What Is Bitcoin? Everything You Need to Know in 2024

The Bitcoin network launched in 2009, promising a peer-to-peer electronic cash system. Largely unknown at the time, Bitcoin has since changed the way many of us perceive money, offering a decentralized alternative to traditional assets.

In this article, we’ll answer the question, “What is Bitcoin?” as well as how Bitcoin works and ways to buy and use BTC in April 2024.

Key Takeaways

- Bitcoin’s supply is limited to 21 million bitcoins. By comparison, fiat currencies like the USD grow in supply, decreasing their value.

- The Bitcoin blockchain serves as an immutable record of transactions. By contrast, traditional finance requires banks and financial institutions to track transactions accurately.

- Bitcoin’s value comes in part from its security. The Bitcoin network uses proof of work as both an incentive to keep the blockchain going and a disincentive for bad actors due to the cost involved with proof of work.

Understanding the Basics of Bitcoin

Cryptocurrencies like Bitcoin have a storied past dating as far back as the late 1980s and 1990s, including early efforts like eCash and BitGold. Borrowing from and improving upon existing ideas while adding innovations of its own, Bitcoin was the first cryptocurrency to achieve escape velocity.

A cryptocurrency is a digital asset independent of governments or financial institutions, although companies like Ripple manage some cryptocurrencies.

Unlike gold or silver, both of which have a long history as money, Bitcoin is completely digital, an electronic currency created by software. This allowed its anonymous creator(s) to build features similar to gold, namely scarcity and divisibility. Unlike gold, however, Bitcoin can be divided infinitely. Bitcoin’s supply is capped at 21 million bitcoins, with the smallest denomination being a satoshi (one 100 millionth of a bitcoin).

What’s a Bitcoin?

A single Bitcoin is one of a 21 million capped supply of bitcoins, the cryptocurrency of the Bitcoin network. Bitcoin (singular and capitalized) often refers to the network, whereas bitcoin (lowercase) is used when referring to the currency itself.

Bitcoin is a decentralized cryptocurrency, meaning that balance tracking and transactions occur on a distributed network of computers around the world. The code itself is also decentralized, requiring approval by the worldwide network for code changes.

In traditional financial systems, we have to trust banks for reconciliation and to ensure no double spending occurs. If you pay out more than you have in your bank account, the result is often reversed transactions or overdraft fees – as determined by the bank. By contrast, the Bitcoin network prevents double-spending by design. More on that in a bit.

As a decentralized peer-to-peer payment network, Bitcoin also offers censorship resistance, meaning you can spend your bitcoins for whatever you wish, and no one can close your Bitcoin address due to political beliefs. By comparison, banks and payment services can decline transactions or close accounts without warning.

In short, Bitcoin promises financial sovereignty. But how did it start, who made it, and why?

