Bitcoin Price Forecast – Where is the Bottom for BTC?

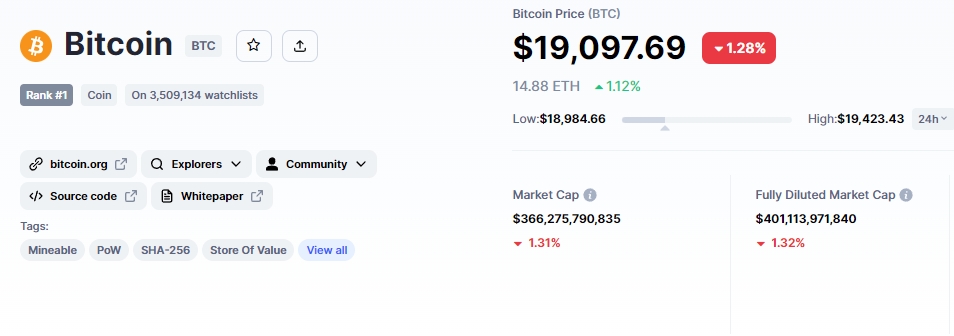

Bitcoin, the world’s most valuable cryptocurrency, dropped more than 2% today to $19,061. At the time of writing, the total market capitalization of cryptocurrencies is $920 billion, just shy of $1 trillion.

The US dollar is bullish at the moment, which is weighing on the prices of Bitcoin and the wider global markets. The majority of investors are looking forward to the release of US inflation figures on Thursday.

Bitcoin Price

The current Bitcoin price is $19,100.67, and the 24-hour trading volume is $28 billion. Bitcoin has fallen by 1.32% in the last 24 hours and more than 4% in the last seven days.

Bitcoin and Ethereum Will Achieve High Values Post-Recession

Paul Tudor Jones, a well-known investor, has stated that scarce digital assets will rise in value in the future, confirming his belief in cryptocurrencies.

On October 10, the billionaire hedge fund manager discussed the role of cryptocurrencies in the current macroeconomic environment with CNBC’s Squawk Box. Jones expressed his belief that digital assets will grow rapidly in the future and his assessment of scarce cryptocurrencies benefits the value of ETH and BTC.

According to Paul Tudor Jones, Bitcoin and Ethereum may benefit from rising inflation and precarious macroeconomic situations because of their scarcity.

Paul Tudor Jones Tells CNBC ‘Spectacular’ Times for Macro https://t.co/LNKt8tNL6a

— Bloomberg Markets (@markets) October 10, 2022

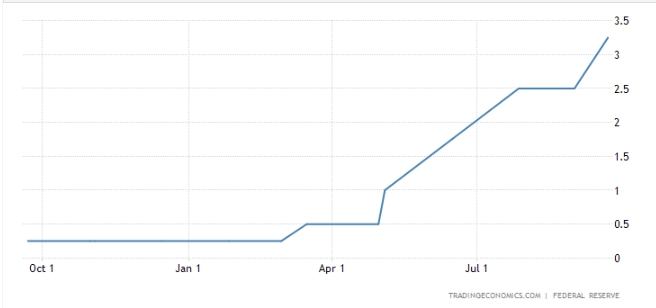

Markets, in his opinion, may rise if the Federal Reserve stops raising interest rates to combat inflation, despite the US economy being on the verge of a recession. The Fed’s interest rate hike expectation of 4.6% in 2023 has increased economists’ expectations of further increases before the end of the year.

The current fund rate is between 3% and 3.25%. According to Jones, cryptocurrencies will be ready to take the spotlight when the tides turn, but first, there will likely be a recession.

