7 Best Crypto Liquidity Providers in 2024

Liquidity is crucial when trading cryptocurrencies, or any asset class for that matter. Liquidity is required by exchanges, institutional clients, miners, and even individual tokens. This ensures smooth trading conditions.

Otherwise, markets will witness wide spreads, high slippage, delayed execution times, and increased volatility. This guide explores the best crypto liquidity providers, how they work, and why they’re important for the broader trading ecosystem.

List of The Best Crypto Liquidity Providers

Here’s a list of the best crypto liquidity providers for 2024:

- Cumberland – Crypto liquidity for institutional clients, including spot trading and non-deliverable forwards

- Galaxy Digital – Deep liquidity services for large-scale traders, brokers, hedge funds, and miners

- GSR Markets – A solid liquidity option for crypto projects at various life-cycle stages

- B2Broker – Established crypto liquidity provider for regulated CFD brokers

- Empirica – Liquidity services for 200+ crypto markets on decentralized and centralized exchanges

- GBE Prime – Crypto CFD liquidity for 10 pairs with ultra-fast latency and tight spreads

- B2C2 – Strategic liquidity partner for OTC and spot trading, derivatives, and structured loans

Best Crypto Liquidity Providers Reviewed

Let’s explore the above crypto liquidity providers list in more detail.

1. Cumberland – Crypto Liquidity for Institutional Clients, Including Spot Trading and Non-Deliverable Forwards

The first crypto liquidity provider to consider is Cumberland. It’s a global liquidity provider with offices in multiple jurisdictions, including the US, Canada, the UK, Japan, and Singapore. Cumberland’s target market is the institutional space. It ensures institutional investors can acquire or sell large amounts of cryptocurrencies without impacting the market price.

In terms of markets, Cumberland provides liquidity for four trading products. This includes spot crypto trading against multiple currencies, including USD, GBP, and EUR. This segment covers both centralized and decentralized exchanges. Cumbersome also specializes in listed options and futures for Bitcoin and Ethereum.

The platform offers bilateral options and non-deliverable forwards. The latter enables clients to settle forward contracts in cash rather than the underlying crypto asset. To become an approved counterparty, visit the Cumberland website and complete the application form. Most applicants receive a response within 3-4 business days.

| Crypto Liquidity Provider | Target Market | Key Products |

| Cumberland | Institutional clients | Spot trading, listed options and futures, bilateral options, non-deliverable forwards |

Pros

- Solid reputation with testimonials from Bloomberg and Goldman Sachs

- Covers multiple products, including spot trading and non-deliverable forwards

- Deals in multiple fiat currencies such as USD, GBP, and EUR

- Also provides liquidity to centralized and decentralized exchanges

Cons

- Listed options and futures only cover Bitcoin and Ethereum

2. Galaxy Digital – Deep Liquidity for Institutional Traders, Brokers, Hedge Funds, and Miners

Galaxy Digital bridges the gap between Web 3.0 assets and the traditional financial landscape. In addition to liquidity provision services, it also offers direct trading solutions. This includes a 24/7 global platform for over-the-counter (OTC) trading, plus lending and advisory services.

It also provides access to derivative products, including futures, forwards, swaps, and options. Galaxy Digital services several client types, including institutional clients who seek deep liquidity. It also serves trading firms that need to execute large orders with lightning-fast execution speeds.

Other clients include hedge funds, banks, and mining operations. Not only does Galaxy Digital have an excellent reputation for quality and reliability, but it’s listed on the Toronto Stock Exchange. This offers increased transparency that’s often not available with other liquidity providers.

| Crypto Liquidity Provider | Target Market | Key Products |

| Galaxy Digital | Institutional clients, including hedge funds and trading platforms. Also serves mining operations. | Spot trading, multiple derivative products, lending protocols, banks, Web 3.0 entrepreneurs |

Pros

- Trusted global liquidity provider with a TSE stock listing

- Serves multiple client types, including hedge funds and mining operations

- Also provides liquidity to lending protocols

- Covers derivative products like options and swaps

Cons

- Client onboarding can be slow

3. GSR Markets – A Solid Liquity Option for Crypto Projects at Various Life-Cycle Stages

We found that GSR Markets is the best crypto liquidity provider for projects. It serves crypto projects at all stages of the life-cycle journey, from new presale campaigns to established market leaders. GSR builds a custom liquidity strategy based on the project’s needs. This is based on expert-led market analysis and analytics.