The Origin and Development of Bitcoin

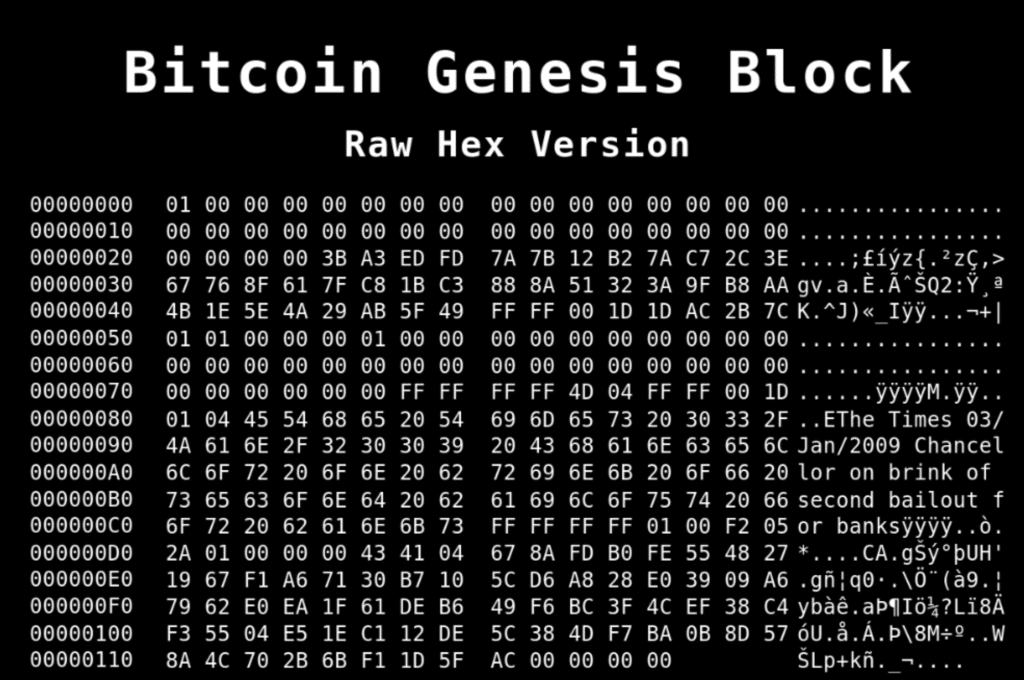

In October 2008, a person or group using the pseudonym Satoshi Nakamoto published the Bitcoin whitepaper, a now-famous document that explained the purpose of the project and how it would work. By January of 2009, Satoshi mined the first Bitcoin block, the Genesis Block.

The Bitcoin blockchain functions as a ledger, a record of transactions and balances.

On the Bitcoin blockchain, transactions are grouped into blocks for validation. Think of a block as a box holding the details of who sent what to whom. These blocks each link to a parent block using a cryptographic hash. Simply put, a hash value (a long string of letters and numbers) from the previous block becomes part of the data in the following block, thereby forming a chain. More on how that works in a bit.

Blocks are just data, including transactions. The Genesis Block contained both a transaction and a message. Satoshi sent 50 bitcoins to an unrecoverable address.

In addition, the first block held a message:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

The message was a headline from The Times, a well-read British newspaper. Satoshi’s message serves as a timestamp for the Genesis Block but may also indicate why Satoshi built Bitcoin. The Global Financial Crisis (GFC) had left the financial system teetering on the precipice of the abyss. People were frightened, and many were angry that the actions of governments and banks threatened to destroy modern life.

Many believe Bitcoin was created as an alternative to not just financial institutions, as mentioned in the whitepaper, but as an alternative to traditional currencies entirely.

The Genesis Block started it all, with each subsequent block linking to it, making an unbreakable chain. Today, over 820,000 Bitcoin blocks have been mined.

The Mysterious Creator – Who is Satoshi Nakamoto?

Long after Bitcoin’s creation and Genesis Block, we still don’t know Satoshi Nakamoto’s real identity. Satoshi might have been an individual or perhaps a group of people.

Satoshi first mentioned the Bitcoin whitepaper on a cryptography mailing list (metzdowd.com), publishing the PDF on Bitcoin.org, where it still resides at the same URL today. This led many to speculate that Satoshi was a cryptography or coding expert.

An archived user profile on a peer-to-peer discussion site suggests Satoshi was a 37-year-old male residing in Japan. However, an email address used by Satoshi ([email protected]) suggests a US-based IP address. GMX used different domain extensions for email addresses, depending on location.

Adding to the confusion, Satoshi sometimes used British English, while switching to American English in others. For many speculating about Satoshi’s identity, this inconsistency points to a group rather than an individual. Others suggest the variation may have been an intentional part of operational security for the project.

Over the years, several potential “Satoshis” have emerged in speculative discussions, including:

- Hal Finney

- Nick Szabo

- Dorian Nakamoto

- Craig Wright

- Adam Back

- Elon Musk

- Yonatan Sompolinsky

To date, the question remains unanswered in the minds of many in the Bitcoin community. Of note, Craig Wright claims to be Satoshi and describes a competing cryptocurrency called Bitcoin Satoshi Vision (BSV) as the original Bitcoin blockchain.

