Best Crypto to Buy Today December 20 – Near, Stacks, Sei

Stacks’ near 30% STX price increase so far today has captured the attention of market observers, and it stands out among the best cryptos to buy today, alongside Near Protocol (NEAR) and Sei Network (SEI).

These cryptocurrencies, including the promising crypto presales Sponge V2 and Bitcoin Minetrix, are drawing interest from all quarters of the crypto market.

Best Crypto to Buy Today in the News

Near Protocol (NEAR) is experiencing a considerable price swing, with its current trading price at $2.977, marking a notable 22.42% increase so far today.

Should NEAR successfully surpass the psychological barrier of $3, the next potential target range lies between $3.30 and $3.50, representing a potential price swing of nearly 18% from its current levels.

NEAR’s substantial monthly growth of over 52% underscores its strong presence in the short-term market.

As one of the top-performing altcoins lately, Stacks’ recent bullish market activity is currently attempting to push past the key extended Fib -0.382 level of $1.5141.

With its current price of around $1.5229, STX seems set to continue climbing towards higher price targets at $1.78, $1.93, and potentially even $2.4 if it can successfully surpass $1.5141.

This potential upside momentum aligns with major upcoming developments for Stacks.

Every experiment in crypto will eventually gravitate towards Bitcoin 🟧

⭐️ @TimDraper mentions Stacks as the project that excited him this year during an interview with @RaoulGMI and @jessicasmw on @coinbureau pic.twitter.com/GFycyqqV0o

— stacks.btc (@Stacks) December 19, 2023

The highly anticipated Nakamoto testnet launch is an event that could boost Stacks’s performance to be on par with leading Ethereum scaling solutions.

Additionally, a new partnership with Figment seeks to strengthen Stacks’s market position by offering staking services.

Although the broader cryptocurrency market has seen consolidation in recent weeks, STX has shown resilience and increased by over 54%.

This price action highlights Stacks’ potential for further growth ahead as both technical and partnership milestones draw near.

With strong foundations and positive sentiment, Stacks looks set to continue its ascent in the altcoin ranks if it can conquer its immediate resistance levels.

Sei Network’s market performance has also been exceptional, with a surge of over 20%, and its trading volume skyrocketing by 413% in the last 24 hours.

This has positioned SEI as the top gainer in its category for the day. The network is not solely DeFi-oriented but is expanding into gaming, NFTs, stablecoins, and infrastructure.

Early load tests have confirmed Sei’s capability of handling over 5k transactions per second (TPS), with plans for Sei v2 to launch on a public testnet in early 2024.

The market sentiment toward Sei is predominantly bullish, buoyed by increasing discussions on platforms like Telegram.

Amidst these established cryptocurrencies, two Bitcoin alternatives – Sponge V2 and Bitcoin Minetrix – are debuting in the market via crypto presales.

With the crypto community always on the lookout for the best crypto to buy today, these presales are attracting attention due to their potential role in the evolving cryptocurrency space.

The vitality of the market and the presence of these cryptocurrencies and presales underscore the diversity and dynamic nature of the crypto investment ecosystem.

As investors evaluate the broader economic context and the potential of individual cryptocurrencies, they continue monitoring these market developments and new opportunities closely.

Bullish MACD Crossover: Is NEAR Protocol Set for Further Upside?

