Launching Bitcoin ETFs Could Burst the Bitcoin Floodgates – Study

A new survey has found that financial advisors in the U.S. would be keen to put their clients’ money into cryptocurrency exchange-traded funds (ETFs) – hinting that should Bitcoin ETFs become easily available, widespread BTC adoption could follow.

The findings come from a study entitled “The 2020 Benchmark Survey of Financial Advisor Attitudes Toward Cryptoassets,” compiled by fund operator Bitwise and media outlet ETF Trends.

The authors suggested that advisors were eagerly awaiting crypto ETFs, and wrote,

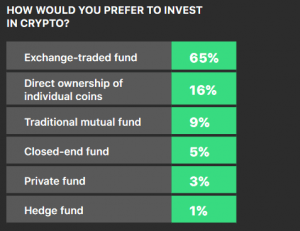

“Advisors would overwhelmingly prefer to buy crypto in an ETF package compared with all other options.”

According to the company that is unsuccessfully trying to launch its own Bitcoin ETF, these results were consistent with last year’s survey, although the percentage of advisors with a preference for an ETF somewhat increased year over year, up from 62% to 65%.

Also, 37% of advisors stated that “the launch of a Bitcoin ETF” would be “a key factor” that would make them “more comfortable” with the idea of investing in Bitcoin. But first, they need better regulation, better custodial solutions, and better education.

However, some crypto industry players opined that waiting around for regulators to decide what to do about Bitcoin ETFs displays a possible lack of proactive impetus from advisors.

Meanwhile, speaking of better custodial solutions and better education, three-quarters of advisors had no idea that Fidelity Digital Assets, a crypto custody solution by the U.S.-based mutual fund giant Fidelity, already offers custodial services for Bitcoin.

The findings come less than a year after Bitwise’s senior management made similar claims, stating that as “half the money in the United States is managed by financial advisors,” winning advisors’ confidence could be a watershed moment for Bitcoin.

Also, the authors noted that “some legacy concerns about crypto” are “continuing to fade from view.” Only 6% of advisors believe that cryptocurrencies are a scam,” down from 11% last year. And 13% thought that “cryptocurrencies are in a bubble,” a drop from 2019’s figure of 19%.

Some other findings in the survey that elicited 415 eligible, complete responses from financial advisors:

- The number of advisors allocating to crypto in client portfolios is expected to more than double in 2020, from 6% to 13%.

- The No. 1 motivation for including crypto in portfolios continues to be its low/uncorrelated returns with other assets.

- Other key attractions include crypto’s high potential returns, client demand for access to crypto, and the desire to win new business.

- Investor interest in crypto is not going away: 76% of all financial advisors report receiving questions from clients on crypto in 2019

- 72% of advisors think clients may be investing in crypto on their own, outside of their advisory relationship.

- 64% of advisors expect the price of bitcoin to appreciate over the next five years, up from 55% of advisors in last year’s survey.

- 35% of advisors expect the price of bitcoin to at least double by 2024.

- Meanwhile, the fraction expecting bitcoin’s price to fall to zero decreased sharply this year, from 14% to 8%.

____

Learn more: Bitcoin ETF May Be Approved in 2021 and Will Bring a Host of Benefits