Biggest Crypto Gainers Today on DEXTools – XELON, PMR, EMOTI

Bitcoin is up against increasing bearish sentiments this week, just days after attempting to push past $30,000. Crucial technical markers are signaling further downside potential for the cryptocurrency over the near and medium terms.

With this in mind, what are the biggest crypto gainers today on DEXTools?

The number of #Bitcoin addresses with 1,000 BTC or more in the balance returned to the level preceding last week's spike above $28,000 (based on the data from @Lookintobtc). A lack of engagement among big players at the current price levels suggests more downside is possible.

— TradersWeekly (@Traders_Weekly) September 6, 2023

According to an analysis from TradersWeekly, caution should be exercised when evaluating Bitcoin’s latest price action. Following a brief period of relative stability over the extended weekend, Bitcoin remained largely stagnant, with prices hovering around $26,000.

The analysis highlighted that after briefly rising above $28,000 last week, Bitcoin’s technicals have turned bearish again.

The weekly timeframe also shows expanding negative momentum, with key indicators like the MACD, RSI, and Stochastic Oscillator pointing down. Of particular concern is the MACD indicator, which currently hovers just above the midpoint.

TradersWeekly cautioned that a sustained decline in the price of Bitcoin could serve as a precursor to an array of challenges in the future. There are expectations Bitcoin’s price may dip below $24,000.

“Our perspective has not changed since the previous update on Bitcoin. We expect further declines over the short and medium terms, with a potential slide towards the $24,000 area,” the TradersWeekly analyst stated.

Another worrying sign is waning interest from large investors. The number of Bitcoin addresses holding 1,000 or more coins has fallen below levels seen before last week’s price spike, which analysts see as fading interest at current prices.

While Bitcoin briefly climbed after a U.S. appeals court directed the SEC to reevaluate its decision on a Bitcoin ETF, the cryptocurrency has since slid back into the familiar trading range this year.

Market analysts believe that the ETF ruling could act as a catalyst for Bitcoin, potentially driving it to achieve new highs and attracting institutional capital.

In the meantime, Bitcoin continues to trade below the $26,000 mark, with its current price standing at $25,624, with its weekly loss approaching 6%.

While Bitcoin and the broader cryptocurrency market persist in their consolidation, crypto observers are exploring unfamiliar territories with lesser-known cryptocurrencies.

XELON, PMR, and EMOTI are the frontrunners in this trend, registering as the biggest crypto gainers on DEXTools today.

XELON: Bullish Trend Continues as Price Soars

Despite the cryptocurrency market’s current sluggishness, XELON is currently surging, boasting an increase of 593.58% so far today. This surge has propelled it to a new all-time high of $0.000006286 as of writing.

Examining the 15-minute chart, the 20-period Exponential Moving Average (EMA) stands at $0.000004983, while the 50-period EMA is at $0.000004168. Both these prices are below the current price, indicating a prevailing bullish trend.

The 20 EMA, often considered dynamic support in an uptrend, is closer to the current price and could provide substantial support in case of a pullback.

XELON’s RSI is currently at 85.95. An RSI above 70 typically suggests that the cryptocurrency is overbought, hinting at a potential correction.

However, in strong trending markets, the RSI can remain overbought (or oversold in downtrends) for extended periods, reinforcing the strength of the prevailing trend.

Traders should be cautious as the RSI approaches these extreme levels, but should also be aware that a high RSI can sometimes merely indicate strong momentum.

The Moving Average Convergence Divergence (MACD) histogram, which serves as an oscillator that measures the speed and direction of a trend, is currently at 0.00000054.

Positive values of the MACD histogram indicate bullish momentum, further supporting the case for XELON’s ongoing rise.

While XELON is currently in price discovery mode, with no obvious resistance levels in sight, traders should keep an eye on potential areas of support should a retracement occur.

The immediate support level appears to be at $0.000005305, followed by the dynamic support level of the 20 EMA at $0.000004983.

If XELON’s price were to retrace to these levels, it could provide potential buying opportunities for traders who missed the initial surge.

XELON’s rise has been backed by robust technical indicators. The coin’s momentum appears strong, with key indicators suggesting further upside potential.

