How to Buy Cardano (ADA) in 2024 – Step-by-Step

Cardano has long been ranked in the top 10 on many cryptocurrency ranking websites, and this means it gets a fair bit of attention. As an investor, you might be looking to diversify your portfolio, and you’re wondering how to buy Cardano to do just that.

Here, we’ll cover a little of what Cardano is before delving into how and where to buy Cardano. Then we’ll close by looking at some use cases of Cardano and where you can store it.

What is Cardano?

Cardano is a third-generation blockchain that was founded by one of the co-founders of Ethereum, Charles Hoskinson. It is one of the only blockchains based on peer-reviewed research, and it is backed by over 200 scientific papers. It has a philanthropic mission to “provide economic identity to the billions who lack it by providing decentralized applications to manage identity, value, and governance.”

On a technical level, Cardano is based on the accounting model behind Bitcoin, called the UTxO model, and extends it—creating the extended UTxO model, eUTxO—to allow for smart contracts and other novel functionalities not available on the Bitcoin network. It was first released in 2017 after multiple years of research and development. Cardano’s initial functionality was limited to just trading the network’s native token, ADA.

This initial lack of utility, along with its slow pace of development, led many in the crypto world to label it a “ghost chain.” However, over the years, the Cardano blockchain has undergone multiple upgrades which, among other things, have delivered fungible and non-fungible tokens (NFTs), smart contracting capabilities, and a proof-of-stake consensus mechanism that allows for native, non-custodial liquid staking on the network.

Since tokenization and smart contracts were launched in 2021, the Cardano ecosystem has blossomed. Below are a few statistics about the Cardano ecosystem:

- $423m in TVL, 17th in DeFiLlama’s list of chains ranked by TVL

- 52 dApps, and 32nd in DAppRadar’s list of protocols ranked by dApp count

- 7th in all-time NFT trading volume, according to CryptoSlam’s rankings

- 62% (22.71B ADA) of all ADA in circulation is staked and securing the network

As a third-generation blockchain, Cardano is designed to surpass the limitations of existing blockchains by solving the blockchain trilemma of security, decentralization, and scalability to offer users a secure, decentralized platform that can scale to mass adoption. Here’s how Cardano addresses each of these issues:

- Security: Cardano uses a delegated proof-of-stake model called Ouroboros, which is provably secure. This has resulted in over 3,000 community-run pools securing the network. Cardano’s smart contracts are also written in Haskell, a programming language that lends itself well to the use of formal verification, the industry’s golden standard for smart contract security and a necessity when over $200m was stolen by hackers in the first two months of 2024 (none of it from Cardano).

- Decentralization: Cardano is secured by over 3,000 community-run stake pools and operates with a Nakamoto Coefficient of 35—much higher than the likes of Ethereum (1) and Solana (21). There are also plans to implement minimum-viable, on-chain community governance in 2024, handing over control of the protocol to holders of ADA.

- Scalability: The Hydra Head protocol is currently live in beta, and this allows for state channels, e.g., Bitcoin’s Lightning Network, to be launched on the network. These state channels are isomorphic, meaning that these layers 2s mimic the on-chain environment and can allow the protocol to scale to tens or hundreds of thousands of transactions per second while also reducing transaction costs in the process.

How to Buy Cardano in 5 Easy Steps

Below, we’ve broken down, into 5 simple steps, exactly how to buy Cardano crypto tokens. These steps are universal for almost every exchange available.

1) Select a Crypto Exchange

Below we’ve listed the top 3 exchanges to buy Cardano on. However, you may want to consult our list of best exchanges for April if you want a greater array of options. All top exchanges will offer their users access to Cardano’s ADA. We found eToro to be the best platform for buying ADA tokens.

Once you’ve chosen your exchange, go through the signup process. This will include creating your account and giving some basic details about you and where you’re from.

2) Verify Your Identity

To comply with anti-money laundering (AML) requirements in most jurisdictions, exchanges must collect and verify the identities of the people who use their platform. This involves providing the exchange with a copy of your government-issued ID, e.g., passport or driver’s license, and some other pieces of identifying information.

The process of verifying your identity can take anywhere between 5 minutes and 48 hours. This depends on your country of residence, the exchange, and the service they exchange users to verify identity.

3) Choose a Cardano Trading Pair

Exchanges offer users multiple trading pairs for each token, and the number of pairings will vary by exchange. When choosing which trading pair you want to use, it’s worth keeping in mind what you’re going to fund your account with.

