Ethereum Gas Fees Highest During US Business Hours, Coin Metrics Finds

Ethereum (ETH) fees are still on the rise, with no day so far in November seeing average transaction fees of less than USD 30. However, the fees vary significantly depending on the time of day transactions are made, opening up opportunities for savings, a new report from on-chain analytics firm Coin Metrics has found.

According to the report, transaction fees on Ethereum – also called gas fees – are highly dependent on the amount of traffic on the network at any given time – an issue that is still present after Ethereum’s implementation of the EIP-1559 upgrade.

As pointed out by Coin Metrics, Ethereum transaction fees since EIP-1559 include a fixed-per-block network fee known as a base fee that must be paid in order for a transaction to be included in a block. And given that this base fee fluctuates with demand for block space, transactions become significantly more expensive during peak hours on the network.

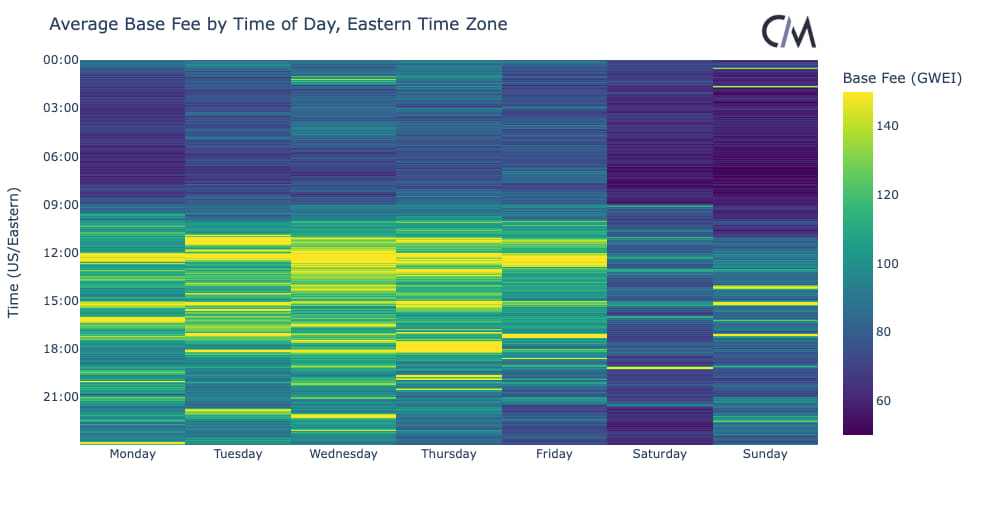

Fortunately, however, finding out when the network is typically most congested can be done, with Coin Metrics saying that US business hours tend to have the highest base fees during any 24-hour period.

“Interestingly, the morning period of midnight to 8am [US Eastern Time] tends to have cheaper base fees vs. US business hours (9am-5pm),” the report noted. It added that weekends, and in particular Sunday mornings Eastern Time, tend to be quiet periods, with a base fee that is on average 50% lower than the average at noon on Wednesdays.

The finding that US business hours have the highest fees is perhaps surprising given that Ethereum is a global network that is open 24 hours per day all days of the year.

However, the report cited peaks seen in sales of non-fungible tokens (NFTs) on the marketplace OpenSea, and peaks in the usage of the stablecoins tether (USDT) and USD coin (USDC) seen during those hours, as major contributors to traffic during these peak hours.

In conclusion, Coin Metrics said that one possible solution to minimize the amount of fees paid might be to schedule transactions to non-peak hours. And luckily for users, solutions, such as the Gelato Network of decentralized smart contract bots, already exist for scheduling transactions for other times of the day.

With increased adoption, bots like Gelato that automate smart contract executions to occur during optimal times have the potential to ease congestion on the Ethereum network, the report finally said.