However, traders should remain alert to the possibility of a price retracement and be ready to take advantage of potential buying opportunities at the outlined support levels.

Pomerium Utility Token’s (PMR) Parabolic Run Fizzles Out, Will the Surge Continue?

PMR staged a parabolic rally exceeding 1,180% gains in the first few hours after the market opened today. However, the upward momentum was short-lived, with prices slowly pulling back from PMR’s intraday high.

Traders are now looking for signals as to whether PMR’s surge will resume or continue to fizzle out.

PMR is currently trading at $0.001370, still a significant 690.85% increase so far today.

The currency appears to be retesting its 1-hour 10 EMA at $0.0011336 for potential support. This is a key level to watch, as successfully holding above the 10 EMA could indicate that the bullish momentum remains strong.

PMR’s RSI is at 69.28, a level that suggests that PMR is nearing overbought conditions.

Meanwhile, PMR’s MACD histogram is currently at -0.00002261. PMR’s negative MACD histogram implies that the short-term momentum of PMR is slowing down, which might lead to further price correction.

However, this should be interpreted with caution, as the MACD is a lagging indicator and might not instantly reflect recent price changes.

In terms of resistance, the Fib 0.382 level at $0.001395 stands as a significant barrier that PMR needs to conquer for more upside potential.

A breakout above this level could reignite the bullish momentum and possibly send the currency back towards its earlier highs.

On the downside, immediate support is seen at the hourly 10 EMA of $0.0011336. If this level fails to hold, PMR could look towards the Fib 0.5 level at $0.001152 and the hourly 20 EMA at $0.001132 for additional support.

While PMR’s parabolic move has undoubtedly caught the eye of many traders, the cryptocurrency now stands at a critical juncture.

The next few hours will be crucial in determining whether PMR can sustain its explosive momentum, or if a deeper retracement is on the cards.