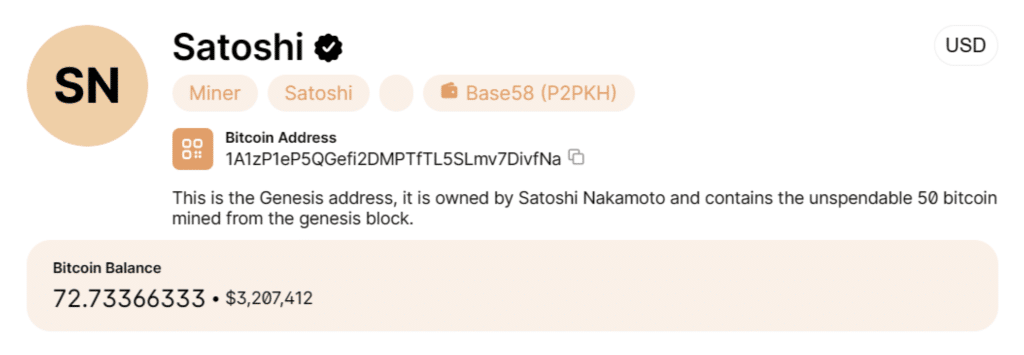

Bitcoin wallet addresses presumed to belong to Satoshi currently hold about 1.1 million bitcoins, or nearly $50 billion, assuming the current Bitcoin value of $44,000.

How Bitcoin Works: The Technology Behind the Currency

We briefly covered the Bitcoin blockchain earlier. To understand how Bitcoin works, it’s helpful to trace a transaction and how transactions are recorded.

Let’s say you want to send 0.2 bitcoin (about $9,000 at current BTC price) to someone to buy a used car. Here’s how the transaction flow works on the Bitcoin network.

- Initiate the transaction. You open your Bitcoin wallet (an app) and choose the seller’s address.

- Broadcast the transaction. Your wallet communicates with the network, broadcasting the new transaction to all nodes. The nodes then check the ledger to be sure you have enough bitcoin to cover the transaction and its associated fees.

- Miners discover a block. Miners are always working to mine a new block to hold transactions. In the interim, the transaction is stored in the mempool, a digital waiting area for transactions awaiting a block. More on how mining works later.

- The winning miner includes the transaction in the block. Once a new block is mined, the transaction is included in the block, and subsequent blocks become “confirmations.” Typically, for high-value transactions, six or more confirmations are considered irreversible. Your wallet address is debited 0.2 bitcoin (plus fees), and the seller’s is credited 0.2 bitcoin.

At the end of the transaction, the seller receives 0.2 bitcoin in an unspent transaction output (UTXO).

The miner earned a block reward consisting of a fixed amount of bitcoin plus the network fees associated with the block’s transactions.

Bitcoin mining is cost-intensive, making it impractical to reverse a transaction. Because the blocks are linked, and a new block is added every ten minutes on average, a rogue miner who wanted to change a transaction would have to re-mine all the blocks after a given transaction and do so faster than the network mines new blocks.

The Role of Blockchain in Bitcoin

In the previous section, we looked at a basic transaction on the Bitcoin network. All transactions are stored in blocks and these blocks are then linked together in sequence, forming a chain.

Except for the Genesis Block, each block in the Bitcoin blockchain has a parent block. Bitcoin uses SHA-256 encryption to link the blocks together. SHA-256 turns data into a hash value.

Here’s an example.

| Input | Output Hash |

| To be, or not to be, that is the question. | d899dd565cdb385855a5099025cdc90b7eee44fa504d0c1d17ce781c49529a9a |

But if the input changes even slightly, the hash value changes dramatically.

| Input | Output Hash |

| To be, or not to be, that is the question! | 89415f39f627327c5a21e5da0e73ae1f6b1813f1993986622595401c38ec8430 |

Each new block contains the hash value of the parent block. If a transaction is changed in block 80,000, it will change block 80,000’s hash value and the hash value of every subsequent block. The network would discard this revised version of the chain as invalid because the subsequent blocks are not linked.

The hash keeps the chain linked, and the Bitcoin network chooses the longest chain.

Blockchain technology allows a constant ledger without a trusted third party. In traditional finance, a bank decides if you have enough money to complete a transaction — and may even decide if you can complete the transaction at all. Generally, the Bitcoin blockchain is permissionless, tracking wallet balances and immortalizing successful transactions on the blockchain.

While a miner can choose not to include a transaction in a block, as recently happened with a US-sanctioned Bitcoin address, these transactions will be picked up by another miner in a subsequent block.

The nearly immutable Bitcoin blockchain, combined with Bitcoin’s scarcity and the belief that others will accept Bitcoin as payment, are what give Bitcoin its value.

Encryption and Security Measures

Bitcoin uses encryption in several ways. We discussed how an encryption hash links one block to the next. Hashing is one-way encryption, meaning the source data for the hash can’t be derived from the hash.

