Cathie Wood’s Ark Invest Buys $21 Million Worth of Coinbase Shares – What Do They Know?

Ark Investment Management, the fund led by the well-known technology investor Cathie Wood, has bought a dip.

According to Barron’s, Ark’s exchange-traded funds (ETFs) bought nearly 421,000 – or 420,949, to be precise – of major crypto exchange Coinbase’s shares, to expand its position in the exchange by more than $21 million. This is based on the stock’s price at the close on Tuesday.

The ETFs named in this report are Ark Innovation ETF, Ark Next Generation Internet ETF, and ARK Fintech Innovation ETF.

The first, which is Ark’s flagship ETF, bought some 330,000 shares, while the second got 54,466 Coinbase shares, and the third 36,022, respectively.

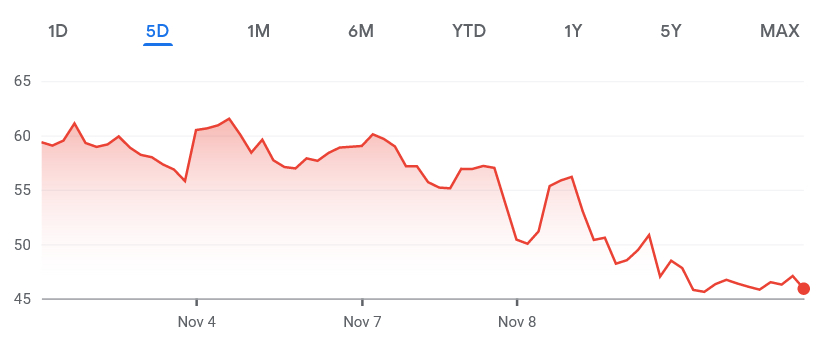

Coinbase saw its stock price drop significantly over the past week. COIN dropped 10.8% on Tuesday and another 2.5% in US pre-market trading Wednesday.

Looking at the price on Thursday morning, UTC time, it stood at $46.9. At the previous close, it was down 9.54% to $45.98.

Coinbase reported net revenue of $576 million for the third quarter, down 28% from $803 million in Q2 2022, per its shareholder letter. Its trading volume fell from $217 billion to $159 billion.

While the latest drop in stock prices comes amid the crisis surrounding crypto exchange FTX, Coinbase said that it has “no material exposure” to the collapsed company, its FTT coin, or its parent company Alameda Research.

As reported, crypto exchange Binance had agreed to acquire FTX on Tuesday this week, before pulling out of the deal on Wednesday, citing mishandled customer funds and regulator investigations.

Meanwhile, the question poses itself: what does Ark know that the rest of us don’t? Why is it buying Coinbase stocks in the midst of the current crisis and market downturn?

The question is especially notable given that Ark Invest sold more than 1.41m shares of COIN in July, then worth about $75 million. Shares of Coinbase Global lost about a fifth of their value at the time. Ark sold at lows of $53, suggesting that the firm may have believed that COIN could extend losses in the following days.

Per Bloomberg, Ark has been buying Coinbase shares since its 2021 debut and was the third-biggest shareholder of Coinbase, holding some 8.95 million shares as of the end of June.

____

Learn more:

– How Investors Should Approach Bitcoin, According to Ark Invest

– This is What’s Backing Ark’s Big Bitcoin, Ethereum and Web 3 Forecasts

– Cathie Wood on Bitcoin

– Cathie Wood on the Fed, Economy, Coinbase, Tesla