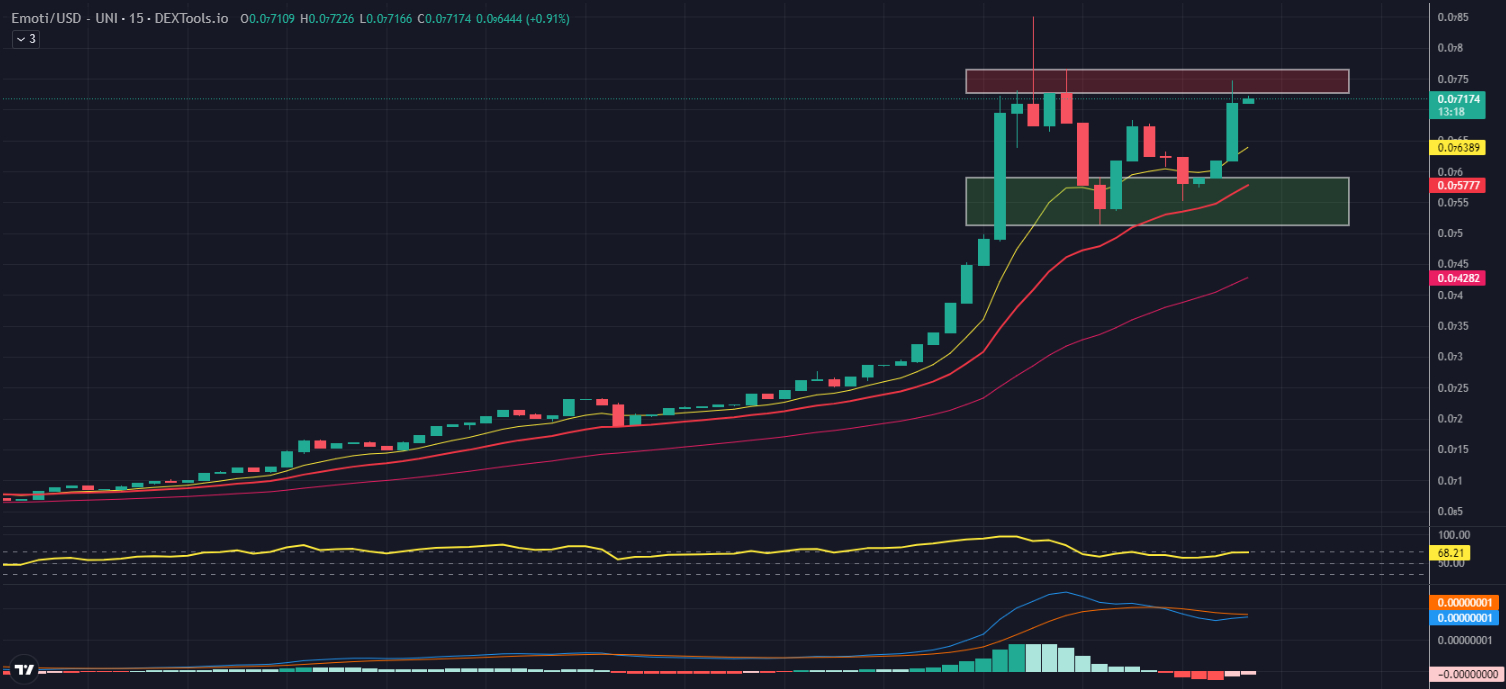

EmotiCoin (EMOTI): One of the Biggest Crypto Gainers Today on Dextools

EmotiCoin (EMOTI) stands out as one of the biggest crypto gainers today on DEXTools. EMOTI is currently trading at a price of $0.00000007174, marking a gain of 1,392.06% so far today.

After setting an all-time high of $0.00000008501 earlier, the cryptocurrency has experienced a minor retracement to its 15-minute 10 EMA.

Despite this, EMOTI has since traded sideways and has recently mounted a convincing price action, signaling that the bullish run might not be over just yet.

Looking at the 15-minute technical indicators, EMOTI’s 10 EMA is currently at $0.00000006389, a figure significantly above the 20 EMA of $0.00000005777.

This difference indicates an ongoing bullish momentum, with the short-term trend favoring the buyers.

The 50 EMA, which represents a longer-term trend, is currently at $0.00000004282. The fact that the current price is significantly higher than the 50 EMA further underscores the bullish bias.

EMOTI’s RSI currently sits at 68.21 which suggests a strong buying pressure. However, it’s nearing the overbought threshold (above 70), indicating that there could be a potential short-term pullback.

Further supporting the bullish outlook is the MACD Histogram, currently at -0.0, hinting at a possible bullish crossover. This could be a precursor to a continuation of the upward momentum in the price of EMOTI.

On the resistance front, EMOTI faces a horizontal resistance zone from $0.00000007261 to $0.00000007649, with the intraday high of $0.00000008501 acting as the next significant barrier. Traders should monitor these levels closely, as they may pose challenges to the uptrend.

In terms of support, the 15-minute 10 EMA of $0.00000006389 serves as the immediate cushion, followed by the horizontal support zone ranging from $0.00000005133 to $0.00000005900.

These levels could provide a safety net should the price experience a downward correction.

In light of the current technical indicators, traders should watch for a potential continuation of the upward trend.

The bullish momentum, coupled with the possibility of a bullish MACD crossover, suggests that there may be more upside for EMOTI in the near term.

Crypto Presales to Watch in 2023

Getting involved in cryptocurrency presales can give you an early look at new projects before they become available to the wider cryptocurrency market.

Buying tokens at a discounted presale price compared to later public rates can offer a big financial upside if the project does well after its launch.

Although there are risks, early investment in presales can be quite profitable for those focused on growth. The challenge is to find good opportunities managed by competent teams with well-planned blockchain ideas.

Analysts at Cryptonews.com use their extensive knowledge of crypto to study upcoming presales. They identify options that have a good chance for growth due to their strong management teams and unique project concepts.

After a detailed review, they’ve found some presales for 2023 that appear to be under-the-radar opportunities that may be worth taking a risk on.

If you’re a crypto investor willing to take some calculated risks for the possibility of high returns, taking part in these selected presales could offer you financial growth in 2023 and beyond.

New Cryptocurrencies to Buy In 2023

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.