Bitfarms Mined 189 BTC in June, Up 21%, Amid Hostile Takeover Attempt from Riot Platforms

Bitfarms, a prominent Bitcoin mining company, reported a significant increase in Bitcoin (BTC) production for June 2024. This growth comes amid efforts to fend off a hostile takeover attempt by Riot Platforms.

The company’s strategic upgrades and expansion plans highlight its resilience and commitment to growth in the competitive crypto-mining industry.

Bitfarms Reports 21% Increase in Monthly BTC Production in June Despite Halving Impact

#Bitfarms Provides June 2024 Production and Operations Update

– Earned 189 BTC in June 2024

– Secured additional 120 MW in Pennsylvania with potential to add 8 EH/s in 2025

– Increased installed hashrate to 11.4 EH/s with 10.4 EH/s operational

– Improved corporate energy… pic.twitter.com/sI6rPtaU1L— Bitfarms (@Bitfarms_io) July 1, 2024

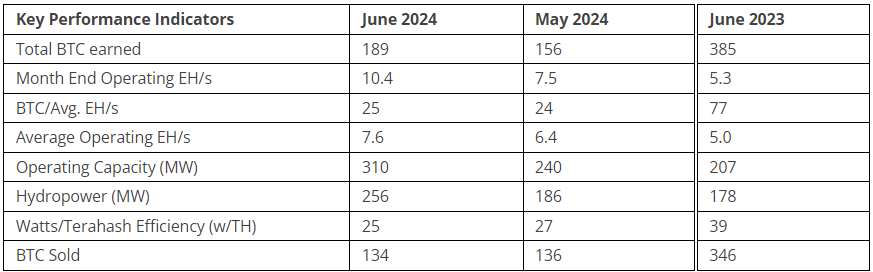

Bitfarms disclosed a 21% month-on-month increase in Bitcoin production for June, mining a total of 189 BTC. The company sold 134 of these Bitcoins for approximately $8.8 million, leaving with 905 BTC valued at around $57 million.

Despite this month-over-month growth, Bitfarms’ production is down by 51% compared to June 2023. This decline is attributed to the Bitcoin halving event in April, which reduced block rewards by 50%. The halving, occurring approximately every four years after 210,000 blocks, aims to control the supply of Bitcoin until it reaches the maximum limit of 21 million coins.

Bitfarms’ installed hashrate reached 11.4 exahashes per second (EH/s) in June, with 10.4 EH/s operational. This marks a significant 96% increase year-on-year and a 39% increase from the previous month. The company has set a target to achieve a 21 EH/s hashrate by the end of 2024, indicating its aggressive expansion in mining capabilities.

However, severe weather conditions in June disrupted mining operations at Bitfarms’ Paso Pe facility in Paraguay. Despite this setback, the company managed to mitigate some challenges with a slight 0.8% decrease in network difficulty compared to May, supporting operational efficiency.

Chief Mining Officer Ben Gagnon noted,

“We continue to make progress on our fleet upgrades and new facility constructions, having installed over 39,000 new miners and deracked over 39,000 old miners so far this year. Upgrades at all of our Quebec facilities are now complete and have significantly expanded our hashrate and improved our energy efficiency and gross mining margins across our portfolio.”

Recently, Bitfarms expanded its operations in the United States with a new 120-megawatt site in Sharon, Pennsylvania. Once fully operational, this site will support an additional 8 EH/s.

This new facility, with a power capacity of 120 megawatts, will be located within the Pennsylvania-New Jersey-Maryland Interconnection (PJM), the largest wholesale electricity market in the U.S.

The new site will contribute up to 8 exahashes per second (EH/s) to Bitfarms’ mining capacity, projecting over 35 EH/s by 2025. This expansion will increase Bitfarms’ projected power capacity to 648 megawatts by 2025, a 170% increase from its current capacity.

Bitfarms Internal Struggle with Riot Platforms

In mid-June, Riot Platforms made a $950 million buyout offer for Bitfarms but ultimately admitted defeat. Riot managed to acquire a 14.9% stake in Bitfarms by June 24 but was blocked from increasing its stake further.

Riot also attempted to replace three of Bitfarms’ board of directors members, but this effort was unsuccessful.

Riot stated on June 24,

“[It’s] clear that engaging with the incumbent Bitfarms Board on a potential combination is just not possible.”

In response, Bitfarms added a new board member to deter Riot’s takeover attempts. Bitfarms has appointed Fanny Philip, a blockchain technology and finance expert, as an independent board member, making four out of five board members independent.

This appointment is part of Bitfarms’ strategic shift amidst the ongoing internal conflict with Riot Platforms.

As Bitfarms works to thwart a hostile takeover from Riot Platforms, it continues to enhance its mining operations and expand its infrastructure. Bitfarms has engaged multiple financial and legal advisors to maximize shareholder value and possibly resolve the conflict with Riot.

The Bitcoin mining industry is seeing increased interest due to rising demand for AI-driven computational power, with significant investments such as Coatue Management’s $150 million in Hut 8.