Following the launch of its mainnet in April 2018, Bytom went on to promote itself as a chain and digital asset protocol designed to bring together tokenization and streamlined management of both digital and real-world assets.

What is Bytom?

At the heart of the Bytom project is its namesake chain which allows organizations and individual users to build and deploy peer-to-peer financial applications aimed at easier registration and exchange of digital and traditional physical assets. This is to be achieved with the help of the Bytom blockchain protocol and the Bytom token (BTM) – both of them being parts of the ecosystem in which the Bytom team hopes to create the foundations of future “asset-based†Internet. In this global network, all digital assets are supposed to be tokenized and managed as part of a single layer, while the individual by-assets would exist on their own chains operating as parts of the wider Bytom network.

What is Bytom Trying to Achieve?

- The Bytom chain is seen as empowering the users to better cope with the meteoric rise in the amount and importance of digital assets. The Bytom chain project came into existence after its developers decided that the emerging blockchain technology might become useful in helping the users gain more control over their digital assets, at the time when the latter have almost eclipsed traditional physical assets in terms of their value and accessibility. Bridging the domains of “old-fashioned†assets such as bonds, securities or valuable data with those of digital origin (such as cryptocurrencies) is seen as the main task of the Bytom project which is supposed to bring together the “best of both worldsâ€.

- Tokenization of traditional assets is a growing trend which is still held back by the lack of platforms allowing for easy mapping of assets which simultaneously exist in digital and physical worlds. Assisted by the rise of new technologies such as big data, real world assets are increasingly turned into “tokensâ€, with various deeds and transaction ledgers finding their home on the blockchain. The Bytom chain wants to make it possible for the user to complete all the operations related to tokenization on a single platform, be it asset registration, settlement, transaction management etc.

- The Bytom team believes that decentralization, automation and securing of asset management processes can be implemented at no expense of any of them. The Bytom chain promises to provide infrastructure for building both a decentralized exchange and decentralized trading system. In case of the exchange, working with the Bytom technology should allow the users to avoid having to rely on third-party providers which would be in charge of managing their funds. Instead of this, Bytom allows the customers to engage in direct asset trading by automating this process. At the same time, the trading system supported by the Bytom blockchain will use open source smart contracts to ensure easier asset custody and clearing and transaction matching. Finally, the platform’s identity verification system uses blockchain technology and its hashing and time stamping system to secure digital assets and ensure their traceability.

How Does Bytom Classify Assets?

The main concept behind the Bytom’s mode of operation is that of “heterogeneous byte-assetsâ€. This is the term by which the Bytom team described indigenous digital currency and/or digital assets. Based on this, the Bytom’s developers divide the platforms in which the assets exist into two “worldsâ€: “atomic†i.e. physical world and the “byte†or digital world, with their solution acting as the bridge between the two.

To make it possible to register and exchange both atomic and byte assets, the Bytom platform divides them into three main groups:

- Income assets: These assets encompass non-performing assets, various fixed government investments, crowdfunding campaigns, homestay properties etc.

- Equity assets: This category includes, among other things, equity of nonlisted companies, private funds or private companies, shares of non-public investments etc. With these assets, the investors are usually required to verify related transfers.

- Securitized assets: These assets include the likes of debts and automobile loans, as well as other assets featuring cash flows that can be monitored and predicted more easily.

How Does Bytom Protocol Work?

No matter which asset class a user wants to put on the Bytom chain, trading with them will be an option as long as it is governed by the Bytom protocol. The protocol allows the user to record all instances of asset ownership and transfers on the blockchain which is supposed to offer several benefits:

- By its very nature, the blockchain should be a more secure and accurate option for keeping sensitive records on it compared to other currently available alternatives. Records kept on the Bytom’s immutable ledger should be a guarantee that no third party will gain access to them.

- With Bytom, asset exchanges and maintenance of related records on them should be made possible without forcing the user to work with the middlemen. The users would also perceive Bytom as a solution which gives them a more “hands-on†control over their assets.

- Elimination of middlemen from the asset registration and management processes would reduce the bloat on the platforms which have been previously used for this task. Based on this, Bytom promises to offer faster transfer times and reduced costs of asset management.

- As the assets records on the Bytom platform are kept on a global network of nodes, the risk of data manipulation is supposed to be reduced to a minimum together with the number of potential points of failure.

Bytom’s Cross-Chain Features

The Bytom chain’s protocol has yet another important feature: its allows for cross-chain interactions, including transactions and dividend distribution through side chains:

- One of the requirements for this is the creation of a “smaller†version of desired blockchain or a relay based on the Bytom platform.

- Once a developer takes care of this, the user can make API calls with the help of smart contracts and verify the activities taking place on the main chain.

- By using the API calls, the user can establish cross-chain communication, transact with assets between multiple chains and use side chains to distribute dividends.

At the same time, the Bytom separates transaction signatures from the rest of the data involved in a transaction. This is done via a distributed ledger protocol which enables interaction between various types of assets. This protocol can be adopted by multiple blockchains, allowing them to engage in cross-chain trading and simplify related processes by having various actors in it use the same format.

