10 Best Coinbase Alternatives in 2024

As the largest publicly traded crypto exchange in the world, Coinbase provides a commonly used onramp for new crypto traders. However, dozens of exchanges offer a similar or larger selection, often with lower fees or other benefits. If you’re looking for a Coinbase alternative, we cover some of the best choices and detail the pros and cons of each in this guide.

Reasons to check out Coinbase competitors range from fees to selection to trading tools or even regional availability. We found websites like Coinbase that are well-suited to nearly every trader, whether you want to keep things simple or you need an advanced trading platform.

Let’s find out what each alternative to Coinbase has to offer in comparison.

Top 10 Best Coinbase Alternatives Listed

Here are our best Coinbase alternative platforms in 2024 ranked:

- eToro – Best crypto exchange with 30 million customers and beginner-friendly tools

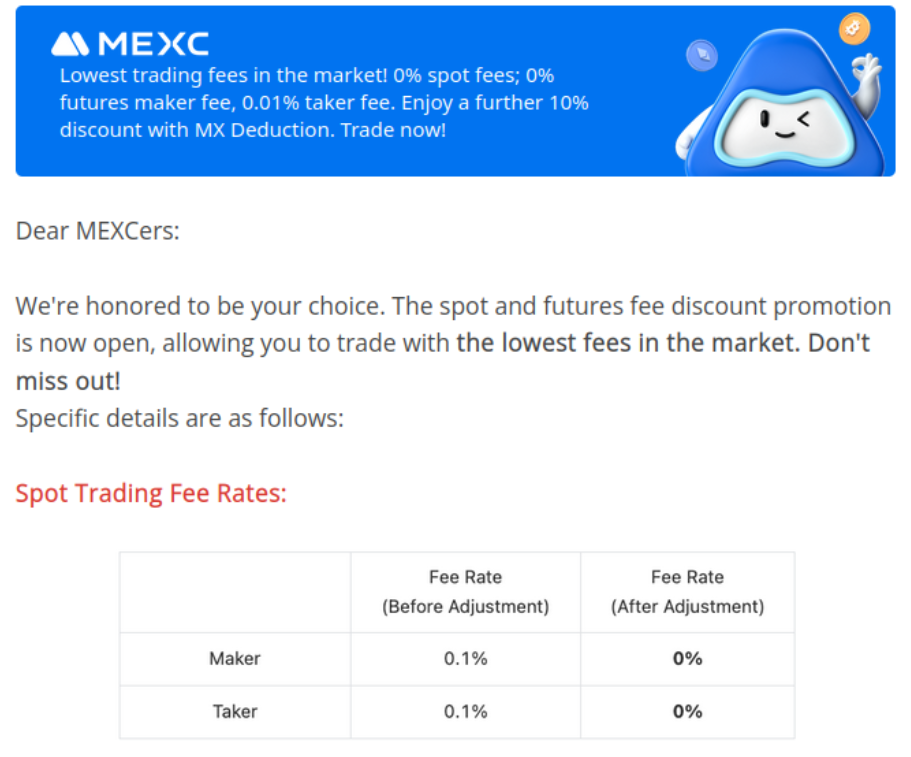

- MEXC – Nearly 2,000 tradable cryptos with no KYC requirement for trading

- OKX – Low trading fees combined with trading bots and other advanced trading tools

- ByBit – User-friendly exchange with low fees and high-level security features

- PrimeXBT – Non-KYC derivatives trading platform with $1 billion in daily volume

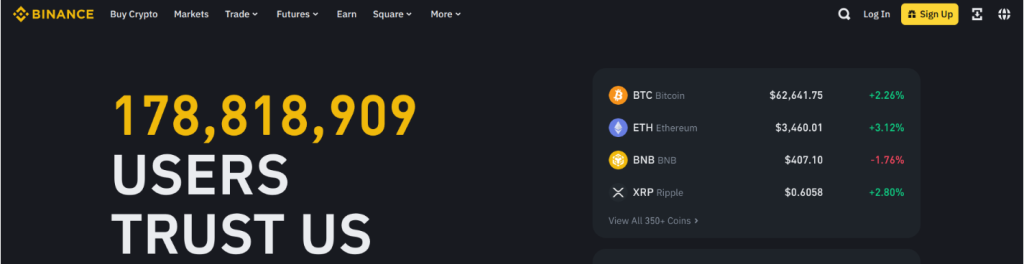

- Binance – $50 billion in daily trading volume makes Binance the world’s largest exchange