Focus on the US Inflation Report

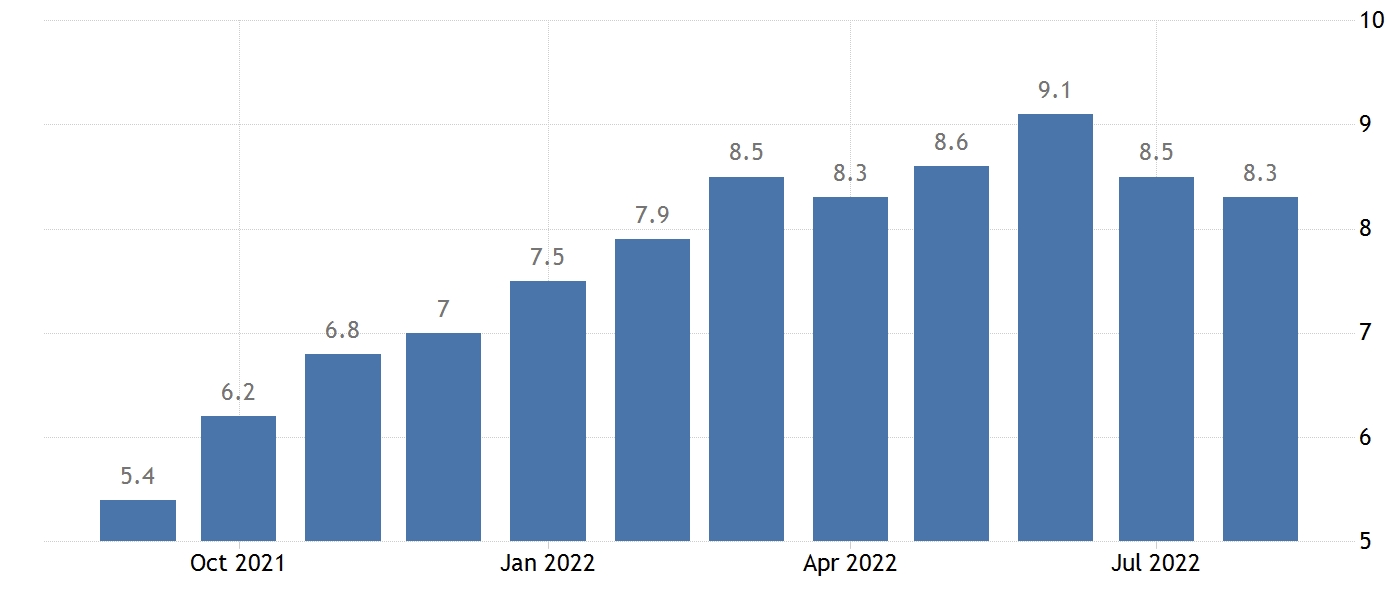

The US Consumer Price Index (CPI) statistics are set to be released on Thursday, October 13, but the crypto market is already factoring in the impact of higher CPI figures, causing Bitcoin to fall.

The annual inflation rate in the United States decreased for the second consecutive month in August 2022, coming in at 8.3% from 8.5% in July. This was the lowest rate in four months, though it was still higher than market expectations of 8.1%.

BTC Under Pressure amid Bitcoin Mining Difficulty

On October 10, the mining difficulty for Bitcoin (BTC) increased dramatically, reaching a new high since May 2021. BTC mining difficulty increased by 13.5% to 35.61T, with an average hash rate of 254.80 EH/s. The increased hash rate makes mining even more difficult in an already difficult crypto winter and inflation-ridden market.

#Bitcoin Difficulty has adjusted to a new all-time-high due to a rapid increase in network hashpower.

— glassnode (@glassnode) October 10, 2022

This increases the $BTC cost of production, and puts additional stress on miners.

We have launched a new dashboard tracking miner capitulation risk🧵https://t.co/oFj1RFiVoe pic.twitter.com/8z3iNlaREo

Several factors may have contributed to the increase in mining difficulty or hash rate.

The Ethereum Merge, which put proof-of-work miners out of work after switching to proof-of-stake, is also said to have prompted miners to repurpose their equipment and use it to mine Bitcoin, which may have increased the hash rate.

Despite the mining difficulty, Bitcoin prices have failed to gain traction; instead, the BTC price has increased just by 1.7% in the last 14 days, defying the popular belief that the price rises as mining difficulty increases.

Bitcoin Price Forecast – Where is the Bottom for BTC?