Apart from enabling the co-existence of separate chains with the same protocol, Bytom will use separation of transaction signatures from other data to set apart asset management segment from the synchronized distributed ledgers. This approach is supposed to deliver better programming and contract deployment support and provide an interface for bypass channels.

Transaction Verification with Bytom

In addition to supporting cross-chain interaction for the benefit of asset management, Bytom wants to appease the users who may still worry about the potential overloading of the network by the requirements of transaction verification. To cope with this, Bytom introduced the system of “compact verificationsâ€. With the help of Merkle proof technology, Bytom allows for the verification of relevant transactions only, without the need to check all transaction in the block.

At the same time, Bytom differs from Ethereum in that that its BUTXO system allows for parallel verification of transactions. This is to be done with the help of the mechanism which allows only one transaction to quote each unspent output. This system should also prevent double-spends and other attempts at manipulation. Since the participants only have to remember the unspent outputs while the trading process itself provides for other relevant data such as asset ID, the Bytom platform bills itself as a lighter solution compared to Ethereum, for example.

Finally, the platform aims to fully implement the Open Data Index Name (ODIN) standards which should ensure the protection of the unique character of assets across its platform. ODIN’s naming index is based on the blockchain height instead of relying on making a record of a character string.

Bytom’s Layered Architecture

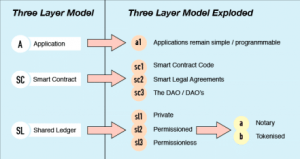

Features offered by the Bytom platform are closely linked to its three-layer architecture:

- Application Layer. This layer supports the development of dApps used for asset management, dividend, trading and asset registration via interaction with contracts. This layer offers compatibility with the UTXO and data structures used with Bitcoin in an attempt to deliver both anonymity and efficiency. Supported app formats include both web and mobile versions. This is the layer which the majority of end users and developers will interact with when using Bytom.

- Contract Layer. This layer is a home to the Bytom’s account system and the virtual space within which the contract coding takes place. Assets are issued and managed based on the use of two types of contracts: genesis contracts and control contracts. The first category is used to both issue and audit other smart contracts which exist on the platform. At the same time, they are responsible for the compliance with the standards which the Bytom protocol may support. On the other hand, the general contracts manage the asset trading between the users of the same protocol. Prior to trading, however, the assets need to be verified by the genesis contract. Finally, the general contracts also provide support for dividend distribution and act as its validators.

- Ledger (Data) Layer. This layer implements the distributed ledger technology layer and links Bytom with the blockchain while also providing support for asset transfer, issuance and other related tasks.

Tensority Algorithm Implementation

The blockchain linked with the Bytom protocol in the ledger layer is a public and permissionless one. It uses Proof-of-Work (PoW) consensus algorithm which the Bytom team implemented as the special Tensority algorithm. While Tensority functions as a proof-of-work mechanism in its essence, it is in fact designed to overcome some of its shortcomings, such as having too much of hardware and energy resources going to waste.

With Tensority, the calculation and difficulty comparison processes are the same as those found in Bitcoin. Yet, it also introduces matrix and convolution calculation into the hashing process, making it possible to use AI hardware acceleration services for the purpose of mining. At the same time, Bytom also features ESCDA encryption and SHA256 hashing. Paired with edge computing and integration with technologies such as cloud and deep learning, Tensority is seen as the pathway to synergizing AI with blockchain technology.

Bytom Token (BTM)

The Bytom token (BTM) supports the operation of the Bytom ecosystem in the following manner:

- It is used to pay for the transaction fees

- BTM enables dividend sharing

- Asset issuance deposits are made with these tokens.

As of March 2019, the BTM market cap stood at USD 88 million, with its historic peak reached in April 2018 when the same cap was valued at more than USD 1 billion. There are currently more than 1 billion BTM tokens in circulation, out of the planned total supply of 1.4 billion tokens.

The ICO took place between June and July 2017, with 30% of the tokens going to the participants, 33% serving as a mining reward pool and the rest being set aside for the Bytom Foundation, reserves or the business development pool. Prior to the mainnet launch, BTM tokens existed as ERC-20 on the Ethereum blockchain.

BTM tokens are available for trading on various cryptocurrency exchanges, including HitBTC and KuCoin. Acquired tokens can be stored in the Bytom official wallet which supports Windows, Mac, and Linux operating systems.

BIP32, BIP43 and BIP441 address formats were used in the design of Bytom wallet to provide support for a multi-currency, multi-account and multi-address wallet. Mining is yet another option for the acquisition of the BTM tokens, with the option to use ASIC on the network with no penalty.

Bytom Project History and Competitors

The Bytom protocol saw the light of day in 2017 as a brainchild of Chinese developers with an extensive background in the blockchain tech. The team included Chang Jia, the founder of the Shanghai-based exchange platform 8BTC, and Duan Xinxing, the Bytom founder and CEO who also served as the Vice President of the OKCoin crypto exchange. Both were active in advocating the use of blockchain technology in China.

When it comes to competitors, Bytom has some potential to tread the same paths as the Ravencoin which also deals with asset transfers, while the Enjin Coin tries to do a similar thing in the gaming assets niche.