDT’s price to dip on exchanges. The depeg event proved short-lived as USDT regained its $1 peg by the following day.

Generally, USDT is considered to be a stable store of value that tracks the USD reliably. Many early criticisms of corporate paper used as backing has fallen aside as Tether reportedly rebalanced its portfolio to contain primarily cash and short-term debt alongside assets of less questionable value compared to unsecured corporate debt.

Similarities Between USDC and USDT

Both USDC and USDT share a common market, making which one to use often a matter of preference. However, you may also find markets that support one rather than the other.

Stablecoins Pegged to the US Dollar

USDT and USDC are both pegged to the US dollar’s value. Both tokens use a similar minting and burning mechanism to match supply to reserves.

In earlier de-pegging events, both tokens quickly regained their peg, largely due to the market’s confidence in the value of the reserves. USDT fell by only 5% during a liquidity crunch that swept the market. USDC fell as much as 13% briefly due to a banking scare that created temporary uncertainty for 8% of Circle’s reserves.

By contrast, many other stablecoins, including UST, have failed. Facebook’s planned Libra stablecoin was never launched, facing pushback from lawmakers. For the time being, the viable stablecoin choices remain USDT vs. USDC.

High Liquidity and Trading Volume

Eight out of the ten leading Bitcoin exchange markets pair BTC with USDT. USDC dominates stablecoin positions on many DeFi lending projects, particularly on Layer 2 networks. These numbers are underscored by the circulating supply compared to trading volume.

Currently, USDT boasts a $74 billion 24-hour trading volume compared to a $104 billion overall market cap. By contrast, USDC turned 27% of its market capitalization in 24 hours, trading $8.7 billion of its $32 billion market cap. By comparison, both assets dwarf the liquidity and trading volume of other competing stablecoins.

Backed 1:1 by US Dollars in Reserve

Both tokens also use a similar basket of assets, largely USD equivalents, to back to tokens 1:1 with USD. However, each uses a slightly different mix of assets to achieve backing.

Tether (USDT) provides the following breakdown.

- Cash & Cash Equivalents & Other Short-Term Deposits: 84.58%

- Secured Loans: 4.95%

- Other Investments: 3.89%

- Precious Metals: 3.62%

- Bitcoins: 3.89%

- Corporate Bonds: 0.05%

Of note, less than a half percent of the Cash and Cash equivalents are held in USD. US Treasuries make up nearly 77% of this category.

By comparison, Circle uses a more streamlined list of assets for USDC with the following current mix.

- Cash: 12.88% (held in banks)

- Circle Reserve Fund: 87.12% (money market fund held by BlackRock)

Circle’s Reserve Fund uses cash, short-dated US Treasuries, and overnight US Treasury repurchase agreements, with a weighted average maturity of 19 days.

Differences Between USDC and USDT

While both stablecoins track the US dollar’s value with proven reliability, there are differences between USDT and USDC. These differences center on transparency and regulatory compliance.

Issuing Companies: Circle/Coinbase vs Tether Limited

While launched by a consortium founded by Coinbase and Circle, minting and redeeming of USDC is now in the hands of Circle. The company uses an SEC-registered money market fund to safeguard the majority of the assets backing USDC.

Tether holds various assets backing USDT, including hard assets like precious metals and Bitcoin. While these non-cash assets may bring more volatility, the bulk of Tether’s holdings are in US treasuries.

Circle is headquartered in Massachusetts, whereas Tether is incorporated in the British Virgin Islands.

Transparency Surrounding Reserves

Historically, USDC has provided better transparency regarding reserves. Circle has partnered with BlackRock to hold its reserve fund and provide detailed information on the holdings in the fund. Monthly reports keep USDC holders well informed on changes to the mix of assets.

Tether’s USDT has provided less transparency historically but has improved in its efforts to detail which asset mixes back the USDT stablecoin. Tether was fined by the CFTC in 2021 for alleged discrepancies in its backing assets compared to its provided figures. Also, in 2019, the New York Attorney General’s office discovered an $850 million hole in Tether’s reserves, allegedly due to a loan to Bitfinex.

Regulatory Compliance

As a US company, Circle is licensed as a money transmitter in most US states. Assets backing USDC are held in regulated banks or in the SEC-registered Circle Reserve Fund held by BlackRock.

Tether, based in the British Virgin Islands, faces different regulatory challenges and calls for increased transparency. Run-ins with US regulators such as the CFTC suggest the token may be better served with closer regulation. However, recourses are limited for US regulators as well as other jurisdictions and largely center on after-the-fact enforcement actions. There has also been significant speculation on whether Tether is being used to manipulate the price of Bitcoin. These are important considerations when comparing Tether vs USDC.

Blockchain Networks: ERC-20 Only vs Multiple Options

Both USDT and USDC support multiple blockchains and token standards, although they diverge in which chains are supported. The most notable difference regards the Tron network. USDT still supports the TRC20 token standard, whereas USDC has announced it will remove support for Tron.

Both tokens support the ERC20 token standard in use for the Ethereum network and Ethereum Virtual Machine (EVM) compatible Layer 2 networks, such as Arbitrum. Both tokens also support the Solana blockchain.

