Best Crypto to Buy Now December 12 – KuCoin, Injective, Osmosis

Today’s cryptocurrency market condition highlights established tokens KuCoin, Injective, and Osmosis as some of the best crypto to buy now with the KCS price gaining 11.08% to reach around $12.897, the INJ price hitting an all-time high above $27 after anticipated network upgrades, and the OSMO Price gaining nearly 20% so far today amidst a proposed merger.

Meanwhile, ongoing crypto presales Bitcoin ETF Token and Meme Kombat have surfaced as potential options for investors seeking the best crypto to buy now. As major currencies react to the market’s volatility, these Bitcoin alternatives offer new opportunities.

Best Crypto to Buy Now in the News

KuCoin’s price has been on the rise due to its development, with KuCoin (KCS) witnessing a notable increase of nearly 60% in price over the past week.

This surge has catapulted the token to the 55th position in terms of market capitalization, which now stands at roughly $1.25 billion. The exchange’s trading volume resurgence, crossing $1.22 billion, has propelled it back into the top 10 crypto exchanges.

KuCoin’s performance has eclipsed broader market trends, trading at approximately $12.897 up by 11.08% so far today.

We are delighted to announce our strategic investment in and partnership with @Dovi_L2, an innovative BTC L2 solution aiming to optimise transaction efficiency . We will continue to assist Dovi in achieving its pivotal milestones to bring an efficient application for users! pic.twitter.com/uMCYHw1Res

— KuCoin Labs (@KCLabsOfficial) December 10, 2023

KuCoin’s market presence is further strengthened by strategic investments, such as its backing of Dovi, a Bitcoin Layer 2 solution. This move by KuCoin Labs signifies a commitment to the Bitcoin ecosystem, emphasizing product development and user experience.

Despite the current upswing, some analysts caution about potential overbought conditions, with a relative strength index currently at 87.67.

Yet, the robust investor interest and KuCoin Labs’ ongoing support for ventures like Dovi maintain a generally positive near-term outlook for the token.

Injective (INJ) has also been at the center of market attention, with its price reaching a new all-time high above $27, marking an increase of more than 50% within a week and a near 1500% gain in the past year.

The buzz is partly due to the anticipation of Injective’s Volan network upgrade, announced on November 30, which contributed to a 66% price jump for INJ. The protocol’s periodic token burns and the substantial amount staked—reportedly over $1 billion—have also underscored its market strength.

Although INJ has slightly retreated to around $26, the potential for continued bullish momentum remains, with some analysts predicting a rise beyond $30. Conversely, a broader market downturn could push the price to the $18 to $20 support range.

Osmosis (OSMO) has also seen substantial gains today, with its price per token rising nearly 20% so far, surpassing $1 for the first time since February. Its market capitalization currently sits at approximately $512 million, ranking it as the 95th largest cryptocurrency by market cap.

#CryptoNews: #Osmosis, the leading decentralized exchange on #Cosmos, and lending protocol UX Chain (formerly Umee) have put forward a merger proposal within the Cosmos ecosystem. 🧐https://t.co/fM1Ugl2Pad

— CoinMarketCap (@CoinMarketCap) December 5, 2023

One of the biggest developments for Osmosis is the community proposal for a chain merger with Umee UX Chain, which could considerably affect its utility and market perception. Osmosis’s performance and the proposed merger underscore investors’ importance in staying informed and conducting due diligence.

The cryptocurrency sector continues to be dynamic, with altcoins like KuCoin and Injective distinguishing themselves through gains and technological advancements. In contrast, Osmosis is navigating through community-driven developments.

As the market evolves, the introduction of new players like Bitcoin ETF Token and Meme Kombat in the presale stage adds an edge to the list of best crypto to buy now.

These presales offer a glimpse into potential future trends and opportunities within the cryptocurrency industry.

With market conditions putting major tokens and new presales in the spotlight, let’s examine the technical and fundamental outlook on what makes KCS, INJ, OSMO, BTCETF, and MK some of the best crypto to buy now.