Comprehensive risk management solutions are also included. Crucially, GSR Markets’s liquidity solutions solve many issues for projects. For instance, constant liquidity flows ensure the respective token operates in stable markets. This reduces the risks of volatility and high slippage.

What’s more, projects benefit from GSR Market’s expertise in hedging – meaning token prices can survive wider market downfalls. In addition to individual projects, GSR Markets also serves the best crypto exchanges. This helps centralized platforms build deep order books, meaning positive trading experiences even when volumes are down.

| Crypto Liquidity Provider | Target Market | Key Products |

| GSR Markets | Crypto projects (new and established), exchanges, mining operators, and financial institutions | Spot trading, futures, options, decentralized finance (including lending) |

Pros

- The best crypto liquidity provider for individual projects

- Serves crypto projects at all stages of their life-cycle journey

- Also provides liquidity to exchanges and mining companies

- Products include spot trading and decentralized finance

Cons

- OTC services require at least $250,000

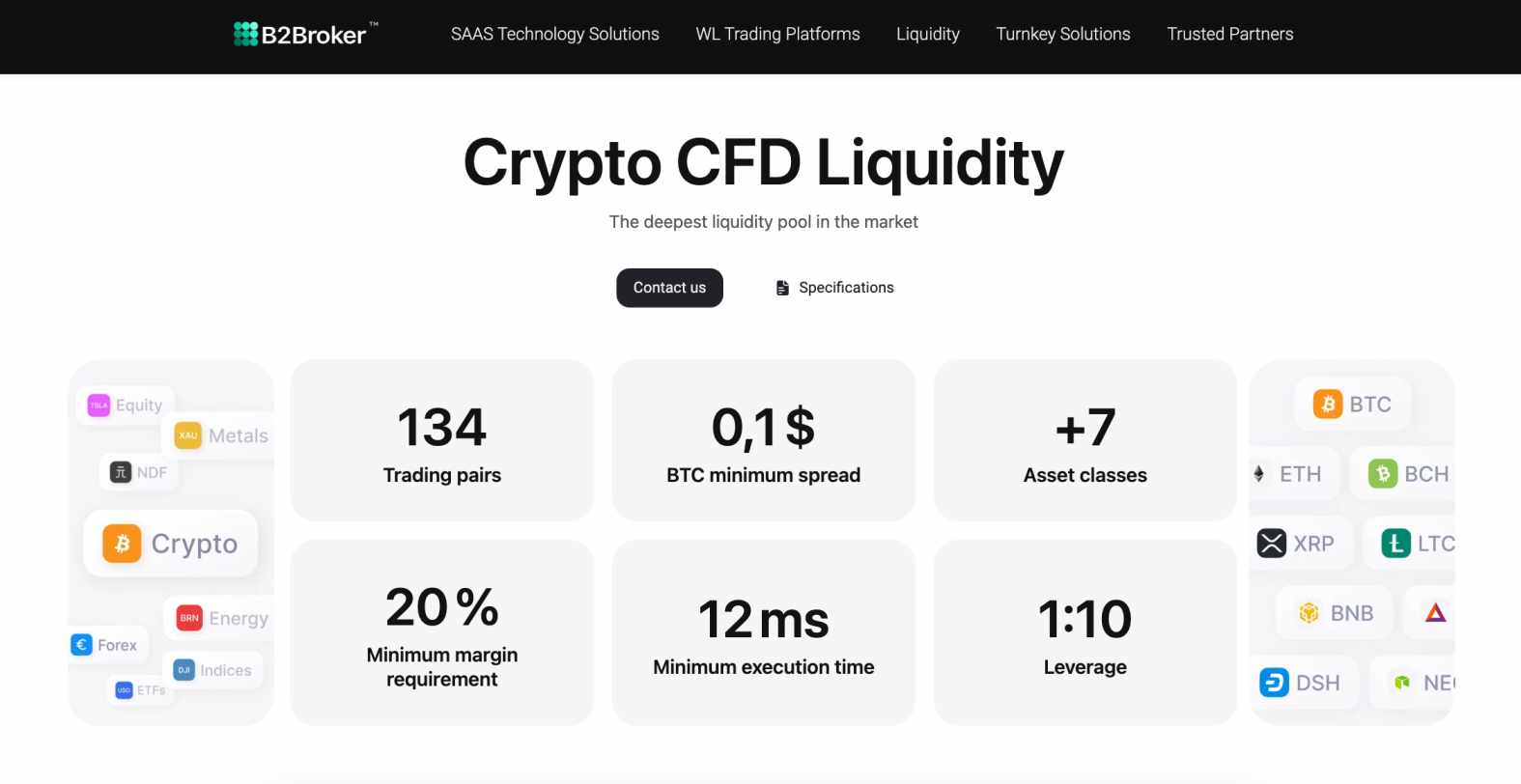

4. B2Broker – Established Crypto Liquidity Provider for Regulated CFD Brokers

Our research shows that B2Broker is the best crypto liquidity provider for derivative products. Founded in 2014, B2Broker operates in over 40 countries and has served more than 500 clients. Not only does it specialize in crypto liquidity but also other financial instruments. This includes everything from indices and forex to commodities and ETFs.

In terms of crypto derivatives, B2Broker mainly provides liquidity to regulated brokerages that specialize in contracts-for-differences (CFDs). Its promise of deep liquidity ensures that CFD brokers can offer low-margin trading services with tight spreads and minimal slippage.

It also ensures trades are executed with low latency times and fast execution speeds. Brokers can connect with B2Broker via traditional APIs, with leading providers including WebSocket and REST. In line with the wider crypto industry, GSR Markets offers liquidity services 24 hours per day, 7 days per week.

| Crypto Liquidity Provider | Target Market | Key Products |

| B2Broker | Regulated brokers offering crypto CFDs | CFDs for multiple markets, including crypto, forex, ETFs, and metals. |

Pros

- One of the best liquidity provides for regulated CFD brokers