Encryption and hashing are also used in Bitcoin wallets. First, let’s look at how Bitcoin wallets work.

Bitcoin wallets generate and store two types of keys.

Types of Wallet Keys

- Private keys control the assets at a given Bitcoin address on the blockchain. Anyone who has the private keys can control the assets, spending the bitcoins or sending them to another wallet. Private keys are encrypted. The Bitcoin Core wallet, for example, uses Advanced Encryption Standard (AES-256-CBC) to protect the private keys. Most wallets generate the private keys using a seed phrase, a series of 12 to 24 words.

- Public keys are generated by the private keys using one-way encryption. Public keys then generate Bitcoin wallet addresses. These are the addresses visible in transactions using a block explorer such as blockchain.com. Public keys can also be used for digital signatures, a way to show you have the private key for an address.

While a public key is derived from a private key, the private key can’t be derived from the public key or its Bitcoin addresses.

Below, find an example of the first Bitcoin address, which was owned by Satoshi. The wallet address holds the first Bitcoin transaction (50 bitcoins) as well as several subsequent transactions.

The private key for this address is only known to Satoshi, however.

As you can see, Bitcoin transactions are not encrypted, but the technology used to complete a transaction requires encryption. Anyone can see a Bitcoin transaction on a block explorer. What remains unknown, in most cases, is the address’s owner.

Pseudonymous vs. Anonymous

People often assume the crypto is anonymous, meaning no one can identify you. That’s not accurate. Crypto blockchains use addresses that act as your identity in transactions. This makes crypto pseudonymous rather than anonymous. Often, the real owner of a crypto address can be revealed through their transactions.

Encryption appears again in Bitcoin mining. To use a simple explanation, Bitcoin mining consists of guessing a correct hash (the SHA-256 encrypted hexadecimal value) of the block header before other miners. The first miner to guess the hash — plus a randomly generated nonce (number only used once) — gets to add the next block and reap the rewards.

Bitcoin Mining Explained

The Bitcoin network provides a financial incentive to validate transactions called mining rewards. But the process of mining for rewards paid in bitcoins is also what keeps the network secure.

We discussed some of the basic structure of the network earlier.

Someone initiates a Bitcoin transaction. The wallet broadcasts the transaction to the Bitcoin network.

While people all over the world are transacting, Bitcoin miners are searching for a block to store those transactions. They’re working to find a new block.

Bitcoin mining requires computing power. Essentially, it’s a process of guessing — a lot. Bitcoin network is trying to guess the correct hash and nonce to find the next block.

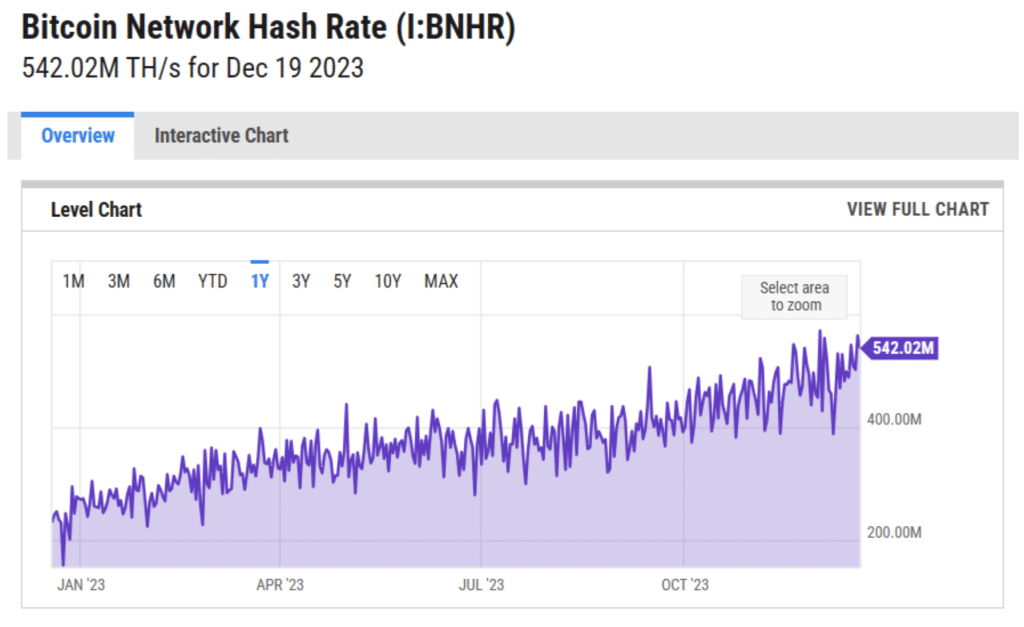

As shown below, the current hash rate (number of guesses) is over 542 trillion hashes per second.