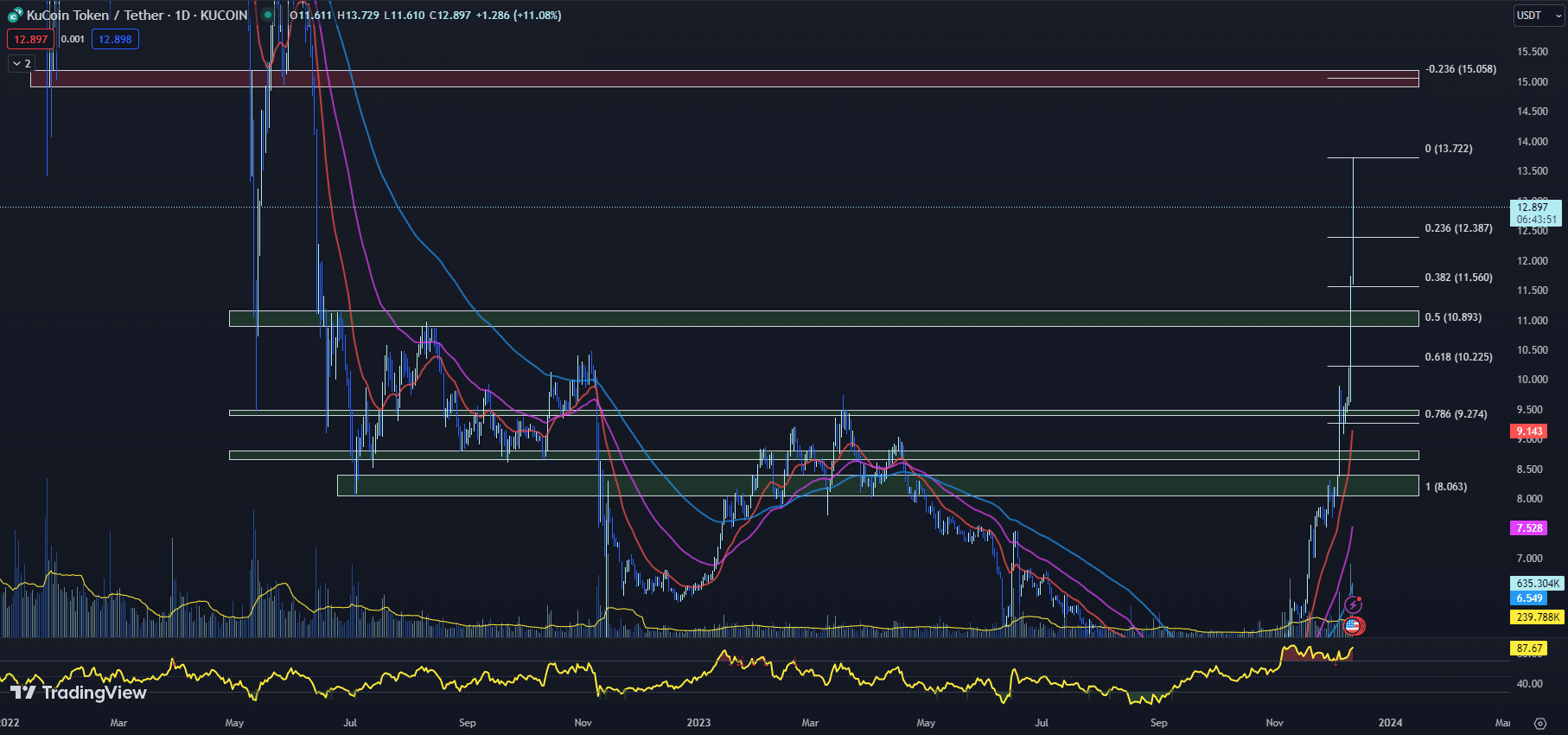

KCS Price Charts New Highs: Is a Pullback Looming?

