Cardano Foundation Releases Sustainability Indicators to Comply with EU MiCA Regulations

The Cardano Foundation, in collaboration with the Crypto Carbon Ratings Institute (CCRI), has released a set of sustainability indicators designed to comply with the Markets in Crypto-Assets (MiCA) regulation in the European Union.

This initiative shows Cardano’s commitment to transparency, sustainability, and regulatory compliance among similar service providers, setting a new benchmark for the broader crypto industry in the EU.

Cardano’s Sustainability Report Aligns with MiCA Regulations

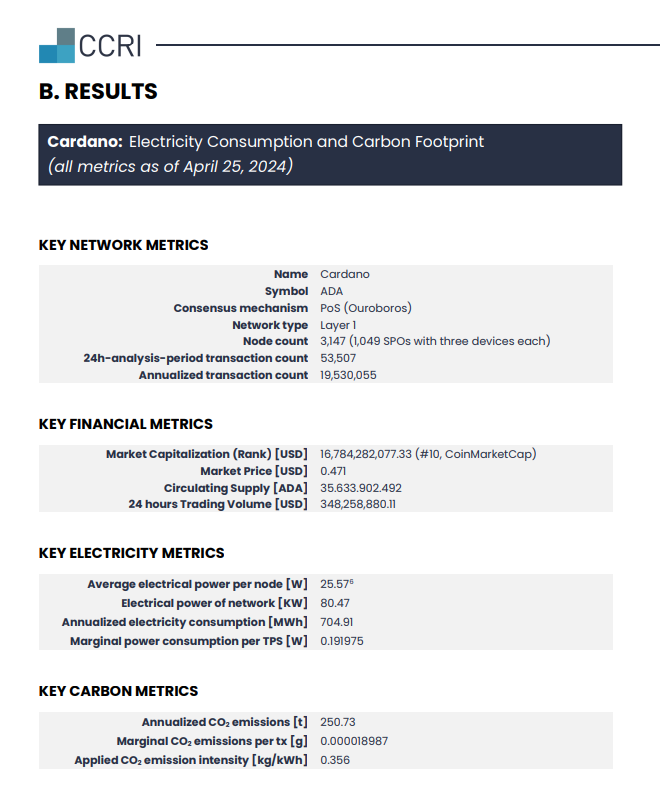

Today, July 2, the Crypto Carbon Ratings Institute (CCRI) released a comprehensive report on Cardano, aligning with the Markets in Crypto-Assets (MiCA) mandate, which requires crypto asset issuers and service providers to disclose sustainability indicators. This adherence is in line with MiCA’s Article 6 (1) and Article 66 (5), which demand detailed environmental impact information for both token issuers and crypto-asset service providers.

The Cardano Foundation, which oversees the ADA cryptocurrency, collaborated with CCRI to ensure rigorous blockchain monitoring and data collection. The CCRI report underscores Cardano’s commitment to sustainability through its adoption of an energy-efficient consensus protocol.

In contrast to energy-intensive Proof of Work (PoW) protocols like Bitcoin, Cardano operates with significantly lower electricity consumption. As of May 2024, the network’s total annualized electricity consumption is reported at 704.91 MWh. The report states:

“Cardano employs an energy-efficient consensus protocol. In comparison to Proof of Work (PoW)-based protocols such as Bitcoin, Cardano consumes significantly less electricity.”

Key metrics highlighted in the report include not only electricity consumption but also the carbon footprint of the Cardano network and marginal power demand per transaction per second. These metrics are in line with the draft regulatory technical standards (RTS) set forth by the European Securities and Markets Authority (ESMA) under the MiCA framework.

“In addition to electricity consumption and carbon footprint, we provide sustainability metrics in line with the draft regulatory technical standards (RTS) provided by the European Securities and Markets Authority (ESMA) in the second consultation package of the Markets in Crypto-Asset (MiCA) regulation.”

The ESMA’s second consultation package on MiCA, released on October 5, 2023, outlines ten mandatory indicators for climate and environment-related impacts, covering energy usage, greenhouse gas emissions, waste production, and natural resource utilization. CCRI’s adherence to these standards ensures transparency and compliance with regulatory requirements.

Frederik Gregaard, CEO of the Cardano Foundation, emphasized the importance of these efforts. He stated:

“By developing MiCA-compliant sustainability indicators, we aim to ensure adherence to the upcoming EU regulations and set a benchmark for the crypto industry. With the MiCA regulations partially coming into effect this week, the industry is now on a six-month countdown to implement crucial ESG binding requirements.”

Gregaard highlighted the role of such initiatives in building trust with regulators, investors, and users, facilitating the wider adoption of blockchain technology sustainably. He stressed that this initiative demonstrates how blockchain networks can address environmental, social, and governance (ESG) concerns while maintaining transparency and efficiency.

MiCA’s Impact on Service Providers

The initial phase of MiCA regulations focuses on stablecoins. In December, additional regulations affecting crypto asset service providers will be introduced, impacting ecosystems such as Cardano.

The same can be seen from other providers, like Circle, which, as of July 1, has become the first global stablecoin issuer to obtain an Electronic Money Institution (EMI) license under the MiCA regulatory framework. The license enables Circle to issue its USDC and EURC stablecoins in Europe, positioning the company to capture a significant portion of the European market.

Similarly, Bitstamp announced on June 26 that it would delist Euro Tether (EURT), Tether’s euro-pegged stablecoin, in response to the MiCA regulation in the European Union. Despite EURT’s significant market cap decline from a peak of $236 million to around $33 million, regulatory pressures have also influenced Bitstamp’s decision.

Similarly, Binance, the largest cryptocurrency exchange by trading volume, restricted the availability of certain stablecoins in the EU to comply with the MiCA regulation. As a result, several existing stablecoins may face restrictions. Binance plans to allow users holding “unauthorized” stablecoins to convert them into other digital assets like Bitcoin, Ether, regulated stablecoins, or fiat currency.

MiCA, effective from last month, June 30, 2024, aims to create a unified regulatory framework for crypto assets in the EU. Fiat-backed stablecoin issuers must implement stringent safeguarding measures and ensure full backing by liquid reserves. This regulation mandates that only stablecoins issued by regulated companies will be accessible to the public.