As the hash rate increases with more computing power added to the network, the difficulty of solving for the nonce also increases. The Bitcoin network automatically adjusts the difficulty every 2,016 blocks (about two weeks). The goal is to average one block every ten minutes based on the hash rate.

When a miner finds a block, that miner earns block rewards consisting of newly created bitcoins and the fees for transactions in the block.

The Process of Mining Bitcoin

Bitcoin mining is the process of finding new blocks in which to store transactions. The process is called proof of work (PoW).

In proof-of-work consensus mining, the miners must show they have done work, expending energy (and money) to find a block. The idea comes from Hashcash, a spam-prevention concept pioneered in 1997 by Adam Back, one of the people some think might be Satoshi.

The PoW process makes it expensive to mine a new block, which in turn makes it extremely difficult to change the transaction in a block that’s been mined. As more blocks are added to the blockchain, the odds approach zero, even if a group of miners controls a significant amount of the network’s hash rate.

We covered the basic process earlier.

- Miners work to solve a nonce.

- A nonce is a random number used once, which is appended to a block header’s hash.

The Bitcoin protocol creates a hash value of the block header, including:

- Bitcoin version number

- A hash of the previous block

- Merkle root (a hash of all the transaction hashes in the block)

- A nonce

The only variable miners can change when hashing (guessing) is the nonce. Miners then create hashes of the block header combined with the nonce.

One recent block (block height 822,140) had a nonce of 3,175,838,978. The winning miner (ViaBTC) earned 7.98439474 BTC, including 6.25 newly minted bitcoins.

What is BTC?

The trading symbol BTC refers to bitcoin.

Once a miner finds a block, it broadcasts the nonce, which other nodes can verify with a single hash. The block is then added to the chain, and the process begins again. This is proof-of-work consensus (agreement across nodes).

Solo Mining and Mining Pools

In the early days of Bitcoin mining, solo miners used CPUs to crank out hashes and guess nonces. As the network grew, the processing power needed to be competitive also increased. Today, Bitcoin miners use Application-Specific Integrated Circuit (ASICs) that are designed to hash at much higher rates.

Solo Mining is unlikely to net a reward in today’s competitive mining world, so mining pools have become a popular alternative. As the name suggests, individual miners contribute their hashing power to a pool of miners. Collectively, the pool has a better chance of earning a reward. When it does, the mining reward is split proportionately according to the hashing power contributed.

Acquiring Bitcoin: Buying and Trading

Because mining has become so competitive, the easiest way to acquire bitcoin is to buy on an exchange like Coinbase or MEXC. Both platforms offer easy onboarding for new investors and both also offer a way to move your bitcoins off the platform to a self-custody wallet.

For example, to get started with MEXC, just follow these simple steps.

- Visit MEXC to open a new account. To open an account with MEXC simply head over to the official website and tap on ‘Sign Up’.

- Register your account. Users can register their accounts via their mobile phone numbers or email addresses.

- Deposit funds in your MEXC account. Depositing funds into your MEXC account is straightforward. Users can buy BTC via bank cards, P2P/OTC trading or via Blockchain transfer.

- Buy Bitcoin. Tap on the ‘Buy Crypto’ button to view the available methods in your location. For a more streamlined experience some expert traders purchase stablecoins like Tether and then use that to buy BTC via the spot market.

Choosing a Bitcoin Wallet

After you purchase Bitcoin, you may want to move your holdings off the trading platform for safekeeping.

Earlier, we discussed the role of crypto wallets to safeguard your Bitcoin. A wallet holds the private keys that control Bitcoin on the network.

You can choose from hot wallets or cold wallets.

- Hot wallets generate and store the private keys on a device that’s connected to the internet. A hot wallet is an app that runs on your phone or computer. For example, Electrum is a popular Bitcoin-only wallet. However, you could also choose a multi-chain wallet that supports Bitcoin, such as Coinbase Wallet. Most hot wallets are free to use.

