Bitcoin & Crypto Selloff: Liquidations, Extreme Fear, Eyes on MicroStrategy, and Possible Support Levels

Bitcoin (BTC) and the broader crypto market went into a sharp selloff over the past day, led lower by a de-pegging of the partially BTC-backed stablecoin terraUSD (UST) and a falling risk sentiment globally.

At the time of writing (10:30 UTC), BTC was down by 5.5% over the past 24 hours to USD 31,512, having trimmed some of its losses from Monday when it dipped as low as USD 29,730. At the same time, ethereum (ETH) was down 2.2% for the past 24 hours to USD 2,384 – also up from its Monday low of USD 2,200.

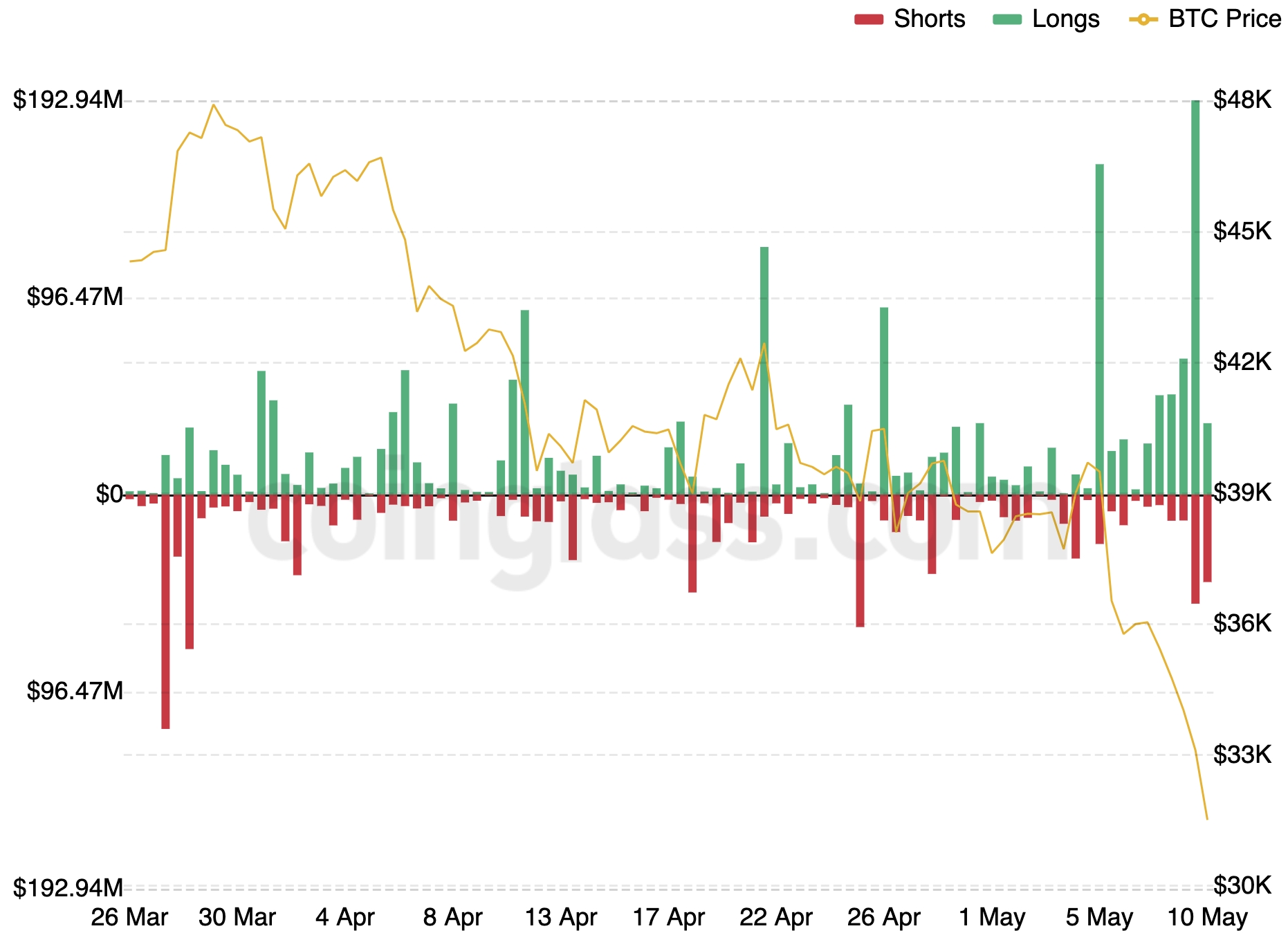

The selling led to massive liquidations of leveraged bitcoin long positions across exchanges, with about USD 193m liquidated in the 12 hours from noon to midnight UTC time on Monday.

The liquidations in crypto came as stocks globally also went into deep red territory, with the US S&P 500 index losing 3.2% on Monday and the technology-heavy Nasdaq index shedding 4.3%.

