Crypto Taxes Explained in May 2024

The Internal Revenue Service (IRS) is very clear on crypto investments; digital assets are treated as property, meaning they’re taxed just like any other asset. Therefore, US-based investors should have a clear understanding of their crypto tax obligations.

This guide on crypto tax explains everything there is to know for US investors. Not only do we cover capital gains and income requirements, but also what rates to expect and how to keep your tax liabilities to a minimum.

Key Takeaways on Crypto Taxes

The key takeaways on crypto tax in the US are as follows:

- The IRS views crypto assets as property, so they’re taxed the same as stocks, ETFs, and other investment classes.

- Capital gains tax is assessed on realized profits, meaning you’ll need to dispose of your digital assets before tax is due. Tax rates depend on whether the crypto assets were held for under or over 12 months.

- The IRS will also tax crypto income, such as staking and yield farming. This is added to your income for the respective year.

- There are several ways to reduce or even avoid capital gains tax, including strategic selling, gifts, and offsetting previous losses. However, crypto income is always taxed in the same year that it was received.

Do You Have to Pay Tax on Crypto in the US?

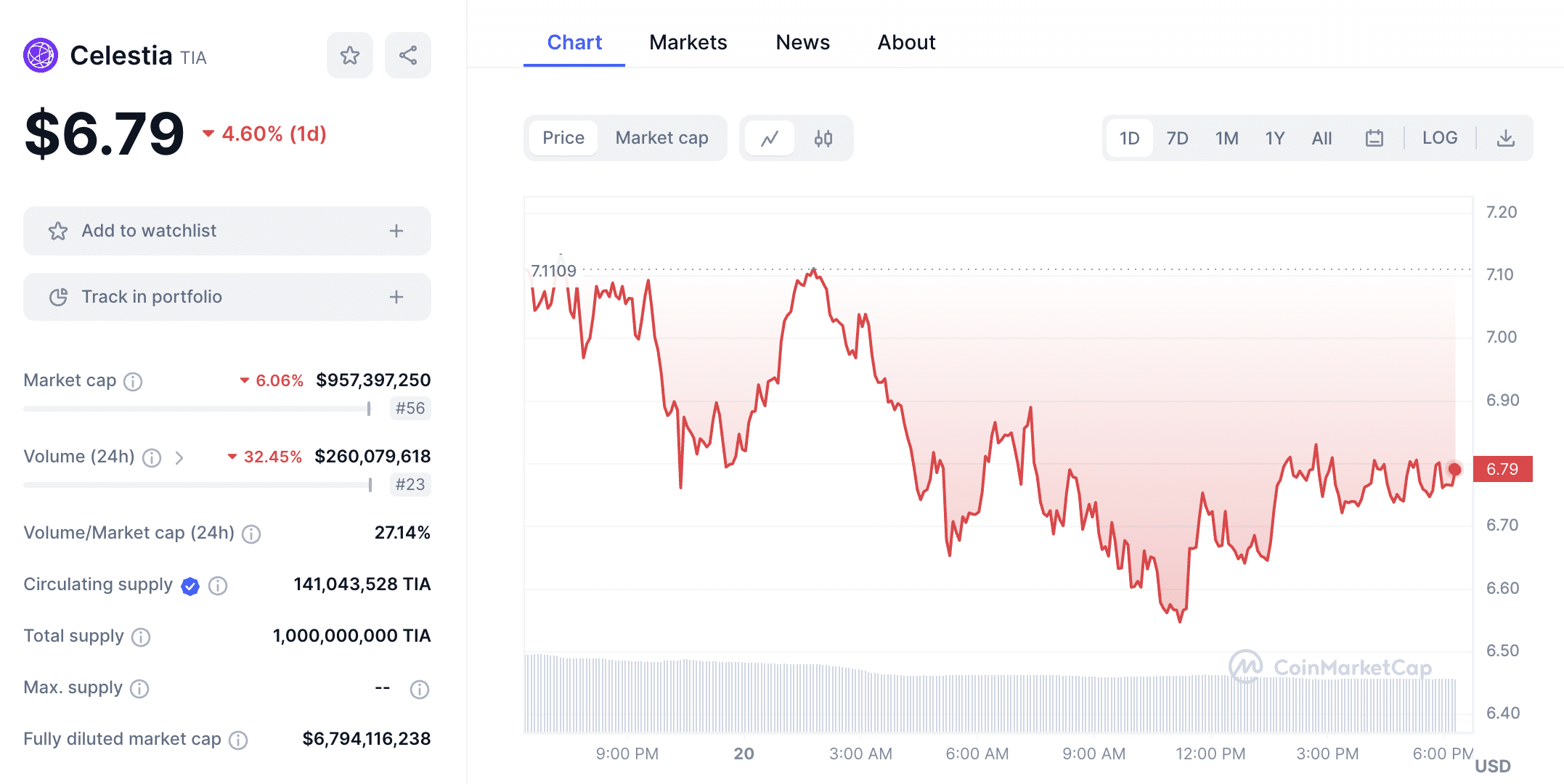

Cryptocurrencies like Bitcoin and Ethereum are unregulated financial instruments. However, the IRS treats digital assets as property, meaning they’re taxed like any other investment – such as stocks and mutual funds. Whether or not you’ll be required to pay tax depends on many different variables. Nonetheless, there are two forms of crypto tax that you need to be aware of. First, there’s capital gains tax.

Just like stocks, tax on crypto gains is only applicable to realized profits. In simple terms, this means that you’ve sold the cryptocurrencies for a profit. For instance, suppose you bought 1 Bitcoin in January 2023 for $21,000. You sold your 1 Bitcoin in April 2023 when it was worth $30,000. Therefore, your realized capital gains are $9,000. In this instance, the crypto investment was held for under 12 months, so short-term capital gains tax rates apply.

