Singapore Flags Higher Terrorism Financing Risk for Digital Payment Token Services

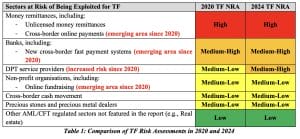

Singapore has raised the risk level for digital payment token (DPT) service providers potentially facilitating terrorism financing (TF) from “medium-low” to “medium-high” in its latest update to the terrorism financing national risk assessment.

The Ministry of Home Affairs, Ministry of Finance, and Monetary Authority of Singapore jointly announced on Monday that the latest risk assessment, last conducted in 2020, identified comparable areas of terrorism financing risk.

However, the report also admitted a lack of clear evidence for widespread use of digital payment tokens in Southeast Asia. This might be due to limited technology in areas hit by terrorism, lacking both financial infrastructure and good internet.

DPT service providers include companies that deal in digital currencies.

Why Digital Tokens Makes Terrorist Financing Harder to Stop

Even though traditional currencies are still the main way terrorists finance their activities, experts around the world are increasingly worried about virtual currencies like Bitcoin being used for this purpose. This concern has grown especially since the COVID-19 pandemic. The authorities in Singapore are closely watching this situation as virtual currencies become more popular.

“While there are no known domestic TF cases involving DPTs, Singapore is cognisant of the higher TF risks originating from the increasing presence of DPT service providers,” the report said.

There are several reasons terrorism financing is a concern for DPTs. First, these transactions are often anonymous, fast, and can happen across borders, making it difficult to track. Second, there’s a risk that even licensed companies in Singapore might do business with unlicensed ones overseas, which could be more vulnerable to misuse.

Finally, not all countries have implemented the same rules for tracking these transactions, creating gaps that terrorists could exploit.

Also, features like anonymity tools and privacy coins make it difficult to track who is sending and receiving money, as well as where they are located. Additionally, these currencies allow for quick and easy transfer of funds across borders, making them a more efficient way for terrorists to move large sums of money compared to traditional methods.

However, this very anonymity and ease of use also creates significant challenges for law enforcement agencies trying to track terrorist financing through digital currencies.

Singapore Prioritizes Combating Money Laundering in Banks and Digital Token Services

Singapore’s assessment found that banks, especially those dealing with wealth management, are most at risk for money laundering. This is because banks handle large sums of money and often serve clients who might be more likely to engage in illegal activities.

Beyond banks, Singapore’s assessment also identified payment companies that handle international money transfers and investment firms managing external assets as areas of concern for money laundering.

Back in April, Singapore’s financial regulator took action to address these money laundering risks. It announced changes to the Payment Services Act, which will give the agency more control over companies dealing in digital currencies.