If you’re funding your account with Bitcoin, then you will want to use the ADA/BTC pair to buy Cardano. If you’re funding it with USD or USDT then you’ll want to buy Cardano on the ADA/USD or ADA/USDT markets.

4) Deposit Funds

Depositing funds can be done using various methods, and different exchanges will have different options, and charge different fees for those options. Some deposit methods, such as debit or credit card deposits, are instantaneous. Others, like ACH bank transfers, may take a few hours or a few days to complete.

5) Buy Cardano

Once your funds are in your account you can head over to your chosen trading pair or the Cardano asset page to buy Cardano. Simply enter how much you’d like to buy as a market order, click the Buy button, and your trade will be placed and executed. Your ADA should appear in your account almost instantly.

Where to Buy Cardano in 2024? The Top Platforms

Choosing where to buy any cryptocurrencies can be difficult. It also requires taking into account many factors, both general, such as fees, and those more specific to you, like an exchange’s availability in your region.

Below, we’ve analyzed all the exchanges available and listed the three best exchanges for buying Cardano. After that, we’ve also covered our methodology for how these exchanges made our list.

1. eToro – Best All-Round Exchange for Buying Cardano With Social Trading Features

eToro services over 30 million investors around the globe, and users have access to over 70 different cryptocurrencies alongside stocks, forex pairs, and more. The eToro brokerage platform offers just 1% fees—in addition to the bid-ask spread—for buying and selling cryptocurrencies, and accounts can be funded via numerous payment methods.

The eToro platform offers a friendly and intuitive interface for investors of all levels of experience and features all the necessary charts and tools for analyzing price movements and executing trading strategies. EToro is the most popular social trading platform and users can view the sentiment of other traders on the platform in a unique social feed for each asset.

EToro requires a minimum deposit of just $50 (higher in some nations) and offers users a demo account and copy trading services. CopyTrader™ allows users to select a popular investor on the platform and automatically copy their trades. Finally, eToro also offers users a mobile app for Android and iOS devices for trading on the go.

| Number of Cardano Pairs | 1 (ADA/USD) |

| Trading Fees | 1% |

| Deposit and Withdrawal Fees |

|

Pros

- Minimum deposit of $50 (varies by location)