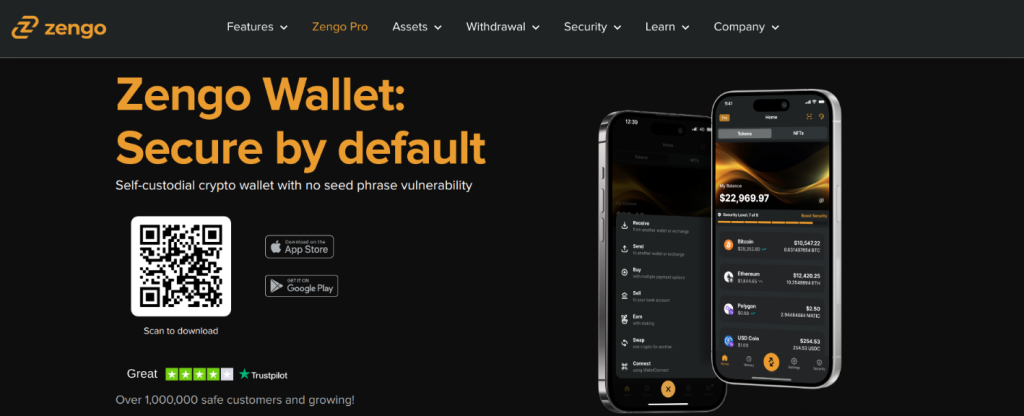

- Zengo – Buy and store your crypto in this self-custody wallet. Over 1 million users.

- Kucoin – Advanced trading for nearly 800 cryptocurrencies

- Margex – Low fees and up to 100x leverage for futures trades

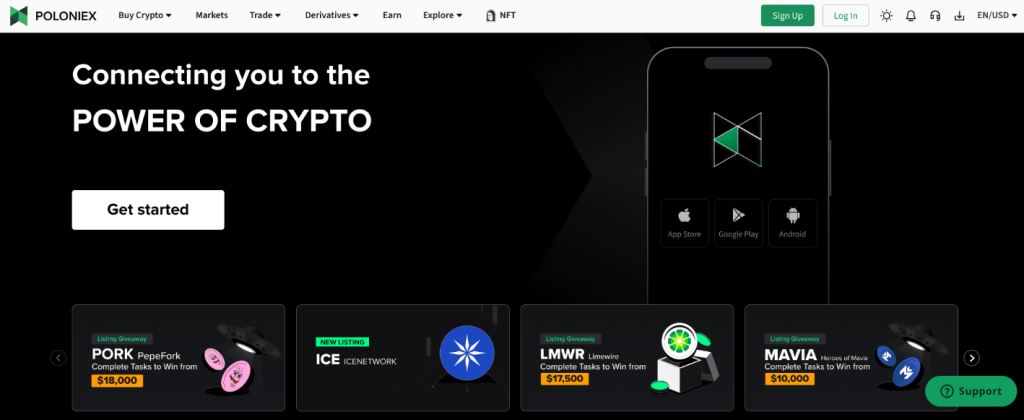

- Poloniex – Supports 500 cryptocurrencies and high staking yields without KYC

The Best Coinbase Competitors Reviewed

Let’s take a look at each in more detail and see how they compare to Coinbase.

1. eToro – Best Crypto Exchange and Ideal for Beginners

eToro is our top choice for the best crypto exchange in 2024. The popular platform offers various trading tools, and its clean interface is easy to use for beginners and advanced traders alike.

A feature that makes eToro very appealing to new traders is its innovative copy trading function, which replicates the orders of experienced investors automatically. Users can also choose to invest using Smart Portfolios, which are pre-selected collections of assets.

Traders can fund their accounts with debit/credit cards, bank transfers, or e-wallets. Another stand-out feature when comparing eToro to Coinbase is that its fees are some of the lowest in the industry, with a flat 1% commission fee to buy or sell crypto. On the other hand, Coinbase can have quite high fees across the board.