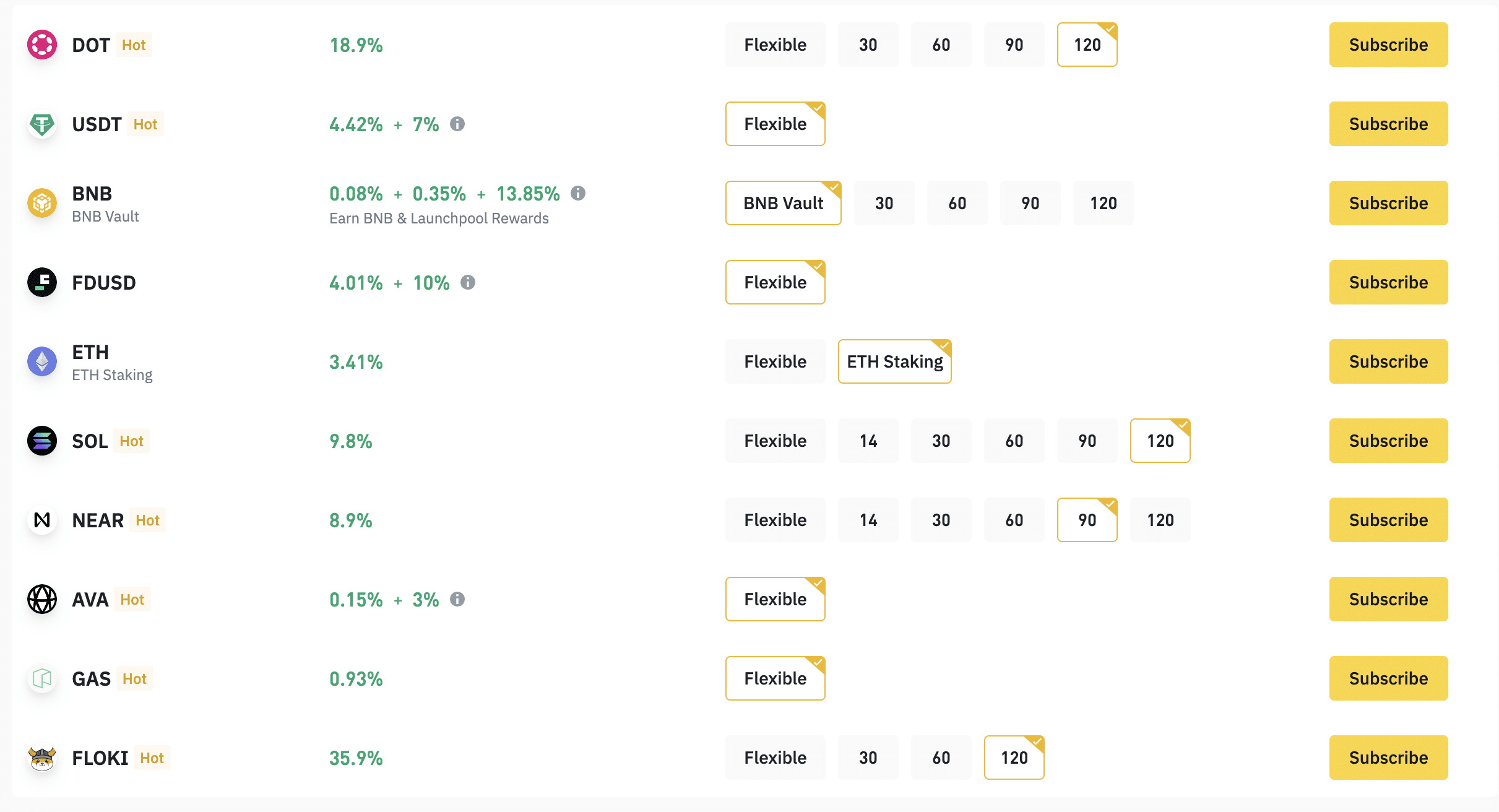

Long-term rates apply if the cryptocurrencies were held for over 12 months, just like other assets. The second tax obligation to be aware of is crypto income. The most popular income tools include staking and yield farming. Unlike capital gains, the IRS views crypto income the same as any other income stream – such as employment, stock dividends, or bond payments. Therefore, crypto income is always taxed in the same year it was received.

Not only is it important that you’re aware of how crypto taxes work but how to avoid them. There are many different strategies used by seasoned investors, which we’ll unravel in this guide. Examples include crypto tax harvesting, taking advantage of long-term capital gains rates, gifting, and holding investments in an IRA. Ultimately, the IRS is clamping down on crypto tax evasion, with US-listed exchanges now reporting customer holdings. As such, this guide will prepare you accordingly.

How is Cryptocurrency Taxed?

There are many different products and services in the crypto space. Some will trigger a tax obligation while others won’t. The specific type of tax treatment and applicable rates will also vary.

Therefore, this section discusses the most common scenarios facing crypto investors, and how they’re taxed by the IRS.

Profitable Crypto Investments

Most of you will be wondering about taxes on profitable crypto investments. If you’ve previously invested in stocks, the same rules apply to crypto assets. In a nutshell, the IRS is only interested in your crypto profits once the digital assets have been disposed of.