- Promises fast execution speeds and low latency times

- Supports 134 crypto trading pairs

- Bitcoin trading spreads start from just $0.10 per slide

Cons

- Minimum margin requirements of 20% when trading crypto

5. Empirica – Liquidity Services on 200+ Crypto Markets for Centralized and Decentralized Exchanges

Incorporated in 2012, Empirica is an established software firm that has been providing crypto liquidity services since 2017. It supplies liquidity for more than 200 crypto markets via price-stabilizing algorithms. This enables exchanges to offer a smooth trading environment for their clients.

Not only regarding tight spreads and optimal market depth but also minimal slippage. Services are provided to both centralized and decentralized exchanges. What’s more, Empirica also serves individual projects, including some of the best crypto presales. In addition to liquidity, it advises on exchange listing applications and helps connect projects to the right people.

Empirica is also a solid option market making services. This helps exchanges stabilize market prices and meet trading volume targets. In terms of geographical reach, Empirica operates globally, with clients spread across Asia, Europe, and North America. It also has offices in multiple jurisdictions, ensuring clients receive a localized service.

| Crypto Liquidity Provider | Target Market | Key Products |

| Empirica | Centralized and decentralized exchanges. Also serves individual crypto projects. | 200+ crypto spot trading markets |

Pros

- Provides liquidity for over 200 crypto spot trading markets

- Used by centralized and decentralized exchanges

- Also provides liquidity and advisory services to new crypto projects

- Incorporated in 2012

Cons

- The website doesn’t offer the best user experience

6. GBE Prime – Crypto CFD Liquidity for 10 Pairs With Ultra-Fast Latency and Tight Spreads

GBE Prime is another top liquidity provider in crypto that serves CFD trading platforms. This licensed and reputable provider offers liquidity for 10 crypto pairs – including BTC/USD, ETH/USD, XRP/USD, and LTC/USD. Brokerages using GBE Prime can offer their clients competitive leverage levels, tight spreads, and low or zero commissions.

What’s more, GBE Prime offers some of the fastest execution speeds in the industry. Its liquidity services can be sourced via MT4 – which is one of the most popular trading suites for CFDs. GBE Prime is also a good option for brokerages that support other CFD asset classes.