Operating since 2001, eToro has a strong reputation for security and is used by over 30 million traders around the world. The platform has a range of security features, including two-fact authentication (2FA). Customer support is available through live chat, email, and a 24/7 chatbot.

eToro also supports dozens of new cryptocurrencies and offers staking services for certain cryptocurrencies, providing an option to earn passive income on your holdings.

Pros

- Copy trading and social trading tools

- Active customer support

- Flat 1% fee

- Supports Bitcoin and the top altcoins

- Mobile app for Android and iOS

Cons

- Non-USD payments attract a 0.5% deposit fee

eToro vs Coinbase Compared

| eToro | Coinbase | |

| Trading Fees | 1% buy and sell fee | Simple trades: Variable based on trade amount ($3.84 for $100 trade) Coinbase Advanced: 0.6% limit order, 0.8% market order |

| Number of Cryptocurrencies | 70+ | 239 |

| KYC Required | Yes | Yes |

| Spot Trading | Yes | Yes |

| Advanced Trading Supported | Yes | Yes |

| Futures/Options Trading | No | Futures supported for qualified accounts |

2. MEXC – Best for Crypto Selection

MEXC offers the largest selection of cryptocurrencies in this roundup, boasting nearly 2,000 available crypto assets. This compares extremely well against Coinbase, which currently offers about 240 cryptocurrencies. Fees are also low, typically 0.1% for limit and market orders, although frequently lowered to 0.0% for promotions.

As a Coinbase alternative, MEXC brings three main advantages: low fees, massive selection, and no KYC requirements. KYC refers to identity verification, a common requirement for crypto exchanges. Privacy-conscious traders flock to MEXC for this reason. There is also an unrivaled selection of cryptocurrencies, allowing users to trade hard-to-find cryptos and newly listed tokens that aren’t available elsewhere.

MEXC offers both spot trading and futures trading, making the platform well-suited to intermediate and advanced traders. As a caveat, you can’t buy crypto with a bank transfer, and you’ll need to complete KYC before buying crypto with a debit or credit card.

Pros

- MEXC offers a vibrant futures trading platform for advanced traders.

- A massive selection of nearly 2,000 cryptocurrencies enables trading for hard-to-find cryptocurrencies.

- MEXC’s low fees let you trade in size while keeping more of your profit.

Cons

- MEXC does not support traders in the US and several other countries.

- Direct bank deposits aren’t supported.

MEXC vs Coinbase Compared

| MEXC | Coinbase | |

| Trading Fees | 0.1% limit order, 0.1% market order | Simple trades: Variable based on trade amount ($3.84 for $100 trade) Coinbase Advanced: 0.6% limit order, 0.8% market order |

| Number of Cryptocurrencies | 1,988 | 239 |

| KYC Required | No | Yes |

| Spot Trading | Yes | Yes |

| Advanced Trading Supported | Yes | Yes |

| Futures/Options Trading | Futures supported | Futures supported for qualified accounts |

3. OKX – Best for Learning Advanced Trading

The OKX exchange dates back to 2017, when it was called OKEx. Over the past several years, this Seychelles-based exchange has added new features and is now the world’s second-largest crypto derivatives trading exchange worldwide. While OKX offers many features optimized for advanced traders, OKX also provides tools to help newer traders find their way. These include a useful demo account and copy trading.

With more than 300 cryptocurrencies available for trading, OKX offers a wider selection of crypto assets compared to Coinbase, which has about 240. Fees for spot trades also come in considerably lower, with OKX at 0.1% or lower, whereas Coinbase Advanced charges 0.6% fees for limit orders and 0.8% for market orders.

Additional features of the OKX exchange include futures trading, with both dated futures and perpetual futures — as well as options trading, which is a rare find. OKX also provides a full-featured demo account that lets newer traders learn the ropes or allows experienced traders to test trading strategies.

Pros

- Demo trading lets traders learn trading basics and test trading strategies in real time.

- OKX’s copy trading lets you follow the moves of successful traders on the platform.

- Low fees for spot and derivatives trades allow more profitable trades.

Cons

- OKX is not available to US or Canadian traders.

- The OKX trading interface can be overwhelming to newer crypto traders.