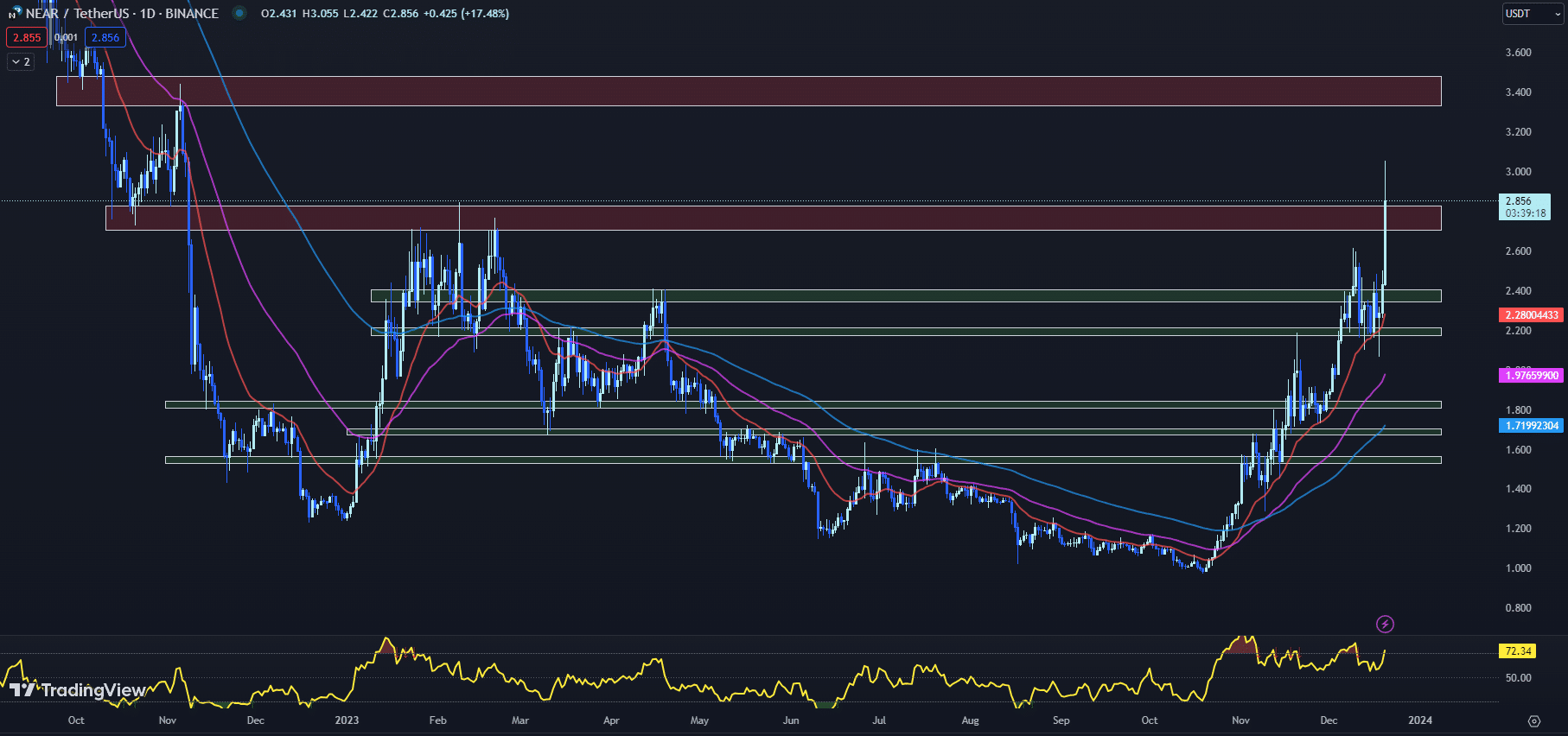

The recent market dynamics have thrust Near Protocol (NEAR) into the spotlight of heightened bullish market activity.

The cryptocurrency has vigorously ascended to a new year-to-date high of $3.055 earlier today, capturing the attention of traders and analysts alike.

The NEAR price, now trading at $2.856, is still reflecting a notable uptick of 17.48% so far today, signaling robust bullish sentiment in the near term.

Delving into the technical indicators, the 20-day EMA currently stands at $2.280, a notable distance above the 50-day and 100-day EMAs, positioned at $1.977 and $1.720 respectively.

This alignment of the short-term EMA well above the longer-term EMAs typically illustrates a strong upward momentum, reinforcing the current bullish narrative surrounding the NEAR price.

The RSI has escalated to a level of 72.34, a climb from the previous day’s 62.21.

An RSI above 70 often indicates that a cryptocurrency may be in overbought territory, which could precede a potential pullback.

However, in the context of a strong uptrend, such as that shown by NEAR, an overbought RSI can persist for extended periods, hinting that the NEAR price may maintain its bullish stance in the imminent trading sessions.

Further bolstering the bullish outlook is the MACD histogram, which has transitioned to a positive 0.015 from yesterday’s negative -0.016, suggesting a bullish MACD crossover.

This development typically suggests that the near price could continue to experience upward momentum as buying pressure increases.

Yet, traders are closely monitoring the resistance zone stretching from $2.705 to $2.827.

The current NEAR price is challenging these levels, and a decisive break above could open the door to further gains, potentially cementing the cryptocurrency’s bullish trajectory.

Conversely, should the NEAR price struggle to mount this zone, it may encounter a period of consolidation or correction before making another attempt.

On the flip side, the immediate support between $2.345 and $2.406 provides a cushion for the near price, having previously served as a resistance-turned-support pivot point.

