Best Crypto to Buy Now December 19 – Sei, Injective, VeChain

The SEI price has risen more than 50% over the past two days to reach a new all-time high. With this notable price surge, Sei Network now joins fellow top performers like Injective, which has seen a 2,800% year-to-date boom, and VeChain, which has notched over 100% growth in 2023, as some of the best cryptos to buy now.

Meanwhile, ongoing crypto presales like Sponge V2 and Bitcoin Minetrix are also drawing attention for their disruptive potential in the cryptocurrency space.

Best Crypto to Buy Now in the News

Recent partnerships and technical advancements have notably impacted Sei Network’s valuation. A partnership with Circle and forthcoming enhancements, including Ethereum Virtual Machine (EVM) support from Sei Labs, are among the contributors to the network’s heightened performance and efficiency.

Fun fact – @Sei_Labs' first foray into supporting a parallelized EVM started in Aug of 2022

Building the first parallelized EVM is hard, and I'm proud of what we've built so far

Thanks to all the seilors that have been part of this journey, things are just getting started 🔴 💨 pic.twitter.com/X14yTVYJGL

— Jay (@jayendra_jog) December 19, 2023

Despite a high stochastic RSI of 71.26 suggesting a potential upcoming price correction, market predictions generally favor a continued uptrend for Sei’s price.

Additionally, the Sei Blockchain futures market has observed an unprecedented rise in open interest with figures hitting more than $124 million.

With a circulating supply of 2.3 billion tokens and a strong position as the 14th Proof-of-Stake coin as of writing, Sei Network remains a formidable contender in the Layer 1 sector.

Traders closely watch support levels at $0.22, $0.3174, and $0.2628, with resistance potentially near $0.48.

Injective (INJ) has seen its price reach new heights, with a record 2,800% increase so far in 2023.

INJ hit a new high of $39.970 earlier today. This price jump aligns with heightened network activity and the eagerly anticipated “Volan” network upgrade.

The platform’s trading volume has surged by 49.10% in the last 24 hours, exceeding $616 million.

🥁Drumroll🥁

Filament will be launching on @Injective_ EVM in Q1 2024

Filament is a hybrid perpetual DEX combining orderbook w/ novel on-chain liquidity pool model.

Perpetual DEX for degens 🤝 fastest DeFi chain = 🔥🔥

Why are we building on Injective?👇 $INJ pic.twitter.com/SlFxTCb4aK

— Filament (💡,🔱) (@FilamentFinance) December 19, 2023

Injective’s expansion is supported by a growing user base and the development of new initiatives like Moon App and Filament on its blockchain.

These developments, alongside the success of other cryptocurrencies such as Solana (SOL) and Internet Computer (ICP), have contributed to a vibrant market environment for Injective.

VeChain has also charted a notable increase of over 100% since January.

The VET price set a new year-to-date high of $0.03445 earlier today, with the token having risen nearly 20% over the past week and 55% for the month.

Analyst forecasts suggest that VET could soon break past the $0.034 resistance, with projections of hitting $0.044 by early January 2024 – a potential 36% increase from current levels.

Gaining traction in the crypto space, presales like Sponge V2 and Bitcoin Minetrix are drawing interest for their potential.

These projects represent new Bitcoin alternatives within the crypto ecosystem and are gaining attention for their unique offerings and potential market impact.

Investors seeking the best crypto to buy now could consider these developments among SEI, Injective, and VeChain.

With SEI’s partnerships and technical strides, INJ’s network upgrades, and VeChain’s consistent market performance, each presents a unique profile in the current market.

Not to be overlooked, the crypto presales Sponge V2 and Bitcoin Minetrix are also attracting attention, potentially offering new opportunities for early-stage investment.