- Cold wallets generate and store your private keys offline. A cold wallet is usually a hardware device that can communicate with your computer or mobile device but which does not connect to the internet. Trezor is a popular choice because the device firmware and software suite are both open-source. Coders from around the world have reviewed the code to verify what’s happening under the hood.

Hot wallets offer more convenience because you can send Bitcoin in just a few clicks. However, hardware wallets offer more security because nothing leaves your wallet until you confirm the transaction on your hardware device.

Consider your risk level relative to the cost. Hardware wallets are an investment. Many popular Bitcoin hardware wallets range in price from $55 to $200 or more. Top choices like Trezor can pair with hot wallets such as Electrum. This allows you to keep smaller amounts in a hot wallet for convenience while safeguarding larger balances.

Utilizing Bitcoin: From Payments to Investments

Bitcoin’s whitepaper describes Bitcoin as a peer-to-peer electronic cash system. Over the years, however, Bitcoin has become much more than just a payment system. It’s become a hedge against inflation, a store of value, and an investment for many.

- Bitcoin for purchases: Leading merchants like Newegg, Overstock, and even Microsoft now accept Bitcoin for some purchases.

- Bitcoin for payments: Payment apps like Cash App and Strike make it simple to send and receive Bitcoin payments. Some HR and freelance apps like Deel also offer the option of Bitcoin payments for work performed.

- Bitcoin as an investment: You can buy Bitcoin using an exchange, as described earlier, but Bitcoin spot ETFs (exchange-traded funds) are on the horizon in the US, and Bitcoin spot ETFs are already available in Europe and Canada.

Bitcoin in Everyday Transactions

While more merchants accept Bitcoin as a payment method, we haven’t reached universal acceptance yet. Traditional currencies still dominate.

Part of the challenge is volatility. A dollar is always a dollar, but Bitcoin’s value in dollars changes by the minute. If the use of Bitcoin grows, we may be able to expect more retailers willing to accept Bitcoin. In this scenario, the value of Bitcoin should increase due to the limited supply, making it more attractive to vendors.

Spending your Bitcoin comes with some considerations, however. Because Bitcoin is not legal tender in most of the world, spending your Bitcoin can become a taxable event. In effect, you have to account for Bitcoin’s value in your local currency at the time of the transaction. If there’s a gain in value compared to your cost basis, you may have to pay taxes.

Crypto tax software apps can help make accounting easier, but the tax ramifications should be considered before purchasing with Bitcoin or another cryptocurrency.

You’ll also want to consider mining fees. Earlier, we discussed how miners earn the transaction fees for blockers they mine. Those fees can be expensive at times, especially if the network is busy. Mining fees are based on the transaction size in bytes rather than the amount, making Bitcoin a better option for larger transactions because the fees represent a smaller percentage of the transaction.

Innovations like the Lighting Network promise faster transactions and much lower fees by bundling transactions.

Investing and Speculating with Bitcoin

In 2011, Bitcoin and the US dollar reached parity. Since then, a dollar is still a dollar (ignoring inflation) and a bitcoin is worth about $44,000.

Bitcoin rewarded early investors with staggering returns relative to other investments as well. Between November 2013 and November 2023, Bitcoin produced 3249.016% returns. By comparison, the S&P returned 153.09%. However, many investors think we’re still early in the timeline.

Bitcoin can be part of a larger diversified investment portfolio or be used for trading.

- Investment portfolios: You can invest in Bitcoin through trading platforms like MEXC or Coinbase. Because the price of Bitcoin can be volatile, it’s prudent to match your investment to your risk tolerance. The ride gets bumpy.

- Speculative trading: Bitcoin’s volatility makes it attractive to traders, however. Price changes offer an opportunity to trade the market’s ups and downs rather than buy and hold. Exchanges like Kraken, MEXC, and OKX offer perpetual futures trading in some markets, providing a way to trade with leverage and settle the trade without buying or selling actual bitcoin.

The Risks and Challenges of Bitcoin

Bitcoin investors who bought at the all-time high of nearly $69,000 are still down significantly in percentage terms. Bitcoin’s volatility brings meaningful risk. Bitcoin is also difficult to value relative to stocks or real estate investments in which you can measure profits or cash flow. This adds to price uncertainty.