OKX vs Coinbase Compared

| OKX | Coinbase | |

| Trading Fees | 0.08% limit order, 0.1% market order | Simple trades: Variable based on trade amount ($3.84 for $100 trade) Coinbase Advanced: 0.6% limit order, 0.8% market order |

| Number of Cryptocurrencies | 317 | 239 |

| KYC Required | Yes | Yes |

| Spot Trading | Yes | Yes |

| Advanced Trading Supported | Yes | Yes |

| Futures/Options Trading | Both | Futures supported for qualified accounts |

4. Bybit – User-Friendly Platform with Low Fees and Good Security Features

Dubai-based exchange ByBit is a comprehensive trading platform with features to suit all experience levels. Founded in 2018, it offers a user-friendly interface with a wide selection of over 400 cryptocurrencies.

One of its main draws is its perpetual futures products with leverage of up to 100x, but it also offers simplified spot trading for hundreds of cryptocurrencies. It also has a copy trading option where users can replicate the orders of other successful traders.

ByBit is known for its robust security features like 2FA, cold storage, anti-phishing codes, and multi-signature wallets. Traders have access to advanced trading tools such as order types, risk management features, and charting indicators.

ByBit also has a vast resource of educational materials to help users get to grips with the intricacies of the various trades supported, including perpetual and futures contracts and options.

Pros

- High leverage options on derivatives.

- Good resources and tools for new investors

- Comprehensive customer support

- Low fees

- Deep liquidity, over $50 billion traded daily

Cons

- ByBit is not available in all regions

- Fee structure varies

ByBit vs Coinbase Compared

| ByBit | Coinbase | |

| Trading Fees | Fees start at 0.1% for spot trading, with lower fees for VIP-level traders

Perpetual, futures, and options fees are 0.055% and lower |

Simple trades: Variable based on trade amount ($3.84 for $100 trade)

Coinbase Advanced: 0.6% limit order, 0.8% market order |

| Number of Cryptocurrencies | 432 | 239 |

| KYC Required | Yes | Yes |

| Spot Trading | Yes | Yes |

| Advanced Trading Supported | Yes | Yes |

| Futures/Options Trading | Both | Futures supported for qualified accounts |

5. PrimeXBT – Best for Non-KYC Derivatives Trading

The PrimeXBT exchange dates back to 2018 and has designed the platform around trade-execution speed, giving traders access to commodities, forex, crypto, and indices. Although more limited in its selection of tradable crypto assets, PrimeXBT hosts more than $1 billion in average daily volume on its platform.

It’s important to note that PrimeXBT offers contracts for difference (CFDs). In simple terms, you’re buying a contract based on the price of an asset rather than the asset itself. For short-term trading purposes, CFDs offer a functional equivalent to spot market trades. Profit or loss is based on your cost for the contract compared to the market price when you close your contract.

PrimeXBT is becoming better known for its crypto futures trading, a way for traders to bet on the future price direction for crypto assets. The platform also offers leverage trading, allowing up to 100x leverage on crypto trades to maximize potential profits. PrimeXBT uses your cash balance or crypto balance as collateral, with five cryptocurrencies supported for deposits.

Pros

- PrimeXBT does not require KYC identity verification.

- Copy trading lets you follow the trading moves of successful traders on the platform.

- Fast order execution and high liquidity improve trading efficiency.

Cons

- PrimeXBT focuses on CFD derivatives rather than spot trades or delivery futures.

- With no demo account, PrimeXBT is better suited to experienced traders.

PrimeXBT vs Coinbase Compared

| PrimeXBT | Coinbase | |

| Trading Fees | 0.05% limit order, 0.05% market order | Simple trades: Variable based on trade amount ($3.84 for $100 trade) Coinbase Advanced: 0.6% limit order, 0.8% market order |

| Number of Cryptocurrencies | 35 | 239 |

| KYC Required | No | Yes |

| Spot Trading | Contract for Difference (CFD) | Yes |

| Advanced Trading Supported | Yes | Yes |

| Futures/Options Trading | Both | Futures supported for qualified accounts |

6. Binance – Best for Deep Liquidity

Binance is still the 800-pound gorilla of the crypto world, with more than $50 billion in daily trading volume, making it the largest cryptocurrency exchange. The worldwide exchange offers over 370 cryptocurrencies for trading, giving traders access to a wider range of assets compared to Coinbase, which offers about 240. Binance also differentiates itself as a Coinbase alternative in several other ways, centering around advanced trading features.