SEI Price Prediction: Bullish Momentum Surges as SEI Achieves New All-Time High

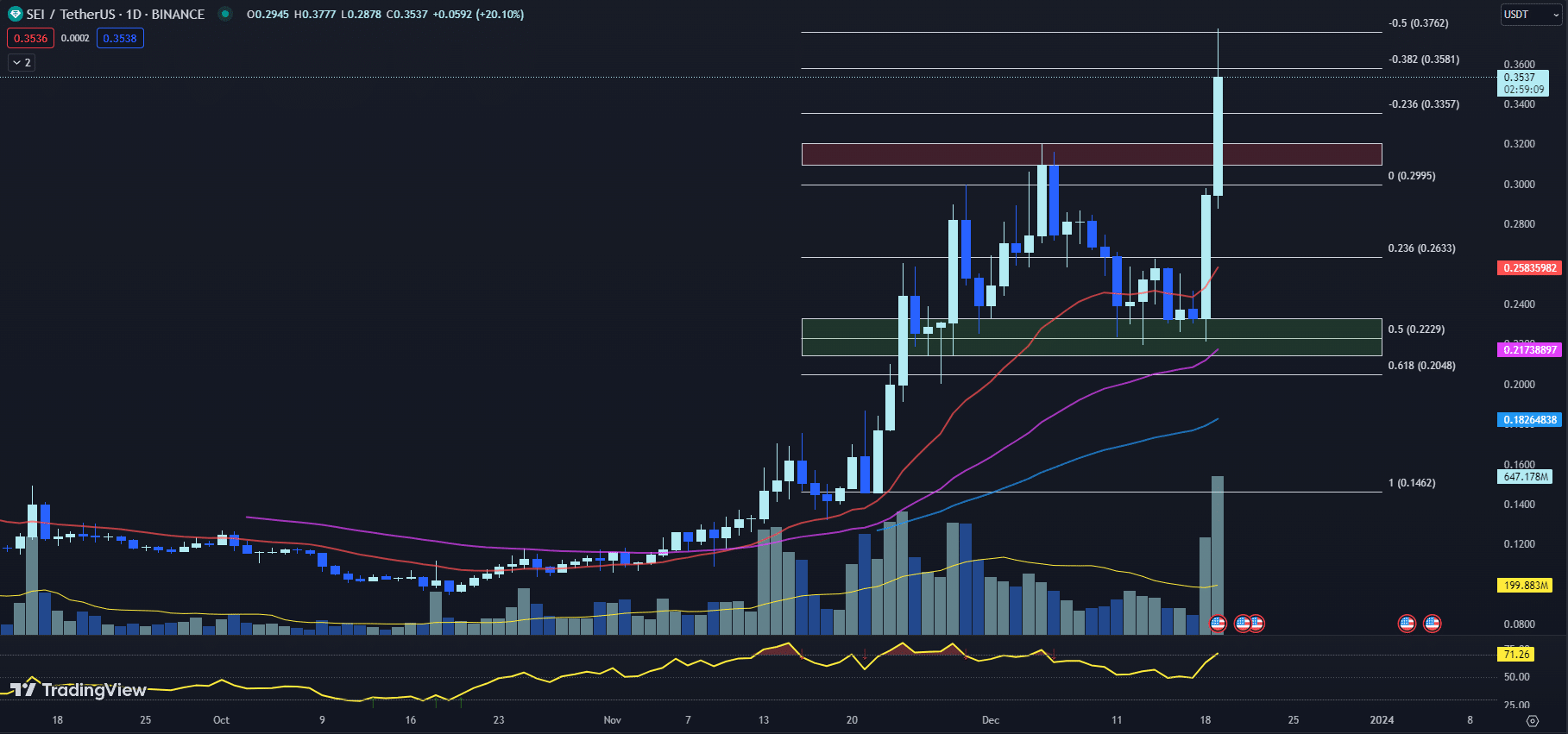

The SEI price has surged to an all-time high of $0.3777, with the current level of $0.3537 reflecting a robust 20.10% increase so far today.

This uptrend comes on the heels of a notable 26.45% move to the upside yesterday, showcasing an increasingly strong bullish momentum for Sei Network (SEI).

As investors and traders watch the SEI price attempt to consolidate above previous resistance levels, the current technicals offer insights into potential future movements.

The EMAs for SEI have aligned in a textbook bullish configuration, with the 20-day EMA at $0.2584 now well above the 50-day EMA at $0.2174 and the 100-day EMA at $0.1826.

This alignment indicates a solid uptrend over the short, medium, and long term, suggesting sustained bullish sentiment in the market.

Further buoying the positive outlook, the RSI for SEI has ascended to 71.26, up from 63.14 just yesterday.

While this RSI level indicates that the SEI price might be entering the overbought territory, it also underscores the strong buying pressure that has been propelling the price upwards.

Adding to the confluence of bullish signals, the MACD histogram has registered a bullish crossover, with today’s reading at 0.0017 marking a reversal from yesterday’s -0.0048.

This shift suggests that bullish momentum is building, and the SEI price could continue to benefit from the positive trend in the near term.

The technical resistance being tested is significant; having breached the immediate swing high resistance zone of $0.3095 to $0.3205, the SEI price is currently facing slight resistance at the extended Fib -0.5 level of $0.3762.