As the KCS price continues to chart an impressive trajectory, traders and investors are keeping a close eye on the indicators that could signal the next phase of action for KuCoin’s native cryptocurrency.

The technical landscape is bullish, with the KCS price notching a new year-to-date high and extending its streak in positive territory.

The EMAs provide a snapshot of this bullish sentiment, with the 20-day EMA at $9.143 well above the 50-day EMA of $7.528, which in turn sits comfortably above the 100-day EMA of $6.549.

This alignment indicates a strong upward trend, as shorter-term sentiment outpaces the long-term view, a dynamic often linked with sustained momentum.

However, the RSI presents a nuanced picture. Currently, the RSI stands at 87.67, an uptick from the previous day’s already-elevated level of 84.37.

This persistent overbought condition — an RSI above 70 typically signals overbought — could be a harbinger of a forthcoming pullback as the market may consider the KCS price to be overextended in the short term.

Meanwhile, the MACD histogram, sitting at 0.315 — up from 0.190 the day before — underscores the strength of the current bullish trend. The increasing gap between the MACD line and its signal line signals that the upward momentum for the KCS price is gaining pace.

Despite the strong uptrend, the KCS price now faces a critical test. The current year-to-date high of $13.729 has established a resistance level that may prove challenging to breach. A consolidation around this level might be healthy, allowing the indicators to reset somewhat, particularly the RSI, before attempting to push higher.

The next significant barrier, at the extended Fib -0.236 level of $15.058, aligns closely with the psychological threshold of $15, suggesting that a concerted effort by bulls will be required to reach and sustain above these levels.

For those looking to enter or add to positions, immediate support presents an attractive opportunity. The Fib 0.382 level of $11.560 and the zone between $10.893 to $11.165, which previously acted as resistance and now serves as support, offer strategic points for setting stop-loss orders or initiating new positions.

Investors should monitor the KCS price for potential signs of exhaustion. A breach of immediate support levels could indicate a deeper retracement is on the horizon.

Conversely, a successful defense of these levels, coupled with a push above current resistance, would likely embolden bulls and could propel the KCS price toward uncharted territory.

While the bullish momentum for KCS is undeniable, prudent traders would do well to recognize the potential risks associated with such overbought conditions.

A cautious strategy might involve waiting for confirmation of further upward movement or a pullback to more robust support levels before taking action.