Choose from spot trading, futures trading with perpetual contracts, dated futures, and crypto options. Binance also offers several popular options for power users, including trading bots that allow you to use pre-programmed bots or customized bots to trade according to rules you define 24/7. This feature is becoming more common for exchanges, including Binance and OKX, but is not available through Coinbase.

As the world’s largest crypto exchange by trading volume, Binance’s key strength comes in its liquidity. A massive worldwide market provides more efficient trading, whether you’re trading top names like BTC and ETH or lesser-known cryptocurrencies. Low trading fees help enhance trading profits as well. Binance charges 0.1% for spot trades, compared to 0.6% limit orders or 0.8% market orders on Coinbase Advanced.

Pros

- High liquidity lets traders enter and exit positions efficiently.

- With more than 370 cryptocurrencies, Binance offers many hard-to-find coins and tokens.

- Advanced trading tools like trading bots and copy trading let you put your trades on autopilot.

Cons

- Binance is not available to traders in the US or Canada. Limited options in the UK.

- Advanced trading features can make Binance more difficult to use for beginners.

Binance vs Coinbase Compared

| Binance | Coinbase | |

| Trading Fees | 0.1% limit order, 0.1% market order | Simple trades: Variable based on trade amount ($3.84 for $100 trade) Coinbase Advanced: 0.6% limit order, 0.8% market order |

| Number of Cryptocurrencies | 373 | 239 |

| KYC Required | Yes | Yes |

| Spot Trading | Yes | Yes |

| Advanced Trading Supported | Yes | Yes |

| Futures/Options Trading | Both | Futures supported for qualified accounts |

7. Zengo – Best for Purchasing Crypto Securely – Directly to Your Wallet

While not an exchange, per se, Zengo offers a newbie-friendly option for both secure crypto storage and purchasing crypto. The easy-to-use wallet removes the mystery from crypto wallets and supports purchases for over 120 cryptocurrencies.

The never-been-hacked Zengo Wallet uses a unique approach to crypto storage that’s designed to be easier to use. Traditional wallets center around mind-numbing private keys, a long string of letters and numbers, or easily misplaced 12 to 24-word recovery phrases. Instead, Zengo uses a two-part hidden key with one part saved on the Zengo servers and one saved on your device. If you lose access to your account, you can regain access using 3-factor authentication.

Buying crypto through Zengo is equally easy. The wallet app connects you to your choice of third-party providers, where you can easily buy crypto with your debit card or bank account. Payment options vary by region. The crypto you purchase is deposited directly into your self-custody Zengo Wallet, saving a step compared to Coinbase and similar exchanges.

Pros

- Support for top cryptos makes Zengo an easy way to get started with cryptocurrencies.

- Suitable for both beginner and seasoned investors

- Combined buying, selling, and storage saves steps compared to traditional exchanges.

- Three-factor authentication offers wallet recovery without cryptic recovery phrases.

Cons

- Purchase fees can be higher compared to Coinbase’s simple trades.

- A limited selection means you may not have access to newly launched cryptocurrencies.

Zengo vs Coinbase Compared

| Zengo | Coinbase | |

| Trading Fees | up to 5% | Simple trades: Variable based on trade amount ($3.84 for $100 trade) Coinbase Advanced: 0.6% limit order, 0.8% market order |

| Number of Cryptocurrencies | 120+ | 239 |

| KYC Required | No | Yes |

| Spot Trading | Third-party support for buying and selling | Yes |

| Advanced Trading Supported | No | Yes |

| Futures/Options Trading | No | Futures supported for qualified accounts |

8. Kucoin – Best for Staking Yield Opportunities

The Kucoin exchange is one of the largest in the world, serving over 200 countries worldwide and offering nearly 800 tradable cryptocurrencies. Trading veterans value Kucoin for the platform’s advanced trading features but also for access to newer cryptocurrencies that you won’t find on Coinbase.

Kucoin provides spot trading, margin trading, and futures trading with up to 100x leverage. Integrated TradingView charts provide more than 100 trading indicators to guide your next moves. Low trading fees on par with OKX, Binance, and MEXC come in at just 0.1%, a fraction of the cost of trading on Coinbase Advanced, depending on trade type.