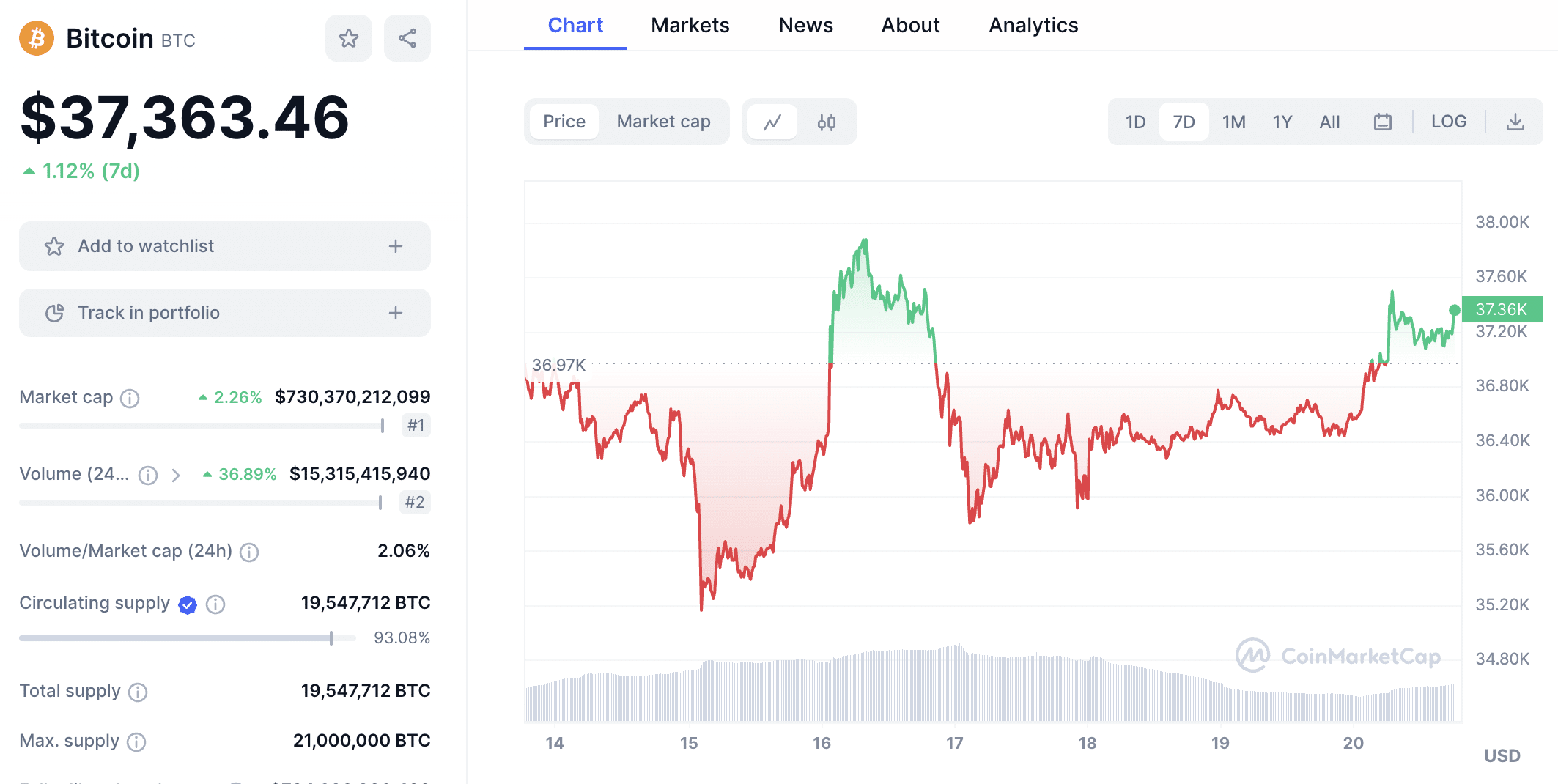

- So, suppose you bought 1 Bitcoin in April 2020 when it was worth $5,000.

- You’re still holding today. At current BTC/USD prices, your 1 Bitcoin is worth about $37,000

- This investment has produced gains of $32,000

Crucially, the Bitcoin has not been disposed of, meaning that your $32,000 profit is unrealized. This will continue to be the case until you decide to sell. When you do, your profits are realized, meaning they are liable for capital gains tax.

In this example, the investment has been held for over 12 months. So, regardless of when you decide to cash out, long-term capital gains tax rates will apply. Conversely, selling within 12 months of making the investment triggers short-term capital gains tax rates.

Now for some important information on what the IRS considers realized profits.

There is a misconception that capital gains are only realized when cryptocurrencies are sold for US dollars (or another fiat currency). However, this simply isn’t the case.

Gains are realized as soon as the cryptocurrencies are disposed of, whether that’s for US dollars or another digital asset. For instance, in the above example, you had $32,000 of unrealized profit. If you exchanged Bitcoin for Ethereum, capital gains tax would still be due on the $32,000 gain – even though it hasn’t been converted to ‘real money’.

Trading Cryptocurrencies

Things get really complicated when you actively trade new cryptocurrencies. As empathized above, every trade is considered a disposal by the IRS. This means that each sale must be accounted for, in terms of cost and disposal prices. This can be challenging when you’re regularly buying and selling different cryptocurrencies on various platforms.

Let’s look at an example to clear the mist:

- Let’s say you buy $5,000 worth of Ethereum, as you’re planning to trade on the best no-KYC crypto exchanges. When you make the purchase, Ethereum is worth $2,000. This is your cost price.

- A few days later, you transfer Ethereum into Uniswap and exchange all of the tokens for Decentraland. At the time of the trade, Decentraland is worth $0.50.

- However, a few days have passed since you bought Ethereum. When you made the exchange for Decentraland, it was worth $2,200. You originally paid $2,000, so in the eyes of the IRS, you’ve made a capital gain of 10%.

- A few more weeks have passed and you swap Decentraland back to Ethereum. When you trade, Decentraland is worth $1. This represents a capital gain of 100%, as you originally paid $0.50 per token.

In the above example, you bought Ethereum for cash, swapped the tokens for Decentraland, and then eventually back to Ethereum. This triggered at least two realized capital gains, as tokens were sold for a higher price than you originally paid. This is the case even though crypto-to-crypto trades were involved.

Importantly, don’t think that you can evade crypto taxes just because you’re using a decentralized exchange. Although decentralized exchanges offer an anonymous user experience, blockchain transactions can still be tracked. For instance, suppose you bought Ethereum with a credit card on Coinbase.

You then transfer the Ethereum tokens from Coinbase to a decentralized exchange. Any future transactions can be traced back to your original purchase on Coinbase, which is associated with your identity.

Earning Crypto Income on DeFi Investments

Another misconception in the crypto space is that decentralized finance (DeFi) income isn’t taxed. For example, staking, yield farming, or crypto savings accounts. Once again, this couldn’t be further from the truth. In simple terms, DeFi yields are taxed the same as income, such as employment or selling unwanted goods on eBay.

In other words, crypto income taxes are due in the same year they were received. This is also a complicated scenario, as crypto income should be reported based on its market price on receipt. Crucially, some DeFi products make distributions weekly, or even daily. This means you’ll have many different cost prices to calculate.

Let’s look at an example of how DeFi income is taxed:

- You invest 10 ETH into a DeFi platform, opting for a staking pool that pays 30% per year. Keeping the ETH tokens in the staking pool for one year would yield 3 ETH in rewards (30% of 10 ETH). However, distributions are made weekly.

- After one week, you receive your first distribution of 0.057 ETH. At the time, ETH is worth $2,000, so your rewards are worth approximately $114.

- After week two, you receive another 0.057 ETH. On the day you receive the tokens, ETH is worth $2,500. Therefore, your rewards are worth $142.50.

- This process must be repeated every week that you receive the staking rewards.

As per the above example, you received $114 and $142.50 worth of ETH rewards. This is what needs to be reported as income to the IRS. The rewards are simply added to any other income you earn during the year.

For instance, suppose you earned $20,000 from a part-time job, and $5,000 selling unwanted goods on eBay. In addition to your staking rewards, your total income is $25,256.50. Your total income will be taxed accordingly, as per your income bracket (more on this later).

Important: DeFi income can also trigger crypto capital gains tax. This will be the case if you sell your crypto income for a profit. The cost basis is determined by the price when you receive the income. For instance, suppose you receive staking rewards of 1 ETH. At the time, Ethereum was worth $1,500. When you sell your 1 ETH reward, Ethereum is worth $1,700. Therefore, you’ve made capital gains of $200, even though you didn’t pay for the ETH.

Paying for Goods or Services With Crypto

There’s a lot of misinformation online about paying for goods or services with crypto, and the subsequent tax requirements. As we have established, the IRS considers crypto profits as realized once the tokens are disposed of. Not only does this include selling crypto for cash or exchanging it for another token, but making purchases too.

Therefore, spending crypto will invariably trigger a tax event. Whether or not tax needs to be paid depends on the original and disposal prices.

For example:

- Let’s suppose you buy 2 Bitcoins at $15,000 each, and keep the tokens in a private wallet.

- A few months have passed and Bitcoin is now worth $20,000. You decide to pay for an airline ticket with Bitcoin. The purchase costs 0.1 BTC.

- As soon as you transfer the 0.1 BTC to the airline company, this is viewed as a disposal from the IRS.

- So, when you disposed of 0.1 BTC, the Bitcoin price was worth $5,000 more than you originally paid ($20,000-$15,000). 0.1 BTC of your $5,000 capital gain is realized, so that’s $500.

- Therefore, $500 will be added to your capital gains liability for the year.

This once again highlights the importance of keeping adequate records of all cryptocurrency movements.

Crypto Mining

Crypto mining is another area that will be taxed. Just like DeFi rewards – such as staking or yield farming, crypto mining is considered income.

For example, let’s say that in week one you mine 1 BTC. When the 1 BTC is received, it’s worth $40,000. This is what needs to be added to your income for the year. Of course, you haven’t made $40,000 in net income, as mining can be a cost-intensive business.

As such, if you’re a registered mining company, you’ll be able to offset the expenses required to mine. At the forefront of this are energy costs and hardware maintenance. In addition, once the 1 BTC mining rewards are sold, capital gains tax could be triggered. Similar to DeFi income, this is based on the price of the mining rewards when they are sold.

So, if you sold the 1 BTC when it was worth $50,000, you’ve made capital gains of $10,000. This is because when you received the 1 BTC, it was valued at $40,000.

Selling Goods for Crypto

We mentioned earlier that buying goods with crypto can trigger a taxable event. But what about selling goods for crypto? The same rules apply but in reverse.

- For example, let’s say that you sell your car for $20,000. You originally paid $30,000, so there are no capital gains on the sale.

- The buyer pays you in Bitcoin, which is currently worth $40,000. Therefore, you receive 0.5 BTC from the buyer.

- You hold onto the 0.5 BTC for a few more months.

- When you’re ready to sell, Bitcoin is valued at $80,000. As such, you sell your 0.5 BTC for $40,000, making a $20,000 profit.

- The realized capital gain is $20,000, which will be taxed accordingly.

Note that if you sold the car for more than you originally paid, capital gains tax on the sale will also apply.

Unprofitable Crypto Investments

The focus so far has been on profitable crypto investments. However, not all investments will yield a profit, so what happens when you make a loss? Fortunately, the IRS has very favorable rules on capital losses. Most importantly, this extends to cryptocurrency investments.

Put simply, if you dispose of a cryptocurrency at a loss, you can offset these losses against your capital gains liability.

Let’s look at a hypothetical example of how this works in practice:

- You buy 10,000 DOGE tokens when Dogecoin is worth $1. This takes your total investment to $10,000.

- A few months later, you sell your 10,000 DOGE tokens. At the time of the sale, Dogecoin is worth just $0.30. This means you receive $3,000 back, even though you originally invested $10,000.

- On this investment, you lost $7,000.

- Prior to this loss, your total capital gains for the year was $9,000. You can now offset the $7,000 Dogecoin loss from this liability. Therefore, your capital gains for the year is now just $2,000.

As we cover in more detail later, some investors will strategically sell their cryptocurrencies at a loss. This helps them reduce their tax bill for the year. This is known as tax harvesting and it’s one of the best ways to avoid crypto taxes.

Another thing to note is that crypto losses can be carried over into future years. This will be the case if your losses exceed the total capital gains for the period. As such, learning how to claim crypto losses on taxes can be helpful in 2024.

For instance, in the example above, we mentioned that you made $7,000 in capital losses from the Dogecoin investment. In the same year, suppose you made just $2,000 in capital gains. You would use $2,000 from your Dogecoin losses to bring the capital gains to $0. In the following year, you could use the remaining $5,000.

Receiving a Salary in Crypto

According to a CNBC report, more than half of Americans aged 25 or under would be happy to receive their salary in crypto. From a tax perspective, the rules work much the same as receiving your salary in dollars.

However, it’s important to remember that your income is based on the value of the crypto when it’s received. For example, suppose your monthly salary amounts to 0.1 BTC. When it’s paid, Bitcoin is worth $30,000. You received 0.1 BTC, so your income is $3,000. This is what needs to be added to your income for the tax year.

In addition, don’t forget about disposals. At some point, whether that’s through cashing out or spending crypto, it will be sold. If the disposal results in a profit, capital gains tax will apply.

For instance, suppose you sell your monthly salary of 0.1 BTC when Bitcoin is worth $40,000. When you received it, Bitcoin was worth $30,000. At 0.1. BTC, this would represent a capital gain of $1,000 ($40,000 – $30,000 0.1 BTC).

Donating Crypto

The IRS views cash and crypto donations similarly. This means that crypto donations can help you offset your tax liability. However, you need to consider the cost and sale basis for the transaction.

For instance, let’s say that you buy 1 Bitcoin in 2020 for $6,000. In 2023, the same 1 Bitcoin is now worth $40,000. This would represent a capital gain of $34,000 once cashed out. However, suppose you donate the 1 Bitcoin to charity. In this instance, you could offset $40,000 from your capital gains liabilities. This is because the deduction is based on the total market value that was donated.

There are specific rules to be aware of before donating crypto for tax advantages. For example, the most you can donate on non-cash assets (like crypto) is 30% of the total adjusted gross income (AGI). Nonetheless, anything left over can be offset in future tax years.

Gifting Crypto

Similar to donating crypto, gifting is another common way for investors to reduce their tax burden. There are two angels to consider, the person giving the crypto gift and those receiving it.

The Giver

- Suppose an investor buys 1 BTC at $15,000.

- Two years later, Bitcoin is worth $25,000. This would trigger a capital gain of $10,000 if sold.

- However, the investor decides to gift 0.5 BTC. The other 0.5 BTC remains in the investor’s private wallet.

- The 0.5 BTC donated does not trigger a taxable event.

The Receiver

- The person receiving the crypto gift received 0.5 BTC.

- When the gift was received, Bitcoin was valued at $25,000. This means the receiver has $12,500 worth of Bitcoin.

- However, the receiver acquires the original cost basis that the investor paid, which was $15,000 for the 1 Bitcoin.

- So, on a 0.5 BTC gift, the receiver has $7,500 worth of Bitcoin.

- Suppose a few years later the receiver sells their 0.5 BTC for $10,000. The capital gains on the sale would be $2,500.

Do note that in 2023, you can gift up to $17,000 without reporting the transaction to the IRS. Anything above this does need to be reported. In 2024, this will be increased to $18,000.

How is Cryptocurrency Taxed?

Unless you’re heavily invested in DeFi earning tools like staking or yield farming, your main tax liability will likely come from capital gains. In general, the amount you pay will depend on two key metrics:

- How much profit you made from the cryptocurrency investment

- How long you held the cryptocurrency investment before selling

First and foremost, the profit element is simply the sale price less than the original cost price. For example, you buy 10 ETH for a total outlay of $10,000. You sell the 10 ETH for a total of $15,000. Your capital gains are $5,000.

Now, the amount you need to pay on the $5,000 gain depends on whether you held the investment for more or less than 12 months.

- Let’s say you bought the 10 ETH in January 2023 and sold the tokens in October 2023.

- This is less than 12 months, so short-term capital gains tax applies.

- So, your $5,000 gains are simply added to your total income for the year.

- If you earned a salary of $50,000, your total income is $55,000 – and this will be taxed accordingly.

That said, different rules apply for certain circumstances, such as filing jointly as a married couple. We provide a breakdown of what to expect in the section below.

So what about selling crypto after holding for at least 12 months? In this instance, long-term capital gains rates apply. This offers more favorable tax rates, as US investors are encouraged to hold long-term.

There are three potential capital gains tax rates, 0%, 15%, and 20%. The rate is based on your total taxable income for the year, which includes capital gains. For instance, suppose you earn a salary of $30,000 and you make $5,000 in long-term crypto gains. This totals $35,000 in assessable income.

In the US, if you earn less than $44,625 as a single filer, the long-term capital gains rate is 0%. Therefore, you wouldn’t pay any tax on your $5,000 capital gains.

If your total assessable income as a single filer was between $44,625 and $492,300, you would pay capital gains tax of 15%. Anything over this threshold would be taxed at 20%.

Crypto Tax Rates

We’ve established that crypto tax rates will depend on whether you held the investment for under (short-term) or over (long-term) 12 months.

We’ve prepared tables to help you assess what you could owe to the IRS.

If you held the investment for under 12 months, refer to the short-term crypto tax rate table below:

| Short-Term Capital Gains Tax Rate | 10% | 12% | 22% | 24% | 32% | 35% | 37% |

| Taxable Income | |||||||

| Single | Up to $11,000 | $11,001 to $44,725 | $44,726 to $95,375 | $95,376 to $182,100 | $182,101 to $231,250 | $231,251 to $578,125 | Over $578,125 |

| Married Filing Jointly | Up to $22,000 | $22,001 to $89,450 | $89,451 to $190,750 | $190,751 to $364,200 | $364,201 to $462,500 | $462,501 to $693,750 | Over $693,750 |

| Married Filing Separately | Up to $11,000 | $11,001 to $44,725 | $44,726 to $95,375 | $95,376 to $182,100 | $182,101 to $231,250 | $231,251 to $346,875 | Over $346,875 |

| Head of Household | Up to $15,700 | $15,701 to $59,850 | $59,851 to $95,350 | $95,351 to $182,100 | $182,101 to $231,250 | $231,251 to $578,100 | Over $578,100 |

If you held the investment for 12 months or more, refer to the long-term crypto tax rates below:

| Tax Rate | 0% | 15% | 20% |

| Taxable Income | |||

| Single | Up to $44,625 | $44,625 to $492,300 | Over $492,300 |

| Married Filing Jointly | Up to $89,250 | $89,250 to $553,850 | Over $553,850 |

| Married Filing Separately | Up to $44,625 | $44,625 to $276,900 | Over $276,900 |

| Head of Household | Up to $59,750 | $59,750 to $523,050 | Over $523,050 |

Are There Any Tax-Free Crypto Transactions?

Fortunately, not all crypto transactions trigger a taxable event.

Here are some examples of tax-free transactions available to US residents:

- Buying Crypto With Fiat: No tax is due when buying crypto with fiat money. This is the same as buying stocks, ETFs, or any other investment asset.

- Transferring Crypto Between Your Own Wallets: You can freely transfer crypto between your own wallets without triggering a tax event. For instance, moving Ethereum from MetaMask to Trust Wallet, or Bitcoin from Electrum to Coinomi. In addition, you can also transfer crypto from a private wallet to an exchange without the transaction being taxed. However, once you dispose of the crypto (either for fiat or another crypto), this will trigger a tax event.

- Gifting Crypto: In 2023, you can gift up to $17,000 worth of crypto without triggering a tax event. While you can gift more than this without paying tax, amounts above $17,000 need to be reported to the IRS.

- Donating Crypto: You can also donate crypto to a registered charity without being taxed. What’s more, you can offset the donation as a tax-deductible.

- Holding Crypto: In the US, only realized capital gains trigger a tax event, meaning when the crypto is actually disposed of. This means that you can hold crypto in your wallet for as long as you want without needing to worry about tax.

How to Calculate Crypto Tax

We briefly covered some examples of how to calculate crypto taxes, including capital gains and income. Let’s look at some more detailed examples to help clear the mist.

Calculating Short-Term Crypto Gains

- In March 2023, you buy 5 BNB tokens, valued at $200 each. This takes your total investment to $1,000. In April 2023, BNB is valued at $250. You sell all 5 tokens, returning $1,250 in total. Therefore, your capital gain on this short-term trade is $250.

- In June 2023, you buy 1 BTC at $25,000. In November 2023, Bitcoin is worth $35,000. You sell your 1 BTC, making a short-term capital gain of $10,000.

To clarify, you made two short-term crypto trades in 2023. You made $250 on the first, and $10,000 on the second. This takes your total short-term capital gains to $10,250.

During 2023, you received a salary of $45,000. This needs to be added to your short-term capital gains of $10,250. As such, this brings your total income for 2023 to $55,250.

As per the 2023 income tax rates, you would pay 10% on the first $11,000 (as a single filer), so that’s $1,100.

For anything earned between $11,000 and $44,725, you’d pay 12%. You consumed the full bracket of $33,725 ($44,725-$11,000), so that’s another $4,047.

The remaining income of $10,525 ($55,250 – $44,725) is taxed at 22%. So that’s another $2,315.50. Therefore, in total, you’ll need to pay $7,462.50 ($1,100 + $4,047 + $2,315.50) for the year.

Calculating Long-Term Crypto Gains

Now let’s look at how to calculate long-term capital gains. We’ll stick with the same figures to illustrate how long-term holders offer more favorable tax rates.

To recap, you made two separate trades, making profits of $250 and $10,000. This total capital gains of $10,250. This time, you held both your cryptocurrency investments for over 12 months, so long-term capital gains rates apply. Adding in your annual salary of $45,000, this takes your total to $55,250.

In this instance, you would pay a capital gains tax of 15%, as your total income sits between the $44,625 and $492,300 threshold. However, the 15% tax is only applied to the capital gains element of $10,250. As such, your capital gains for the year is $1,537.50.

The $45,000 salary would be taxed at the ordinary income bracket. As we explained above, you’d pay $1,100 on the first $11,000 earned, and $4,047 on the next $33,725. That leaves you with $275, which would move into the next tax bracket of 22%. So that’s an extra $60.50. In total, your income tax for the year is $5,207.50.

- Total Capital Gains Tax: $1,537.50

- Total Income Tax: $5,207.50

- Total Tax for 2023: $6,745

So, when holding your cryptocurrency investments for at least 12 months, and including your $45,000 salary, you paid $6,745 in tax for 2023 as a single filer.

In contrast, using the same figures, you paid $7,462.50 when holding onto the cryptocurrency investments for under 12 months. Therefore, you saved $717.50. While this might not sound like a lot, consider an investor that makes significantly higher profits. Simply avoiding selling for at least one year can save considerable amounts.

Calculating Crypto Income

Now that we’ve explained how to calculate capital gains taxes, let’s move on to crypto-related income. In general, most income sources follow the same rules, whether that’s staking, yield farming, or mining.

- In this example, we’ll consider an investor who buys Bitcoin with a credit card, totaling $20,000. At the time, Bitcoin is worth $20,000, so the investor gets 1 BTC.

- They instantly deposit the 1 BTC into a savings account that yields 5% annually. At this stage, no taxable event has taken place.

- The Bitcoin savings account makes distributions quarterly. Over the course of one year, 5% of 1 BTC gets 0.05 BTC in rewards. So split between four quarters, that’s four distributions of 0.0125 BTC.

Naturally, on each quarterly payment, the value of Bitcoin will be different.

| Bitcoin Price | Quarterly Rewards | Value of Rewards in USD | |

| Payment 1 | $25,000 | 0.0125 BTC | $313 |

| Payment 2 | $30,000 | 0.0125 BTC | $375 |

| Payment 3 | $21,000 | 0.0125 BTC | $263 |

| Payment 4 | $40,000 | 0.0125 BTC | $500 |

| Total | 0.05 BTC | $1,450 |

So, the table above shows the value of each quarterly distribution in dollars. Added together, the total income generated from the Bitcoin savings account was $1,450.

This simply needs to be added to the total income for the year. For instance, suppose the investor’s salary was $50,000. The total income for 2023 is $51,450. This will be taxed based on the progressive system discussed above.

However, the above makes the assumption that the Bitcoin rewards were not sold. If they were, this would trigger a taxable event, as the Bitcoin was disposed of. For example, when the investor received their first distribution, Bitcoin was valued at $25,000. If they instantly sold at $25,000, the rewards would not generate capital gains. This is because both the cost basis and sale price are the same.

Conversely, suppose the investor held the rewards for a couple more weeks. Originally, the 0.0125 BTC rewards were worth $313. But when they sell, the investor receives $333. This represents capital gains of $20. This would need to be added to any other short-term capital gains for the tax year.

That said, if the investor sold their Bitcoin rewards for a lower price than when they were originally received, a capital loss would occur. As noted, this can be offset against capital gains liabilities for the year.

In addition, the investor also needs to consider the tax implications once the 12-month savings period passes.

This is because the investor will receive their original 1 BTC back from the savings account. When the 1 BTC was originally deposited, it was worth $20,000. When the investor receives it back 12 months later, it’s worth $40,000. Therefore, the investor has made long-term capital gains of $20,000.

Crucially, the capital gain is only realized if the investor sells their 1 BTC. If they don’t, no tax is required – as it hasn’t been disposed of.

When Do You Have to Pay Crypto Taxes?

In general, any capital gains or income made from crypto needs to be paid the following year. More specifically, ‘tax season’ runs between January 1st and April 15th each year, meaning you’ll need to pay within this time frame. This is why it’s crucial to get your crypto taxes in order.

Leaving things to the last minute can result in delays, meaning potential fines from the IRS. We would suggest keeping adequate records as you go along. However, if you’re an active trader, an even better idea is to use a crypto tax software provider. Examples include Koinly, CoinTracker, and CoinLedger, but many others exist.

CoinLedger offers a complete suite of useful tools to help users manage the crypto economy. Most crypto transactions take place across several mediums including DEXs, CEXs, hot and cold wallets, and much more. This makes it hard for traders and crypto enthusiasts to keep tabs on their portfolios and ultimately pay the necessary taxes.

This free crypto tax software gives traders the upper hand allowing them to navigate the crypto sector. It offers a complete suite of tools allowing all crypto users to easily track their holdings and generate tax forms quickly and efficiently. To try this leading cryptocurrency tax software follow the link below and let CoinLedger take the complexity out of crypto taxes once and for all.

These providers allow you to connect your exchange accounts and wallets via an API. The crypto tax calculator will then scan every transaction you’ve compiled, alongside the respective cost and disposal prices. Within minutes, your crypto tax report for the entire year will be generated. This gives you sufficient time to submit the report to the IRS and make a payment accordingly.

What’s more, tax software can also calculate income from the best crypto staking platforms and other DeFi products. This is particularly important if you’ve got multiple coins earning interest and distributions are being received daily. After all, attempting to calculate cost prices yourself will be cumbersome and time-consuming.

How to Report Cryptocurrency Tax

Once you’ve calculated your crypto tax for the year, the next step is to file your report with the IRS.

The general process is as follows:

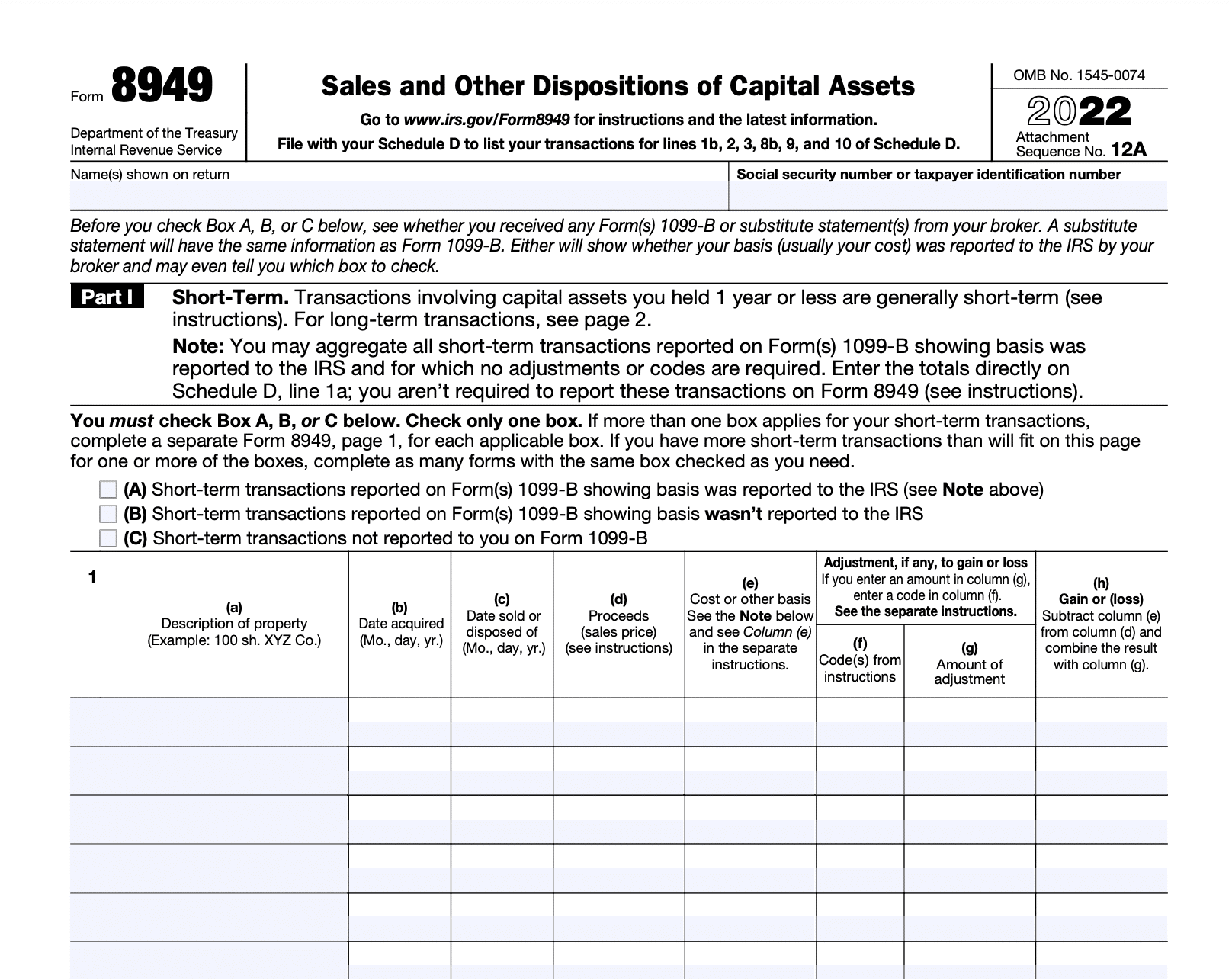

IRS Form 8949

First, you’ll need to complete IRS Form 8949. This form is used to report any capital gains or losses for the year. For each transaction, you’ll need to fill out the date you bought and sold the cryptocurrency, alongside the respective cost and sale prices.

This form is only for capital gains; we’ll come to crypto income shortly. Moreover, you should also add any other capital disposals made for the year, such as stocks, ETFs, or property.

Schedule D on IRS Form 1040

Now that you’ve totaled all of your capital gains and losses for the year, you’ll need to transfer the totals to Schedule D on IRS Form 1040.

Add Crypto Income to IRS Form 1040

Now that you’ve covered capital gains, let’s move on to crypto income. This also needs to be added to Form 1040, but in Schedule 1 under ‘Additional Income and Adjustments to Income’.

Submit to the IRS

Once you’ve completed IRS Form 8949 and 1040, you can submit them to the IRS. Just make sure this is done before tax season closes on April 15th.

Many investors will use a qualified tax advisor who has experience in crypto assets. They will calculate all of your taxes on your behalf, fill out the required forms, and submit them to the IRS.

Does the IRS Track Crypto?

As explained by CNBC, the IRS has many ways to track cryptocurrency investments made by US residents. The best crypto exchanges in the US, such as Coinbase, Gemini, and Kraken, are legally required to submit customer transactions to the IRS.

Therefore, if the IRS opens an investigation into your trading activities, you’ll want to hope you’ve previously submitted the right tax reports. If taxes have been understated, or not reported at all, serious penalties can apply. Moreover, the IRS has other ways to track your cryptocurrency transactions – even if you’ve made a withdrawal to a private wallet.

- For example, suppose you originally bought $10,000 worth of Ethereum on Coinbase. As a regulated exchange operating in the US, Coinbase conducts KYC on all registered users.

- Therefore, you would have had to supply Coinbase with your personal information and government-issued ID before making a purchase.