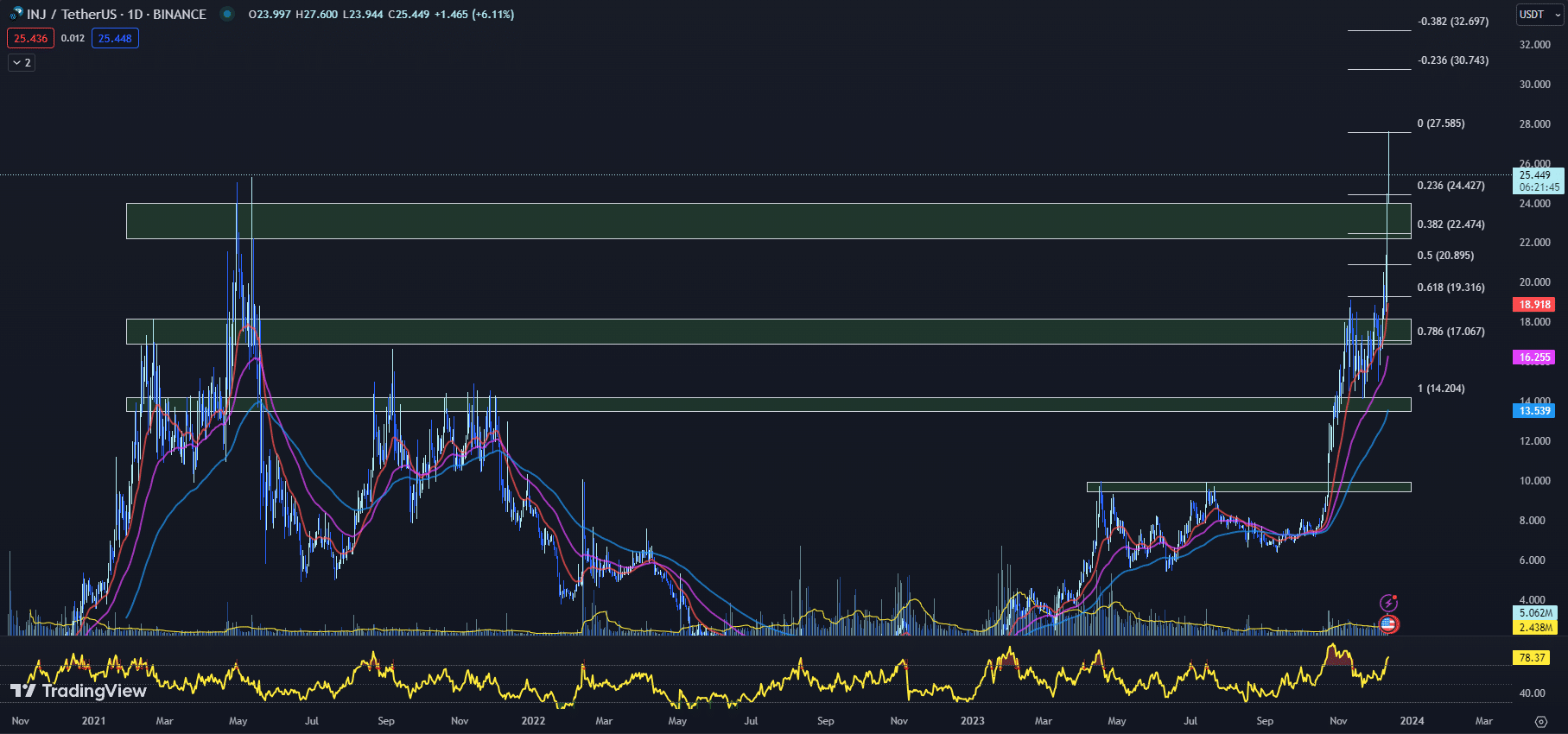

INJ Rockets: Setting a New All-Time High as It Sustains Its Bullish Momentum

Advancing to set a new all-time high of $27.60, Injective (INJ) has maintained its upward trajectory and sustained investor interest in its bullish narrative.

At the current level of $25.449, which marks a 6.11% increase in value today, the trajectory for the INJ price is painting a decidedly bullish picture.

A deeper dive into the technicals reveals that the INJ price is comfortably seated above its 20-day EMA of $18.918, which itself is well above the 50-day EMA of $16.255, and even more so compared to the 100-day EMA at $13.529.

This alignment of EMAs is a classic bullish setup, suggesting a solid uptrend with the INJ price demonstrating considerable strength.

The RSI is signaling an overheated market, having climbed to 78.37 from yesterday’s 75.80. An RSI above 70 typically indicates overbought conditions, which could hint at a potential pullback or consolidation in the near term for the INJ price.

However, the MACD histogram tells a story of growing bullish momentum, having risen to 0.700 from 0.482 the previous day. This increase suggests that buyers are very much in control, and the upward trend has yet to exhaust its energy.

With a positive outlook, market participants must consider the potential INJ price targets ahead. The INJ price currently faces its all-time high of $27.60 as its immediate challenge.

Should INJ break this level, the extended Fibonacci levels suggest that the INJ price could go for $30.743 (Fib -0.236) and even $32.697 ( Fib -0.382), presenting tantalizing targets for bullish traders.

On the flip side, immediate support is found within the range of $22.224 to $24.011, which aligns with the Fib 0.382 level at $22.474. This zone, previously a swing-high resistance, now serves as a crucial area of support, offering a potential springboard for the INJ price should any retracement occur.