Among the more notable developments over the past 24 hours was seen by the UST stablecoin, which lost its US dollar peg and fell to as low as USD 0.67 before its recovery started. The event forced the team behind the stablecoin to act and lend out BTC to a trading firm that is likely to have sold it to defend the UST peg.

Extreme fear

The selling in crypto over the past day has brought the so-called Crypto Fear and Greed Index, which measures sentiment from across the crypto market, to ‘Extreme Fear’ with a reading of 10.

Throughout its history, dating back to early 2018, the index has only been below 10 on a few occasions. Among these was the Covid-19-related crash in March 2020, and the final capitulation of the 2018 bear market in November that year.

MicroStrategy’s BTC Profit Dives

Meanwhile, bitcoin bull Michael Saylor’s firm MicroStrategy is also in the news today, after reports that the company’s profit on its massive bitcoin investment dropped sharply.

According to Saylor’s latest purchase announcement, the company’s average purchase price for its enormous bitcoin stack is about USD 30,700.

The news that MicroStrategy’s investment had turned into a loss was nonetheless widely reported on Monday, with some reports pointing to a “margin call” level for the firm at a BTC price of around USD 21,000.

The margin call in question refers to a loan MicroStrategy took out at Silvergate Bank in March for USD 205m.

As of April 4, MicroStrategy held BTC 129,218 in its reserves. At the current bitcoin price, the holding is worth some USD 4.08bn, suggesting that the loan is a relatively minor amount considering the company’s overall holding. (Learn more: MicroStrategy is Only HODLing Bitcoin, Says the CEO; MicroStrategy Has No Limits For Bitcoin Purchases, Discusses Sale Scenarios)

Meanwhile, speculations about a margin call level for the company led Saylor to take to Twitter on Tuesday, clarifying that BTC would need to fall to as low as USD 3,562 for MicroStrategy to run of BTC to pledge for its loan, while hinting that even that would not be enough for the firm to sell any coins.

“MicroStrategy has a USD 205M term loan and needs to maintain USD 410M as collateral,” Saylor wrote, adding that the company has BTC 115,109 “that it can pledge.” Still, Saylor didn’t stop there, but further suggested that his company could “post some other collateral” should the price fall below USD 3,562.

Bitcoin support areas

Commenting on the state of the market at the moment, several analysts pointed to possible support zones for bitcoin in the USD 25,000 to USD 30,000 range.

Joe DiPasquale, CEO of crypto hedge fund manager BitBullCapital, said in an emailed commentary that,

“Moving forward, more downside can be expected, especially as monetary policy continues to contract but we don’t expect BTC to lose the zone between 25k – 30k even in the event of an extreme downturn.”

He added that “a bounce in the near term cannot be ruled out,” and pointed to this month’s options expiry worth around USD 1.3bn on the major crypto derivatives exchange Deribit as something investors should keep an eye on.

Meanwhile, the Singapore-based crypto hedge fund QCP Capital wrote in a market update on its Telegram channel on Tuesday that USD 30,000 for BTC and USD 2,200 for ETH are “key support levels” for the two coins. However, it warned that there is a “material tail risk” from the de-pegging of the UST stablecoin, as well as “ongoing macro concerns,” hinting that the prices could fall even further.

“The market will now be looking closely at Wednesday’s US [inflation] print for some macro guidance amidst the pain,” the firm added.

Similarly, Mike Novogratz, the founder and CEO of Galaxy Digital, said during an earnings call for his company on Monday that he believes “there’s some more damage to be done.”

“[Crypto] will trade in a very choppy, volatile and difficult market for at least the next few quarters before people are getting some sense that we’re at an equilibrium,” Novogratz was quoted by Bloomberg as saying on the call.

Further, Novogratz reiterated that BTC could hold at the USD 30,000 range and ETH at the USD 2,000 level.

Lastly – and on the more bullish side – ARK Invest founder and major technology investor Cathie Wood said in a video update last weekend that an increasing correlation between crypto and traditional assets could indicate that the crypto bear market is soon ending.

“Crypto, a new asset class, should not look like the Nasdaq, but it does. It’s highly correlated right now. You know you’re in a bear market and maybe close to the end when everything starts acting alike, and we’re seeing the capitulation of one market after the other,” Wood said in the video.

“I’ve been around in the business for 45 years, and I’ve never seen the opportunities I see now,” she said in regards to her outlook for the broader crypto and technology space.

____

Learn more:

– Conspiracy Theories Abound as Terra Tries to Save UST

– Bitcoin Extends Selloff Despite Luna Buying, Strong On-Chain Data

– Bitcoin and Ethereum Slide, Analysts Look for Possible Bottom

– Bitcoin On-Chain Metrics Strongest Among Peers – Kraken

– Azuki Sales Skyrocket as Floor Price Drops by Nearly 45%

– Bukele Showcases Bitcoin City Plans and ‘Buys the BTC Dip’ Amid Stark Warning

___

(Updated at 14:40 UTC with additional comments from Michael Saylor.)