Despite this, the SEI price’s ability to remain above the swing high zone implies that former resistance may transform into a support level, providing a springboard for potential future advances.

As for immediate support, the SEI price looks to the Fib 0.236 level of $0.2633 as its first line of defense against any retracements.

The recent breakthrough and establishment of the swing high zone as a potential support area could be a bullish indicator for the upcoming days.

Given these technical indicators, investors and traders might consider maintaining their positions to capitalize on the bullish trend.

However, vigilance is advised as the SEI price navigates near the overbought region, which could potentially lead to a pullback or consolidation in the short term.

Market participants should closely monitor the SEI price as it interacts with the critical support and resistance levels outlined, ready to adjust their strategies in response to any signals of trend reversal or continuation.

INJ Price Soars Amidst Strong Uptrend: A Promising Outlook

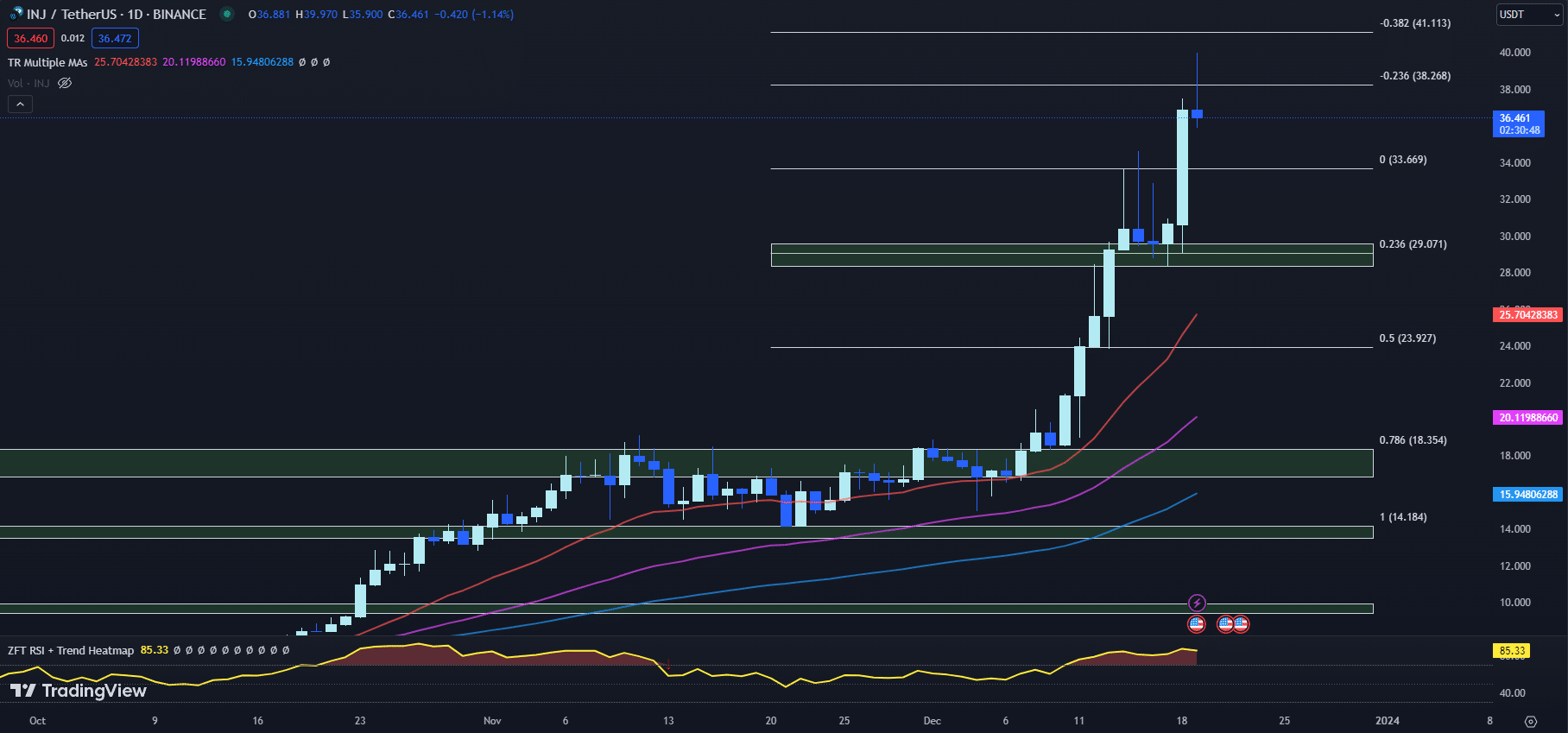

Injective (INJ) has been on notable ascent, with the INJ price once again carving out a new all-time high at $39.970 earlier today, following a substantial 20.36% bullish move yesterday.