This level is crucial, as a dip below could signal a weakening of the current bullish fervor, possibly leading to a test of lower price levels.

Investors and traders are advised to monitor these technical indicators and price levels closely.

The near price has shown remarkable resilience and strength, yet the markets remain a tapestry of evolving dynamics.

As such, maintaining vigilance and adapting to fresh technical cues will be key to navigating the near-term price action of Near Protocol.

STX Price Exhibits Resilience Amidst Fluctuating Market Conditions

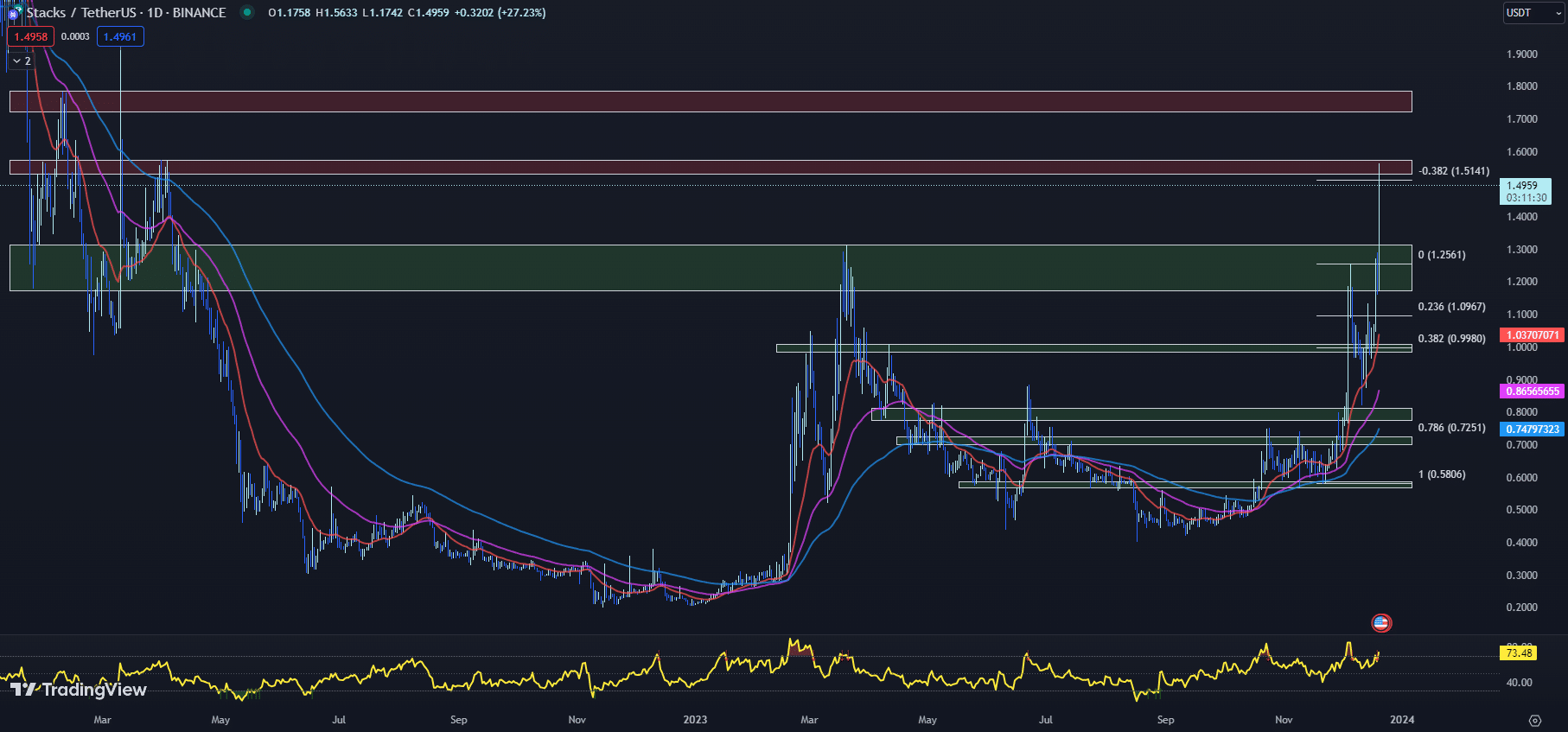

The STX price has exhibited remarkable resilience amidst market fluctuations, with the cryptocurrency rebounding sharply from yesterday’s retracement, signaling a bullish undertone among investors.