However, the largest risks facing Bitcoin investors may be regulatory.

In 1933, President Franklin D. Roosevelt banned private ownership of gold bullion in the US with the stroke of a pen. It’s not hard to imagine something similar applied to cryptocurrencies that compete with fiat currencies worldwide.

While bans remain a possibility, restrictive regulations or legislation are more likely possibilities and could affect the value of Bitcoin and other cryptocurrencies.

For example, a recently proposed bill in the US called the “Digital Asset Anti-Money Laundering Act” would threaten the ability to transact in cryptocurrencies, according to many experts. If similar laws were passed in other major markets, the value of Bitcoin and other digital assets would likely plummet.

Fortunately, the bill is considered unlikely to pass.

Read More: Best Crypto Giveaways

Common Misconceptions and Myths about Bitcoin

As a new technology, cryptocurrencies aren’t yet well understood by the public (or its legislators).

Here are some of the most common misconceptions and myths about Bitcoin.

- Bitcoin is a bubble. While Bitcoin has seen tremendous growth in value, relative to the world’s population, Bitcoin’s value is likely still low. By some estimates, less than 3% of the world’s population uses Bitcoin.

- There are no real-world uses for Bitcoin. Although Bitcoin can be an investment or a store of value, there are many ways to use Bitcoin as a payment method for everyday transactions. And because Bitcoin is an asset, you can also borrow against it to buy real-world goods and services or invest in traditional real-world assets.

- Bitcoin is printed out of thin air. Bitcoin uses proof of work to mint new bitcoins and validate Bitcoin transactions. The process is energy-intensive and requires a significant financial investment.

- Another crypto will displace Bitcoin. While newer cryptocurrencies offer some advantages over Bitcoin, like faster transaction times or lower network fees, Bitcoin was first and remains the leading cryptocurrency. More people using and investing in Bitcoin helps Bitcoin hold the top position.

- Bitcoin uses too much energy. Bitcoin mining uses more energy than some countries, according to estimates. However, large-scale miners have moved to areas where they can access renewable energy or areas where energy is “trapped” and can’t be transported elsewhere.

Bitcoin Regulation and Legal Aspects

Another misconception about Bitcoin is it’s an unregulated security and will be banned by regulators like the SEC. While some cryptocurrencies may fit that definition, Bitcoin’s decentralized nature makes it a commodity, similar to gold or silver, rather than a security.

Currently, Bitcoin trading remains legal in major markets like the US and UK. Many governments treat Bitcoin as property for tax purposes. However, the road ahead could still hold peril. A competing currency shines a light on the falling values of traditional currencies.

Proposed legislation like US Senator Elizabeth Warren’s Digital Asset Anti-Money Laundering Act could change the crypto landscape in years to come. Already, many exchanges and Bitcoin mining pools around the world require KYC (Know Your Customer) identity verification before you can transact.

Regulations and future legislation could make trading in Bitcoin or other cryptocurrencies more difficult — or even impossible. To revisit the idea behind Bitcoin, the ability to transact without an intermediary, it’s not too hard to imagine how governments might try to stifle that ability.

Evaluating Bitcoin as an Investment

Investing in Bitcoin or other cryptocurrencies can bring more risk compared to traditional investments. However, the potential returns can also be much higher.

Bitcoin investing is best suited for:

- People who can accept price volatility. The ups and downs of the crypto market put penny stocks to shame.

- Investors with a diversified portfolio. Bitcoin offers exposure to the growing blockchain sector.

- People who value the Bitcoin ethos of transacting without intermediaries. At its core, Bitcoin is s peer-to-peer payment system. Privacy and anti-censorship advocates may feel more at home in a crypto world.

- Investors who want to hedge against inflation or devaluation. The supply of fiat currencies like the USD and GBP are controlled by governments and central banks. By contrast, Bitcoin has a fixed supply of 21 million bitcoins, which could mean further price appreciation against fiat currencies.

Advantages and Disadvantages of Bitcoin Investment

A Bitcoin investment comes with pros and cons to weigh.

Pros

- Bitcoin’s limited supply could bring dramatic price appreciation if demand continues to grow.

- With nodes across the globe, Bitcoin is decentralized and censorship-resistant.

- Bitcoin wallets allow you to travel anywhere in the world while taking your savings with you.

