Promoted as the foundation of future “borderless economy”, the Algorand platform and its ALGO token are dedicated to the cause of balancing security, scalability and decentralization at no expense of one another.

What Is Algorand?

Algorand was born out of the ambition to solve the so-called “blockchain trilemma”, which posits that one cannot have full-blown decentralization, scalability and security on a single blockchain platform, unless at least one component is toned down to accommodate for the others. In other words, building strong decentralized platform, for example, should make it unavoidable to harm its security and scalability potential. The proposed answer to this challenge came in the form of the Algorand platform, which was launched in June 2019 as a global project seeking to promote the decentralization of digital economy based on open and permissionless access, instant verifiability, internally developed Pure Proof-of-Stake protocol, and transaction management system capable of scaling custom blockchain projects.

The core philosophy of Algorand revolves around the concept of “democratic” user participation. Instead of the mining-based Proof-of-Work algorithm that Bitcoin and other cryptocurrencies use, Algorand proposes its upgraded Proof-of-Stake and self-validating transactions. This Boston-based project was founded by Silvio Micali, an MIT professor and recipient of the Turing Award, an annual prize nicknamed the Nobel Prize of computing. Micali is joined by the rest of his team of blockchain experts and researchers. In June 2019, Algorand was listed following a public sale, with its booming prices eventually stabilizing after initial hype. The Algorand Foundation in charge of the project reported that the sale manage to raise some USD 60 million.

What Is Algorand Trying to Do?

Algorand project has set for itself a list of goals which rest on the successful implementation of its concept and technologies:

- Economic innovation of Algorand should be the creation of a blockchain offering authentic value to efforts to build a “borderless” economy. Algorand’s technology of decentralized, secure, scalable and distributed ledger is hoped to serve as the bridge with companies and organizations seeking access to untapped markets. This would count for nothing if the blockchain platform cannot offer adequate performance to keep up with the demands of this type of economy. The Algorand blockchain offers immediate transaction finality, without the risk of forking or uncertainty, based on its unique consensus algorithm. Once created, each new block remains on the chain indefinitely, thus ensuring that all transactions in this blockchain remain final. Upon the launch of the Algorand MainNet the network was reported as being capable of processing 1,000 transactions per second, putting it closer to the performance levels of payment networks such as VISA, which is said to handle approximately 1,700 transactions per second.

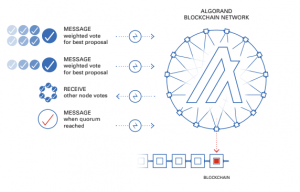

- Algorand’s Pure Proof-of-Stake focuses on recognizing one’s ownership rights over assets as its main mode of operation. This focus should make Algorand more at home in its planned implementation in the financial industry. To achieve this, its Pure PoS is promoted as a unique consensus algorithm, developed by Silvio Micali himself. It features significantly reduced demand for computing power as well as the ability to settle transactions in the span of a few seconds. The system is capable of reaching consensus without the need for central authority, with tolerance for malicious users as long as the majority of stakes are kept by honest users. Each user can read every block and is given an opportunity to write a transaction in a future block. Users can influence the selection of a new block based on the size of their stake in the system which is measured in the number of ALGO tokens. Users are selected discreetly, based on randomness principle, and allowed to propose blocks and vote on block proposals, with the likelihood of being chosen being proportional to the stake volume.

- Algorand is promoted as an open-door platform which anyone can join without receiving prior approval by an officially appointed gatekeeper authority. Algorand is big on the openness of its platform, which, its developers hope, will foster the exchange of ideas among various user profiles on it. It operates in a manner similar to open-source software, with a whole range of actors, ranging from small business owners, individual investors and large corporations, having access to its permissionless blockchain. All that is required is the possession of arguably modest computing resources. Unlike the permissioned blockchain which may hamper the users’ innovation potential, the users on Algorand are free to offer new market applications based on the ownership records which are publicly available on the blockchain. This should help the platform create wholly new markets which would not merely imitate their real-world counterparts.

How Does Algorand Protocol Work?

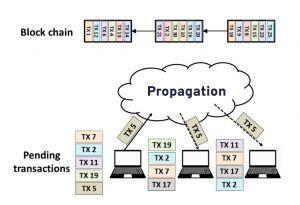

Algorand runs on the blockchain which employs a decentralized Byzantine agreement protocol based on Pure Proof-of-Stake. The Algorand protocol has several features that should set it apart from similar competing solutions:

- Users are not required to use the keys for spending their stakes in order to achieve consensus. Instead of this, Algorand only requires users who want to take part in the protocol to create and register their participation keys. The key is then used to approve participation in making proposals and voting on blocks for an individual account. Security is achieved by keeping the ALGO tokens protected with the help of the keys, even when a participating node may become compromised.

- The role of Verifiable Random Function (VRF) on the Algorand protocol is supporting the self-selection process by which the users can secretly determine whether they have been selected to participate in the consensus protocol round or not. This methodology is based on the fact that Algorand’s blocks feature a randomized selection of users eligible for participation. Each time a new block is committed to Algorand blockchain, participants are made aware of the seed and the Verifiable Random Function is checked by the user with the help of the secret participation key and the selection seed. VRF operations produce cryptographic proof which is available to everyone who wants to verify the ensuing results. The main benefit here is the minimal computation power required for running this function.

How Does Algorand’s Pure Proof-of-Stake Promote Security?

Based on the design of Algorand protocol’s Pure Proof-of-Stake, the whole concept of protecting its users from potential attacks does not rely on the fear of fines, but rather on making malicious actions of a minority of users altogether impossible:

- The owners of the majority of funds on the platform are the only ones capable of preventing other users from making transactions. Those who hold the majority of funds in their hands are strongly discouraged to engage in dishonest actions as this would only serve to devalue their assets.

- If they still decide to engage in dishonest practices, the reputation of Algorand as a means of payment would suffer globally, reducing the tokens’ universal acceptance and value. In the end, the owners of these funds would find their purchasing power drastically reduced.

At the same time, this approach is based on the user replaceability and the lack of any communication between them. Based on the requirement to have the user’s private key for the completion of the block certification procedure, malicious users cannot know who is actually relevant to the generation of the next block. As only the users are aware of their selection, potential adversaries will find that it is too late to target a particular user by the time they finally learn who was chosen as a participant.

Other Technologies and ALGO Availability

In addition to the already implemented technologies, the Algorand developers promise to introduce several new features that would fine-tune the existing capabilities of this platform:

- Vault is proposed as Algorand’s solution to the problem of blockchain storage. As the blockchains grow in size, the storage of all of its blocks may become a genuine challenge. Instead of this, Algorand’s Vault technology aims to promote better scalability by means of efficient on-boarding of new users. These users will be required to download and update just a single piece of information and start participating in the creation and storage of blocks as soon as they join the network.

- Pixel digital signature scheme is the technology by which Algorand aims to reduce its bandwidth demands via a novel system. The system is based on the ability to aggregate multiple signatures of the single message and turn it into a compact signature of the same length. At the same time, malicious users are prevented from forging signatures on earlier messages.

- Self-validating transactions are based on the separation between consensus and storage. The users will be able to check the validity of payments without the need to maintain balances for block verification and individual payments.

- Finally, Algorand plans to support atomic swaps down the line.

As of September 2019, the Algorand currency’s market cap stood at USD 113 million, down from its historic high of USD 156 million in August 2019. At the same time, some 291 million tokens were found in circulation out of the total planned supply of 2.8 billion tokens.

ALGO tokens are available for trading on cryptocurrency exchanges such as Binance and others.