Another notable benefit centers on staking. Kucoin offers many more ways to put your crypto to work compared to simpler platforms like Coinbase. Like Coinbase, Kucoin offers ETH staking but also supports staking dozens of other cryptocurrencies. This allows you to earn a yield while Kucoin does the legwork of finding the best ways to deploy your crypto assets.

Pros

- A wide range of staking opportunities allows investors to earn yields on crypto investments.

- Kucoin’s nearly 800 tradable cryptocurrencies include many newer crypto assets not available on Coinbase.

- Kucoin’s customizable trading bots let you define the conditions for trades to execute for automated trading.

Cons

- Kucoin does not support trading for US residents.

- A lack of clarity for staking program limits informed decision-making.

Kucoin vs Coinbase Compared

| Kucoin | Coinbase | |

| Trading Fees | 0.1% limit orders, 0.1% market orders | Simple trades: Variable based on trade amount ($3.84 for $100 trade) Coinbase Advanced: 0.6% limit order, 0.8% market order |

| Number of Cryptocurrencies | 765 | 239 |

| KYC Required | Yes | Yes |

| Spot Trading | Yes | Yes |

| Advanced Trading Supported | Yes | Yes |

| Futures/Options Trading | Futures supported | Futures supported for qualified accounts |

9. Margex – Best for Non-KYC Margin Trading

As its name suggests, Margex is a popular choice for crypto margin trading. Trade with up to 100x leverage using futures markets. The derivatives exchange works with 12+ liquidity providers to help ensure vibrant trading markets for top assets like BTC, ETH, and more than 30 other cryptos.

Margex provides advanced functionality with an intuitive trading interface and offers tools to help newer traders get started with futures trading. A live demo of the platform provides a preview without registration. Registered users can use a demo account with virtual funds to practice trading against live-market price action. This lets you test your trading strategies without risk.

While Margex doesn’t offer spot trading yet, you can fund your account with any of a dozen cryptocurrencies available from third-party providers using more than 150 payment methods. You can also deposit cryptocurrency from other platforms or self-custody wallets. The platform also supports copy trading, which is a popular way to mirror the trades of profitable traders on the platform.

Pros

- Start trading with as little as $10.

- Margex does not require KYC identity verification.

- Margex’s MP Shield System reduces the risk of price manipulation.

Cons

- Fiat withdrawals are not supported.

- Spot trading is not supported, making Margex more suitable for advanced traders.

Margex vs Coinbase Compared

| Margex | Coinbase | |

| Trading Fees | 0.019% limit orders, 0.06% market orders (futures trades) | Simple trades: Variable based on trade amount ($3.84 for $100 trade) Coinbase Advanced: 0.6% limit order, 0.8% market order |

| Number of Cryptocurrencies | 36 | 239 |

| KYC Required | No | Yes |

| Spot Trading | Coming soon | Yes |

| Advanced Trading Supported | Yes | Yes |

| Futures/Options Trading | Futures trading | Futures supported for qualified accounts |

10. Poloniex – Best for Non-KYC Staking Yields

Boston-based Poliniex provides an advanced trading platform featuring nearly 500 cryptocurrencies, with futures trading, spot trading, and dozens of ways to earn yields on your crypto holdings. However, the Poloniex exchange is not available to US traders, a common limitation for exchanges that offer leverage or crypto derivatives such as futures.

With more than double the number of tradable cryptocurrencies compared to Coinbase, Poloniex has become a popular destination for traders who need access to newer crypto and assets not found on other exchanges. However, staking opportunities are also a big draw for the exchange. Like Kucoin, Poloniex offers a multitude of ways to use crypto assets to earn a yield.

Unlike Kucoin and several other exchanges in our roundup, Poloniex does not require KYC for basic access, including withdrawals of up to $10,000 per day, staking, and futures trading. Access to margin spot trades and higher withdrawal limits requires identity verification, however.

Pros

- No KYC requirement protects the privacy of traders.

- Numerous staking options let traders earn passive income.

- Low trading fees, save up to 75% compared to Coinbase Advanced.

Cons

- Poloniex is not available in the US.

- High fees for funding accounts through third-party crypto providers.