Given these factors, the immediate strategy for INJ may involve monitoring the cryptocurrency’s reaction to its newfound highs. Should the INJ price sustain above the immediate support zone, it could fortify investor confidence, potentially leading to a test of the all-time high once again.

However, any signs of weakness or a break below this critical support could suggest taking a defensive stance, anticipating a possible retracement.

In essence, while the INJ price exudes strength, the overbought RSI cautions traders against complacency. The key for those invested in the trajectory of INJ will be to watch for either a consolidation that could precede further climbs or any bearish reversal patterns that might indicate a short-term top is in place.

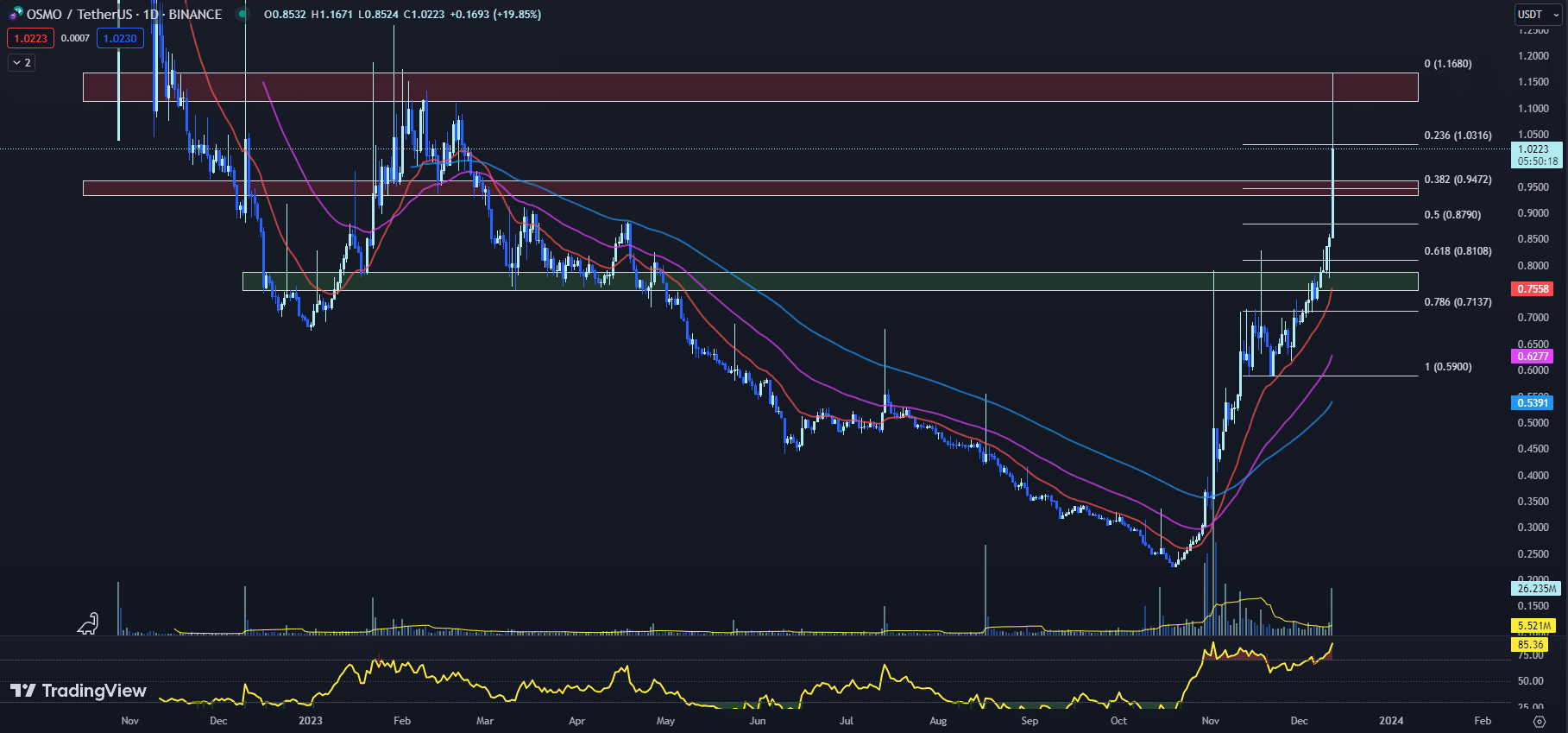

OSMO Price Prediction: Is Osmosis Overbought or Ready for More Uptrend?