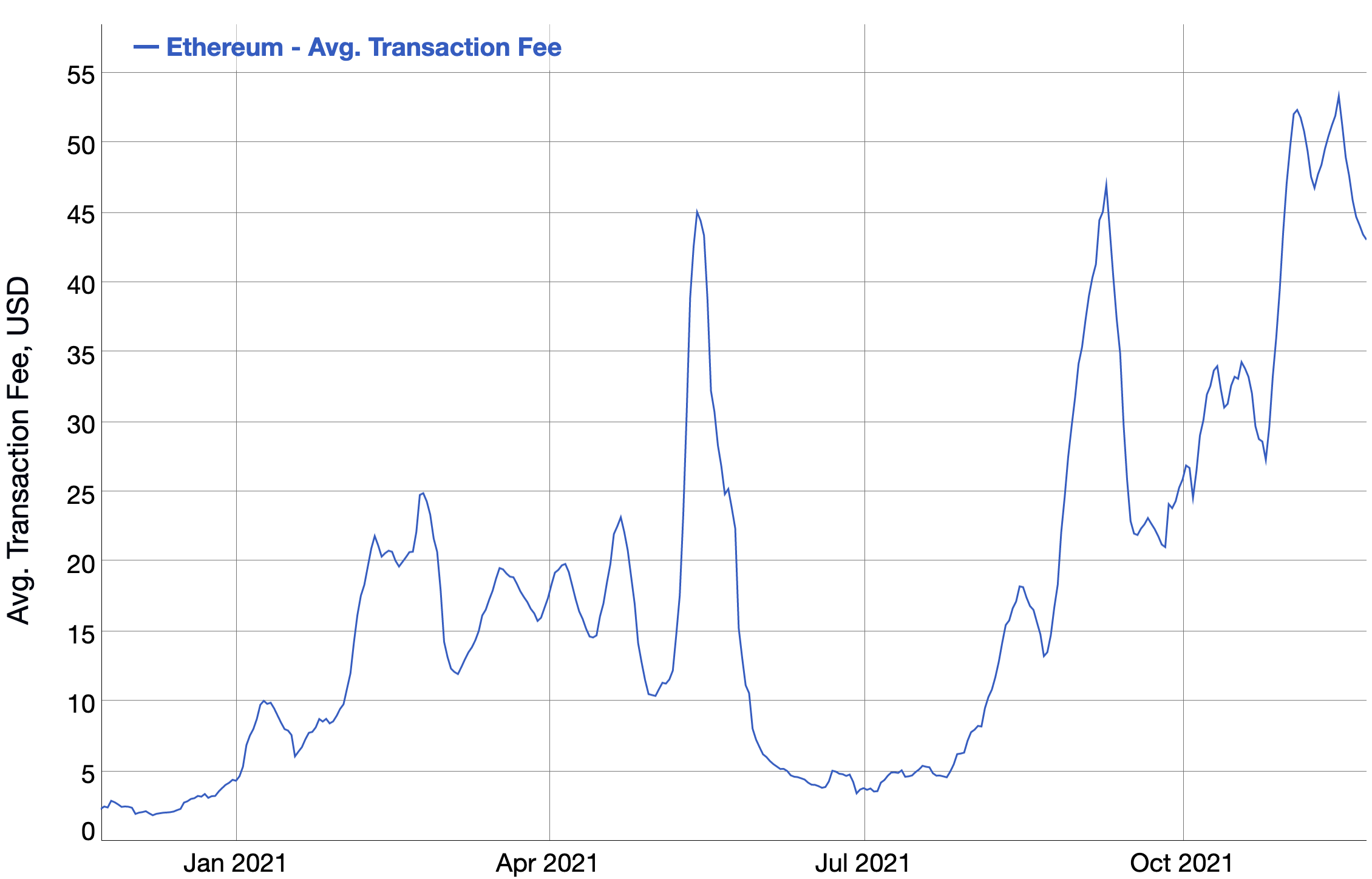

Based on data from BitInfoCharts, the average transaction fee paid on the Ethereum network on Tuesday stood at over USD 45, while the 7-day moving average of the fee remained slightly lower at USD 43.

The 7-day moving average of the transaction fees remains slightly below its all-time high of USD 53.3 reached on November 15, but is still high enough to price out some economic activity from the network, as noted in an earlier Coin Metrics report.

Ethereum average transaction fees (7-day moving average):

At 13:29 UTC on Wednesday, ETH traded at USD 4,303, up a strong 2.6% over the past 24 hours, and up 1.2% over the past 7 days.

____

Learn more:

– Ethereum Fee Debate Heats Up as Avalanche Enters and Exits Top 10

– Ethereum Fees Pushed Higher by DEX Trading as Optimism’s Upgrade Nears

– Ethereum Tests All-Time High as On-Chain Activity Grows, SHIB Burns ETH

– Ethereum’s EIP-1559 Helped Coinbase Save ETH 27 on Daily Fees

– Ethereum Users Flock To Arbitrum In Search of Scalability

– USD 0.5 Million Paid in Failed Ethereum Transaction