Poloniex vs Coinbase Compared

| Poloniex | Coinbase | |

| Trading Fees | 0.145% limit orders, 0.155% market orders | Simple trades: Variable based on trade amount ($3.84 for $100 trade) Coinbase Advanced: 0.6% limit order, 0.8% market order |

| Number of Cryptocurrencies | 486 | 239 |

| KYC Required | No; withdrawal limits apply for unverified accounts | Yes |

| Spot Trading | Yes | Yes |

| Advanced Trading Supported | Yes | Yes |

| Futures/Options Trading | Futures trading supported | Futures supported for qualified accounts |

Reasons to Look for Alternatives to Coinbase

Coinbase provides a comparatively safe and easy way to start your crypto journey, but more experienced traders may want additional choices. Reasons to look elsewhere include lower fees or increased selection. Some traders may be in a region not supported by Coinbase or may prefer not to provide identity verification, as is required by Coinbase.

Lower Fees

One common criticism of Coinbase revolves around fees. The exchange uses two distinct fee structures: simple trades and advanced trades. Of the two, advanced trades are less expensive, but Coinbase Advanced trading fees still come in higher than many alternatives to Coinbase.

Simple Trades

Coinbase’s simple trades follow a fixed fee structure for trades up to $75 in value, with the highest fee in this range at $2.99. Above that tier, Coinbase uses a percentage-based fee structure. For example, a $100 BTC purchase costs $3.84 in trading fees (about 4%) using simple trades.

In addition, simple trades utilize a spread to lock in price quotes for your trade. Generally, you can expect spread fees to add about 1% to your trading costs.

Coinbase Advanced

To save on trading fees and access charts, you can use Coinbase Advanced instead. Both platforms utilize your Coinbase balances, so switching between the two platforms is as simple as clicking a button.

Fees for Coinbase Advanced follow a maker/taker model.

- Maker fees cost 0.6% of the order value and apply to fixed-priced limit orders on the platform.

- Taker fees cost 0.8% of the order value and apply to market orders on Coinbase Advanced.

By comparison, many Coinbase competitors offer much lower fees. For example, both Binance and OKX offer 0.1% or lower for spot trading fees, with additional discounts based on trading volume.

However, MEXC currently offers the lowest fees, with no-fee trading for spot trades as of this writing. In recent months, MEXC spot trading fees ranged between 0.0% and 0.1%, with a promotional “fee adjustment” bringing fees down to 0.0%.

Note: Coinbase Advanced has replaced Coinbase Pro, so if you’re looking for the best Coinbase Pro alternative, MEXC is a great solution.

More Trading Pairs

Coinbase offers 239 cryptocurrencies and 397 trading pairs as of this writing. However, many Coinbase competitors offer a larger selection. For example, MEXC offers nearly 2,000 cryptocurrencies and more than 2,400 trading pairs.

In this roundup of Coinbase alternatives, MEXC is the clear winner when comparing selection. As another consideration, other exchanges may be faster in offering new crypto coins and tokens. By the time new tokens reach Coinbase, many have already seen 2x or greater gains, reducing your opportunity to maximize returns.

Both MEXC and Kucoin provide a wide selection of newer coins and tokens, allowing you to get in earlier on the next big thing.

No KYC

KYC stands for Know Your Customer and refers to identity verification required to comply with regulations for banking and financial institutions.

Coinbase requires users to complete KYC, including name, address, phone number, email address, proof of address, and proof of identity.

Many crypto traders prefer to trade anonymously and may seek Coinbase alternatives in the interest of financial privacy. Fortunately, some platforms don’t require KYC, although you may face other restrictions. In some cases, daily withdrawals are limited to a specified amount.

In other cases, you might not be able to access advanced trading features such as leverage trades. Platforms that require KYC most often ask for identity verification at the deposit stage.

Although fewer non-KYC exchanges are available now, a handful of platforms still offer trading access without identification, including MEXC and Margex.

Regional Availability

Coinbase supports trading in over 100 countries worldwide. However, Reddit users in South Africa recently reported account restrictions based on their country of residence. South Africa isn’t specifically listed on Coinbase’s Prohibited Regions, but trading access was reportedly denied.

In this situation, withdrawals were still supported, allowing the users to transfer their funds and crypto assets elsewhere.

Several countries appear frequently in prohibited regions for exchanges, often including China, Cuba, Iran, Venezuala, and Syria. Other platforms reference countries subject to Office of Foreign Assets Control (OFAC) sanctions.

