MaxiMine platform and its namesake MXM token are the main components of the cloud-based ecosystem in which the owned tokens are staked in exchange for a share of the mining pool rewards.

What Is MaxiMine?

The Singapore-based MaxiMine project garnered media attention in early 2019 after three-figure price surges propelled the platform among the top 100 crowd. After the project’s launch in 2017 and the completion of the ICO in 2018, the platform has operated under the flag of globalization of the cloud-based mining efforts and removal of the “hassle” from this process. The platform is promoted as a distributed pool revenue system whose business model rests on token staking in return for convertible hashing power for mining. All of this should be feasible for doing with a broader spectrum of cryptos of the user’s choosing.

Based on this, the users would be allowed to switch both between various tokens and mining pools with a single goal of maximizing their profits. The MaxiMine platform is supposed to make this possible on a global scale, while cutting down on the unneeded facets of related procedures.

What Is MaxiMine Trying To Achieve?

The MaxiMine team has defined several goals in relation to the platform they are building:

- MaxiMine platform wants to remove obstacles to entering the mining industry, particularly for the less experienced users. The MaxiMine team sees its own take on cloud mining as a solution to increasing the levels of participation and adoption in the mining industry. Yet, instead of resorting to selling or renting hashpower, as it is the case with traditional cloud mining, the MaxiMine platform relies on delivering liquidity in hash power through the use of tokens. Users can deposit their MXM tokens with the help of smart contracts, and, while the contract is in effect, they will be entitled to receive a proportionate amount of hashing power. Based on this, the cloud mining companies can set up miner farms and rent out hashing power to the miners who no longer have to possess much in terms of technical expertise or the initial investment capital for their equipment.

- MaxiMine will offer multi-token mining capabilities, thus eliminating the need for the miners to purchase hardware dedicated to mining individual currencies. One of the initial challenges faced by prospective miners are the prohibitive procurement costs and low supply of Application Specific Integrated Circuits (ASICs) based on the monopolistic tendencies on the side of the manufacturers. Even when the purchase becomes a realistic option, the ASICs developed for mining Bitcoin do not support mining other currencies, such as Ethereum, for example. Instead of this, the MaxiMine will give its users full freedom to switch between multiple tokens and mining pools which they perceive as giving them the best profit and return rates.

- MaxiMine should give the users access to the quality equipment without worrying about its procurement, recurrent costs of electricity and other technical considerations. The MaxiMine team has started working on constructing its mining facilities, with its mining profits being earmarked for expanding its mining pool and raising the value of the MXM tokens. Locating its facilities in northern China has arguably allowed it to reduce the operational overhead costs and reduce the power wastage at the regional level and its environmental footprint. The developers promise that MaxiMine would become one of the first destinations to which the prototype and advanced mining systems are to be delivered, such as Bitmain ASIC for Ethereum. Based on their design, these systems are supposed to consume less power than the GPU mining rigs. Finally, working in this strategically selected area should allow the MaxiMine to keep the price of entry at a lower level at the time when the energy prices are on the rise globally.

- MaxiMine sees mining as a globalized effort, with its pool being designed with an ambition to become the largest one in the world. The MaxiMine platform wants to become a shortcut to introducing its users to the MXM Global Miners Alliance Community whose operations are organized around achieving the economies of scale. This should come to the fore at the time when the mining regulations are becoming stricter in various regions of the world. At the same time, this pool is seen as becoming a gathering place for the mining experts from all parts of the world who are supposed to contribute to turning it into a truly global mining hub.

What Is Hashing Power Credit System?

The MaxiMine platform has implemented the system called the Hashing Power Credit which functions in a similar manner as a Proof-of-Stake model. The users holding the MaxiMine coins can stake them on the platform and receive rewards created in the mining pool proportional to their stake. The calculation for the hashing power allocation involves taking into account several factors:

- Price of mining rigs

- Hashing power of each rig

- The weighted average price of MXM token in a three-day interval

- Deposit period

- Network difficulty

- Capacity and efficiency of the entire farm

The users will be offered multiple staking options which will be validated by individual contracts operating independently of each other on the blockchain. Each contract will be linked with the user’s wallet and receive the needed input from it via a mobile application.