- Assets on the platform are held in cold storage

- Top social trading platform

- Offers other assets alongside crypto, e.g., stocks and Forex

- CopyTrader™ and demo account features

Cons

- Only offers 70 cryptocurrencies

- 1% fee is quite high

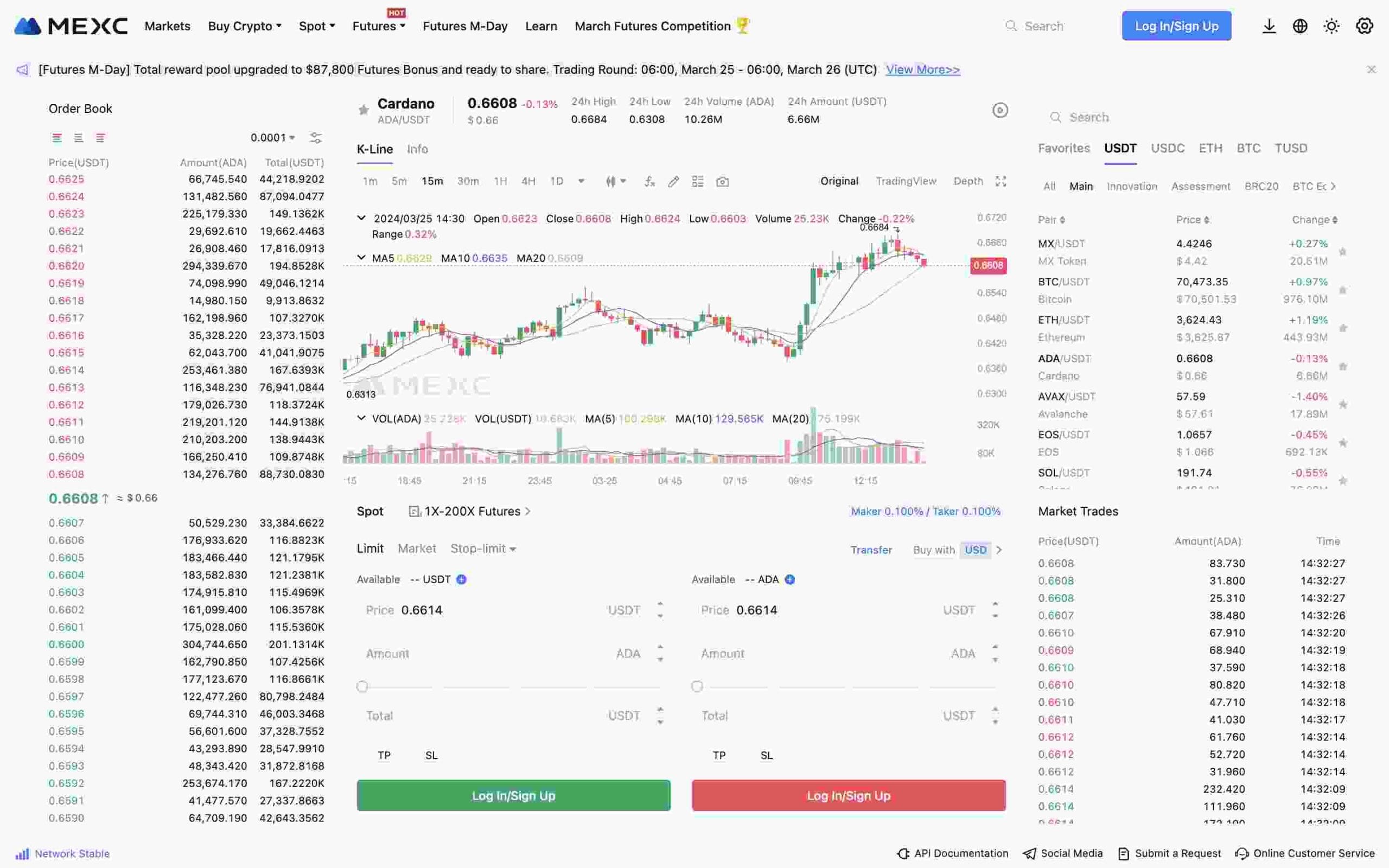

2. MEXC – Lowest Fee Platform for Buying Cardano

The MEXC exchange was founded in 2018 and is used by over 10 million users in over 170 countries. It offers some of the lowest fees, 0.1%, for trading crypto assets, including Cardano, and offers users access to over 1,000 coins. MEXC is a high-speed trading platform, developed by experts from the banking industry to facilitate over 1.4 million transactions per second.

MEXC offers users all the trading tools they need to design and execute trading strategies, including a demo account. For those who wish to be less active with their trading practices, MEXC also offers a copy trading feature.

Alongside spot trading markets, MEXC offers users access to perpetual futures for numerous assets, including ADA, with up to 200x leverage. Finally, all of this is also available in a mobile app for Android and iOS devices, allowing traders to access their accounts and make trades on the go.

| Number of Cardano Pairs | 4 |

| Trading Fees | 0.1% |

| Deposit and Withdrawal Fees |

|

Pros

- Low trading fees of 0.1%

- Low Cardano withdrawal fee of just 1 ADA

- Perpetual futures for Cardano, with 200x leverage available

- Demo accounts and copy trading features

- Charting tools and features required by experienced traders

Cons

- Not regulated in most jurisdictions

- 1.9 star rating on Trustpilot

3. Binance – Highest Liquidity of All Exchanges for Buying Cardano

Binance is the world’s most popular exchange, boasting over 180 million users around the globe. It typically records the largest daily volume of all exchanges (including for Cardano), meaning that it is one of the best places for users to buy and trade ADA.

Users of Binance have access to over 400 cryptocurrencies, alongside ADA, and all the charts and tools they need to make their trading decisions and execute their trades. An extensive Binance Academy is also available, offering users a library of information on all things cryptocurrency and blockchain.

Binance offers users some of the lowest crypto trading fees, 0.1%, and these can be reduced by a further 25% when paid for with the BNB token. Binance stores the majority of user’s funds in cold storage. However, it has been hit by numerous hacks before, and the exchange is currently being sued by the SEC for violating securities laws.

| Number of Cardano Pairs | 10 |

| Trading Fees | 0.1% |

| Deposit and Withdrawal Fees |

|

Pros

- Most popular exchange in the world

- Offers the best liquidity for ADA and other assets

- Attractive 0.1% fee (with a 25% discount for paying in BNB

- Access to over 400 cryptocurrencies

- All the charts and tools necessary to make trades

Cons

- Variable withdrawal fees

- Currently being sued by the SEC

How We Ranked The Best Places to Buy Cardano

To determine which is the best exchange, a methodology must be developed by which all the places to buy Cardano can be assessed. Below, we’ve covered the main factors taken into account when we created the above list.

