10 Best DeFi 2.0 Projects to Invest in 2024

DeFi 2.0 builds on the original decentralized finance ethos – with faster transactions, higher scalability, and cross-chain capabilities. Not to mention lower fees and access to a much broader range of investment markets.

This guide explores the 10 best DeFi 2.0 tokens to buy right now. Read on to discover the leading DeFi 2.0 projects for long-term upside.

Top DeFi 2.0 Tokens to Buy

The best DeFi 2.0 tokens to buy in 2024 are listed below:

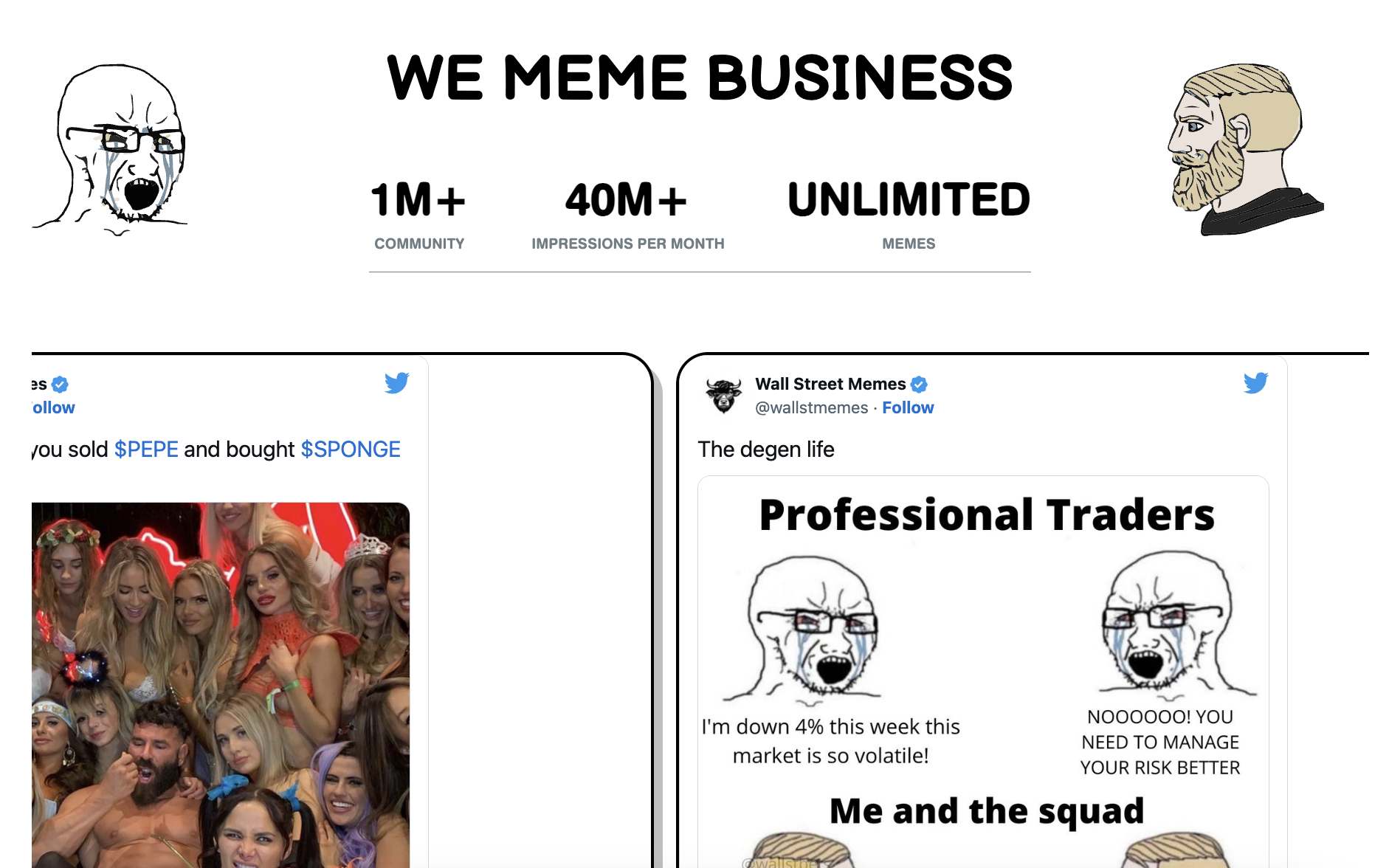

- Wall Street Memes: Overall, we like Wall Street Memes (WSM) as the number one DeFi 2.0 investment. This is a meme coin project with a huge following of over one million people – resulting in 40 million monthly impressions. Wall Street Memes has created a lot of hype in the crypto arena, having raised more than $9 million in presale funding. WSM tokens are selling for just $0.0298, but this will rise as the presale progresses.

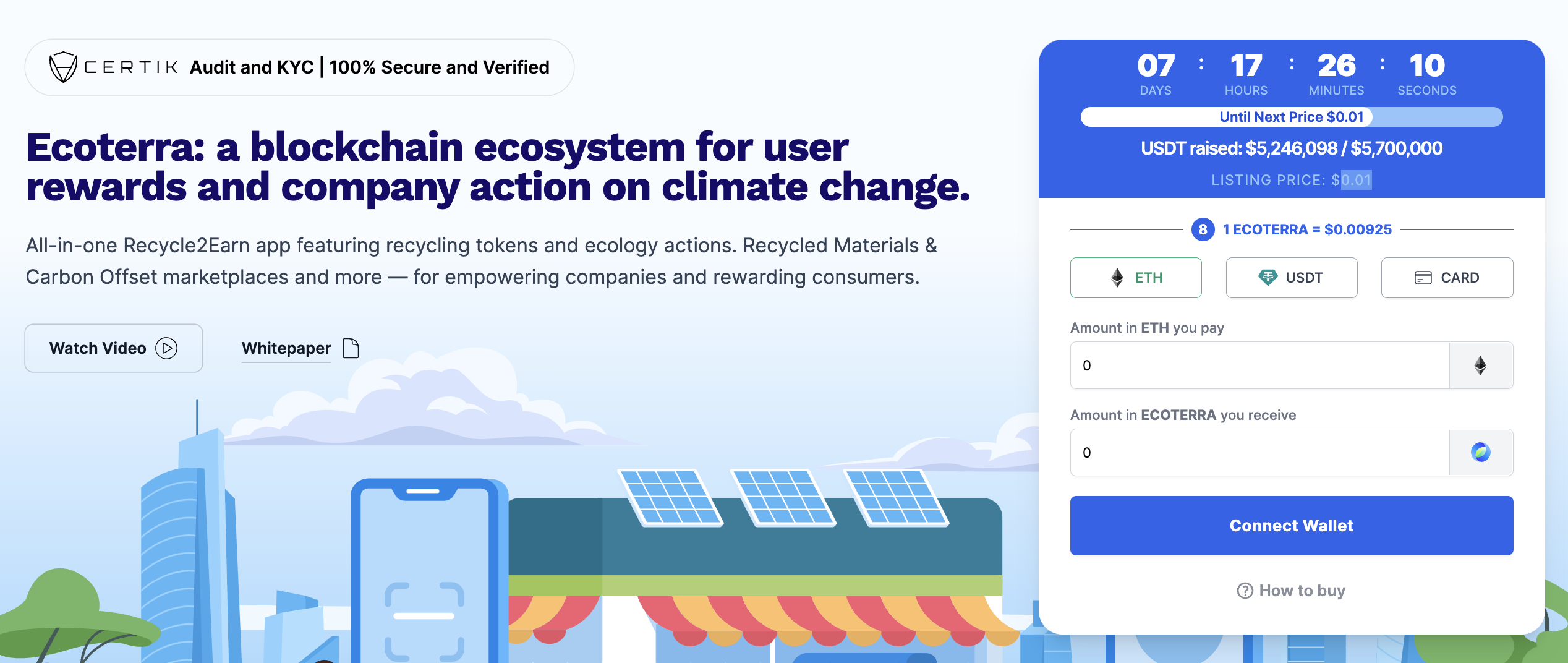

- Ecoterra: Ecoterra (ECOTERRA) is creating a sea-change in the recycling industry through a recycle-to-earn framework. People receive ECOTERRA tokens for recycling their unwanted goods, such as plastic bottles and cans. Additionally, the project allows people to reduce their impact on the environment via tokenized carbon credits. This is also a new cryptocurrency in presale. Ecoterra has raised over $5 million, and the current presale price is just $0.00925 per token.

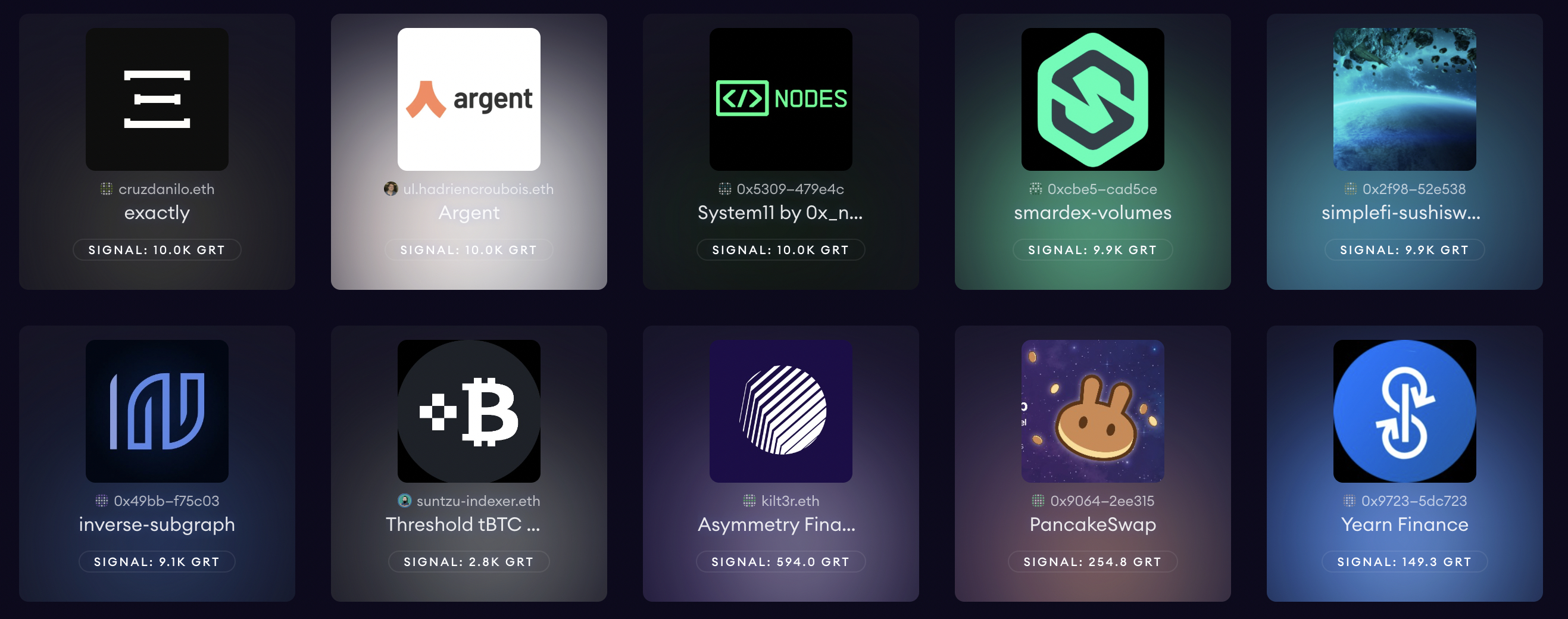

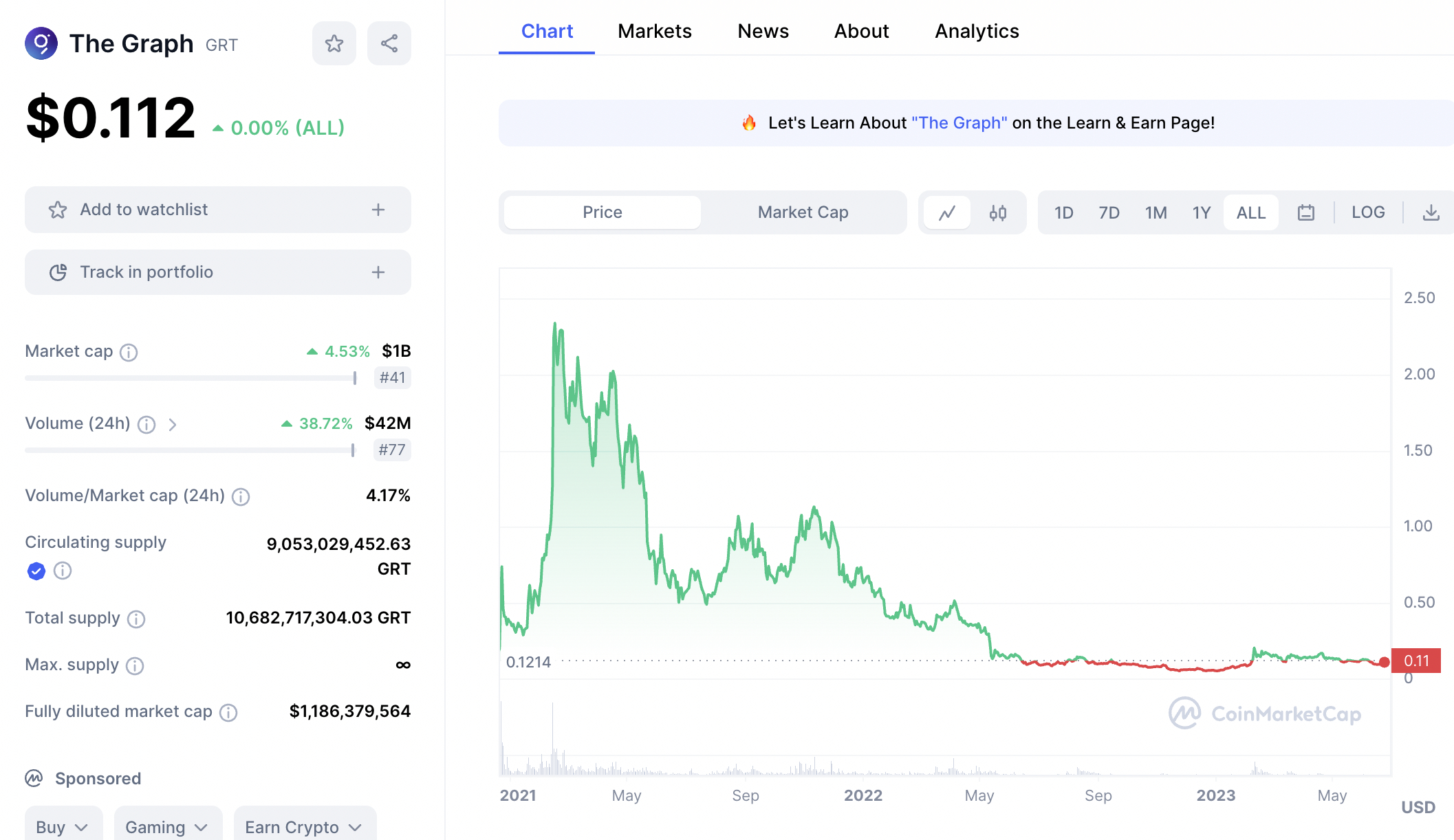

- The Graph: The Graph (GRT) enables DeFi projects to operate efficiently through blockchain indexing. It allows ecosystems to manage, store, and share data seamlessly, paving the way for faster and cheaper transactions. The Graph protocol serves over 30,000 projects and 450 indexer nodes. Developers pay fees in GRT tokens to query blockchain data.

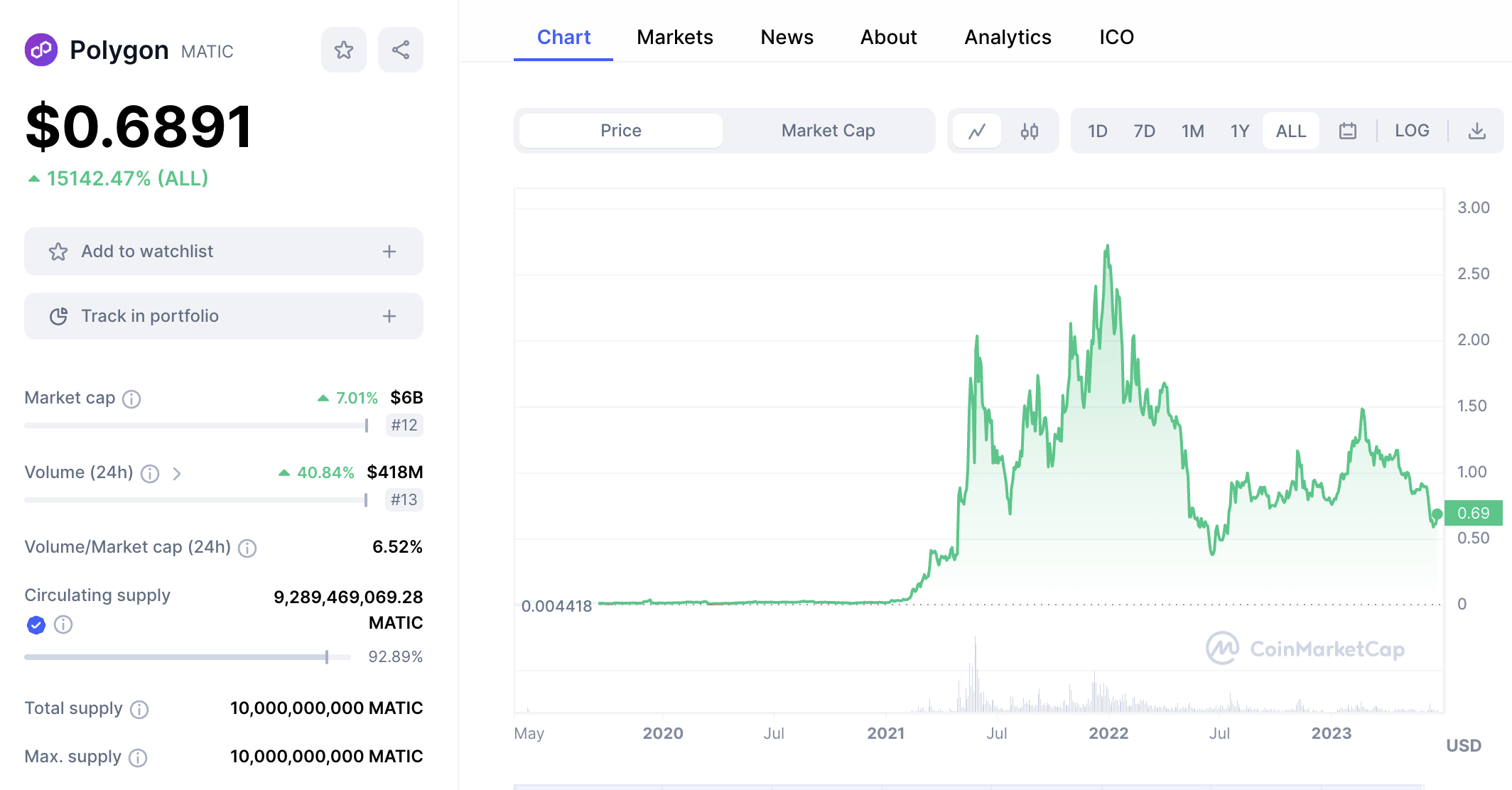

- Polygon: Polygon (MATIC) is a large-cap project that provides layer 2 solutions for DeFi 2.0 projects. It allows ERC20-standard ecosystems to increase their scalability, reduce fees, and increase transaction fees. More than 210 projects have bridged to the Polygon network.

- Hedera: Hedera (HBAR) is an open-sourced blockchain with superb performance. The Hedera network can facilitate transactions in just 5-6 seconds at an average cost of $0.001. Its ecosystem is used by a range of DeFi projects, including SaucerSwap, TOKO, Stader Labs, and Pangolin. The Hedera blockchain also supports smart contracts, making it ideal for the DeFi 2.0 landscape.

- Cosmos: Cosmos (ATOM) has developed the Inter-Blockchain Communication protocol, enabling projects to facilitate cross-chain functionality. This means that competing networks can share and swap data seamlessly without needing to go through a centralized entity. Nearly 250 projects are using Cosmos, including many DeFi 2.0 ecosystems.

- Chainlink: Chainlink (LINK) is primed to play a major role in the future of DeFi 2.0. It has developed a robust protocol that provides smart contracts with real-world data. Known as ‘Oracles’, this enables DeFi 2.0 ecosystems to bridge the gap between the real and decentralized worlds.

- RocketPool: RocketPool (RPL) offers a simple and secure way to stake Ethereum. Unlike centralized yield platforms, RocketPool deposits are secured by the Ethereum blockchain. This is an inclusive DeFi 2.0 project, with staking minimums of just 0.01 ETH.

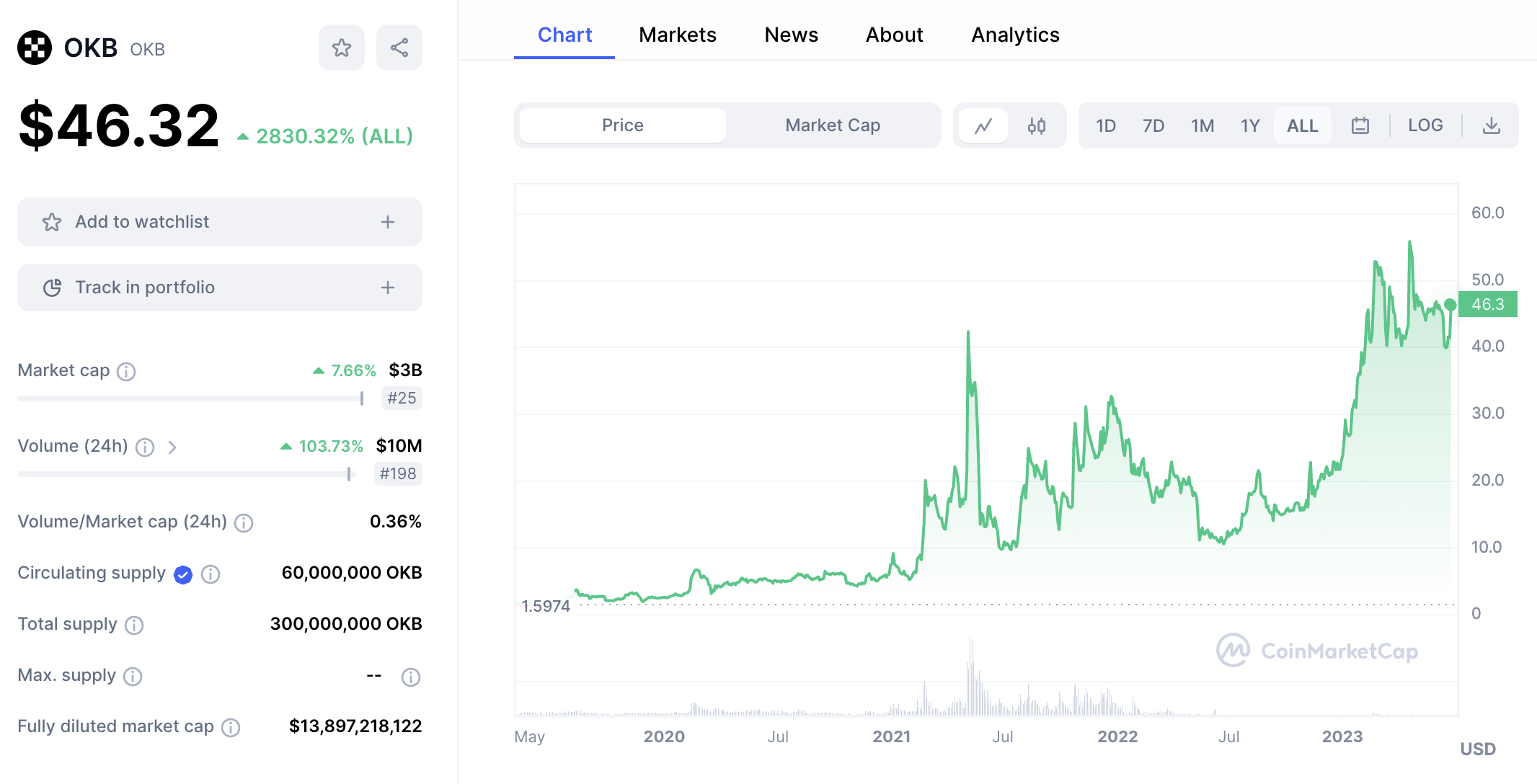

- OKB: Popular crypto exchange OKX is backed by OKB (OKB) tokens. Its decentralized Web 3.0 wallet supports DeFi 2.0 ecosystems, which bridges to over 200 exchanges and yield pools. The result is that OKX users can swap, stake, and lend cryptocurrencies at the best APYs – without leaving the wallet.

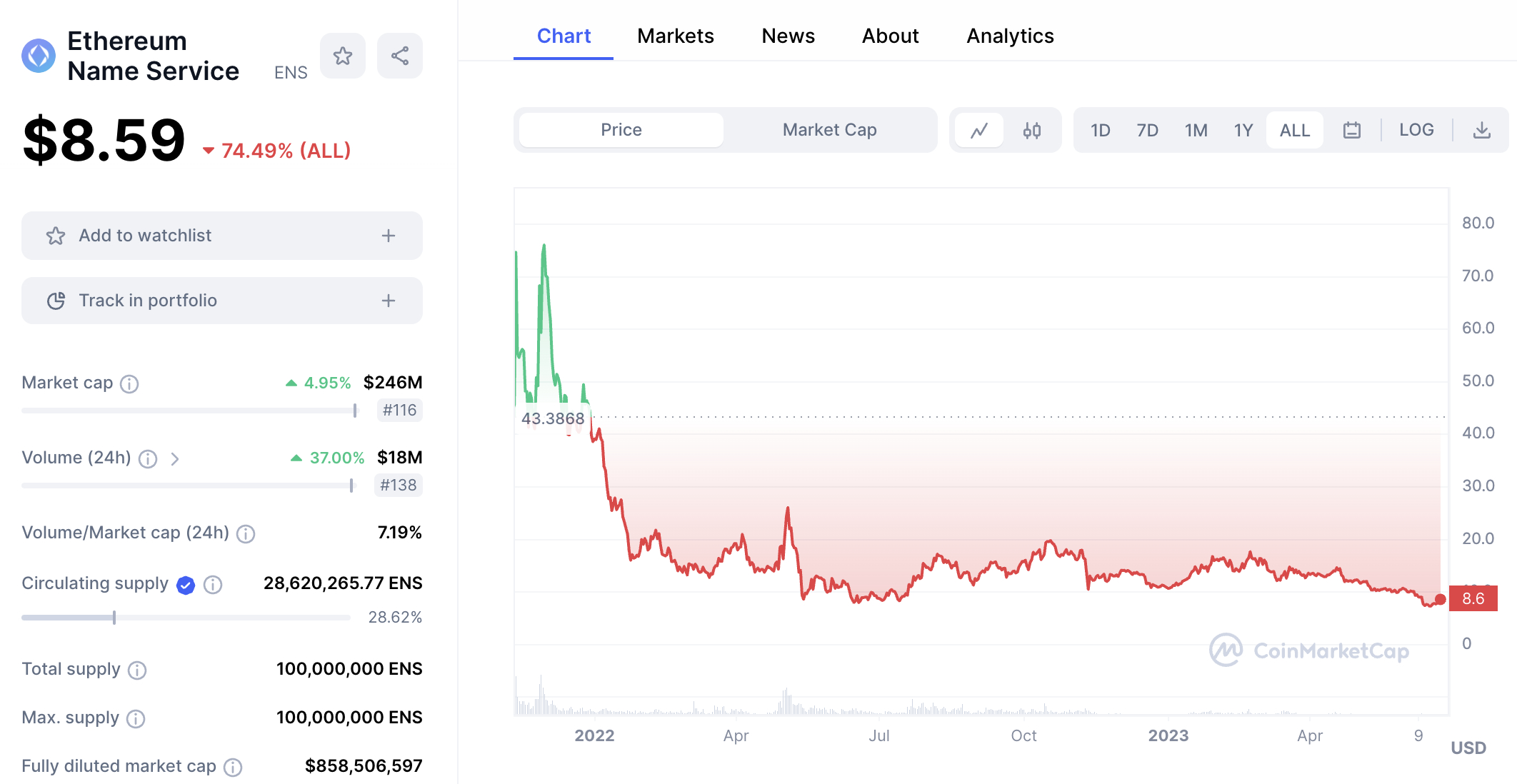

- Ethereum Name Service: Ethereum Name Service (ENS) is an innovative DeFi 2.0 project that supports .eth domains. It allows users to convert long and complex wallet addresses into simple usernames. This makes DeFi ecosystems more user-friendly and accessible for beginners. Nearly 700,000 people have already purchased an ENS domain.

What is DeFi 2.0?

Decentralized finance, or DeFi, is increasing its capabilities at a rapid pace. This industry allows the average citizen to access core financial services without going through middlemen. This includes banking, remittances, loans, insurance, and investment products.

But what is DeFi 2.0? Put simply, DeFi 2.0 extends the original DeFi landscape through real-world solutions. More specifically, it solves many of the issues found in the DeFi 1.0 arena. For example, many DeFi 1.0 ecosystems suffer from high fees and scalability restrictions. This is largely because most DeFi 1.0 projects are built on the Ethereum framework.

As stated by ETHTPS, those on the ERC20 standard are currently limited to 29 transactions per second. This overloads the network and results in high DeFi fees. The solution here comes from layer 2 solutions like Polygon and Arbitrum. These protocols support thousands of transactions per second, with fees costing a small fraction of a cent.

DeFi 1.0 also faced issues with liquidity, especially when facilitating peer-to-peer trades. This made many DeFi 1.0 exchanges inefficient, resulting in wide spreads and high slippage costs. The DeFi 2.0 frontier solves this through multi-chain bridges that can source liquidity from hundreds of different locations.

Another area that DeFi 1.0 was lacking is cross-chain capabilities. Innovative projects like Cosmos solve this through the Inter-Blockchain Communication protocol. This allows DeFi 2.0 ecosystems to connect with multiple blockchains, enabling consumers to trade cryptocurrencies with different network standards.

The inability of DeFi 1.0 platforms to connect with the real world was another pressing issue. Innovators like Chainlink solve this through decentralized Oracles. These provide DeFi smart contracts with reliable data from the real world. There is no risk of third-party manipulation, considering that Oracles derive from millions of sources.

Overall, DeFi 2.0 is an exciting concept that will take decentralized finance to the next level. People from all walks of life will be able to bank, transact, borrow, and trade in an efficient, fair, and democratic way. DeFi 2.0 also serves as a viable long-term investment. The industry is still in its infancy, so some of the best DeFi 2.0 projects are heavily undervalued.

A Closer Look at the Top DeFi 2.0 Projects

We will now analyze the best DeFi 2.0 coins with the greatest upside potential.

We cover the most important metrics for investors to make informed decisions. This includes the concept being developed and why it has the potential to revolutionize the future of finance.

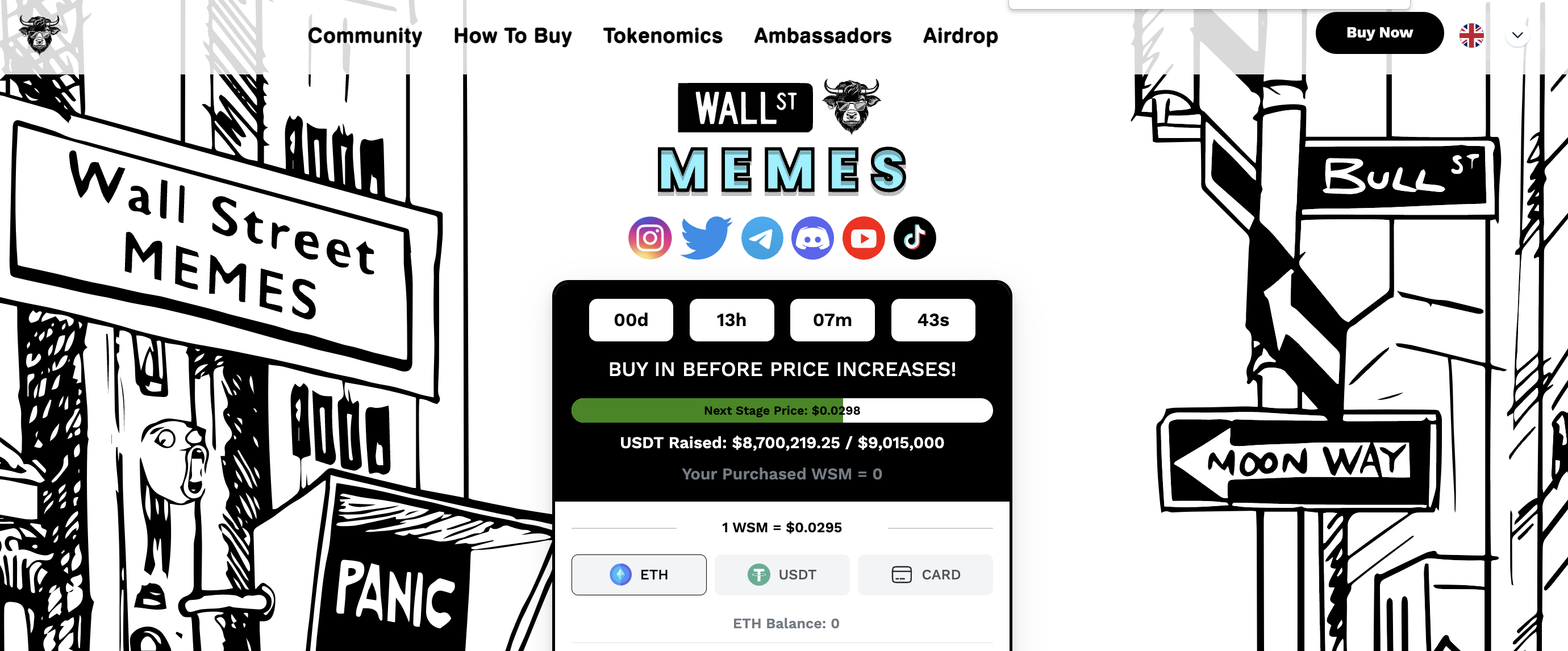

1. Wall Street Memes – Best DeFi 2.0 Token to Buy For Maximum Gains

We rank Wall Street Memes as the best DeFi 2.0 project for growth investors. This project is developing a community-driven ecosystem that shares an important message – financial inclusivity. It is based on the WallStreetBets ethos, where average citizens should have access to a fair and transparent financial landscape.

Wall Street Memes has a huge community of followers, who share, like, and collaborate on memes. The project claims its one million-strong army of supporters yields 40 million impressions each month. This exposure means that Wall Street Memes is one of the top trending cryptocurrencies in the DeFi 2.0 space.

In fact, Wall Street Memes is currently running a presale campaign that has already raised more than $9 million. This is unprecedented, considering the broader market conditions. While it should be remembered that Wall Street Memes is a meme-inspired project, presale investors believe that this could be the next cryptocurrency to explode.

After all, the best meme coins achieve success by creating hype and an active community of followers. Just like Shiba Inu and Dogecoin, Wall Street Memes meets both of these criteria. Additionally, Wall Street Memes is primed for a global marketing campaign that will create FOMO (Fear of Missing Out).

As per the Wall Street Memes whitepaper, the project is “allocating serious funds to marketing campaigns“. Those with a higher appetite for risk can invest in the Wall Street Memes presale with ETH, USDT, or a debit/credit card (KYC required). The current price of WSM tokens is $0.0298. This is a discounted price for early investors.

The presale price will continue to increase as each batch of WSM tokens sells. For instance, the next stage prices WSM at $0.0301. After the presale finishes, investors will receive their WSM tokens. WSM will then be listed on an exchange, allowing the general public to invest. Ultimately, Wall Street Memes is the best DeFi 2.0 for high-risk, high-return strategies.

2. Ecoterra – Bridging the Gap Between DeFi 2.0 and Sustainability

Not only is Ecoterra one of the best DeFi 2.0 tokens, but it’s also the most sustainable cryptocurrency to buy. Ecoterra is a new cryptocurrency project currently in presale – more on that shortly. Its concept focuses on the global recycling industry, which encourages people to recycle their unwanted consumables.

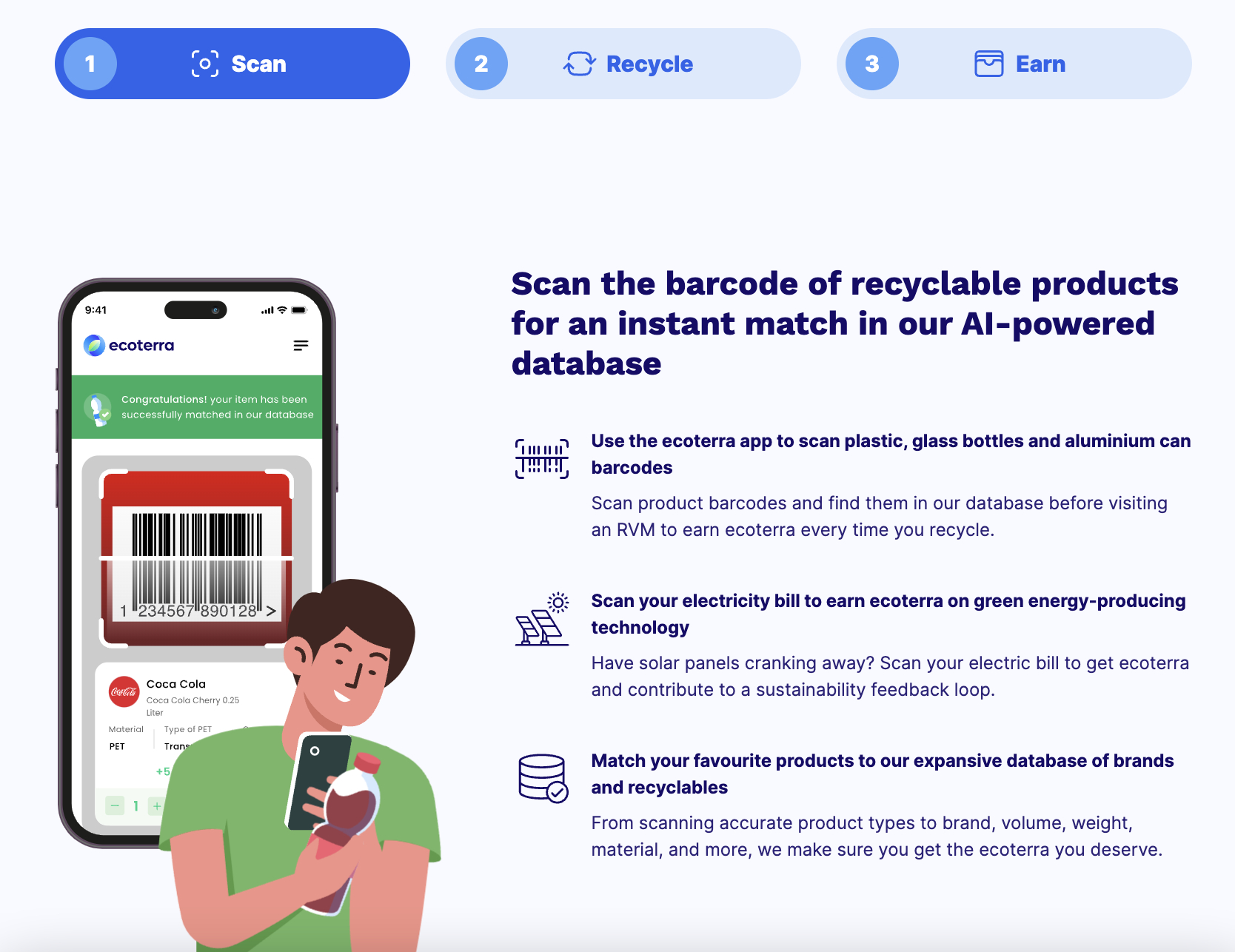

Ecoterra achieves this through an innovative recycle-to-earn mechanism. Put simply, people depositing plastics, tins, paper, clothing, and other recyclables into a reverse vending machine (RVM) will receive ECOTERRA tokens. The size of the reward depends on how much is being deposited.

The project will develop a global network of RVMs that collaborate with its proprietary app. Before depositing recyclables, users will scan the items. This creates a transaction on the Ecoterra network, ensuring that all recycle-to-earn rewards are trackable and transparent. Not only will users receive ECOTERRA tokens but an ‘Impact Tracker’ that can be shared online.

This highlights to others that the recyclables were deposited into an Ecoterra RVM. The Impact Tracker will also be used by brands that want to showcase their green credentials. Additionally, Ecoterra is also developing a recycled raw materials database. This allows the global supply chain to buy, sell, and transport materials at the best price possible.

What’s more, ECOTERRA tokens can be used as payment. ECOTERRA can also be used to fund sustainable projects and buy eco-friendly merchandise. Now onto the Ecoterra presale – which has raised over $5 million so far. ECOTERRA tokens can now be purchased at $0.00925. Payment can be made in ETH, USDT, or a debit/credit card.

3. The Graph – Decentralized Data Queries Through a Blockchain Indexing Protocol

The Graph is an innovative DeFi 2.0 project that specializes in blockchain indexing. Its decentralized protocol sorts, filters, and manages blockchain data. While this helps blockchain ecosystems operate more efficiently. it also enables developers to query data. This can be achieved without needing to manually sort through millions of transactions.

For example, through the Graph, developers can query DeFi transactions from hundreds of leading platforms. This provides real-time insights into investor trends. The data could then be used to make informed investment decisions. Another use case is aimed at DeFi exchanges like Aave, Compound, and Uniswap.

These projects use the Graph to source real-time data from liquidity pools. For example, how much is being staked and what APYs are available. Crucially, the Graph has many use cases within the DeFi 2.0 landscape. What’s more, the Graph is a self-sufficient project, as it charges fees when making blockchain queries.

Fees are payable in GRT, the native token of the Graph. According to CoinMarketCap, GRT has a market capitalization of $1 billion. This is just a fraction of its prior peak of over $5.3 billion. GRT tokens currently trade at $0.11. During the bear market, GRT hit highs of over $2.34. Therefore, GRT can be purchased for a significant discount.

4. Polygon – Layer 2 Solution for DeFi 2.0 Projects Seeking Scalable and Fast Transactions

Polygon is one of the best DeFi 2.0 projects for scalability. It enables ERC20 ecosystems, such as Uniswap, SushiSwap, Yearn.finance, and Aave, to offer DeFi services efficiently. Without bridging to the Polygon network (or another layer 2 solution), ERC20 projects face high fees and an inability to increase transaction throughput.

As noted earlier, this is because the Ethereum blockchain is still only able to process 29 transactions per second. This is the case even though Ethereum has completed its proof-of-stake upgrade. In contrast, Polygon can handle up to 65,000 transactions per second. This makes Polygon over 2,000 times more efficient than Ethereum.

Over 200 ERC20 ecosystems have already bridged to Polygon. Not only to increase scalability but to significantly reduce fees. According to Polygon, the average transaction fee is just $0.018. This makes DeFi investing and trading more cost-effective and viable, especially for small amounts. The Polygon network has its own native token, MATIC.

As per CoinMarketCap data, this is a large-cap cryptocurrency currently valued at over $6 billion. But like many of the best DeFi 2.0 cryptos, MATIC is trading at a bear market discount. At its peak, the project was valued at over $19 billion. Currently, MATIC can be purchased at $0.68, a discount of over 75% from its all-time high.

5. Hedera – Layer 2 Solution for DeFi 2.0 Projects Seeking Scalable and Fast Transactions

Hedera is a proprietary blockchain network that uses an asynchronous Byzantine Fault Tolerance (aBFT) hashgraph consensus mechanism. It has developed a high-performance ecosystem that enables projects to facilitate fast and low-cost transactions. According to Hedera, transactions average just 5-6 seconds.

This is at an average cost of $0.001. Hedera is also a sustainable blockchain that requires just 0.000003 kWh per transaction. The Hedera blockchain offers many use cases, including DeFi payments, decentralized trading, and NFT minting. Its network is already being used by multiple DeFi projects, including SaucerSwap, TOKO, Stader Labs, and Pangolin.

It also provides a home for DOVU, Hashport, and HSuite. More than $25 million worth of liquidity is currently locked in the Hedera network, which is small when compared to other ecosystems. That said, the network is active, with over 17,500 smart contracts processed in the prior 24 hours. Hedera has its own governance token, HBAR.

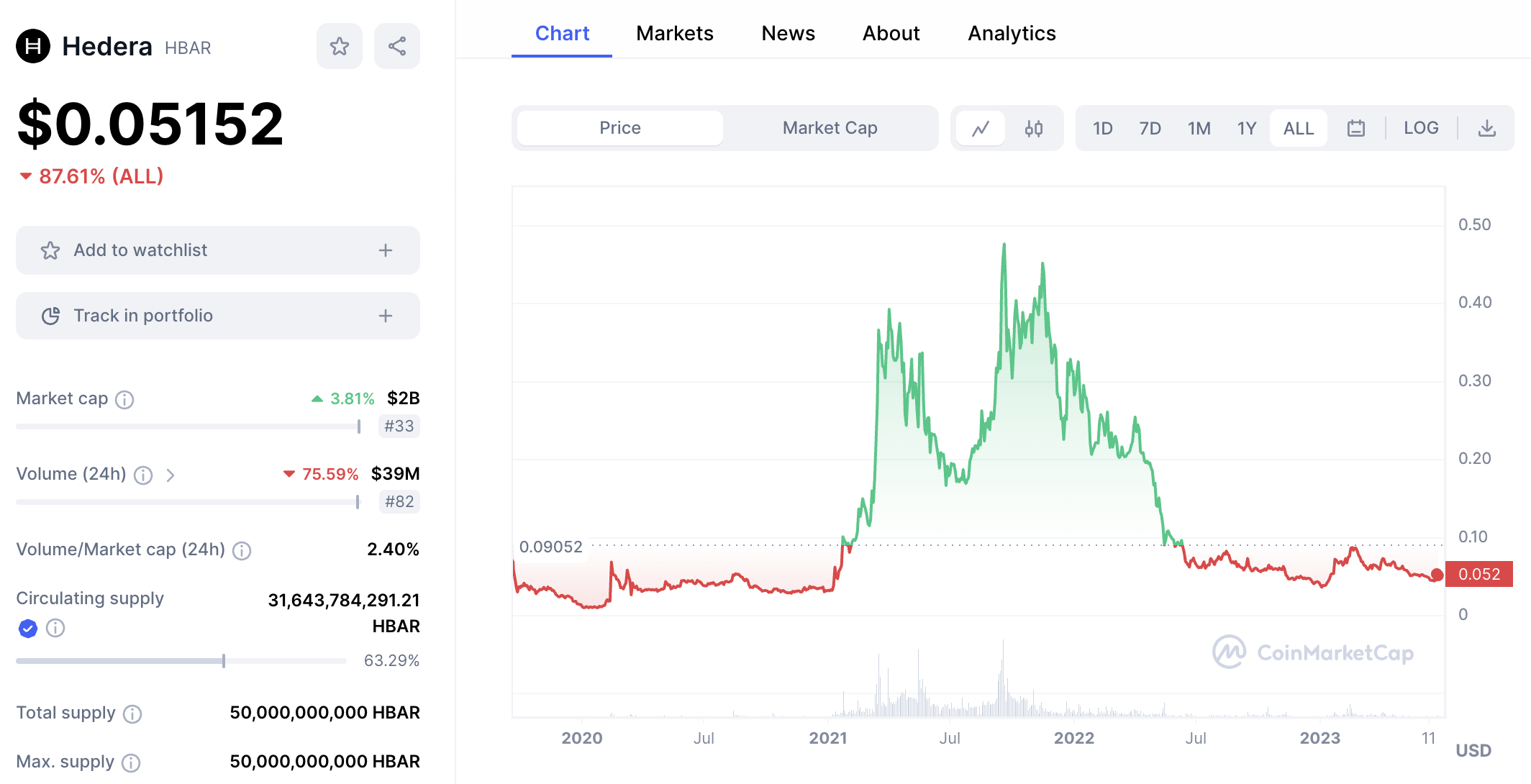

HBAR was launched in late 2019, with CoinMarketCap quoting an initial listing price of 0.09052. Like many DeFi projects, HBAR hit its all-time high in late 2021. While it peaked at $0.47, HBAR is currently trading at just $0.05. That’s a bear market decline of almost 90%. HBAR has a market capitalization of $2 billion, down from its peak of $6.7 billion.

6. Cosmos – Inter-Blockchain Communication Protocol Supporting Cross-Chain Transactions

Cosmos solves one of the biggest issues found in DeFi 1.0 – an inability to transact across two or more blockchains. Put otherwise, DeFi 1.0 would only allow projects to offer services within their respective network ecosystem. Cosmos solves this issue through its native Inter-Blockchain Communication protocol.

In simple terms, this interoperability allows blockchain networks to communicate with one another. For example, consider a DeFi 2.0 exchange that allows people to trade tokens anonymously and cost-effectively. Being compatible with Cosmos means that the exchange can offer cross-chain swaps. This means being able to swap XRP for Litecoin or Solana for Bitcoin.

Without interoperability, the exchange would require users to make the swap via a centralized platform. Additionally, Cosmos is also working on cross-chain liquidity. This will enable DeFi 2.0 projects to source liquidity from a much broader pool of networks. In turn, this will provide DeFi 2.0 investors with more competitive yields.

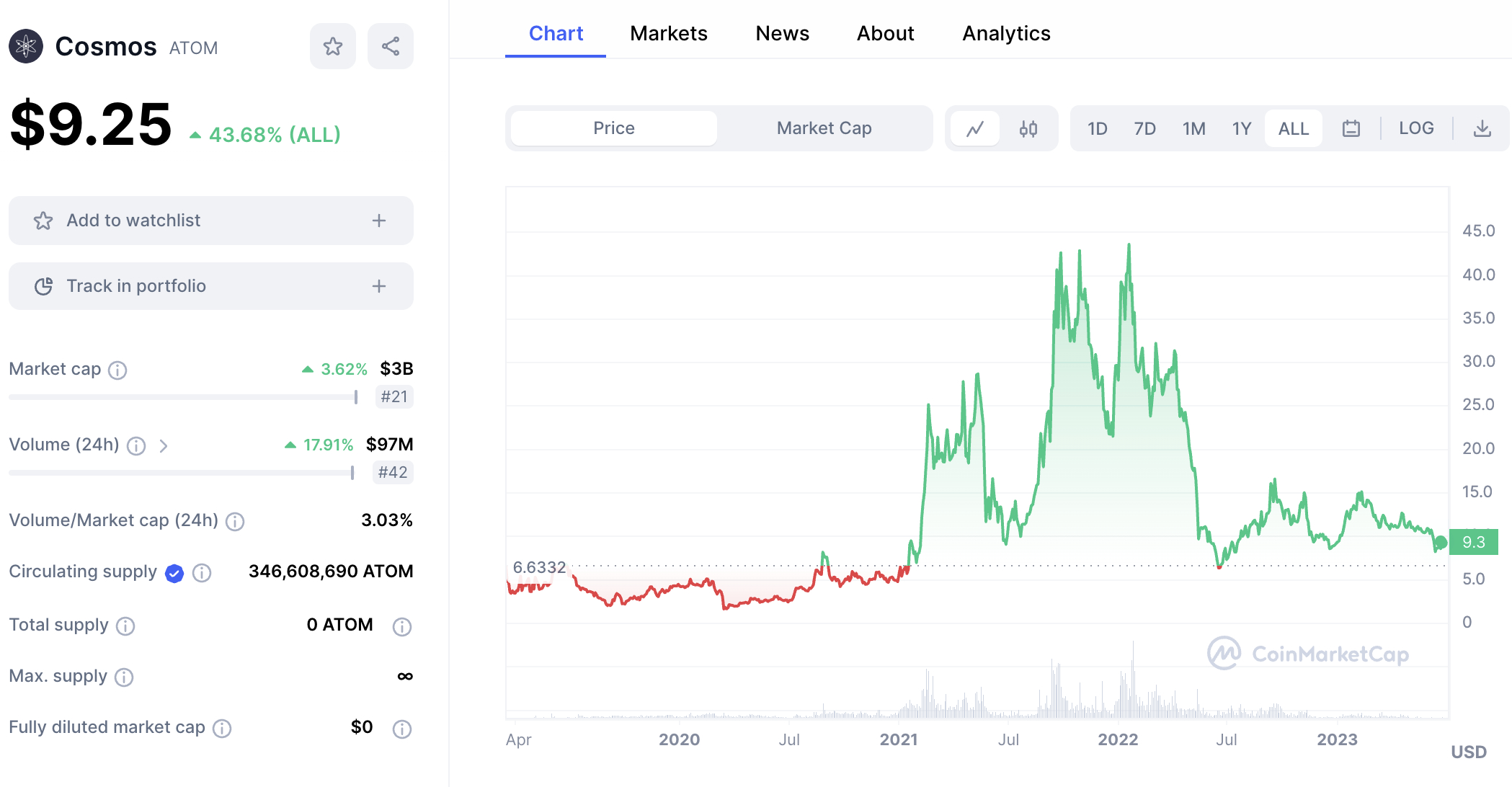

Cosmos, which was launched in 2019, has its own native token, ATOM. According to CoinMarketCap, ATOM is currently trading at just over $9 per token. Rewind to late 2021, and ATOM hit all-time highs of over $43. As such, this is one of the best DeFi 2.0 tokens for bear market discounts. After all, ATOM is trading 80% below its former peak.

7. Chainlink – Real-World Data for DeFi 2.0 Smart Contracts via Oracles

Chainlink will serve the DeFi 2.0 industry by providing real-world data to smart contracts. This solves yet another major shortcoming of the DeFi 1.0 landscape. So how does it work? Put simply, Chainlink uses Oracles to scan real-world data, using millions of sources to ensure information is credible, accurate, and unbiased.

This data is then fed to DeFi 2.0 ecosystems in real-time. The entire process is autonomous, decentralized, and facilitated via smart contracts. The use cases for Chainlink are virtually unlimited. For example, consider a DeFi 2.0 betting site that allows people to wager money on sporting events.

As soon as a sporting event has finished, Chainlink Oracles will provide the results to the platform. In turn, the platform can instantly payout winning bets without needing to manually check results. Another use case is in the insurance market. Consider a consumer that takes out insurance on an upcoming vacation. The premium paid includes flight delays and cancellations.

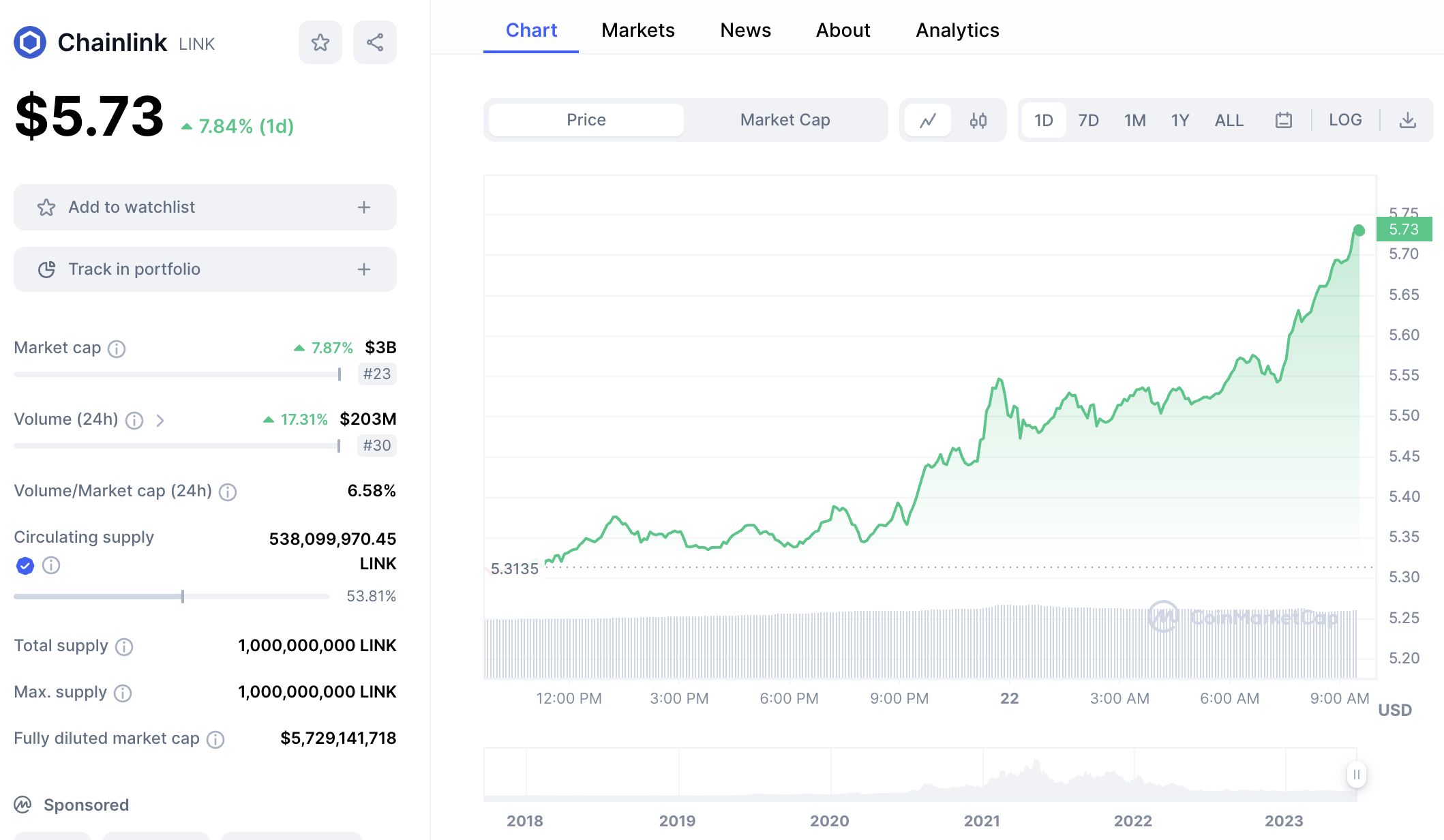

After the flight is canceled by the airline, the Oracle smart contract is executed in real-time. It provides this information to the insurance company, and the consumer is paid out instantly. No forms, and no delays. All Oracle transactions require LINK tokens, which are native to the Chainlink blockchain. Currently, LINK is valued at $3 billion, as per CoinMarketCap.

8. RocketPool – Earn Staking ETH Rewards Without Using a Centralized Platform

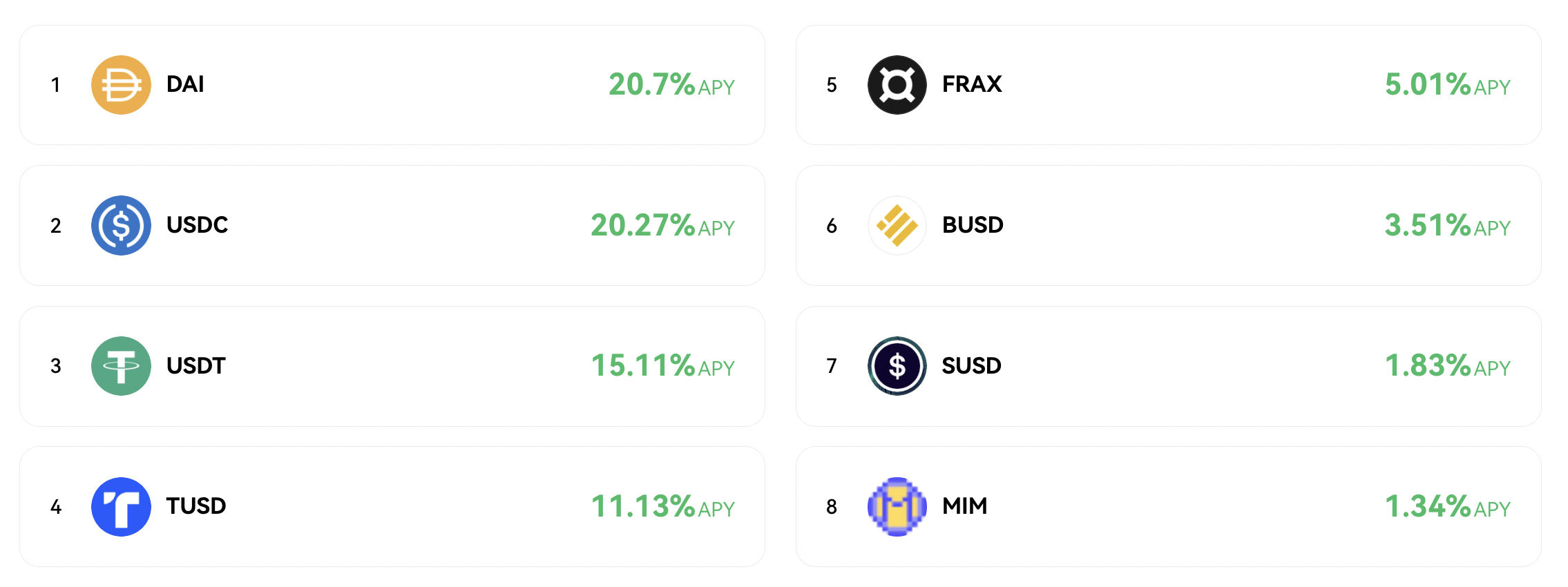

RocketPool is one of the best DeFi 2.0 projects for earning passive rewards. It supports Ethereum staking, with RocketPool APYs currently at 3.1%. The reason that RocketPool stands out is that it allows casual investors to stake ETH without needing a large upfront payment. After all, Ethereum requires staking validators to deposit at least 32 ETH.