The OSMO price trajectory has been a textbook case of volatility, with the cryptocurrency pushing through a bearish phase for most of the year and into a robust recovery for the past 3 months.

Technical indicators are now providing traders with a mixed bag of signals, offering a glimpse into the potential future movements of the OSMO price.

The EMAs are showing a clear bullish pattern for OSMO. With the 20-day EMA at $0.7558, the 50-day EMA at $0.6277, and the 100-day EMA at $0.5391, there is a consistent upward trend in the short, medium, and long-term outlooks.

This is further supported by the OSMO price increase of 19.85% in a single day, suggesting a growing enthusiasm from buyers.

However, the RSI paints a slightly different picture. The current RSI is at a high of 85.36, up from yesterday’s 76.86, indicating that OSMO might be overbought.

Despite this, RSI can remain elevated during strong trends, and given the recent momentum, it could be that OSMO is not yet ready to reverse.

The MACD histogram adds another layer of bullish sentiment. The increase to 0.0176 from the previous day’s 0.0062 suggests that the bullish momentum is gaining strength. The MACD histogram measures the distance between the MACD line and its signal line, and a rising histogram indicates that the uptrend is picking up pace.

The OSMO price action has brought it to an immediate swing high resistance zone between $1.1139 and $1.1679 after clocking a new 10-month high. This zone may prove to be a tough nut to crack in the short term, especially if traders decide to take profits.

If OSMO manages to sustain above the Fib 0.236 level of $1.0316, it may consolidate before attempting another push upward.

On the downside, the immediate support zone ranging from $0.9344 to $0.9627, which aligns with the Fib 0.382 level of $0.9472, offers a cushion should the OSMO price retreat below the psychologically significant $1 mark.

If this level holds, it could reinforce the upward trend and potentially serve as a springboard for further gains.

Investors and traders of OSMO should be vigilant in the coming days. While the EMA and MACD indicate a strong uptrend, the overbought RSI suggests that the OSMO price could experience a pullback.

The key will be to watch how the OSMO price interacts with the identified resistance and support zones. A consolidation above current support could indicate readiness for the next leg up, while a break below could signal a short-term trend reversal.

While current market conditions put tokens like KCS, INJ, and OSMO in the spotlight, ongoing crypto presales like Bitcoin ETF Token and Meme Kombat offer investors a window into future trends. Getting in early with these new crypto projects could provide opportunities for potential upside.

Finding the Next Big Thing: Investing in New Bitcoin Alternatives

Bitcoin may dominate the headlines, but plenty of up-and-coming blockchain projects are quietly building in the background.

For investors seeking exposure to the next potential breakthrough in crypto, looking beyond Bitcoin uncovers a diverse range of promising Bitcoin alternatives.

Rather than chasing established coins with billion-dollar market caps, identifying promising projects in their infancy can provide the chance to get in early.

Projects like Bitcoin ETF Token and Meme Kombat offer intriguing value propositions in growing sectors like crypto ETFs and play-to-earn crypto gaming.

By participating in the presale stage, investors gain maximum upside exposure to these developing ecosystems before the rest of the market catches on.

For investors comfortable with higher risk levels, supporting promising Bitcoin alternatives from their early stages presents unparalleled opportunities for asymmetric returns.

Bitcoin ETF on the Horizon: Get In Early With BTCETF, One of the Best Crypto to Buy Now

With bitcoin recently surpassing the $40,000 mark for the first time since last year’s crash, anticipation is building around the potential for a bitcoin exchange-traded fund (ETF) to receive approval from the Securities and Exchange Commission.