Cardano Trading Volume – 25%

Trading on an exchange requires liquidity. Liquidity in crypto refers to the ease with which you can swap a cryptocurrency without significantly impacting the price. Exchanges with high trading volume usually have deeper liquidity, meaning more buyers and sellers—this is important for you to be able to buy Cardano easily and at competitive rates.

A high trading volume also means that you are less vulnerable to a drastic price change when executing your transaction. Other benefits of high trading volume include narrower spreads, more order options, and faster execution.

Number of Cardano Trading Pairs – 25%

Being able to buy Cardano with the currency, crypto or fiat, that they have available is an important feature for many users—lest they be charged a commission for switching currencies or a trading fee for having to purchase another cryptocurrency beforehand. Multiple trading pairs can also show that an exchange has good levels of liquidity and that users have more choices. Finally, more trading pairs can mean more markets in the form of crypto futures.

Lowest Trading Fees – 25%

Most platforms charge users a fee for each trade they place. Depending on a user’s desired activity—continuous trading or just a single buy—these will factor differently into how they choose an exchange. This is why this is only given a 25% weighting, as it is often quite user-dependent.

Deposit and Withdrawal Speed – 25%

Crypto is a fast-moving industry and a volatile market. Therefore, being able to use deposited or withdrawn funds within a short timeframe is of paramount importance to many users. The speed at which an account was credited with a deposit or withdrawal was taken into account when creating the above ranking.

Where to Safely Store Your Cardano

Storing your Cardano on an exchange is fine if you plan on actively trading it, as this provides them with the easiest possible access to the markets. However, those planning on holding all or a portion of their assets long-term should consider moving them to personal storage for security purposes.

Luckily, the Cardano community and core developers have built a variety of wallets that can be used to store your tokens and interact with the dApps built on Cardano. The most popular of these are listed below:

- Daedalus – Full node wallet from Cardano’s core developers, IOHK. Compatible with Ledger and Trezor hardware wallets.

- Flint – Cardano community lite-wallet, with a mobile app, access to EVM sidechains, and compatibility with Ledger and Trezor hardware wallets.

- Eternl – Cardano community lite-wallet for desktop and mobile. Compatible with Ledger and Trezor hardware wallets.

- Nami – Lightweight community-created wallet, now owned by IOHK. Simple, intuitive, and easy to use. Browser extension only.

What Can You Use Cardano For?

Cardano’s native ADA token has multiple use cases on the Cardano network. We’ve listed these below:

- Staking to secure the network and earn rewards

- Paying transaction fees on the Cardano network

- Buying NFTs on Cardano marketplaces

- Participating in Cardano DeFi on DEXes, lending platforms, and more

- Voting in Project Catalyst (community-voted project funding)

- Spending at merchants and businesses that accept ADA

- SOON – voting in on-chain governance actions

Conclusion

As a longtime member of the top ten coins by market cap, Cardano is a name familiar to many crypto traders. Since the launch of token and smart contracting functionalities on the Cardano network in 2021, the Cardano ecosystem has blossomed into a thriving hub of DeFi and NFTs, and ADA is your gateway to that ecosystem.

Now that you know how to buy Cardano and the best places to do so, you can take your newfound ADA out to the network to explore all that Cardano has to offer.

FAQs

Where Can I Buy Cardano?

Cardano can be bought from many centralized exchanges. However, we have conducted research and found that the best places to buy Cardano are eToro, MEXC, and Binance.

How Do You Buy ADA?

You can buy ADA through a centralized crypto exchange using a variety of methods, including credit and debit cards, bank transfers, PayPal, Venmo, and other money services providers.

What is The Best Way to Buy Cardano?

The best way to buy Cardano is through the eToro exchange, which offers low minimum deposits (in some countries) and an intuitive interface with all the tools needed by traders.

How Do I Start Investing in Cardano?

To start investing in Cardano you need to follow five simple steps: create an exchange account, verify your identity, choose your trading pair, deposit funds, and buy ADA. Once done, you are invested in Cardano.

References

- IOHK|Library – IOHK.io

- Cardano says it has added smart contracts to its network after the alonzo upgrade – while its ada token runs into profit-taking – BusinessInsider.com

- Total Value Locked All Chains – DeFiLlama.com

- Top Blockchains – DappRadar.com

- Blockchains by NFT Sales Volume – CryptoSlam.io

- Cardano Explorer – Cexplorer.io

- Ouroboros: A Provably Secure Proof-of-Stake Blockchain Protocol – IACR.org

- Nakamoto Coefficient – Cexplorer.io

- MEXC – Trustpilot.com

- SEC sues Binance and CEO Changpeng Zhao for U.S. securities violations – CNBC.com

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman