Market Turbulence Might Push Crypto Users Towards More Centralized Projects

In order to avoid current turbulences in the market, crypto users might start to favor more centralized blockchain finance projects.

“To-date, I haven’t seen any change in dapp [decentralized app] activity specifically related to COVID-19 or people being in self-isolation,” Jon Jordan, Communications Director at DappRadar, a dapp data aggregator and analysis firm, told Cryptonews.com, “so the impact has been mainly about the price crash, which liquidated a lot of MakerDAO vaults and generated a generalized sell-off/flight to cash for all asset classes including crypto.”

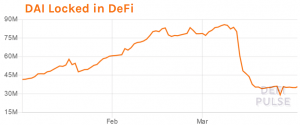

He estimates that the current situation in the markets will make many people favor more centralized crypto finance projects, such as crypto lenders Blockfi and Celsius, rather than MakerDAO and similar DeFi (decentralized finance) projects. Furthermore, people may also potentially favor centralized stablecoins like USDT and USDC over MakerDAO’s DAI, “because in such a crisis, having centralized controls means you can stop bad things happening.” (Learn more: Demand for ‘Internet Dollars’ to Increase – Circle CEO; Not All Celebrate)

However, some decentralization-focused projects claim they didn’t face many issues during the crash.

Kyber Network (KNC), an open-source, on-chain liquidity protocol, claims they broke their 24-hour trading volume record when they facilitated over USD 33 million worth of trade within 24 hours on March 12. As to where the volume came from Kyber’s CEO Loi Luu said it was from KyberSwap, an in-house decentralized exchange (DEX) powered by Kyber, Ethereum wallets, as well as the DeFi platforms that integrated Kyber.

“End users converted all of their assets to stablecoins using KyberSwap and other Ehtereum wallets that provided in-wallet swap powered by Kyber, such as Enjin wallet and MEW,” says Luu. “DeFi dapp users exiting their positions or topping up their margins so dapp required to rebalance the portfolio/inventory through Kyber.”

According to Luu, they “didn’t really have any liquidity or token price issues during the event” because Kyber has access to many different liquidity pools, including Kyber reserves, token project reserves, other market makers, as well as bridge reserves such as Oasis and Uniswap. “So if one goes down, there are others to continue supplying the liquidity.”

__

__

__