- You then withdraw your Ethereum to a decentralized wallet like MetaMask. You use MetaMask anonymously and connect it to a decentralized exchange like Uniswap. You then swap Ethereum for the Sandbox.

- At this stage, although you’re trading anonymously, your original Ethereum purchase is linked to your Coinbase account. Blockchain transactions are transparent, meaning all other transactions can be tracked.

Ultimately, we strongly advise that you correctly report all relevant cryptocurrency activities to the IRS. If you’re ever unsure of what needs to be reported, speak with a qualified tax advisor.

Are There Ways to Reduce How Much Crypto Tax You Pay?

Now that we’ve covered everything there is to know about crypto trader tax in the US, we can now discuss some tax avoidance strategies. Read on to discover legal ways to reduce your taxes on crypto.

Tax-Loss Harvesting

In simple terms, tax-loss harvesting involves purposefully selling a cryptocurrency investment at a loss. This is done for tax advantages, as the loss can be offset against capital gains for the year.

For example:

- The end of 2023 is approaching and so far, you’ve accumulated capital gains of $20,000.

- Let’s say that you’re still holding 1 BTC in your crypto wallet, which you paid $50,000 for.

- Right now, Bitcoin is trading at $40,000, meaning you’re down $10,000.

- If you sold your 1 BTC, some of the $10,000 loss could be offset against your $20,000 capital gains.

- Only $3,000 can be offset per year, but the balance can be carried over into following years.

Now, you likely didn’t want to sell Bitcoin; you did this to reduce your tax liabilities. Therefore, you could then repurchase Bitcoin, ensuring that you hold at least until the end of the year. This strategy of selling and re-buying isn’t allowed in the traditional investment scene, as it’s known as a ‘wash sale’. Instead, investors need to wait 30 days before rebuying the same asset.

However, Bitcoin is treated as property by the IRS and not a security like stocks and bonds. As such, the wash sale rule doesn’t apply to crypto assets. If you’re an active trader who still holds many different currencies, it can be difficult to know which investments to sell to benefit from tax-loss harvesting. In this regard, crypto tax software is the way to go.

Hold Your Crypto for at Least 12 Months

Another way to reduce your crypto taxes is to avoid selling for at least 12 months. In doing so, you’ll benefit from long-term capital gains rates. These are a lot more favorable than short-term capital gains, as we identified earlier.

For example, suppose you originally bought 5 BTC at $10,000 each, totaling $50,000. Each BTC is now worth $50,000, so your portfolio is valued at $250,000. If you sell today, that’s capital gains of $200,000. Selling within the 12-month period could mean paying a tax rate as high as 37%. Holding for at least 12 months means the most you can pay is 20%.

You should consider the risks of holding onto a profitable investment just to save tax. The crypto markets can be extremely volatile. Waiting for 12 months to pass could mean losing all of the gains you’ve secured.

Gifting Crypto to Somebody on a Low Tax Bracket

Another strategy is to gift cryptocurrencies to someone. More specifically, to someone in a low tax bracket.

Here’s how it works:

- Let’s say you own 1 BTC, which you originally paid just $2,000 for. Bitcoin is now worth $50,000, so your capital gains would be $48,000 if you cashed out.

- This could mean a huge tax bill as you’re in a high-income bracket. As such, you decide to gift the 1 BTC to a family member who is a low-income earner.

- Once you’ve made the transfer, you no longer own the Bitcoin, meaning you’re not required to pay tax.

The person who received the 1 BTC will inherit your original cost price, which was $2,000. If they sell it, they will have triggered capital gains of $48,000. However, as they’re in a low-income bracket, they pay significantly less tax.

Do note that the rules around gifting are very clear. The person receiving the crypto is the rightful owner. If they transfer the proceeds to you, they would be breaking the law. Additionally, we mentioned earlier that gifts of over $17,000 in 2023 need to be reported to the IRS. That said, this doesn’t mean that you’ll need to pay tax.

Donating Crypto to a Registered Charity

You might also consider donating crypto to a charity, which is another way to reduce or eliminate taxes. The donation can then be used to offset your taxable income. This is based on the market price at the time of the transfer.

For instance, suppose you bought 3 ETH when they were worth $500 each. ETH is now worth $1,500, so your investment is valued at $4,500. If you donate the 3 ETH tokens to a registered charity, you can offset the $4,500 donation as a tax-deductible.

Conclusion

In summary, crypto taxes in the US can no longer be ignored. Whether you’ve made capital gains or income, it’s likely you’ll need to submit a tax report to the IRS. That said, there are several tax avoidance strategies to consider before proceeding, such as tax-loss harvesting and ensuring you hold at least 12 months.

Overall, the best practice is to speak with a qualified tax advisor who has experience with crypto assets. Not only will they ensure you file your taxes correctly, but they might be able to help you reduce them.

References

- https://www.irs.gov/individuals/international-taxpayers/frequently-asked-questions-on-virtual-currency-transactions

- https://www.bloomberg.com/news/articles/2023-08-25/crypto-exchanges-to-report-customer-data-under-treasury-proposal?embedded-checkout=true

- https://www.cnbc.com/quotes/BTC.CB=

- https://www.irs.gov/taxtopics/tc409

- https://www.cnbc.com/2022/04/12/want-to-be-paid-in-bitcoin-or-dogecoin-here-are-the-rewards-and-risks.html

- https://www.reuters.com/legal/transactional/charitable-deductions-donating-cryptocurrency-nfts-tax-purposes-2022-07-25/

- https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

- https://www.cnbc.com/2023/03/25/what-cryptocurrency-investors-should-know-about-filing-taxes.html

FAQs

Do you have to pay tax on Bitcoin?

Tax needs to be paid if you sell Bitcoin at a profit. Fortunately, you can keep Bitcoin in your private wallet without paying tax, as capital gains are only realized on disposals.

How much tax do you pay on crypto?

Crypto trading tax depends on how much profit you made from the disposal and how long you held the tokens before selling. Taxes are more favorable when you hold for at least 12 months, as you’ll pay long-term capital gains rates.

Do you have to report crypto under $600?

The $600 rule is what US crypto exchanges need to report to the IRS. From a personal standpoint, you must report any crypto gains made during the year, irrespective of the amount.

Do I need to report crypto if I didn’t sell?

No, the IRS only considers crypto gains that have been realized, meaning you’ve already sold. No reports need to be filed while the crypto tokens remain in your wallet.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Eric Huffman

Eric Huffman

Sergio Zammit

Sergio Zammit