The Advantages and Disadvantages of USDC

Despite its lower market share, USDC does bring some advantages, depending on how you use stablecoins. You may also find situations in which USDT is a better option. For example, some crypto exchanges favor USDT for trading pairs.

Among the advantages, however, is the Circle Cross Chain Transfer Protocol (CCTP). The protocol offers a more secure way to transfer USDC across chains compared to using a bridge. CCTP’s functionality can be built into other dApps.

Pros

- Well-documented assets

- Regulated in various jurisdictions

- Licensed in most US states

- Well-represented in DeFi apps

- Promotional yields from several exchanges

Cons

- Fewer trading pairs compared to USDT

- Tron support removed

- May blacklist USDC addresses at law enforcement request

The Advantages and Disadvantages of USDT

The advantages of USDT center on trading. Some exchanges like Binance, OKX, and MEXC use USDT as a part of trading pairs rather than USDC.

However, USDT’s disadvantages center on transparency concerns and how USDT adheres to current regulations. Unlike cryptocurrencies like Bitcoin, which find their own market value, USDT gets its value from its underlying assets. As a store of value equivalent to USD, transparency in holdings is essential for stablecoins like USDT.

Pros

- High liquidity and wide acceptance

- Better support for exchange trading

- Historically regains its peg quickly

Cons

- Spotty history regarding transparency

- Largely unregulated

- Fewer cash-equivalents held compared to USDC

- Regulatory uncertainty based on prior fines

- May blacklist USDT addresses at law enforcement request

USDC vs USDT: Which is the Safest Stablecoin?

From asset backing and transparency standpoints, USDC presents a safer option for most investors. USDC backing assets are held in cash (about 13%) and an SEC-registered money market fund (about 87%). This liquid backing helps ensure the availability of funds if the market demands redemptions. Circle assures holders that USDC is always redeemable at 1:1 for USD. However, for retail customers, USDC must be redeemed via an exchange or trading platform. Meanwhile USDT can be redeemed through their platform, with redemptions over $1,000 incurring a 0.1% fee. This is important to consider when comparing USDC vs USDT fees.

Circle also makes its SEC filings dating back to 2021 easy to find. A growing number of partners, including Mastercard, Visa, Robinhood, BlackRock, and MoneyGram, demonstrate continuing growth and acceptance of USDC.

Conclusion

When choosing between USDC vs. USDT, which stablecoin you choose often depends on the type of transactions you intend to make. When trading on exchanges, you’ll often find better support for USDT. However, if you’re using DeFi apps, USDC often brings better support or better yields. USDC may also offer better support for payments to crypto-backed debit cards.

If you plan to hold either stablecoin for an extended period, be aware of the risks. Both tokens have lost their $1 peg in the past. However, both also recovered quickly. Also, weigh the assets held by each, matching the asset backing to your risk tolerance.

FAQs

Is USDC better than USDT?

USDC offers better transparency compared to USDT. However, both stablecoins are widely accepted and have a solid history in regard to holding their $1 peg.

Is USDC equal to USDT?

Both USDT and USDC are pegged to $1 USD, so they are equal in value. However, these two stablecoins use different asset mixes to back the value of the token. USDC holds about 13% of its assets in cash, with the balance in a money market fund managed by BlackRock. By contrast, USDT holds less than half a percent in cash, with other assets, including treasuries, making up the bulk of USDT holdings.

Has USDC or USDT ever gone below $1?

Yes. Both USDC and USDT have briefly fallen below $1. USDC fell to $0.87, and USDT fell to $0.95.

Is USDC still safe?

USDC’s mix of assets suggests that it is the safest fiat-backed stablecoin when comparing USDT vs. USDC. Circle, the company behind USDC, keeps about 13% of its holdings in cash while keeping the balance in short-term treasuries in a money market fund held by BlackRock.

Why is USDT more popular than USDC?

USDT has a longer history compared to USDC, leading to USDT becoming a popular asset in trading pairs on crypto exchanges. The network effect of being in use for a longer period of time helps make USDT the leading stablecoin by market capitalization.

References

- Circle is Discontinuing Support for USDC on the TRON Blockchain (circle.com)

- The EU Markets in Crypto-Assets (MiCA) Regulation Explained (legalnodes.com)

- The regulation of stablecoins in the United States (globallegalinsights.com)

- US regulators say SVB customers will be made whole as second bank fails (cnn.com)

- Tether records surprise profit as stablecoin giant aims to put reserve controversy behind it (cnbc.com)

- Tether to Pay $41 million Over Claims that Tether Stablecoin was Fully Backed by US Dollars (cftc.gov)

- World’s biggest stablecoin regains dollar peg after $3 billion in withdrawals (cnbc.com)

- Tether Says Its Reserves in Cash, Equivalents Are at the Highest Ever (bloomberg.com)

- Why Stablecoins Fail: An Economist’s Post-Mortem on Terra (richmondfed.org)

- Cryptocurrency firms Tether and Bitfinex agree to pay $18.5 million fine to end New York probe (cnbc.com)

- Is Bitcoin Really Untethered? (wiley.com)

Kane Pepi

Kane Pepi

Elliott Lee

Elliott Lee

Michael Graw

Michael Graw