At the same time, the off-chain information needed to calculate mining rewards will be also fed into these contracts, such as the information on a particular network’s difficulty. To make this possible, the MaxiMine team will establish an Ethereum-based Oracle system which will receive data from several trusted feeds. The system will feature its own smart contract which will store the information gathered off-chain onto the Ethereum and give access to the MaxiMine’s contracts to source information from it.

How Are Rewards Distributed on the MaxiMine?

The mining rewards are earned for each mining system per hash which is owned by the MaxiMine investors. The rewards will be distributed in the following manner:

- 80% of mining rewards are given to the investors who deposit MaxiMine tokens. These are treated as investment returns.

- 16% of mining rewards will be used to invest in the mining farm.

- 4% of mining rewards should cover the operational expenses. These include daily maintenance, servicing of the mining rigs and wages for the staff performing diagnostics and monitoring.

As the mining rewards can be unrelated to Ether, the MaxiMine platform will have to mint new ERC20 tokens for each cryptocurrency whose mining is supported. In the case of Bitcoin, for example, the rewards will be designated as “MBTC”. The users should bear in mind that these tokens act as no more than temporary placeholders for the real currency. In other words, the tokens featured in the smart contracts will represent ERC20 equivalents of the concrete mining rewards and will be used to track the activities of each user and his/her wallet. Finally, upon the expiry of a staking period, the contracts will be regularly topped up with MXM tokens.

How Does MaxiMine App Work?

To ensure the unobstructed interaction with the MaxiMine ecosystem, the MaxiMine app will be used as the foremost control interface for any investor. The MaxiMine team opted for the mobile option in order to be able to simplify the design features as well as reduce the risk from web and phishing attacks.

The main features of the app include the following:

- The app is used for checking the balance and status of the active contracts

- User’s profile and account are managed with the app

- Rates and returns related to particular contracts can be checked

- If the user/investor wishes to stake MXM tokens for additional contracts, this can be done via the app

- Wallet addresses for multiple minable cryptos can be synchronized and validated

- Users can check daily return rates and forecasts

- The app enables streamlined withdrawal of the mining rewards

What Are the Components of the MaxiMine Ecosystem?

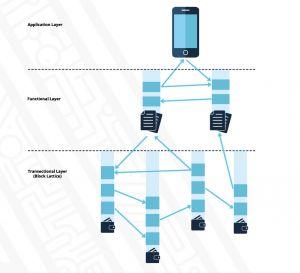

The MaxiMine ecosystem is made up of several components, with the team promising to introduce new ones down the road. At the heart of the MaxiMine Decentralized Operating System (MDOS) is the MaxiMine protocol which is secured by the combined hashing power of all the crypto mining farms. Its architecture is organized in three main layers:

- Transactional Layer. This layer features a directed acyclic graph (DAG) in which the transactions take place between wallet addresses without reliance on blocks for the storage of the data relevant to them. Instead of this, each wallet is supposed to operate as a blockchain of sorts in itself and keep track of transaction inputs and outputs.

- Functional Layer. This layer plays the role of the host to the smart contracts. In relation to the transaction layer, this layer should operate as its “sidechain”, with support for data transfers and interactions with it.

- Application Layer. Application layer functions as an interface for collecting and accessing data featured in numerous smart contracts, enabling the dApps to interact with the two remaining layers.

MaxiMine Public Chain and Token

August 2019 has been chosen as a tentative launch date for the MaxiMine public chain which is currently under development. With its current level of operations, the MaxiMine relies on a private chain which is more suitable for dealing with a smaller number of users and enforcing stricter access control to the platform. Yet, the launch of the public chain should offer the following benefits:

- The MaxiMine team hopes to further reduce the barriers associated with entry into the mining business

- The public chain should enforce further decentralization by eliminating the risk of data tampering and having the data controlled by a single authority

- Users will be given full access to read, send and receive confirmations for each transaction made on the chain

- MaxiMine plans to use the “MaxiMinechain” as the main platform for issuing tokens for fundraising efforts

In the meantime, the MXM’s market cap has hit USD 140 million as of April 2019, in a month in which the currency has also recorded its historic high of USD 244 million. At the same time, about 1.6 billion MXM were in circulation, out of the planned supply of 16 billion units. The token is available for trading on the cryptocurrency exchanges such as CoinBene, BitForex and others.

The project is helmed by a team of professionals headed by Hua Cai (CTO), Quinn Li (CMO) and Cheng Zhenyu (advisor).