The rally of 27.23% so far today has propelled the STX price to a new year-to-date high of $1.5633, underscoring the surmounting confidence in the cryptocurrency as it pierces through previous resistance levels.

Technical indicators for STX suggest a dynamic interplay between bullish momentum and emerging caution.

The 20-day EMA at $1.0371, comfortably above both the 50-day EMA of $0.8657 and the 100-day EMA of $0.7480, indicates a strong uptrend.

Such alignment of short-term and long-term EMAs typically affirms ongoing positive sentiment, bolstering the case for a sustained upward trajectory in the STX price.

However, the RSI presents a nuanced picture. Standing at 73.49, a climb from yesterday’s 63.57, the STX price finds itself in overbought territory.

This condition, compared to last week’s higher RSI peak of 84.90 with a lower STX price, hints at a potential bearish divergence.

Traders should monitor this divergence closely, as it may preclude a near-term price correction if buying pressure begins to wane.

Meanwhile, the MACD is presenting an optimistic outlook with its histogram at 0.0318, up from 0.0119 the previous day.

This positive momentum suggests that buyers are currently in control, reinforcing the bullish trend in the STX price.

As for critical price levels, STX is challenging an extended Fib -0.382 level resistance at $1.5141.

Earlier in the day, the price brushed against the overhead resistance zone stretching from $1.5315 to $1.5742, further affirming the strength of the current rally.

On the downside, an immediate support zone lies between $1.1733 and $1.3131.

This range stands as a pivotal area for the STX price to sustain its bullish narrative. Should the price dip, maintaining this support will be important to avert a deeper retracement.

Considering the current landscape, the STX price could be at a critical juncture.

While the robust uptrend and bullish technicals suggest the potential for further gains, the risk of a bearish RSI divergence cannot be overlooked.

Investors may find it prudent to remain vigilant, balancing their optimism with an awareness of possible pullbacks.

As STX navigates these decisive levels, maintaining a close watch on both resistance and support zones will be key to identifying the next potential move in the market.