Although the INJ price has experienced a slight pullback to $36.461 today, down by 1.14%, the overall trend remains decidedly bullish.

The technical landscape for INJ is particularly compelling, with the 20-day EMA now at $25.704, the 50-day EMA at $20.120, and the 100-day EMA at $15.948. The considerable gap between the current INJ price and the EMAs underscores the strength of the recent uptrend.

The alignment of the EMAs, with each shorter-term average above the longer ones, is a classic bullish signal, reinforcing the positive momentum behind INJ.

Despite the strong uptrend, the RSI presents a note of caution. With the RSI currently at an elevated 85.33, down slightly from yesterday’s 87.24, INJ has been in overbought territory for the past eight days.

This suggests that the INJ price may be primed for a retracement, as extended periods in the overbought zone often precede pullbacks in price.

The MACD histogram supports the bullish sentiment, with today’s reading at 1.423, up from yesterday’s 1.378. The growing positive value on the MACD histogram indicates that bullish momentum is still in play and could continue to drive the INJ price upward in the immediate term.

However, the INJ price’s immediate resistance looms at the extended Fib -0.236 level of $38.268, which was retested earlier today when INJ set its new peak. This level may continue to pose a barrier to further gains in the short term. A break above this resistance could validate the continued strength of the uptrend.

The INJ price finds immediate potential support at the previous swing high of $33.669. Should a retracement occur, this level might cushion the INJ price, preventing deeper losses. Below that, the more formidable support zone of $28.459 to $29.573, aligning with the Fib 0.236 level of $29.071, stands ready to provide a stronger level of support.

Given the extended stay of the RSI in overbought territory, such a retracement would not only be unsurprising but could also be considered healthy for the longevity of the INJ price’s uptrend.

While the INJ price demonstrates strong bullish momentum, traders should stay vigilant for signs of retracement due to the overextended RSI. The key to navigating the current market will be to watch how the INJ price interacts with the immediate resistance and support levels.

A prudent strategy might involve tightening stop-loss orders to protect gains or waiting for a clearer signal that the INJ price has consolidated above support levels before considering new positions.

