Researchers Stick to Their Forecast: Bitcoin to Bottom Out in Q1

Bottom calling is one of the most sought-after practices during red markets, as everyone wants to know when the days might become brighter. Despite the recent sell-off, New York based research company Delphi Digital confirmed yesterday that their previous forecast that Bitcoin to bottom out in the first quarter of this year still stands.

This time, the company published analysis of bitcoin holders to explain the process by which they concluded this.

“We’ve established that selling pressure from long term holders is significantly tapped, and accumulation has begun,” the company said in the report.

The process uses UTXO age dynamics to figure out when long term holders will stop the selling pressure. UTXO stands for the unspent output from bitcoin transactions, while the UTXO age indicates the last time bitcoin was moved.

“Bitcoin’s aggregate UTXO age distribution over time provides insight into buying and selling patterns through previous market cycles, along with where we stand now, and what we can likely expect moving forward,” the researchers explained.

Separating HODLers who haven’t moved their funds in over a year from those who haven’t moved it in longer timeframes, they conclude that most of the selling pressure comes from 3 to 5 year hodlers with a caveat: “An important understanding that allows this to work is that a large portion of the coins in the 5 year+ band are lost.”

The company then explains, “Another important takeaway is we can assume these older owners have exhausted much of their selling efforts, evident in the flattening of these older UTXO bands, coupled with the 1 Year UTXO band reaching a floor and staying flat through the first half of 2018.” The graphs point to an accumulation process that is similar to what happened at the end of 2014, implying a bottom in sight.

They further add that there are strong correlations between the current situation and historical figures, especially the end of 2014 and the end of 2018: “With this data, we can estimate the date of these events. A uniformity across both cycles was the slope from the base of the 1 Year+ line to its peak […] The date and UTXO floor holding rate, which will occur during the next selloff, are the remaining factors that are needed to complete the cycle. It’s difficult to be confident in a forecast this far out, but our estimates have the next UTXO floor occurring in Q4 2022.” This new UTXO floor could be the foreshadowing of the next bottom, should the pattern stay consistent.

The previous research, published by the company back in December, drew a parallel between 2013 and 2017, as the price’s rise of late 2017 mimics that of 2013, where peak valuations were followed by an extended bear market, characterized by multiple relief rallies on the way to drastically lower prices, but the bottom does not seem to be too far off.

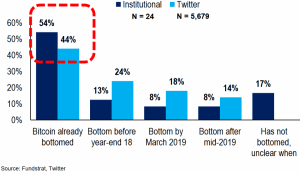

Meanwhile, an informal poll in the beginning of last autumn showed that usually very cautious Wall Street investors were calling a bottom in the bitcoin market. Twitter users, however, were more skeptical.

As for the current state of the market, CEO of cryptocurrency company Circle, Jeremy Allaire, explained during a recent AMA (Ask Me Anything) session on Reddit: “My general perception is that the markets have been oversold and that some core assets have decoupled from their usage, which suggests they are undervalued. We look at things like hashrate health, on-chain activity, as key indicators of usage and adoption and underlying unit economic support.”

As reported by Cryptonews.com, as discouraging as recent market events may be for anyone hoping that Bitcoin will ‘go to the Moon,’ there are other measures of the cryptocurrency’s health, and these reveal that it’s doing better than many people currently think.