In contrast, RocketPool offers the same service but with a minimum of just 0.01 ETH. Based on the current ETH price, just $19 worth of tokens is needed. With that being said, RocketPool offers much higher yields to those that deposit 8 ETH or more. Currently, the APY stands at 8.3%. Do note that this includes RPL rewards, the native token of RocketPool.

Nonetheless, RocketPool is considered a much safer way to stake ETH when compared to centralized exchanges. Its staking protocol is open-sourced, regularly audited, and comes with permissionless nodes. RocketPool also offers a bug bounty, rewarding developers that find vulnerabilities in its smart contract.

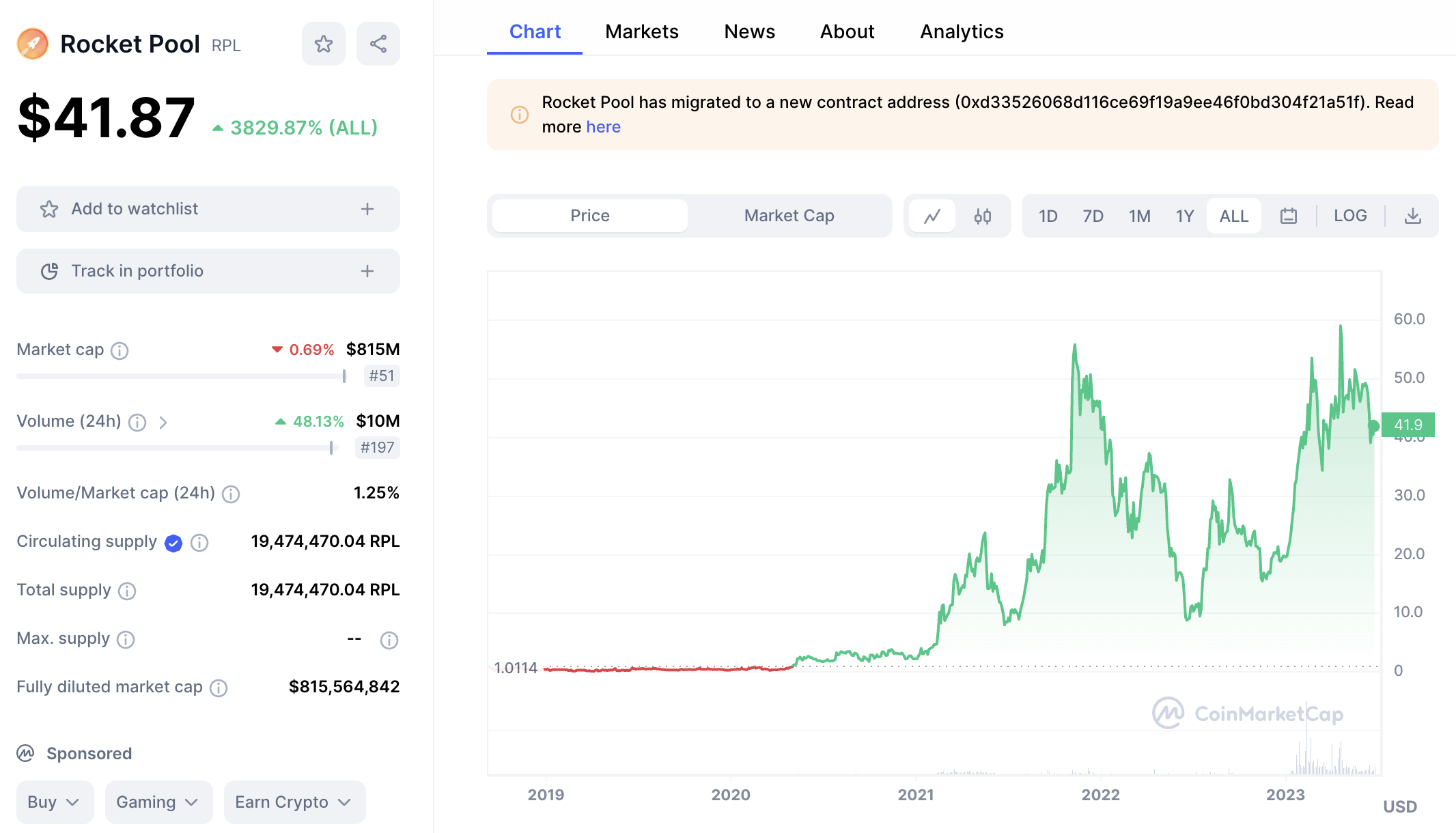

Perhaps the main drawback with RocketPool is that it does not support any other ERC20 tokens. From an investment perspective, RPL tokens continue to outperform the market. For example, while the majority of cryptocurrencies are trading at huge declines, RPL is up 336% over the prior year. Since its inception in late 2018, Rocket Pool has grown by more than 3,800%.

9. OKB – Native DeFi 2.0 Token of the OKX Web 3.0 Ecosystem

DeFi 2.0 and Web 3.0 operate hand-in-hand, and OKX could be the best ecosystem to bridge the two concepts together. OKX, which is backed by the OKB token, has developed one of the most robust and comprehensive Web 3.0 ecosystems. Connected to a decentralized wallet with MPC security, OKX supports a wide range of DeFi 2.0 products.

This includes anonymous token swaps across more than 50 blockchain networks. Users can trade thousands of tokens instantly and at the best market price. This is because OKX has developed a bridge protocol that aggregates prices from over 200 DeFi platforms. What’s more, DeFi 2.0 investors are fully catered for.

For instance, OKX supports staking, yield farming, and crypto deposit accounts. Its bridge protocol will scan over 200 platforms to find the highest APY for the respective token and product. Users can then complete their DeFi investment without leaving the OKX wallet. It is important to note that the OKX wallet is 100% decentralized.

The OKX exchange does not have access to the wallet’s private keys. This allows users to store their DeFi 2.0 investments safely, without using a third-party platform. The best way to invest in the OKX Web 3.0 ecosystem is via OKB tokens. According to CoinMarketCap, OKB has increased in value by over 314% in the prior 12 months. This makes OKB one of the best cryptos to buy.

10. Ethereum Name Service – Simplifying DeFi 2.0 Transactions and Wallet Addresses

Ethereum Name Service solves an ongoing issue, not only in the DeFi space but the broader blockchain economy. In a nutshell, the project allows Ethereum and ERC20 investors to purchase their own .eth domain. The chosen .eth domain can be used for various purposes, including receiving transactions.

For example, suppose somebody buys the ‘John.eth’ domain. In doing so, the user can receive ETH tokens to this domain, meaning there is no requirement to use long and complex wallet addresses. This simplifies the world of DeFi 2.0, as .eth domains are a lot more user-friendly and suitable for beginners.

What’s more, .eth domains are backed by unique NFTs on the Ethereum network. This enables users to transfer ownership of their domain to another person, potentially for a profit. In total, there are 2.73 million .eth domains for sale, and about 25% have been purchased so far. Another benefit is that .eth domains can be uploaded to IPFS.

The domain owner can then use their domain to create a censorship-free website. Many DeFi 2.0 projects have incorporated support for .eth domains. This includes everything from Rainbow, Trust Wallet, and Enjin to MetaMask, Steakwallet, and Keystone. Ethereum Name Service is backed by ENS tokens. As per CoinMarketCap data, ENS has a market capitalization of just $246 million.

How we Picked the Best DeFi 2.0 Coins

Picking the best DeFi 2.0 coins is a complex task, considering how many options there are in the market.

For this guide, we ranked the best DeFi 2.0 projects by the following criteria:

Contribution to the DeFi 2.0 Economy

Investors should assess how the project contributes to the DeFi 2.0 economy. More specifically, the chosen project should offer a concept that is unique. This will give the project the best chance possible of becoming mainstream.

For instance, we like that the Graph allows DeFi 2.0 ecosystems to index their blockchain data. This removes unnecessary clutter and manages data into easily filtered blocks. In other words, the Graph allows DeFi 2.0 projects to operate efficiently.

Polygon is another example of how a project can revolutionize the DeFi 2.0 arena. This is a layer 2 solution that supports ERC20 ecosystems. By bridging to Polygon, these ecosystems benefit from much lower fees and higher transaction throughputs.

Put simply, the best DeFi 2.0 coins solve issues that are prevalent in DeFi 1.0.

Token Use Case

The best DeFi 2.0 projects have a native token that serves a specific purpose. This ensures that people have a reason to buy the token, other than just for speculative reasons.

For example, Ecoterra offers token holders a wide range of benefits. This includes the ability to offset carbon footprints, invest in eco-friendly projects, and purchase recycled raw materials.

ATOM – the native token of Cosmos, is required to use its blockchain interoperability protocol. Blockchains pay fees in ATOM, giving it a real-world use case.

Upside Potential

Making money from a DeFi 2.0 investment is the primary objective. As such, investors should consider the future potential of their chosen project. A good starting point is to assess the market capitalization.

The market capitalization refers to the value of the DeFi 2.0 project. It is calculated by multiplying the number of tokens in circulation by the current price.

- For example, suppose a DeFi 2.0 token is trading at $1.

- If there are 100 million tokens in circulation, the DeFi 2.0 project has a market capitalization of $100 million.

So why does this matter? Well, for the greatest upside, investors should consider focusing on lower-cap projects. This is because the project has more room to grow. This is especially the case with new cryptocurrencies like Wall Street Memes and Ecoterra.

That said, DeFi 2.0 projects with a lower market capitalization will also witness increased volatility. This is the trade-off that needs to be considered when choosing the best DeFi 2.0 coins.

Current Price vs All-Time High

The crypto industry has been in a bear market since it peaked in late 2021. This is just the nature of the markets, which go through bull and bear cycles. While nobody wants to see their portfolios decline, the current bear market offers plenty of opportunities.

This is because some of the best DeFi 2.0 cryptos can be purchased at a fraction of their bull market highs.

For example:

- At its peak, GRT hit an all-time high of over $2.34

- Currently, GRT is trading at $0.11

- This means those buying GRT today will secure a discount of over 95%

It’s not just GRT trading at such sizable lows. This is the case with most cryptocurrencies in the market.

Ultimately, buying DeFi 2.0 tokens at bear market prices can pay off once the next bull cycle arrives.

Presale Opportunities

Not all DeFi 2.0 projects are established and trading on crypto exchanges. On the contrary, some of the best DeFi 2.0 tokens are yet to launch to the public.