The BTC/USD pair is trading in line with the Asian session’s Bitcoin price prediction report. On the daily timeframe, BTC is falling toward a key support level of $18,970. The triple bottom pattern is likely to extend support at $18,970; this level could act as a bottom, and BTC may rebound if it stays above this level.

BTC is still bearish, with the 50-day moving average (MA) at $19,850 providing significant resistance. A break below the $18,970 support level could send BTC down to $18416.59 or $17,709 levels.

On the daily timeframe, a descending triangle pattern is still in place, and it is likely to keep BTC bearish until it breaks out of the $20,275 resistance level. If Bitcoin rises above $20,475, it has the potential to test the next resistance level of $21,905 or $22,760.

With Bitcoin’s environmental impacts remaining a contentious issue in the markets, many investors are now also looking at green alternatives on the market.

IMPT – The Green Alternative Crypto

The ongoing Impact Project (IMPT) token presale has been grabbing significant attention, having successfully raised more than $3 million in a week or so.

The Impact Project is an Ethereum-based marketplace for carbon credits, making it an interesting proposition for ESG investors or for anyone seeking the big gains that can come from a new coin being listed for the first time.

The platform tokenizes carbon credits meaning the sale and use of such credits become more transparent. As explained in the IMPT white paper, this solves a number of problems that undermine the carbon credit market today, such as double-selling credits, overcalculating credits, and also not performing proper retirement procedures.

Visit IMPT Today

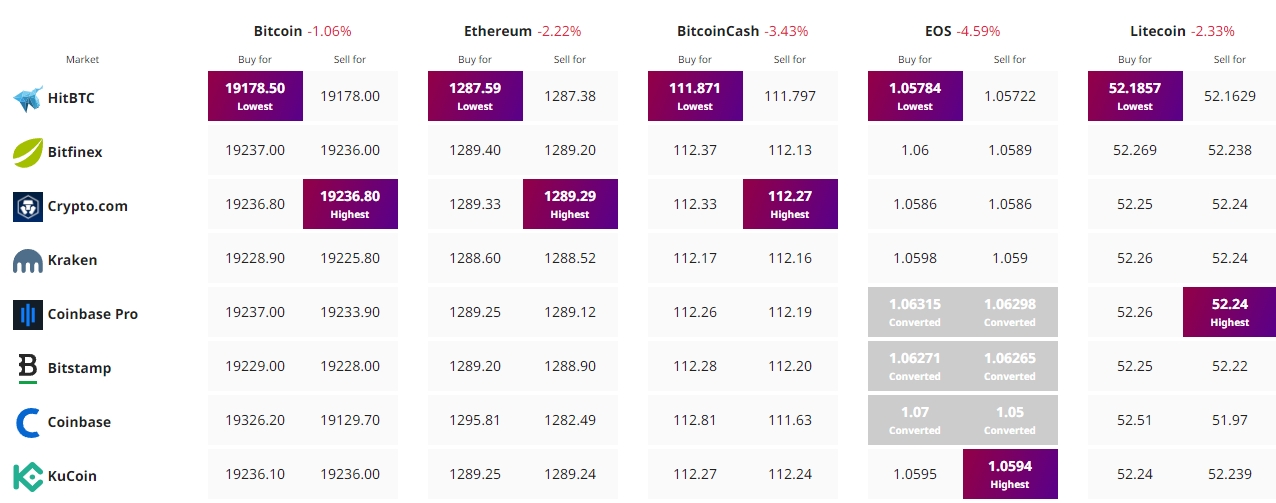

Find The Best Price to Buy/Sell Cryptocurrency:

Related News:

–Crypto Listing and Delisting Announcements: Week 49

–SmarterWorx Project Fresh On The Scene With Concept To Rival MakerDAO And BitDAO

–CoinWealth Lists on P2PB2B

–FinTech Platform YouHodler Lists Five New Metaverse Tokens For Staking, Lending, and Trading

–Bitcoin, Ethereum and Major Altcoins Trim Gains, THETA and SLP Rally

–Bitcoin and Ethereum Struggle, Altcoins Correct Lower