If you’re in a region prohibited from trading with Coinbase, you’ll need to choose a Coinbase alternative. We didn’t find any exchanges that offer worldwide access for every country.

However, a platform such as MEXC may be an option because the exchange does not require personal identification for trading (some restrictions apply).

Be aware that many exchanges restrict access based on IP address location, and many also disallow VPN access in their terms of service. A VPN is a Virtual Private Network, a common way to access online services through another region.

Other Factors We Considered in Our Rankings

Each trader may have different reasons to look for Coinbase alternatives, but we looked at several key factors in our rankings. These include withdrawal times, support, user reviews, and liquidity.

Average Withdrawal Speed

As a caveat, not all crypto exchanges offer fiat withdrawals, and some only offer fiat withdrawals through third-party providers. We considered the ease of withdrawals, whether by fiat or crypto, as well as the speed and any hurdles along the way.

Customer Support

While phone support is a rarity amongst crypto exchanges, we considered response time via chat or email as well as the availability of multiple support channels. Most issues and questions can be answered through the help pages, so we also weighed the thoroughness of documentation for exchanges, typing questions a new user might have into the provided search box.

App Store Ratings

App store ratings offer an overview of community sentiment regarding the app or the trading platform itself and whether users encountered difficulties. However, comments often prove more illuminating because they provide specific features, questions, or issues to research. In some cases, we found a quick answer, whereas other topics required more research or a chat with support.

Highest Trading Volume

Liquidity refers to the ability to trade in or out of a position easily. We looked for exchanges with higher trading volume on popular assets, with the understanding that less-commonly traded assets would not have the same liquidity as BTC or ETH. Higher trading volumes can indicate a more trustworthy exchange and a greater ability for traders to enter or exit a position with minimal price impact.

Conclusion

Reasons to look for a Coinbase alternative vary based on the features you need and the assets you want to trade. Trading costs can play a role as well, with Coinbase being one of the pricier places to trade crypto due to its fee structure. We found eToro to be the best overall crypto exchange compared to Coinbase due to fees, ease of use, social trading tools, and more.

If you need a wide selection of cryptocurrencies, the next best alternative to Coinbase is MEXC or Kucoin. Traders who value privacy can choose a non-KYC exchange, such as MEXC, Margex, PrimeXBT, or Poloniex. With the proliferation of trading platforms, there’s a crypto exchange for nearly any type of trader — and you might even decide to use more than one.

FAQs

What is a better option than Coinbase?

Several options may offer better benefits than Coinbase, depending on your trading needs. eToro offers low trading fees and handy trading tools like copy trading, smart portfolios, and a social media feed. MEXC provides another Coinbase alternative with an extensive range of cryptocurrencies.

Is there an app like Coinbase?

Most crypto exchanges offer both web apps and mobile apps like Coinbase. Binance matches up well with Coinbase in its polished user experience and crypto selection. The Binance exchange offers both a web app and a well-designed mobile application.

What is the safest crypto exchange?

Many traders consider Binance the safest crypto exchange, largely due to its transparency. Binance was one of the first exchanges to provide proof of reserves, which is a method of proving the exchange has adequate reserves to cover user funds.

What is the best Coinbase alternative in the US?

Binance US offers a similar number of tradable cryptocurrencies when compared to Coinbase while also offering lower fees for advanced trades. The Binance US platform is available to traders in most US states.

Who is Coinbase’s biggest competitor?

Binance is the largest crypto exchange worldwide, making Binance Coinbase’s biggest competitor on a global scale.

Is Kraken better than Coinbase?

Each platform has its advantages and disadvantages. For example, Coinbase offers a crypto debit card, a convenient way for users to spend crypto like cash and earn rewards in the process. However, Kraken offers lower fees on its Kraken Pro platform compared to Coinbase Advanced. Both platforms offer a similar number of tradable cryptocurrencies at just under 240 each.

References

- Biggest crypto exchanges 2024 (statista.com)

- Definition of Margin Trading (coingecko.com)

- Proof of Reserves (coinmarketcap.com)

- ‘‘Know Your Customer’’ (federalreseve.gov)

- Sanctions Programs and Country Information (treasury.gov)

Viraj Randev

Viraj Randev

Kane Pepi

Kane Pepi

Dassos Troullides

Dassos Troullides