Two examples include Wall Street Memes and Ecoterra.

Wall Street Memes is a newly launched meme coin that is currently in presale. It has already raised $9 million, showing that investors are bullish on its potential.

The presale – which will soon come to an end, offers investors a discounted price. This means once Wall Street Memes is listed on an exchange, presale investors will secure an immediate upside.

Similarly, Ecoterra is another DeFi 2.0 presale project that is attracting a lot of investor attention. Particularly those with an interest in green and sustainable concepts.

Ecoterra has developed an ecosystem that rewards people for recycling. It is also working with global suppliers to create a supply chain for recycled raw materials. The Ecoterra presale is still ongoing and has raised over $5.5 million so far.

While presales can yield above-average gains, they are also riskier than established DeFi 2.0 projects. As such, it’s important that investors create a well-balanced portfolio.

Why Invest in DeFi 2.0 Crypto Tokens?

Those unsure of DeFi 2.0’s potential should read on. We will now explain why DeFi 2.0 projects could witness unprecedented growth in the coming years.

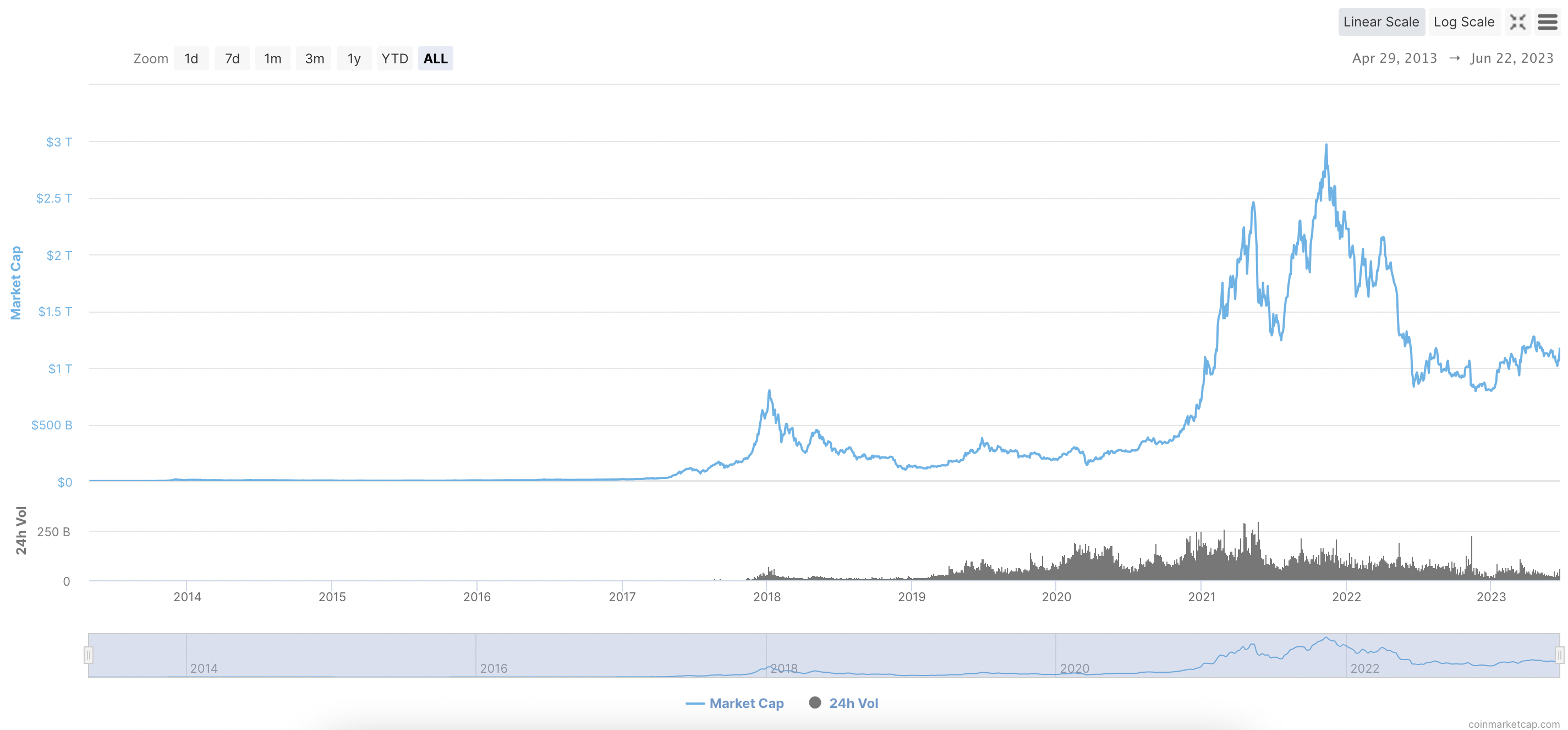

Huge Market Potential

The DeFi market has the potential to become a multi-trillion-dollar sector. After all, decentralized finance covers a vast range of traditional financial services. This includes everything from banking and insurance to interest accounts and trading.

According to CoinMarketCap, the total DeFi market is worth over $41 billion. This is the case even though many DeFi projects are trading over 70% below their all-time highs. Some have declined by 90% and more.

The key point is that based on current valuations, the upside potential of DeFi 2.0 could be sizable. And never has there been a better time to gain exposure, considering the discounts available.

Simple to Diversify

Another benefit of investing in DeFi 2.0 is that it offers plenty of opportunities to diversify. This is because there are many niches within the DeFi 2.0 space.

For example, one segment of the portfolio could focus on DeFi 2.0 projects with increased scalability. The importance of this should not be understated, considering how many DeFi transactions occur.

Polygon is a notable option here, with the layer 2.0 solution capable of 65,000 transactions per second. Polygon also facilitates cost-effective transactions.

Another area of the portfolio could focus on DeFi 2.0 trading. dYdX is worth considering for its decentralized trading suite. This not only supports leveraged crypto derivatives but anonymous accounts and near-instant payouts. These are features that will not be found in the traditional trading industry,

Some investors will also diversify into sustainable concepts. As noted above, Ecoterra has built a recycle-to-earn ecosystem. This will encourage people to recycle their plastics, cans, and glasses in return for crypto rewards.

Crucially, a diversified portfolio allows DeFi 2.0 investors to mitigate their risks. It also reduces the impact should an investment fail to take off.

Inclusivity

One of the core pillars of DeFi 2.0 is that traditional finance should be more inclusive. This means ‘banking the unbanked.’

- For example, according to the World Bank, more than 1.4 billion people still do not have access to a bank account.

- This also means a lack of everyday financial services, such as transferring funds, buying products online, or taking out loans.

DeFi 2.0 already solves many of these issues.

For instance, there are various platforms that support crypto loans. There is no requirement for borrowers to provide personal information – let alone a credit report.

Similarly, many DeFi 2.0 platforms support high-yield savings accounts. OKX, for example, sources interest rates from over 200 platforms. This offers a simple and transparent way to maximize savings.

DeFi 1.0 vs DeFi 2.0

Before investing in DeFi 2.0, it is important to understand why this niche market is needed. Similar to how we have Web 1, 2, and 3.0 – the DeFi landscape is constantly evolving and improving.

DeFi 2.0 is the latest version of decentralized finance, and it improves on the shortcomings of DeFi 1.0. For example, DeFi 2.0 allows platforms to offer cross-chain services. This means that transactions can take place between two or more blockchains.

Known as interoperability, this wasn’t possible in DeFi 1.0. As an example, DeFi 2.0 interoperability allows people to trade cryptocurrencies on two different networks. This is without using a centralized exchange. For instance, swapping Solana for Cardano or BNB for Bitcoin.

DeFi 1.0 also had major liquidity issues. There was no way for platforms to source liquidity from external providers while remaining decentralized. DeFi 2.0 solves this through bridge aggregators.

Put simply, a DeFi 2.0 platform can bridge multiple blockchains without using third parties. This is how OKX is able to support token swaps and yields across over 50 networks. Additionally, the majority of DeFi 1.0 was built on the Ethereum blockchain.

While Ethereum is a trusted framework with unparalleled security, it is also slow, expensive, and unable to scale past 29 transactions per second. Polygon, Arbitrum, and other layer 2 solutions solve this issue. This allows DeFi 2.0 projects to bridge to their networks for increased efficiency.

Conclusion

DeFi 2.0 is one of the biggest trends in the blockchain space right now. Many projects are building real-world solutions to DeFi 1.0 shortcomings, including Polygon, the Graph, and OKX.

From an investment perspective, Wall Street Memes stands out for us. This meme coin project – having already raised $9 million, could be one of the fastest-growing cryptocurrencies this year.

Those looking to secure a discount before the presale concludes can visit the Wall Street Memes website.

References

- pwc.ch/en/insights/digital/defi-defining-the-future-of-finance.html

- https://thegraph.com/

- https://coinmarketcap.com/view/polygon-ecosystem/

- https://hedera.com/

- https://cosmos.network/

- https://ens.domains/

- https://polygon.technology/

- https://www.blockchain-council.org/blockchain/solana-vs-polygon-vs-ethereum/

- https://coinmarketcap.com/currencies/polygon/

- https://hedera.com/use-cases/defi

- https://coinmarketcap.com/currencies/cosmos/

- https://coinmarketcap.com/currencies/chainlink/

- https://www.cnbc.com/quotes/ETH=

- https://coinmarketcap.com/currencies/rocket-pool/

- https://rocketpool.net/

- https://coinmarketcap.com/currencies/okb/

- https://coinmarketcap.com/currencies/ethereum-name-service/

FAQs

What does DeFi 2.0 mean?

DeFi 2.0 is the second generation of decentralized finance, providing the industry with cross-chain functionality, faster and more cost-effective transactions, and increased liquidity.

What are some DeFi 2.0 projects?

Examples of DeFi 2.0 projects include Hedera, Polygon, the Graph, RocketPool, and Chainlink.

What is the most promising DeFi 2.0 project?

The most promising DeFi 2.0 project is Wall Street Memes, a meme coin community that has raised over $9 million in presale funding.

Is DeFi 2.0 sustainable?

One of the core improvements made by DeFi 2.0 is that it is now sustainable and environmentally friendly, with projects using more efficient networks and layer 2 solutions.

Which DeFi project is best on Solana?

Some of the top DeFi projects in the Solana ecosystem include Mango, Orca, Drift Protocol, and Raydium.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Sergio Zammit

Sergio Zammit

Eric Huffman

Eric Huffman