Bullish Signals: SEI’s Moving Averages Point to Positive Trends

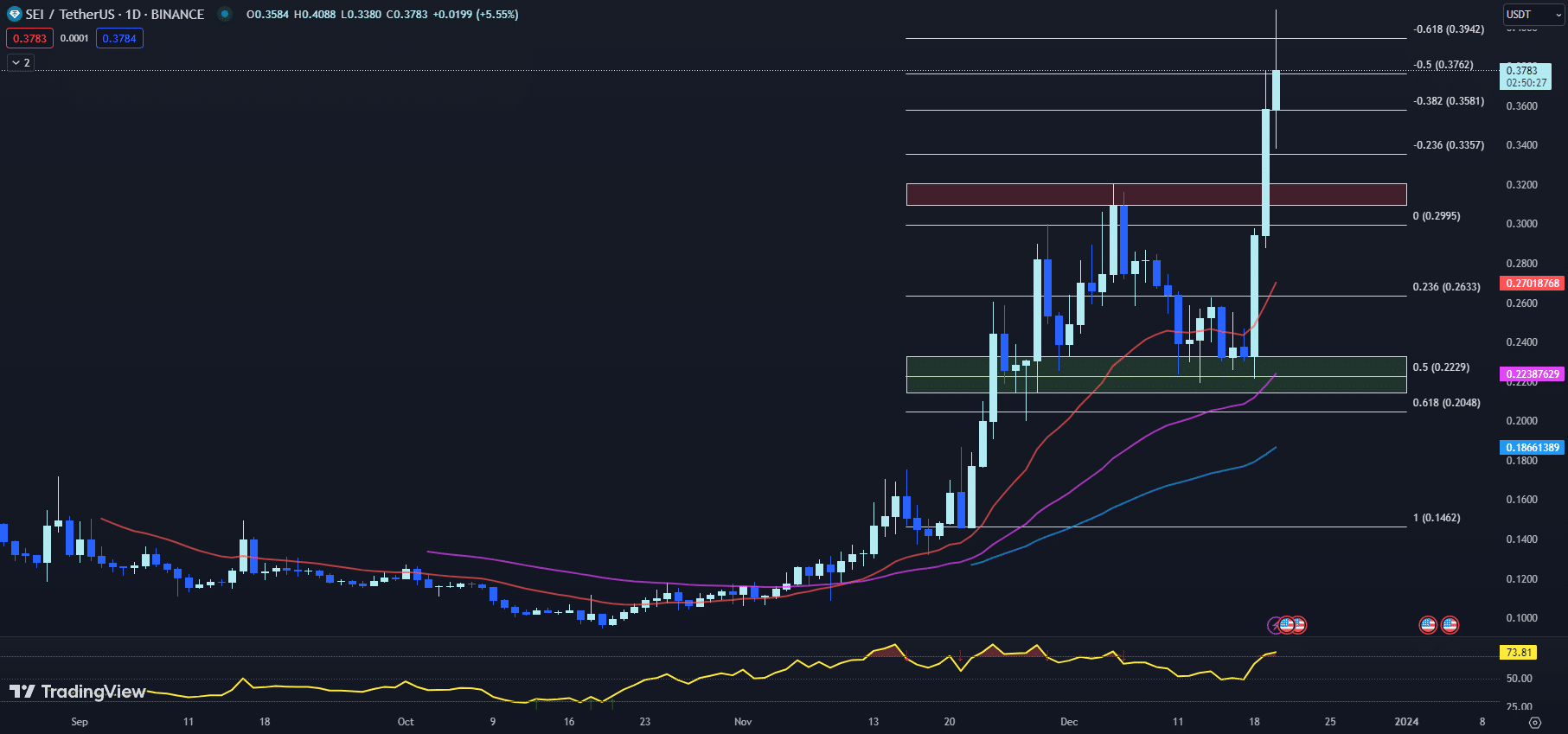

SEI’s price momentum continues to astound traders and investors alike, as this cryptocurrency has once again managed to carve out a new all-time high earlier today, touching $0.4088 and pushing against the $0.40 psychological level.

The recent uptick is not a short-lived blip; rather, it reflects a substantial 56.46% increase over the past week and an even more impressive 154.86% over the preceding month, signaling strong bullish sentiment in the market.

The EMAS for SEI is painting a picture of sustained bullishness.

The 20-day EMA, at $0.2702, lies considerably above both the 50-day and 100-day EMAs, positioned at $0.2239 and $0.1866, respectively.

This alignment typically indicates that the uptrend is well-established and could act as dynamic support levels during any pullbacks.

The RSI for SEI has surged to a high altitude of 73.81, marking an increase from the previous day’s reading of 63.57. This places the SEI price firmly in overbought territory.

While this may suggest the market’s enthusiasm for SEI, it also waves a flag of caution, as readings above 70 often precede potential pullbacks as the market cools off from an overheated state.

The MACD histogram provides further evidence of the strong bullish momentum.

The MACD value has expanded to 0.0322, up from yesterday’s 0.0119, indicating a growing divergence between the MACD and its signal line, which could suggest that the uptrend is accelerating.

The SEI price is currently trading at $0.3783, marking a notable ascent of 5.55% so far today.

This climb is against the backdrop of an immediate resistance zone defined by the Fibonacci extension levels.

The -0.5 level at $0.3762 has been breached, while the SEI price nudged the -0.618 level at $0.3942 earlier today, hinting at the possibility of a consolidation or minor retraction before attempting another rally.

Looking at the charts, the extended Fib -0.382 level at $0.3581 forms the immediate support base for SEI.

This level is critical for maintaining the current bullish structure. Should this support falter, traders might witness a sharper correction as profit-taking could intensify.

For those active in the SEI markets, the technicals suggest a strong bullish trend, but with the RSI in overbought territory, there is a risk of a near-term pullback.

The current price movement of SEI, coupled with the robust volume behind its ascent, suggests that any retracement could be short-lived and potentially serve as a buying opportunity for those who believe in the long-term prospects of SEI.

Investors and traders should monitor whether the SEI price can sustain itself above the immediate support level. A close below this might indicate a shift in market sentiment, whereas holding above could see SEI target new highs.

With substantial gains already in the bag, market participants might consider taking some profits while keeping an eye out for the next resistance levels, especially if the price makes another attempt to breach the $0.40 psychological mark.

Beyond the daily price action of cryptocurrencies already on the market, new blockchain projects in their developing stages are vying for investor attention.

Presales for the hotly anticipated tokens Sponge V2 and Bitcoin Minetrix present a compelling case for finding hidden crypto gems before they gain mainstream notoriety.

Bitcoin Alternatives: Discovering Hidden Gems in the Cryptocurrency Market

Bitcoin’s prominence in the cryptocurrency market is undisputed, yet savvy investors are beginning to explore less familiar but equally promising blockchain ventures.

These projects, still in their initial stages, offer a new avenue for investment.