MACD Shows Continuous Growth in VeChain’s Bullish Momentum

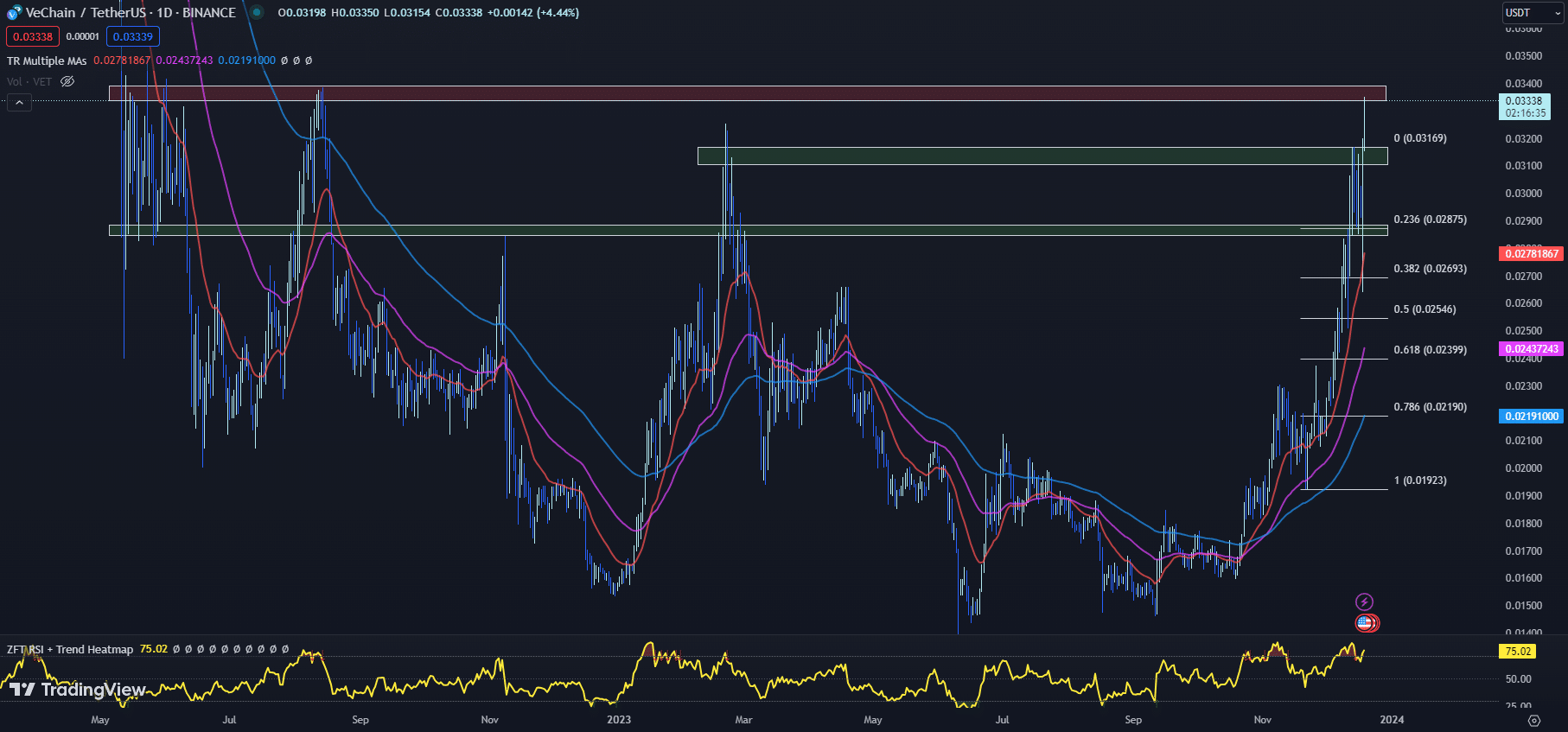

The VET price has displayed renewed bullish vigor over the past two days, following a period of consolidation from December 12 to December 17.

The uptick of 9.64% off its immediate support zone was a robust move, indicating renewed interest and buying pressure. This momentum has been maintained with an additional 4.44% rise in price so far today, pushing the VET price to graze a new Year-To-Date high of $0.03350, before slightly retracing.

Technical indicators for VeChain are painting an optimistic picture for the near term. The 20-day EMA for the VET price stands at $0.02782, with the 50-day EMA trailing at $0.02437, and the 100-day EMA further back at $0.02191.

This alignment, with each shorter-term EMA positioned above the longer-term, typifies a bullish trend and suggests that the VET price enjoys solid upward momentum.

The RSI, currently at an elevated 75.02, up from yesterday’s 72.26, signals that buyers are very much in control, although it borders close to overbought territory. This heightened RSI value warrants attention as it may imply a possible cooling off or consolidation phase for the VET price shortly.

On the MACD front, the histogram’s slight increase to 0.00041 from yesterday’s 0.00032 reflects a subtle yet continuous growth in bullish momentum. The positive histogram values indicate that the upward trend has not yet been exhausted, potentially propelling the VET price further.

However, traders are closely watching the immediate resistance zone, ranging from $0.03337 to $0.03391, which the VET price is currently challenging.

A decisive breakout above this range could signal a continuation of the current bullish phase, with the next significant resistance zone lying between $0.04348 and $0.04457. Achieving this would represent a substantial gain from current levels.

On the flip side, should a retracement occur, the previous swing high of $0.03106 to $0.03169 now serves as a potential support zone. This area is critical as it may act as a springboard for the VET price to recover and attempt another surge if bearish pressure emerges.

The technical indicators for VeChain are conducive to a bullish outlook, with the current price action suggesting a strong buying interest. However, with the RSI nearing overbought levels, investors might proceed with caution.

A clear break above the immediate resistance could validate the bullish scenario, while a pullback would test the new support levels to see if they hold firm.

Looking past rallying cryptocurrencies like SEI, INJ, and VET, new presale launches from Sponge V2 and Bitcoin Minetrix provide fresh opportunities.

Uncovering Bitcoin Alternatives: Opportunities Beyond the Mainstream

As Bitcoin continues to capture a significant portion of the cryptocurrency spotlight, investors must explore beyond the familiar terrain.

The real opportunity lies in identifying less-known but promising blockchain projects still in their early development stages.

This strategy moves away from investing in well-established cryptocurrencies, which often come with high market valuations.

Instead, it involves a more targeted approach toward developing cryptocurrencies, with projects like Sponge V2 and Bitcoin Minetrix standing out as potential candidates for growth.