This includes over 70 FX pairs, covering a blend of majors, minors, and exotics. Banks, fund managers, and professional traders also use its FX liquidity pools. Regarding technology, GBE Prime leverages FIX 4.4 APIs, known for ultra-low latency and reliable real-time pricing.

| Crypto Liquidity Provider | Target Market | Key Products |

| GBE Prime | Regulated brokers offering crypto CFDs. Also serves banks, fund managers, and professional traders | CFDs for 10 crypto markets, plus over 70 FX pairs. |

Pros

- Reputable liquidity provider for CFD trading platforms

- Offers tight spreads and fast execution speeds

- Key markets include BTC/USD, ETH/USD, and XRP/USD

- Leverages FIX 4.4 APIs for ultra-low latency

Cons

- Only 10 crypto pairs are currently supported

7. B2C2 – Strategic Liquidity Partner for OTC and Spot Trading, Derivatives, and Structured Loans

Last on this list of leading crypto liquidity providers is B2C2. Based in London and founded in 2015, B2C2 supplies liquidity to multiple end users. This includes OTC liquidity, ensuring institutional clients can execute large trades with minimal market impact. It also supplies spot liquidity for major cryptocurrencies.

For example, platforms can offer Bitcoin and Ethereum markets with tight bid and ask prices. B2C2 is also active in the crypto derivatives trading industry. It provides liquidity for leveraged products like perpetual futures and options. Structured loans are also popular with B2C2 clients.

This allows institutional investors to obtain financing on existing crypto holdings – ensuring liquidity is raised without selling. Liquidity can be provided in 25 currencies, including fiat and crypto. B2C2 serves clients in multiple global markets – it has offices in Europe, the US, and Asia. The onboarding process starts with an email inquiry.

| Crypto Liquidity Provider | Target Market | Key Products |

| B2C2 | Institutional clients, professional traders, and trading brokers/exchanges. | OTC trading, spot trading, futures, options, non-deliverable forwards, structured loans |

Pros

- Global liquidity provider with offices in London, New Jersey, and Tokyo

- Products include OTC and spot trading, derivatives, and structured loans

- Serves multiple client types – including financial institutions and brokers

- Associate member of the Futures Industry Association (FIA)

Cons

- The only contact method available is email

What is a Crypto Liquidity Provider?

Liquidity sits at the heart of any crypto trading market. It ensures traders can easily buy or sell their preferred coins. For example, suppose you want to invest $10,000 in Ethereum. Not only must the exchange have a trader who’s willing to sell $10,000 worth of Ethereum, but at your required price point. Otherwise, the trade won’t go through.

This is where crypto liquidity providers come in. They ensure that, even without active market participants, that $10,000 Ethereum sell order will get matched. That said, this example is how centralized exchanges work – as they rely on traditional order books. Liquidity on decentralized exchanges works differently.

This is because the best decentralized exchanges use automated market makers (AMMs). In simple terms, each trading pair has a liquidity pool. Let’s take SHIB/USDC as an example. Equal amounts of SHIB/USDC are added to a liquidity pool so anyone can swap SHIB for USDC (and vice versa) at the prevailing market rate.

Nonetheless, those pools still require liquidity from external providers. This can be a large liquidity provider or an independent trader who has some spare coins to invest. Either way, those providing liquidity – whether to centralized or decentralized exchanges – generate passive income. This is usually a percentage of any commissions generated.

We should also mention that some providers supply liquidity directly to the institutional space. This ensures that clients with large order requirements can buy or sell cryptocurrencies without having a notable impact on the market. This includes spot trading and more complex derivative products – such as futures, options, and forwards.

How to Choose a Crypto Liquidity Provider

Here’s what to consider when selecting a cryptocurrency liquidity provider:

- Target Market: Liquidity providers typically serve a specific market. For example, some provide liquidity to centralized and decentralized exchanges. This ensures exchanges offer smooth trading conditions around the clock. There are also liquidity providers that serve new crypto launches. This helps up-and-coming projects obtain liquidity for their respective tokens. Other target markets include institutional clients – such as hedge funds and banks. Large mining operators are often catered for too.