This strategy shifts focus from the well-trodden path of investing in established cryptocurrencies, which typically have high market values, to a more concentrated approach to developing cryptocurrencies.

Projects such as Sponge V2 and Bitcoin Minetrix are notable for their potential for growth.

Engaging with these projects in their early stages, particularly through presale investments, presents an opportunity for potential gains.

This proactive involvement could lead to returns as the projects mature and gain wider recognition, though it comes with the usual risks associated with early-stage investments.

For investors looking to diversify their cryptocurrency holdings, exploring these alternatives to Bitcoin can be a wise decision.

The key is to recognize these opportunities early and understand their potential to challenge the current cryptocurrency sector.

As the cryptocurrency field continues to attract a broad spectrum of interest, it appears that the most substantial gains may be found in investing in these lesser-known crypto projects.

The best crypto to buy today might not be the most widely known; often, the hidden disruptors offer the most growth potential.

Looking for the Best Crypto to Buy Today? Sponge V2 May Be the Top Meme Coin Pick

The breakout meme coin hit of 2023, Sponge Token ($SPONGE), has officially announced its return with the launch of Sponge V2.

The original Sponge Token, based on the beloved Nickelodeon cartoon character, gained a passionate community and achieved over 100x returns for early investors after its launch in May 2023.

Now, the development team behind the meme coin hopes to replicate this success with the release of an upgraded “V2” token, which some experts say could be the best crypto to buy today while it’s still early.

📣 We’re excited to announce that #Sponge is bridging from V1 to V2!

Stake your $SPONGE to earn #SpongeV2 tokens. 🧽💦

Buy and stake now for a special V2 token bonus! Don’t miss out 🔥#MemeCoin #Web3 #BullMarket pic.twitter.com/bYmkg1TNrU

— $SPONGE (@spongeoneth) December 18, 2023

According to the project’s official channels, Sponge V2 will only be available through a unique “stake-to-bridge” utility that rewards stakers of the original V1 token.

Investors must buy and stake Sponge V1 tokens to earn the new V2 currency when it launches. The more V1 tokens staked and the longer the staking period, the greater the V2 rewards.

Sponge V1 originally launched in the crypto bear market of 2023, surging from a $1 million market cap to over $100 million as meme coin enthusiasts jumped at what many called “the next Dogecoin.”

Major exchanges like Gate.io, MEXC, and Bitget rushed to list the viral token during its parabolic rise.

This time, the Sponge team hopes to deliver another triple-digit return opportunity with the release of V2.

The new token will also feature a play-to-earn game that lets players boost V2 earnings through ranked gameplay.

With the stake-to-bridge event underway, Sponge V1 holders are encouraged to unstake their current V1 tokens and re-stake them in the V2 contract to qualify for the airdrop.

For new investors, the presale widget on Spongevip.com offers direct V1 purchases to start earning V2 rewards.

Bitcoin Minetrix Token Presale Closing Soon With Over $5.6 Million Raised

The 14th stage of the Bitcoin Minetrix (BTCMTX) presale is entering its final days, positioning the new cryptocurrency as one of the best crypto to buy today.

With over $5.6 million raised so far, the BTCMTX token presale is gaining momentum.

Only 2 days left for #BitcoinMinetrix Stage 14! ⏳

To seasoned #Bitcoin miners:

What guidance would you offer to beginners starting their mining expedition? ⛏️ pic.twitter.com/kkoBw26nsC

— Bitcoinminetrix (@bitcoinminetrix) December 20, 2023

BTCMTX offers Bitcoin mining rewards through tokenized staking.

Instead of expensive personal mining rigs, users can generate “mining credits” for cloud mining access to earn Bitcoin passively from staking BTCMTX.

Staking also provides APY yields up to 109%, delivering two income streams – mining and staking rewards.

This dual passive income opportunity has quickly made BTCMTX a top contender for best crypto to buy today while its presale stages remain open.

BTCMTX has outlined an ambitious post-launch roadmap that has piqued investor interest.

Planned developments include exchange listings, expanded marketing efforts, mobile and desktop apps, and new mining partnerships.

By exceeding its soft cap early on, BTCMTX has demonstrated substantial traction for its long-term vision.

With its Bitcoin mining industry-disruptive tokenomics, BTCMTX unlocks lucrative staking and mining rewards for holders, giving the project major upside potential as both a staking and mining asset.

As the closing bell approaches on stage 14, investors seeking the best crypto to buy today have a prime opportunity to acquire BTCMTX early before availability expands in future presale stages.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.