This positive outlook has stoked interest in Bitcoin ETF Token (BTCETF), which is conducting a presale seeking to capitalize on an expected green light from regulators.

Recap of #BitcoinETF Milestones! 📊

1️⃣ $100M Trading Vol: 5% burn & 5% ➡️ 4% tax 🔄

2️⃣ First ETF Approval: 5% burn & 4% ➡️ 3% tax 🔄

3️⃣ ETF Launch Date: 5% burn & 3% ➡️ 2% tax 🔄

4️⃣ ETF Assets $1B: 5% burn & 2% ➡️ 1% tax 🔄

5️⃣ $100K BTC Price: 5% burn & 1% ➡️ 0% tax 🔄 pic.twitter.com/HcWwWzghDH

— BTCETF_Token (@BTCETF_Token) December 12, 2023

BTCETF has already raised millions in its presale from investors betting that momentum will continue gaining steam in the lead-up to the SEC’s decision on a spot bitcoin ETF in early 2024.

The project has outlined milestones tied to SEC approval, bitcoin price targets, and ETF asset growth that would trigger token burns and reduced transaction fees.

Crypto analysts point to a clear momentum in the bitcoin ecosystem flowing into BTCETF based on its positioning around macro regulatory trends. But gains remain speculative until SEC approval becomes definitive.

For its part, BTCETF offers a unique value proposition to investors seeking exposure to Bitcoin’s resurgence without direct cryptocurrency investment.

As a proxy for trends in regulation, adoption, and asset growth, BTCETF empowers investors to potentially capitalize on the prevailing winds shaping the cryptocurrency’s future.

By taking advantage of the increased interest in Bitcoin’s resurgence, participating in BTCETF’s presale allows investors to enter early.

As the cryptocurrency market gains momentum, the project has the potential to generate returns.

For cryptocurrency enthusiasts looking for the best crypto to buy now, BTCETF presents an attractive opportunity.

Game on with Meme Kombat: The Best Crypto to Buy Now for Crypto Gamers

The crypto meme coin craze shows no signs of slowing down, with the latest token presale for Meme Kombat (MK) attracting over $2.85 million so far.

Having launched just weeks ago, Meme Kombat’s ongoing presale has crossed 50% of its initial fundraising soft cap of $4.96 million.

The project’s token presale is structured in stages, with the price per MK token increasing incrementally as each stage sells out.

Who wins this fight? ⚔️$KISHU or $MONG? pic.twitter.com/dyE3gAALjX

— Meme Kombat (@Meme_Kombat) December 12, 2023

MK can currently be purchased for $0.235, rising to $0.246 next week when the second stage of the presale opens.

The final presale price will be $0.279 before MK lists on Uniswap.

Meme Kombat’s surge towards its soft cap target reflects the ongoing investor appetite for meme crypto projects.

Dogecoin, Shiba Inu, and Dogelon Mars each rose over 10,000% in 2021, sparking huge interest in the meme coin category.

With meme mania still widespread, many are looking to Meme Kombat as the next potential new meme coin to deliver returns.

Meme Kombat distinguishes itself with a unique crypto-gaming angle focused on AI-driven meme battles.

Users bet MK tokens on randomized fight outcomes between famous meme characters, with rewards paid out in MK.

The project also enables MK staking with staking rewards of up to 295% APY, adding to its utility.

Meme Kombat plans to conclude its presale in mid-January before listing MK on DEX Uniswap, which many anticipate could catalyze substantial price movement.

With its combination of memes and crypto gaming, two of the hottest crypto sectors right now, Meme Kombat ticks all the right boxes for investors seeking the next meme coin to surge.

The parabolic gains achieved by other meme coins have primed expectations that MK could be the best crypto to buy now.

All eyes are now on Meme Kombat’s market debut to see if this buzzing new meme coin can become the next Dogecoin-like success story.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.