- Trading Products: Leading providers supply liquidity for a wide range of trading products. This typically includes spot trading markets against the US dollar, although other major currencies are often supported. Additionally, many liquidity providers specialize in crypto derivative instruments. This can include forwards, swaps, futures, options, and CFDs. Make sure your preferred product is supported before contacting the respective liquidity provider.

- Regulatory Framework: It’s important to choose a reliable crypto liquidity provider that companies with all relevant regulations. For instance, if your platform serves institutional clients in the US, the liquidity provider must be registered with the SEC and the Financial Industry Regulatory Authority. This is as per a recent SEC ruling, which covers all “significant liquidity-providing roles.” Other compliance areas include anti-money laundering and fair market practices.

- Established and Reputable: It’s best to stick with crypto liquidity providers that are established and reputable. Evaluate which organizations the provider has previously worked with. If it has provided liquidity to notable firms – such as investment banks and hedge funds, this is a good sign. Look for any press coverage that mentions the provider alongside endorsements, partnerships, and testimonials.

- Liquidity Size: Liquidity providers don’t have access to unlimited assets, so it’s important to be realistic about your expectations. For instance, if you’re a crypto startup that simply requires liquidity for a new token launch, then your options will be plentiful. However, centralized exchanges with millions of active traders will have much greater demands. Ensure your chosen liquidity provider can handle the required throughput.

Crypto Liquidity Providers vs Market Makers

Liquidity provision and market making are two different services. It’s important to understand how the two roles compare.

Liquidity Providers

Liquidity providers ensure that clients have enough liquidity to trade crypto in smooth market conditions. This includes centralized and decentralized exchanges, which must offer sufficient liquidity levels 24/7.

Otherwise, traders will experience wide spreads, high slippage, and increased volatility. Liquidity is also provided to crypto projects that launch a new token. Other end users include hedge funds, banks, and mining operations.

Market Makers

Although market makers also inject liquidity into crypto tokens and exchanges, they operate differently from conventional liquidity providers. For instance, liquidity is supplied through constant bid and ask orders, meaning there are always opportunities for traders to enter and exit positions.

They also provide order book depth, which enables traders to buy and sell at various pricing levels. Market makers also help stabilize prices, as positions are placed on both sides of the order book. New crypto projects also use market makers to artificially inflate trading volumes. This is because most tier-one exchanges have minimum volume requirements for listing a token.

| Liquidity Provider | Market Maker | |

| Role | Provide liquidity to the market | Trade assets to maintain liquidity |

| Focus | Long-term liquidity provision | Short-term liquidity management |

| Trading volume | Usually higher | Smaller, more frequent trades |

| Fees | Usually fixed fees or volume-based fees | Charges a spread based on the bid-ask |

Conclusion

In summary, we’ve highlighted the most trusted liquidity providers in the crypto market. We’ve covered multiple end users, including centralized and decentralized exchanges, not to mention individual projects, financial institutions, and mining operations.

Careful consideration should be made when choosing the best crypto liquidity provider. In addition to reputation and regulatory compliance, consider the prover’s liquidity scope and supported markets.

FAQs

What are the largest liquidity providers in crypto?

Some of the largest liquidity providers in crypto are Cumberland, Galaxy Digital, and GSR Markets. These providers serve multiple clients, including exchanges, OTC pools, banks, and individual crypto projects

How do you become a crypto liquidity provider?

Anyone can become a crypto liquidity provider – even if you only have a small amount of capital to lend. Some of the platforms you can provide liquidity to include Uniswap, SushiSwap, Binance, and Coinbase.

Who is the biggest crypto exchange liquidity provider?

Binance is the biggest exchange liquidity provider. It regularly injects capital into its order books to ensure sufficient liquidity for its 200+ million users.

How do liquidity providers make money?

Most crypto liquidity providers make money from a commission-sharing agreement. This means they earn a percentage of any trading fees paid when their liquidity is used.

References

- Non-Deliverable Forwards (Commodity Futures Trading Commission)

- What is a Liquidity Provider? (Futures Industry Association)

- SEC Adopts Rules to Include Certain Significant Market Participants as “Dealers” or “Government Securities Dealers” (SEC)

- Liquidity in Cryptocurrency (Corporate Finance Institute)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Eric Huffman

Eric Huffman

Sergio Zammit

Sergio Zammit