Engaging with these projects early, particularly through presale investments, can offer significant advantages.

This early-stage involvement can potentially lead to substantial returns as the projects mature and gain broader market recognition, albeit with inherent risks.

Exploring these Bitcoin alternatives can be a strategic move for those looking to expand their cryptocurrency investments.

The challenge and opportunity lie in recognizing these opportunities early and understanding their potential to disrupt the current cryptocurrency domain.

As the cryptocurrency sector continues to attract diverse interest, the most noteworthy gains may belong to those who identify and invest in these less-heralded projects.

The best crypto to buy now might not always refer to the most popular or well-known options; often, it’s the lesser-known disruptors that offer the most significant potential for growth.

Sponge V2: The Memecoin Leading the Pack as the Best Crypto to Buy Now

The meme coin market welcomed an intriguing new entry this week with the announcement of Sponge V2 ($SPONGEV2).

This cryptocurrency presale intends to build on the legacy of the original Sponge ($SPONGE) token, which generated substantial hype and profits during the crypto bear market in 2023.

Witness the second coming of $SPONGE! 🧽🧽🔥

After a 100X surge in 2023, don't miss the wave of #SpongeV2.

Hurry and stake your tokens now! 🚀#Sponge #Web3 #CryptoStaking pic.twitter.com/tRIoqOVjTL

— $SPONGE (@spongeoneth) December 19, 2023

Sponge V1 boasted impressive stats, including a peak market capitalization near $100 million, over 13,000 holders, and listings on 10+ exchanges such as CoinW and Gate.io.

However, Sponge V2 is not simply riding on the coattails of its predecessor. The new token introduces play-to-earn utility and other features to distinguish itself in the crowded meme coin space.

According to the Sponge V2 website, investors can acquire the new tokens in two ways.

They can purchase and stake the original Sponge V1, or stake any V1 tokens already held.

The more V1 is staked, and the longer it is staked, the greater the V2 rewards. Once all V1 is depleted, V2 will become claimable.

The team emphasized that staked V1 will be permanently locked, transitioning fully to the new token.

Sponge V2 also plans to launch a proprietary play-to-earn game, enabling users to earn tokens and climb leaderboards.

The project roadmap outlines immediate goals like staking launch and game research, mid-term objectives of 10,000 holders and game development, and a long-term target to reach a $100 million market capitalization.

As meme coin projects continue trending in the crypto sector, Sponge V2 brings an intriguing new value proposition to the table.

With the legacy of its predecessor and promises of future utility, it may make a splash as one of the best cryptos to buy now.

Bitcoin Minetrix: The Best Crypto to Buy Now for Simplified Bitcoin Mining

With Bitcoin back above $40k, Bitcoin Minetrix arrives at the right time with its presale raising over $5.5 million and counting.

The project will utilize tokenization models to open Bitcoin mining opportunities to everyday crypto investors.

Exploring the potential of $BTC with #BitcoinMinetrix! ⚒️

Cloud mining provides an accessible gateway to #Crypto:

✅ Easy entry for beginners.

💰 Cost-effective without hardware expenses.

🏙️ No worries about space, noise, or heat.

🛠️ Hassle-free enhancements. pic.twitter.com/yAaOm3Pmng— Bitcoinminetrix (@bitcoinminetrix) December 18, 2023

Bitcoin Minetrix’s $BTCMTX token presale has attracted growing interest in recent weeks alongside Bitcoin’s price recovery above $40,000.

This resurgence has reignited positive outlooks on the Bitcoin mining sector. Major financial institutions like JPMorgan have shown support by recommending Bitcoin mining stocks such as CleanSpark.

By enabling access to Bitcoin mining rewards through staking its BTXMTX token, Bitcoin Minetrix provides an alternative to conventional mining that requires expensive hardware and expertise.

The presale is structured with tiered pricing, with token prices rising 10% in each new stage.

Bitcoin Minetrix intends to launch its staking platform after the presale concludes, allowing users to potentially earn yields on holdings.

Some industry experts predict upcoming developments like Bitcoin’s 2024 halving event will further increase Bitcoin mining profitability.

Bitcoin Minetrix seeks to establish itself among the top cryptocurrencies by market cap by 2024.

With its presale attracting more than $5.5 million so far, Bitcoin Minetrix has shown promise as one of the best cryptos to buy now for its new model enabling simplified bitcoin mining access.

If executed well, the project could open profitable crypto opportunities to a wider audience.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.