Cons

- Limited acceptance as a payment method could affect Bitcoin’s future value.

- Market volatility can lead to large paper losses quickly.

- Secure storage requires users to educate themselves on Bitcoin wallets and safety measures.

Practical Aspects of Using Bitcoin

As a payment method, Bitcoin offers several ways to transact in daily life.

- Online shopping

- Purchasing gift cards

- Peer-to-peer transactions

However, Bitcoin comes without the consumer protections you’ll find with traditional financial services. You can’t charge back a transaction and if you send bitcoins to an incorrect address, it’s likely gone forever.

Also, consider the following tips to help ensure secure transactions.

- Use QR codes. To ensure accuracy when sending Bitcoin, consider scanning a QR code for the receiving address to avoid typos or extra characters.

- Split your funds between wallets. Use a “spending money” wallet for everyday transactions. This keeps your larger balances separate, hidden from blockchain snoops who can see the balances for Bitcoin wallets.

- Use a hardware wallet for larger balances. To protect larger balances, consider purchasing a hardware wallet that stores your private keys offline.

- Keep a safe backup of your wallet. If you lose your wallet or a hardware wallet breaks, you can use the recovery phrase backup to restore access to your bitcoins.

- Beware of scams, phishing, and fake websites. Because cryptocurrency is easy to transfer, crypto holders are common targets for scammers, including phishing attempts to get your recovery phrase or fake websites that look like well-known sites.

The Future of Bitcoin

Bitcoin price predictions are fun, although always speculative. Bitcoin’s future hinges on adoption.

Will more retailers start accepting Bitcoin? Will Bitcoin become a world reserve currency, replacing the dollar? The first situation is bullish for Bitcoin, whereas the second could send prices to the moon and beyond.

There’s also the possibility of a decline.

Our own market-based Bitcoin price predictions put the future price as high as $150,000 by 2030, more than a 3x increase compared to today’s price. Others in the industry, including Jurrien Timmer of Fidelity Investments, put the target as high as $1 million to $10 million per bitcoin.

Bitcoin’s primary strength is in its ability to act as a store of value. Today, everyday transactions on the Bitcoin network remain costly, making it better suited to larger transactions. However, the Lightning Network or similar scaling solutions could make Bitcoin more practical for everyday transactions, dropping transaction fees from dollars to a fraction of a penny and eliminating the long wait between blocks.

Closing Thoughts: Is Bitcoin Right for You?

Bitcoin began the crypto revolution in 2009, but it’s still early for this new technology. Many believe that Bitcoin’s best days are still ahead and that a sizeable opportunity still exists.

The journey ahead comes with risks but without guarantees, much like any investment. However, Bitcoin has outperformed every other asset class since its launch, suggesting it’s not like any other investment.

Consider your risk tolerance carefully before investing, and never invest more than you can afford to lose. But if you decide to invest in cryptocurrency, Bitcoin makes a logical first step. Bitcoin’s security, bolstered by proof of work and its network effect as the largest cryptocurrency, will likely give it advantages over competing cryptocurrencies for years to come.

References

- https://bitcoin.org/bitcoin.pdf

- https://www.metzdowd.com/pipermail/cryptography/2008-October/014810.html

- https://web.archive.org/web/20120529203623/http://p2pfoundation.ning.com/profile/SatoshiNakamoto

- https://craigwright.net/

- https://bitcoinsv.com/

- https://www.coindesk.com/tech/2023/11/22/bitcoins-anti-censorship-ethos-surfaces-after-mining-pool-f2pool-acknowledges-filter/

- https://www.blockchain.com/explorer/addresses/btc/1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

- http://www.hashcash.org/

- https://www.blockchain.com/explorer/blocks/btc/822140

- https://www.blockchain.com/explorer/addresses/btc/18cBEMRxXHqzWWCxZNtU91F5sbUNKhL5PX

- https://lightning.network/

- https://www.nytimes.com/1933/04/06/archives/hoarding-of-gold.html

- https://www.congress.gov/bill/117th-congress/senate-bill/5267

- https://www.nytimes.com/interactive/2021/09/03/climate/bitcoin-carbon-footprint-electricity.html

- https://ccaf.io/cbnsi/about/faq

Eliman Dambell

Eliman Dambell

Michael Graw

Michael Graw